Electric Cars: Understanding the Benefits in Kind Rates and Why Switching Makes Financial (and Environmental) Sense

Hey there reader, have you heard about the buzz around electric cars and their benefit in kind rates? It’s an exciting topic that’s been causing quite a few waves in the automotive industry over the last few years! With increasing concern over environmental issues and the need to reduce carbon emissions, more and more people are making the switch to electric cars. Not only are they more environmentally friendly, but they also come with a number of financial benefits too. One area where electric cars really shine is in the benefit in kind rates that they offer.

But what exactly are these benefit in kind rates, and how do they apply to electric cars? In this blog post, we’ll dive into the details of what benefit in kind rates are, why they matter, and how electric cars are likely to revolutionize this aspect of the automotive industry. So buckle up and get ready to learn all about this exciting topic!

What are Benefit in Kind Rates?

Benefit in Kind (BIK) rates on electric cars are the amount of tax paid by an employee when they use a company car for personal reasons. As electric cars produce zero emissions, they have lower BIK rates compared to petrol or diesel cars. The UK government has introduced a BIK tax system for electric cars to encourage the use of green vehicles.

For the year 2020/21, the BIK rate for zero-emission vehicles is 0%, whereas for petrol and diesel cars, it can be as high as 37%. This means that owning an electric company car can save employees a significant amount of money on tax. Moreover, it helps companies reduce their carbon footprints and show their commitment to sustainability.

In a time where climate change is affecting our planet, it is essential to encourage the use of eco-friendly vehicles and electric cars are one of the solutions. Therefore, the UK government’s incentives such as reduced BIK rates on electric cars are commendable actions to reduce carbon emissions and promote environmental sustainability.

Definition and Explanation

Benefit in Kind (BIK) rates refer to the value of any extra benefits that an employer provides to their employees, in addition to their standard salary. These benefits could include company cars, medical insurance, gym memberships, or childcare vouchers. When an employee receives these benefits, they may be subject to additional taxes, called BIK taxes, which are calculated based on the value of the benefit provided.

BIK rates vary depending on the type of benefit and the employee’s income level. It’s important for both employers and employees to understand BIK rates to ensure compliance with tax regulations and to make informed decisions about compensation packages. By providing attractive benefits packages, employers can attract and retain top talent, which can help drive business success.

How are Benefit in Kind Rates Calculated?

Benefit in Kind (BIK) rates are the tax rates that employers apply to the non-cash benefits provided to their employees, such as company cars, health insurance, and gym memberships. These rates are based on the value of the benefit provided and are set by HM Revenue and Customs (HMRC). The BIK rate is calculated by taking into account a number of factors, including the car’s CO2 emissions, its list price, and the employee’s tax bracket.

The higher the value of the benefit, the higher the BIK rate will be. Employers must pay Class 1A National Insurance contributions based on the total value of the benefits provided to their employees, which is calculated by multiplying the BIK rate by the number of employees. It’s essential for employers to understand BIK rates to ensure that they are paying the correct amount of tax and avoiding any penalties or fines from HMRC.

By keeping up to date with the latest changes to BIK rates, employers can make informed decisions about providing non-cash benefits to their staff.

Why are Electric Cars Important?

Benefit in kind rates on electric cars are important because they encourage the use of environmentally-friendly vehicles and help to reduce carbon emissions. In the UK, the benefit in kind rate for electric cars is currently at 0%, meaning that drivers of electric cars don’t have to pay any tax on the value of the car as a benefit in kind, unlike traditional fossil-fuel cars with much higher rates. This not only provides incentive for businesses and individuals to switch to electric, but it also saves drivers money and makes electric cars more accessible.

Moreover, electric cars are a step towards achieving global sustainability targets and reducing air pollution, making them a vital step in the fight against climate change. When we switch from gas or diesel cars to electric cars, we reduce our carbon footprint and help ensure our planet remains habitable for future generations. In conclusion, benefit in kind rates on electric cars are important in making the transition towards cleaner technologies, ultimately helping to mitigate climate change and create a healthier future for all.

Benefits of Electric Cars for the Environment

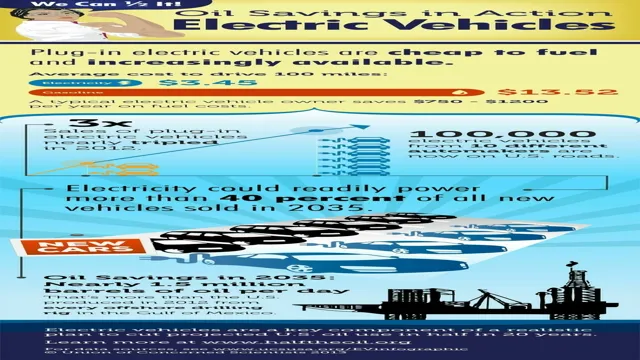

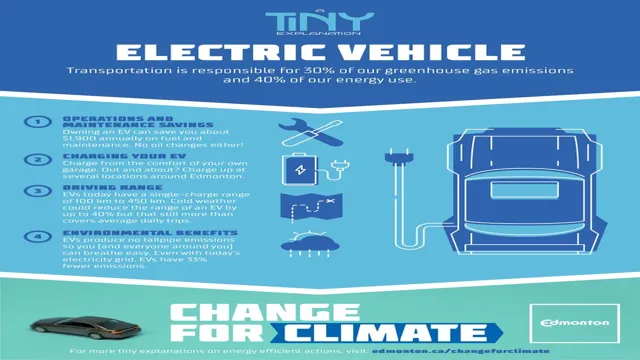

Electric cars are an important step towards reducing our carbon footprint and creating a cleaner environment. By using electricity instead of gasoline, electric cars do not release harmful pollutants into the air. This means that they are not only better for the environment, but also for our health.

Additionally, electric cars are more energy efficient than traditional vehicles, which means they use less energy to operate, ultimately reducing our dependence on fossil fuels. They are also becoming more accessible and affordable, making sustainability and environmentalism more accessible to everyone. It is important to recognize the significant role electric cars play in our efforts to combat climate change and promote a healthier environment.

As we continue to move towards a sustainable future, electric cars will undoubtedly play a crucial role.

Cost Savings of Electric Cars

Electric cars are important because they offer a wide range of benefits, especially when it comes to cost savings. Unlike gas-powered vehicles, electric cars require less maintenance and fewer repairs in the long run, saving car owners a significant amount of money on maintenance and repair costs. Additionally, electric cars save a lot of money on fuel costs, as electricity is a much cheaper and cleaner source of energy than gasoline.

This means that electric car owners can enjoy substantial savings on their monthly fuel bills when compared to traditional gas-powered vehicles. In the end, purchasing an electric car is not just an environmentally-friendly choice, but also a practical one that can save you money in the long run. So why not make the switch and enjoy the many benefits of driving an electric car?

Future of Electric Cars in the Auto Industry

Electric cars have become increasingly popular in recent years, and for a good reason. They are not only environmentally friendly, emitting fewer greenhouse gases than their gasoline or diesel-powered counterparts, but they are also cheaper to operate and maintain. Their batteries can be charged at home, which is convenient for daily commutes.

The development of fast-charging technology has also made it possible for electric vehicles to travel longer distances on a single charge, making them more practical for long road trips. Furthermore, electric cars help reduce our dependence on fossil fuels, which are finite resources and require significant efforts to extract and transport. As more people switch to electric vehicles, the demand for charging infrastructure also increases, creating new opportunities for businesses and entrepreneurs.

In short, electric cars are important because they provide a greener and more sustainable future for the auto industry and our planet.

How do Benefit in Kind Rates Benefit Electric Car Drivers?

Electric car drivers are set to benefit from the new benefit in kind rates that have been introduced by the UK government. These rates cover the amount of tax that an employee has to pay on a company car, based on the car’s CO2 emissions and list price. With electric cars producing no CO2 emissions, they are given a low benefit in kind rate – as low as 1%.

This means that employees who choose an electric car as their company vehicle will be paying considerably less tax than those who opt for a petrol or diesel car. Not only is this good news for electric car drivers, but it also incentivizes companies to invest in more eco-friendly vehicles as a means of reducing their carbon footprint. Overall, this is a positive step towards a greener, more sustainable future for all.

Comparing Benefit in Kind Rates on Gas vs. Electric Cars

When it comes to Benefit in Kind (BIK) rates, electric car drivers are at a significant advantage compared to their gas-guzzling counterparts. BIK rates are essentially a tax on company cars, based on factors such as CO2 emissions and fuel type. Electric cars have much lower CO2 emissions and, in some cases, are completely exempt from fuel duty.

This means BIK rates are much lower for electric cars, resulting in significant savings for both individual drivers and businesses. For example, in 2021, the BIK rate for electric cars with zero emissions is 1%, compared to 20% for gas cars with CO2 emissions between 170-174g/km. This makes electric cars much more appealing to employees who want to reduce their personal tax liability and to employers who want to provide cost-effective and eco-friendly company cars.

Overall, the BIK rates demonstrate the growing incentives for making the switch to electric vehicles and the positive impact this can have on both the environment and personal finances.

Average Savings on Company Cars for Electric vs. Gas Cars

If you’re considering purchasing a company car, it might be worth looking into electric cars. Not only are they better for the environment, but they can also save you money in the long run. Thanks to Benefit in Kind rates, electric car drivers enjoy significantly lower tax rates than those who drive gas cars.

In fact, recent studies have found that the average savings on company cars for electric cars can be up to £5,000 per year. This is because Benefit in Kind rates for electric cars are much lower than those for diesel or petrol cars. Additionally, electric cars have much lower running costs, which can save you even more money.

And, with the increasing number of charging stations available, electric cars are becoming more convenient than ever. So, if you’re in the market for a company car, it might be time to consider going electric.

Conclusion

In conclusion, the benefit in kind rates on electric cars are a win-win for both the environment and our wallets! By driving electric vehicles, we reduce harmful emissions and contribute to a cleaner planet while also benefiting from lower tax rates. So, let’s ditch the gas guzzlers and embrace the power of electricity – our planet (and wallets) will thank us!”

FAQs

What are benefit in kind rates on electric cars?

Benefit in kind rates on electric cars refer to the tax that employees pay on the value of the electric car they receive as a company car.

Are benefit in kind rates on electric cars different from those on petrol or diesel cars?

Yes, benefit in kind rates on electric cars are generally lower than those on petrol or diesel cars due to their lower carbon emissions.

How are benefit in kind rates on electric cars calculated?

Benefit in kind rates on electric cars are calculated based on the car’s list price, CO2 emissions, and its electric range.

Can employees avoid paying benefit in kind on electric cars?

No, employees cannot avoid paying benefit in kind on electric cars as it is a legal requirement and the tax is deducted from their salary. However, they can reduce their tax liability by choosing a lower-priced, lower-emission electric car.