Unveiling the Great Benefits of Electric Company Cars: Understanding Benefit in Kind

Electric cars have become increasingly popular in recent years with more people opting for eco-friendly and cost-effective transportation options. With the rise in demand for electric cars, many companies have started to offer electric cars as company cars to their employees. Electric company cars come with several benefits, including the exemption of certain taxes and incentives from the government.

In this blog, we will discuss the benefits in kind for electric company cars and why it’s a smart choice for both employers and employees. So, buckle up and let’s dive in!

Overview

If you’re considering an electric company car, it’s important to understand the potential benefit in kind (BIK) tax implications. Under the current BIK tax system in the UK, electric cars often offer significant savings compared to their petrol/diesel counterparts. For zero-emissions electric vehicles, the BIK rate is currently set at 0%.

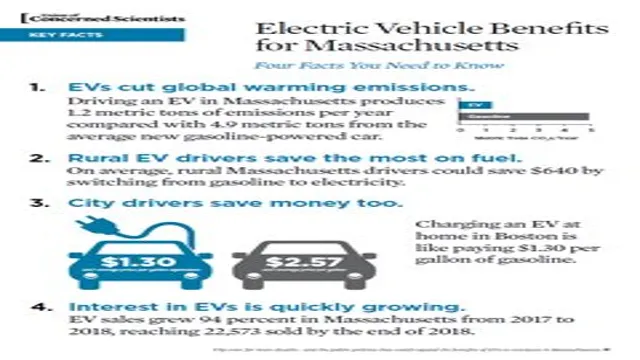

This means that employees who receive an electric company car won’t have to pay tax on it as a benefit in kind. For plug-in hybrids, there is a sliding scale based on their CO2 emissions, but even the worst-rated models are still taxed at a lower rate than traditional petrol or diesel vehicles. What this means for both employers and employees is that choosing an electric company car can offer clear financial benefits.

Additionally, electric vehicles are often cheaper to run than conventional cars, meaning that companies can save money on fuel costs and employees can save money on personal use charges. So, if you’re looking to save money and reduce your carbon footprint, an electric company car might be a great option.

Explanation of Benefit in Kind

An Explanation of Benefit in Kind (BIK) is a taxable benefit that an employee receives in addition to their salary. BIK comes in many forms, such as company cars, health insurance, and housing allowances. These benefits are given by an employer as a way to retain and attract employees.

However, the value of these perks is usually considered taxable income by the government. This means that the amount of tax an employee pays may increase, making the total value of BIK not as straightforward as it may seem. An employer must calculate the proper amount of BIK for each employee and report it to the government accordingly.

Overall, BIK is a way for employees to receive additional benefits, but it is important for both the employer and employee to understand the tax implications that come with it.

Advantages of Electric Company Cars

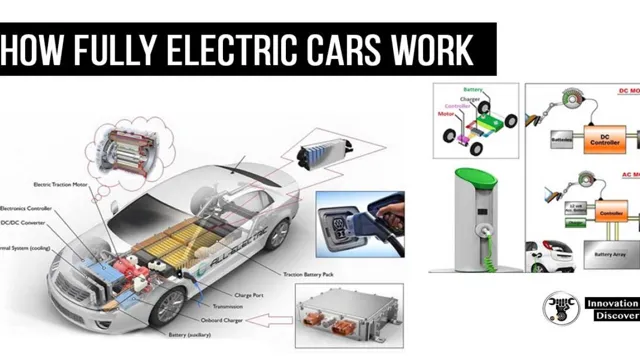

Electric company cars have become a popular choice for businesses in recent years due to their numerous advantages. By switching to electric vehicles, companies can significantly reduce their carbon emissions and contribute to a greener environment. In addition to their eco-friendliness, electric cars are highly cost-effective in the long term, as they require very low maintenance costs and don’t require frequent refuelling.

This results in significant savings for organizations, making them an ideal investment for businesses looking to minimize their overheads. Furthermore, companies that have an electric fleet can benefit from increased brand recognition, as they often receive positive feedback from the public for their commitment to sustainability. Overall, investing in electric company cars is a smart decision that offers numerous benefits both environmentally and economically.

Cost Considerations

If you’re considering getting a company car, it’s important to take into account the associated costs, including the benefit in kind tax that applies to electric cars. With the increasing popularity of electric cars, many employers are now offering them as company vehicles, which can provide a number of benefits. However, it’s worth noting that as of April 2021, electric company cars are subject to a benefit in kind tax rate of just 1%, which is significantly lower than the 4-37% rate applied to petrol or diesel cars.

This means that choosing an electric company car could save you a considerable amount of money in tax. Additionally, electric cars tend to have lower running costs than their fossil fuel counterparts, which can also help to save money in the long term. Of course, it’s important to bear in mind that the cost of an electric car upfront can still be relatively high, so it’s crucial to weigh up the overall cost against the potential benefits before making a decision.

Tax Implications

When investing in real estate, it’s crucial to consider the tax implications and overall cost considerations involved. One important factor to keep in mind is property taxes, which will vary depending on the location of the property. Additionally, when selling a property, capital gains taxes will come into play.

It’s important to work with a knowledgeable accountant to ensure that you understand and plan for these costs. Other expenses to consider include maintenance and repairs, insurance, and any mortgage payments. However, it’s worth noting that real estate can provide significant tax benefits, including deductions for mortgage interest and property taxes.

Overall, it’s important to carefully weigh the costs and potential benefits when considering investing in real estate.

Savings on Fuel and Maintenance

One of the most significant advantages of electric cars is the savings on fuel and maintenance costs. While gas-powered vehicles require a constant supply of gasoline, electric vehicles can be recharged at home or at public charging stations, saving drivers a significant amount of money in the long run. Additionally, electric cars have fewer moving parts compared to traditional vehicles, meaning that there are fewer parts that can break down or require maintenance.

This can translate into significant savings over time, as electric cars require less frequent oil changes, fewer brake replacements, and other mechanical repairs. Overall, the cost savings associated with electric vehicles can add up quickly, making them an excellent choice for drivers looking to save money and reduce their carbon footprint. So if you’re considering switching to an electric car, the cost savings alone make it a compelling option.

Environmental Impact

When considering the environmental impact of our choices, it’s essential to also consider the cost implications. It’s often thought that eco-friendly options are more expensive, but this isn’t always the case. For example, investing in energy-efficient appliances may have a higher upfront cost, but in the long run, they save money through reduced energy bills.

Similarly, choosing to buy products with sustainable and recyclable materials means less waste and a more extended product lifespan. It’s not always about the monetary cost, though. The true cost of environmental impact is the damage it does to our planet and the health repercussions that come with it.

By making informed choices that take both cost and environmental impact into account, we can create a better world for ourselves and future generations.

Implementation

If you are considering an electric company car, you may be curious about the benefit in kind (BIK) tax implications. The good news is that electric cars benefit from a lower BIK rate than their petrol or diesel counterparts. In fact, company car drivers of electric vehicles are eligible for a reduced BIK rate of 0% until 202

This means that you won’t have to pay any tax on the vehicle as a benefit provided by your employer. After that, the rate will increase gradually, but it will still be substantially lower than for traditional company cars. This makes electric company cars an attractive option for both drivers and employers.

Not only are they cheaper to run and maintain, but they also offer a tax-efficient perk that can help to retain and attract talent. So, if you’re looking for a way to reduce your carbon footprint and enjoy tax savings at the same time, an electric company car could be a smart choice.

Applying for Benefit in Kind

When applying for Benefit in Kind, it’s important to understand the implementation process. The first step is to determine whether the benefit is taxable. If it is, then it must be reported to HMRC using form P11D.

Employers should carefully consider the value of the benefit, as this will determine the amount of tax owed. Once the form has been submitted, employees will need to pay the appropriate amount of tax on the benefit. This can be done through a PAYE settlement agreement, which allows employers to settle the tax liability on behalf of their employees.

Overall, the key to successfully implementing Benefit in Kind is to ensure that all parties involved understand the tax implications and follow the correct procedures.

Choosing the Right Electric Car

When it comes to implementing the choice of an electric car, there are a few factors to consider. The first is the range of the vehicle – make sure it can meet your daily driving needs and has enough charging stations along your usual routes. You’ll also want to consider the type of charging required – some models offer fast charging, which can be a game-changer if you frequently take long trips.

Additionally, think about the cost – while electric vehicles can save you money in the long run, they can have a higher up-front cost. It’s important to evaluate the different makes and models to find the best fit for your budget and lifestyle. Ultimately, choosing an electric car can have a positive impact on the environment and can be a smart financial investment, but it’s crucial to carefully consider your needs before making a decision.

Conclusion

In conclusion, the benefits of driving an electric company car extend far beyond just being environmentally friendly. These zero-emission vehicles also come with a substantial tax break in the form of reduced benefit in kind taxation, making them a financially savvy choice for both the employer and the employee. So don’t just feel good about going green, feel good about saving some green as well!”

FAQs

What is a benefit in kind on an electric company car?

A benefit in kind is a taxable benefit that an employee receives from their employer, such as a company car. An electric company car is considered a benefit in kind as it is a perk provided by the employer.

How is the benefit in kind on an electric company car calculated?

The benefit in kind value on an electric company car is calculated based on the car’s list price and its CO2 emissions. For electric cars, the benefit in kind value is currently 1% of the car’s list price.

Are there any exemptions to the benefit in kind on electric company cars?

Yes, there are exemptions for electric cars that meet certain criteria. For example, if an electric car has a range of over 130 miles, it is exempt from paying the benefit in kind charge in the tax year 2021-2022.

Can an employee choose not to receive an electric company car as a benefit in kind?

Yes, an employee can choose not to receive an electric company car as a benefit in kind. However, if they still want to use the car for personal use, they may need to pay for it privately or choose a different form of transportation.