Benefit in Kind Tax on Electric Cars: Key Savings Unveiled

Electric cars are becoming popular. Many people want to know about taxes on them. One important tax is called Benefit in Kind (BIK) tax. This article will explain BIK tax on electric cars. We will explore what it is and how it works.

What is Benefit in Kind Tax?

Benefit in Kind tax is a type of tax. It applies when you receive something extra from your job. This could be a car, health insurance, or a house. If your employer gives you a car, you might need to pay BIK tax.

How Does BIK Tax Work?

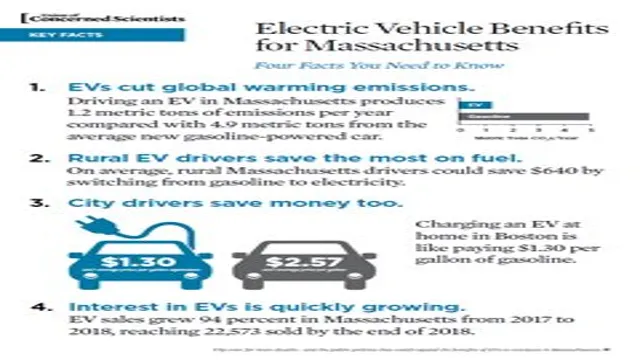

When you have a company car, it is a benefit. You do not pay for it directly. Instead, you pay taxes on it. The amount of tax depends on the car’s value and its emissions. Electric cars have low or no emissions. This means they usually have lower BIK tax rates.

Why Choose Electric Cars?

Choosing electric cars has many benefits. Here are a few:

- They are better for the environment.

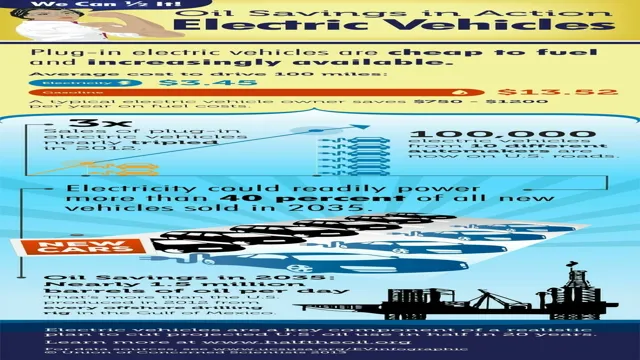

- They can save you money on fuel.

- They often have lower running costs.

- They usually have lower BIK tax rates.

BIK Tax Rates for Electric Cars

BIK tax rates change every year. The government sets these rates. For electric cars, the rates are very low. In fact, some years, there may be no tax at all. In recent years, the BIK tax rate for electric cars has been:

| Year | BIK Tax Rate (%) |

|---|---|

| 2021/2022 | 1% |

| 2022/2023 | 2% |

| 2023/2024 | 2% |

As you can see, the rates are very low. This makes electric cars a good choice for many. It can mean more money in your pocket.

How to Calculate BIK Tax

Calculating BIK tax is not hard. You need three pieces of information:

- The car’s list price.

- The BIK tax rate.

- Your income tax rate.

Here is how to calculate it:

- Find the car’s list price. This is the price before discounts.

- Multiply the list price by the BIK tax rate.

- Multiply that number by your income tax rate.

Example of BIK Tax Calculation

Let’s look at an example. Imagine you have an electric car. The list price is £30,000. The BIK tax rate is 2%. Your income tax rate is 20%.

Step-by-step Calculation:

- £30,000 x 2% = £600

- £600 x 20% = £120

In this example, you would pay £120 in BIK tax for that year.

Other Benefits of Electric Cars

Electric cars have many more benefits. Here are some:

- They are quiet and smooth to drive.

- They can be charged at home.

- Many places have charging stations.

- Some cities offer free parking for electric cars.

Government Incentives

Many governments want more people to drive electric cars. They offer incentives. These can include:

- Grants for buying electric cars.

- Tax credits or rebates.

- Lower registration fees.

These incentives can help reduce costs. They make electric cars more affordable.

What About Hybrid Cars?

Hybrid cars are not fully electric. They use both gas and electricity. BIK tax for hybrids is higher than for electric cars. However, it is still lower than for gas cars. This makes hybrids a good choice, too.

Future of BIK Tax on Electric Cars

The future is bright for electric cars. Many believe BIK tax rates will remain low. Governments want to encourage electric car use. This will help the environment. It will also help reduce pollution.

Frequently Asked Questions

What Is Benefit In Kind Tax For Electric Cars?

Benefit in Kind (BIK) tax is a tax on perks from your job. For electric cars, it’s based on their value and emissions.

How Is Bik Tax Calculated For Electric Vehicles?

BIK tax is calculated using the car’s value and its CO2 emissions. Lower emissions mean lower tax rates.

Do Electric Cars Have Lower Bik Tax Rates?

Yes, electric cars usually have lower BIK tax rates. This encourages people to choose greener options.

What Are The Current Bik Tax Rates For Electric Cars?

Current BIK tax rates for electric cars can vary by year. Check the latest government guidelines for accurate rates.

Conclusion

Benefit in Kind tax on electric cars is very low. This makes them a good choice for many people. Lower taxes mean more savings. Electric cars have many benefits. They are good for the environment and your wallet.

As the world moves towards cleaner energy, electric cars will play an important role. Understanding BIK tax is essential. It helps you make smart decisions about your car.

In summary, if you are thinking about getting a car, consider an electric one. The BIK tax will save you money. You will also help the planet.