Benefit in Kind Tax for Electric Cars: Smart Savings!

Electric cars are becoming more popular. They are good for the environment. Many people want to know about taxes related to electric cars. This article will explain Benefit in Kind (BiK) tax. We will look at what it is, how it works, and why it matters.

What is Benefit in Kind Tax?

Benefit in Kind tax is a tax for people who get benefits from their job. It applies to many things like cars, health insurance, and more. If your employer gives you a car, you may have to pay BiK tax. This tax is based on the value of the car.

Why Is It Important?

Understanding BiK tax helps you know how much you will pay. It can also help you decide which car to choose. Electric cars have different rules. This makes them an interesting option.

How is BiK Tax Calculated?

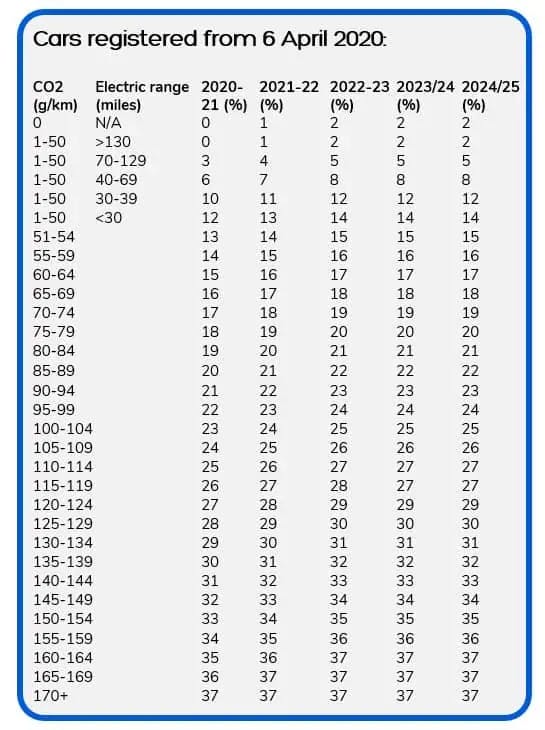

The BiK tax rate depends on the car’s value and its CO2 emissions. The government decides the rates. For electric cars, the emissions are very low. This means the tax is lower.

Key Factors In Calculation

- Car’s Value: The cost of the car when new.

- CO2 Emissions: The amount of carbon dioxide the car emits.

- BiK Rate: The percentage set by the government.

BiK Tax Rates for Electric Cars

Electric cars have lower BiK rates. This is a big benefit. For example, in 2023, the BiK rate for electric cars is only 2%. This is very low compared to petrol and diesel cars.

Comparison Of Bik Rates

| Car Type | BiK Rate 2023 |

|---|---|

| Electric Cars | 2% |

| Petrol Cars | 15% – 37% |

| Diesel Cars | 16% – 37% |

Why Choose Electric Cars?

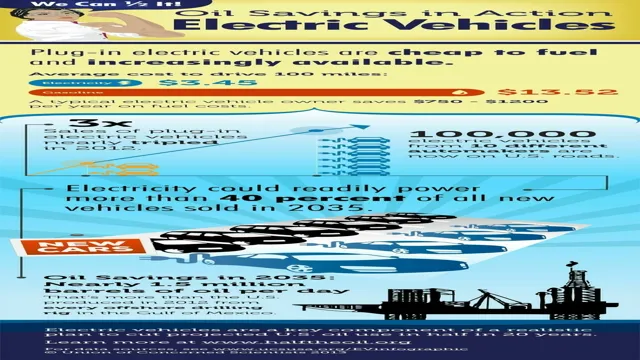

Choosing electric cars has many advantages. First, they are better for the environment. They produce less pollution. Second, you can save money on taxes. Lower BiK rates mean lower tax payments. Third, electric cars can save money on fuel costs.

Other Benefits Of Electric Cars

- Low Running Costs: They cost less to charge.

- Government Incentives: Many countries offer grants and rebates.

- Quiet Operation: They are quieter than petrol and diesel cars.

- Less Maintenance: They need less servicing.

What Should You Consider?

Before choosing an electric car, think about some things. First, check the range of the car. This is how far it can go on one charge. Second, look for charging stations near you. This is important for using your car every day.

Cost Of Electric Cars

Electric cars can be more expensive than regular cars. However, lower BiK tax can help. Over time, you may save money. It is important to calculate the total costs.

Frequently Asked Questions

What Is Benefit In Kind Tax For Electric Cars?

Benefit in Kind (BiK) tax is a tax on company cars. It applies to the value of the car provided by your employer.

How Is Benefit In Kind Tax Calculated For Electric Vehicles?

BiK tax for electric vehicles is based on the car’s value and its CO2 emissions. Lower emissions mean lower tax rates.

What Are The Tax Rates For Electric Cars?

Electric cars have a low BiK tax rate. For 2023/2024, it can be as low as 2%.

Do I Pay Benefit In Kind Tax For A Company Electric Car?

Yes, if your employer provides an electric car, you must pay BiK tax on it.

Conclusion

Benefit in Kind tax for electric cars is a helpful topic. Electric cars have lower BiK rates. This means less tax to pay. They also have other benefits like low running costs. If you are considering a car, think about an electric one.

Remember to check all factors. Look at the price, range, and charging options. Electric cars can be a smart choice for you and the planet.