The Electric Choice: Maximize Your Savings with Benefit-in-Kind Tax on Electric Cars

Electric cars are becoming increasingly popular, not just because they are environmentally friendly, but also because of the financial benefits they can offer. One of the benefits electric car owners can enjoy is the Benefit in Kind tax, also known as BIK tax. For those who are not familiar, BIK tax is a tax on the non-cash benefits employees receive from their employers.

In the case of electric cars, BIK tax is much lower than that of traditional petrol or diesel-fueled cars. In this blog post, we will explore how electric cars can save you money through BIK tax and whether they are a viable option for you.

What is Benefit in Kind tax?

If you’re considering purchasing an electric car, it’s important to understand how Benefit in Kind tax may impact your decision. Benefit in Kind tax, or BIK tax, is a tax paid on non-cash benefits provided by employers to employees. In the case of electric cars, this could include the provision of a company car for personal use.

The amount of BIK tax paid will depend on the value of the car, its CO2 emissions, and the employee’s tax bracket. However, electric cars are eligible for a reduced rate of BIK tax due to their low emissions and green credentials. In fact, electric company cars currently have a BIK rate of 1% for the 2021/22 tax year – significantly lower than the 20-37% rate charged for petrol or diesel vehicles.

This can make electric cars a financially attractive option for both employers and employees looking to reduce their tax liabilities.

Definition and how it’s charged

Benefit in Kind tax, commonly known as BIK tax, is a tax that is charged to employees who receive non-cash benefits from their employer, in addition to their salary or wages. These benefits may include things like company cars, health insurance, free meals, housing allowances, and other perks that are offered as a part of an employment package. BIK tax is calculated based on the value of these non-cash benefits, and the tax liability is the responsibility of the employee.

The amount of tax that an employee is required to pay will depend on several factors, including the type of benefit they receive, the value of the benefit, and the employee’s tax bracket. It’s very important for employees who receive non-cash benefits to consult with a tax professional to ensure they understand their tax liability and to ensure they comply with all relevant tax laws and regulations. By doing so, they can avoid any potential tax penalties or fines.

Benefits of driving an electric car

One of the major benefits of driving an electric car is the significant reduction in Benefit-in-Kind tax. Under the UK government’s current tax laws, electric cars have a much lower Benefit-in-Kind tax rate than traditional petrol and diesel vehicles, making them a much more cost-effective option. This is because electric vehicles emit far less CO2 than their fossil-fuel counterparts, and therefore qualify for a lower tax rate.

Not only does this translate to significant savings for individual drivers, but it also incentivizes more people to switch to electric cars, ultimately leading to a reduction in harmful emissions and a greener future for us all. So, if you’re considering purchasing a car for business use, an electric vehicle may just be the smart and eco-friendly option you’ve been looking for.

Lower Benefit in Kind tax rates, exemption from Vehicle Excise Duty

Driving an electric car can provide a range of benefits, including lower Benefit in Kind tax rates and exemption from Vehicle Excise Duty. These tax incentives can help save you money on both a personal and business level. With electric cars, the Benefit in Kind tax rate is set at 1%, which means you could save up to hundreds of pounds per year as compared to the rates for petrol or diesel cars.

Plus, electric cars are also exempt from Vehicle Excise Duty, or road tax, which means even more financial savings in the long run. These incentives have made electric cars a popular choice for those who are environmentally conscious and looking to save money on car expenses. So, why not make the switch to electric and start enjoying the benefits today?

Calculating Benefit in Kind tax for electric cars

One of the major benefits of owning an electric car is the reduced Benefit in Kind tax. For those who use their electric car as their company car, the amount of tax they pay is based on the value of the car and the amount of CO2 it emits. As electric cars emit no CO2, the tax rate is significantly reduced.

The rate for electric cars is only 1% for the tax years 2021/22, 2022/23, and 2023/24, compared to the rate for gasoline or diesel cars which can be anywhere between 20% and 37%. This means that electric car owners can save a substantial amount on their tax bill each year. Of course, it’s important to note that the tax savings are dependent on the value of the car and personal circumstances, so it’s important to speak to a financial advisor to determine your specific tax situation.

Overall, the Benefit in Kind tax relief for electric cars is a fantastic incentive to make the switch to electric, not only for the environmental benefits but also for the financial benefits.

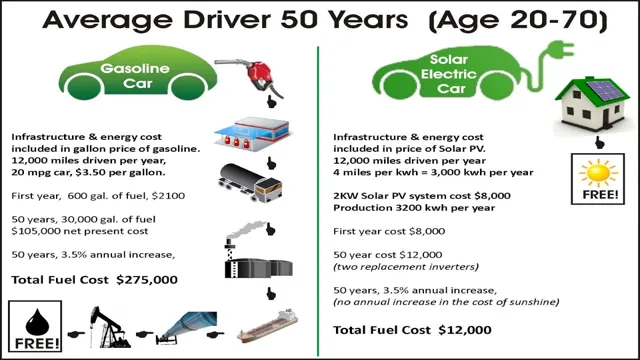

Comparing traditional cars vs electric cars, examples of savings

When comparing traditional cars to electric cars, it’s evident that electric cars come with great savings. One of the ways to calculate the benefits in kind (BIK) tax for electric cars is by taking the car’s list price and multiplying it by the relevant percentage BIK rate. For instance, if your electric car costs £25,000 and the BIK rate is 0%, your company car tax liability will be £0.

However, if the BIK rate is 10%, your tax bill will be £2,500. This means that electric cars are more tax-efficient compared to traditional cars, which can have BIK rates of 25-37% depending on their CO2 emissions. Furthermore, electric cars offer a lower cost of ownership and maintenance over time, thanks to a lower reliance on fuel, fewer moving parts to maintain, and less routine maintenance like oil changes.

By choosing electric cars, individuals and businesses can not only save money on taxes but also reduce their carbon footprint.

How to claim Benefit in Kind tax for electric cars

If you’re thinking about purchasing an electric car for business use, you might be eligible for Benefit in Kind (BIK) tax relief. The UK government is incentivizing eco-friendly vehicles by offering reduced BIK rates for electric cars in the 2021-2022 tax year. To claim this tax relief, you need to provide some information to your employer, like the make and model of the vehicle, its list price, and any accessories that were fitted.

Your employer will then use this information to calculate the BIK tax and apply the savings accordingly. It’s worth noting that these tax savings only apply to electric cars, not hybrids or plug-in hybrids, and they’re only available for business use. So, if you’re thinking of going electric for your next company car, make sure you take full advantage of the BIK tax relief while it’s still available.

Process and requirements for claiming the tax benefit

If you own an electric car, you may be eligible for a tax benefit in kind. To claim this benefit, you must ensure that your car meets certain criteria. Firstly, it must be a fully electric vehicle that emits less than 50 grams of carbon dioxide per kilometer.

Next, it must be a company car that is available for business use and personal use. To claim the tax reduction, you will need to provide evidence of your electric car’s emissions, such as a certificate of conformity. In addition, you will need to calculate the taxable benefit based on your car’s list price, which includes any optional extras or accessories.

It is essential to keep accurate records of your electric car’s usage to ensure that you claim the correct amount of tax benefit. Once you have all the necessary information, you can claim the tax benefit through your employer’s payroll system. Claiming a tax benefit in kind for your electric car can be a great way to reduce your carbon footprint and save money at the same time.

Conclusion and future outlook

In conclusion, opting for an electric car as your company vehicle not only showcases your commitment towards sustainability, but it also comes with significant financial benefits. The benefit in kind tax for electric cars is significantly lower than that for traditional fuel vehicles, resulting in substantial savings for both the employee and the employer. So, switch to an electric car today and watch your tax bill shrink while you drive with a clear conscience!”

Summary of key benefits and overall trend towards electric cars

Electric cars have been gaining in popularity in recent years, thanks to their numerous benefits. These include lower emissions, reduced running costs, and incentives from governments to switch to more environmentally friendly vehicles. One such incentive is the Benefit in Kind tax, which offers significant savings for those who opt for electric vehicles over traditional petrol or diesel cars.

To claim this tax, all you need to do is inform your employer that you drive an electric car and provide them with the necessary details. This will reduce the amount of tax you have to pay and keep more money in your pockets. So, if you’re considering a switch to an electric car, don’t forget to take advantage of this valuable incentive.

FAQs

What is Benefit in Kind tax for electric cars?

Benefit in Kind tax for electric cars is a tax that is levied on employees who are provided with electric cars by their employer for personal use. It is applied because an employee is receiving a benefit in the form of a car for personal use.

How is Benefit in Kind tax for electric cars calculated?

Benefit in Kind tax for electric cars is calculated based on the list price of the vehicle, the CO2 emissions, and the fuel type. For electric cars, the tax is calculated at a rate of 1% of the list price for the tax year 2020/21.

Are there any incentives for employees to choose electric cars as part of a Benefit in Kind scheme?

Yes, there are incentives for employees to choose electric cars as part of a Benefit in Kind scheme. Electric cars are subject to a lower Benefit in Kind tax rate compared to petrol or diesel vehicles, making them more financially attractive for employees. Additionally, electric cars have lower running costs and benefit from various Government incentives, such as the plug-in grant.

Can an employer claim tax relief on the purchase of an electric car for their employees?

Yes, an employer can claim tax relief on the purchase of an electric car for their employees under specific circumstances. If the electric car is used solely for business purposes, the employer can claim full tax relief on the purchase price. If the electric car is also used for personal use, the employer can claim partial tax relief.