Rev Up Your Savings with Electric Car Salary Sacrifice and Tax Calculator – Benefits You Can’t Afford to Miss!

If you are looking for ways to save on taxes and reduce your carbon footprint at the same time, electric car salary sacrifice may be the perfect solution for you. Electric cars are becoming increasingly popular due to their eco-friendliness and cost-effectiveness. With electric car salary sacrifice, you can enjoy all the benefits of owning an electric car while saving on taxes and helping the environment.

This innovative scheme is quickly gaining popularity among employees and employers alike. In this blog post, we will explore the benefits of electric car salary sacrifice and why it is a great option for anyone considering making the switch to electric cars.

Reduced Income Tax & National Insurance Contributions

One of the major benefits of opting for an electric car through a salary sacrifice scheme is the significant reduction in income tax and national insurance contributions. Since electric cars emit much lower levels of harmful CO2 emissions compared to petrol or diesel vehicles, the government provides incentives to choose these eco-friendly options. By selecting an electric car through your employer’s salary sacrifice scheme, you can take advantage of tax and national insurance savings on the monthly payments.

Additionally, if you have a car tax calculator, you can work out how much you could potentially save each year. With reduced tax and national insurance contributions, you can cut your costs while making a positive impact on the environment. It’s a win-win situation for both you and the planet.

Savings of up to £2,400 per year for higher rate taxpayers

As a higher rate taxpayer, reducing your income tax and national insurance contributions can be a significant way to save money. By taking advantage of tax incentives such as salary sacrifice schemes or investing in a pension plan, you could potentially save up to £2,400 per year. This may sound too good to be true, but it’s important to understand that these methods are completely legal and can significantly reduce your taxable income.

Additionally, there are other ways to reduce your tax bill such as claiming tax credits or deductions, which can also save you a considerable amount of money. By taking advantage of these opportunities, you can free up more money to invest in your future and achieve your financial goals. So, why not take a closer look at your tax situation and see if there are any ways you can reduce your income tax and national insurance contributions? It could be the key to unlocking significant savings and improving your financial wellbeing.

Lower Fuel and Maintenance Costs

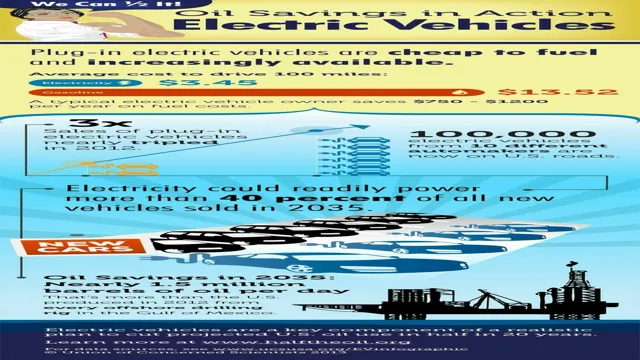

One of the greatest benefits of switching to an electric car through salary sacrifice is the potential for significant savings on fuel and maintenance costs. Electric cars are much cheaper to maintain than their fossil fuel counterparts, as they do not require oil changes, transmission fluid replacements, or other routine maintenance tasks. Additionally, electric cars enjoy much lower fuel costs, with the average cost per mile being roughly one-third that of a gas-powered vehicle.

For those using our car tax calculator to work out the potential savings, switching to an electric car could prove to be a smart financial move. Not only are these cars environmentally conscious, but they can also help individuals save a considerable amount of money in the long run. So why not consider making the switch today and start enjoying the many benefits of electric cars through salary sacrifice?

Electricity costs 3 times less than petrol or diesel per mile

Electricity has proven to be an economical and eco-friendly alternative to petrol or diesel. As per recent studies, it costs three times less per mile than any conventional fuel. With electric vehicles steadily increasing in popularity, the fuel and maintenance costs for these cars significantly go down.

Moreover, the lack of emissions makes them an attractive option for environmentally conscious consumers. As batteries become more advanced, charging stations are becoming more accessible, and the range of electric vehicles is increasing – making them a reliable option for daily commutes or long-distance travel. So, if you’re looking to save a decent amount of money on fuel and maintenance costs, consider switching to an electric vehicle.

It’s eco-friendly, pocket-friendly, and can help save the planet.

Zero Emissions for Cleaner Air

Electric cars are becoming increasingly popular as people look to reduce their carbon footprint and contribute to a cleaner environment. One of the major benefits of electric cars is the zero emissions they produce, which can significantly improve air quality in urban areas. With an electric car salary sacrifice scheme, employees can save money on their vehicle purchase and enjoy a tax-advantaged benefit.

Additionally, with the help of a car tax calculator, drivers can determine the tax deduction they can receive when choosing an electric vehicle over a traditional gas-powered car. It’s clear that the benefits of electric cars are numerous, from reducing air pollution to saving money on taxes. As more people recognize the value of these vehicles, we can look forward to a cleaner, more sustainable future.

Electric cars produce no tailpipe emissions

Electric cars are gaining in popularity for their eco-friendliness and their ability to produce zero emissions. This means that they release no harmful gases or pollutants into the air that contribute to global warming, smog, or other environmental issues. Traditional gasoline-powered cars, on the other hand, produce significant emissions from their tailpipes which can harm the environment and contribute to climate change.

By switching to electric cars, we can significantly reduce our carbon footprint and help create cleaner air for everyone. Not only that, but electric cars are incredibly cost-efficient and require less maintenance than their gasoline-powered counterparts. So why not upgrade to an electric car and join the green revolution? Together, we can make a difference and help create a cleaner, healthier world for future generations to come.

Improved air quality reduces health risks and healthcare costs

Improved air quality has a direct impact on the health of people and the environment. Zero emissions are the way forward to achieve cleaner air. It reduces the risk of respiratory diseases and allergies by minimizing air pollution.

Dirty air poses a severe threat to our health and can cause severe health risks, including heart disease, lung cancer, and stroke. When we inhale polluted air, we inhale harmful particles that penetrate deep into our lungs, causing damage. Reducing carbon emissions is crucial to protect our lungs and ensure cleaner air.

Clean air is essential to lead a healthy and fulfilling life. It’s especially important for children, the elderly, and those with pre-existing conditions who are more vulnerable to the effects of air pollution. By transitioning to zero-emission technologies like electric vehicles, we can make our air safer to breathe and reduce healthcare costs.

In conclusion, reducing air pollution and avoiding harmful emissions leads to cleaner air, a healthier environment, and a better future. It’s important to prioritize clean air as it significantly reduces the risk of chronic diseases, curtail healthcare costs, and ensure a sustainable environment for current and future generations.

Calculate Your Tax Savings with our Car Tax Calculator

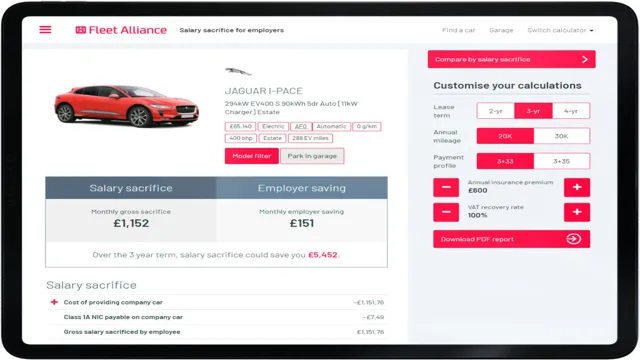

If you’re considering switching to an electric car, you may be eligible for significant tax savings through salary sacrifice. By sacrificing a portion of your pre-tax salary towards the car lease, you can lower your taxable income and potentially save thousands of dollars each year. To make it easier to calculate your potential savings, we’ve developed a car tax calculator that takes into account your salary, tax bracket, and other details to estimate your net savings.

Not only will you be reducing your carbon footprint by driving an electric car, but you could also be putting more money back in your pocket. So, take advantage of the benefits of electric car salary sacrifice and use our tax calculator to see how much you could save!

Estimate your savings on National Insurance Contributions & tax payments

As a car owner, you are required to pay certain taxes and national insurance contributions, but did you know that you can estimate your savings on these expenses? By using a car tax calculator, you can calculate your tax savings and figure out how much you could be saving on your payments. Not only can this help you budget better, but it can also give you a picture of the amount of money you could be saving in the long run. The calculator takes into account factors such as your car’s CO2 emissions and its market value to provide an accurate estimate of your tax savings.

By using this tool, you can take control of your finances and make informed decisions about your car-related expenses. So why not try it out and see how much you can save today?

Determine the impact on your take-home pay

When considering purchasing a new car, it’s essential to determine the impact on your take-home pay, especially since the buying process can be expensive. One factor that comes into play is car tax, which can vary depending on where you live and the type of vehicle you own. That’s why using a car tax calculator can be incredibly useful in calculating your tax savings.

By inputting your details, such as your state and car make and model, you can quickly see how much you could potentially save on taxes. This information can help you make an informed decision about what car to buy and how much you can afford to spend. The car tax calculator is an incredibly useful tool that can save you both time and money.

So, what are you waiting for? Give it a try and see how much you could potentially save.

Join the Electric Revolution Today

Are you considering joining the electric car revolution and want to know more about the benefits of electric car salary sacrifice and how much you could save with a car tax calculator? Well, you’ve come to the right place! Nowadays, more and more people are switching to electric cars as they become increasingly affordable and accessible. The benefits of electric cars are numerous, including lower running costs, zero emissions, and reduced road tax. One great way to save on the costs of an electric car is through salary sacrifice, where an employee can sacrifice a portion of their salary for a brand new electric vehicle.

Additionally, a car tax calculator can help you estimate how much you could save on road tax by switching to an electric car. So, why not join the revolution and be part of a greener, more sustainable future while also saving some money?

Conclusion

In conclusion, electric car salary sacrifice and the car tax calculator not only benefit the environment by reducing emissions, but also offer a financial savings to those looking to make the switch to electrical vehicles. By using these tools, individuals can calculate their potential savings and make an informed decision on whether or not to make the switch. So, why not give your wallet and the planet a break by opting for an electric car through salary sacrifice and making use of the car tax calculator!”

FAQs

1. What is salary sacrifice for electric cars and how does it work? Salary sacrifice for electric cars is a scheme that allows employees to give up a portion of their salary in exchange for a company car. With an electric car, employees can benefit from lower running costs and reduced carbon emissions. The salary sacrifice scheme also means that the cost of the car is spread over several years, making it more affordable. 2. How can using an electric car save me money on car tax? Electric cars are exempt from paying car tax (Vehicle Excise Duty) as they emit zero emissions. This means that you could save hundreds of pounds each year by switching to an electric car. However, it’s worth being aware that from April 2021, only zero-emissions cars with a list price of under £40,000 will be exempt from car tax. 3. What are the benefits of using a car tax calculator? A car tax calculator allows you to work out how much car tax you will need to pay on a particular vehicle. This is useful because car tax can vary greatly depending on the make and model of your car, as well as the age of the vehicle and emissions it produces. By using a car tax calculator, you can get a better picture of your motoring costs and make a more informed decision about which car to purchase. 4. Are there any other financial benefits to using an electric car? Yes, there are several other financial benefits to using an electric car. These include reduced fuel costs, lower insurance premiums and in some cases, reduced maintenance costs. The government also offers grants and subsidies to encourage the purchase of electric vehicles, including the Plug-in Car Grant and the Electric Vehicle Homecharge Scheme, which can help to reduce the upfront cost of buying an electric car.