Revving Up Your Portfolio: Top Battery Stocks to Power Your Electric Car Investment

Electric cars are becoming more popular than ever, and with that comes a demand for high-quality batteries. But what are the top battery stocks for electric cars? It can be difficult to know where to start, especially since there are so many options out there. However, by diving into the details of the industry and taking a closer look at some of the biggest names in the battery business, we can gain a better understanding of which stocks may be worth investing in.

From Tesla and Panasonic to LG Chem and CATL, let’s explore the top battery stocks for electric cars and what makes them stand out in the market.

Tesla, Inc. (TSLA)

When it comes to the best battery stocks for electric cars, Tesla, Inc. (TSLA) is undoubtedly a top player. This innovative company has revolutionized the automotive industry with its all-electric vehicles and advanced battery technology.

Tesla’s batteries are not only powerful and long-lasting but also environmentally friendly, making them ideal for eco-conscious consumers and investors. As the demand for electric vehicles continues to grow, Tesla is poised for continued success. Its Gigafactory, which produces batteries on a massive scale, allows the company to keep up with demand and stay ahead of competitors.

Additionally, Tesla’s commitment to innovation and sustainability ensures that it will remain a leader in the industry. Investing in Tesla is not only a smart financial decision but also an ethical one. By supporting this forward-thinking company, investors can help accelerate the transition to a cleaner, more sustainable future.

And with Tesla’s commitment to zero-emission vehicles and renewable energy, the future looks brighter than ever. In conclusion, when it comes to battery stocks for electric cars, Tesla is a top choice for investors seeking both financial and social returns.

Leading electric vehicle manufacturer with proprietary battery technology

Tesla, Inc. (TSLA) is one of the premier electric vehicle (EV) manufacturers globally. Their proprietary battery technology has set the bar high when it comes to EV performance and range.

With Tesla vehicles, you can expect not only a quiet ride but also a smooth, responsive and efficient one. Tesla’s batteries help deliver the power and range that EVs need to compete with traditional internal combustion engine vehicles. Tesla’s batteries offer high energy densities, so you can drive longer on a single charge.

The company is committed to continuous innovation, and they are constantly working to improve their battery technology. Tesla’s batteries are designed with safety in mind and have durable and long-lasting cycles even in harsh driving conditions. Tesla’s commitment to developing better batteries is one reason they have become the leading electric vehicle manufacturer in the world.

Strong brand recognition and growth potential

When it comes to strong brand recognition and growth potential in today’s market, Tesla, Inc. (TSLA) stands out as a clear leader. With its innovative electric cars, sleek designs, and commitment to sustainable energy, Tesla has captured the attention of consumers and investors alike.

Its recognizable brand has become synonymous with cutting-edge technology and environmental responsibility. Plus, with the growing popularity of electric vehicles and the shift towards clean energy, Tesla’s growth potential only continues to increase. The company is constantly expanding its product line and investing in new technologies, such as autonomous driving and battery storage, which only adds to its appeal.

All of these factors combine to make Tesla a compelling choice for anyone looking to invest in a company with a strong brand and vast potential.

LG Chem Ltd. (LGCLF)

When it comes to investing in electric car battery stocks, LG Chem Ltd. (LGCLF) is one of the best options. LG Chem is one of the largest lithium-ion battery producers in the world and supplies batteries to a variety of notable electric vehicle manufacturers.

The company has also been expanding its production capacity rapidly, which puts it in a position to meet the growing demand for batteries as more automakers shift towards electric vehicles. Investing in LG Chem is a smart move given that the electric vehicle market is expected to continue growing rapidly in the coming years. And with their recent partnership with General Motors to build batteries for their next-generation electric vehicles, LG Chem is likely to see even more growth potential in the future.

So, if you’re looking to invest in electric car battery stocks, LG Chem is definitely one to keep on your radar.

Key supplier of electric vehicle batteries to major car manufacturers

LG Chem Ltd. (LGCLF) is a key supplier of electric vehicle batteries to major car manufacturers. Their cutting-edge technology and commitment to innovation have made them a leader in the industry.

They provide high-quality batteries that are both efficient and effective, which has been instrumental in the success of electric vehicles worldwide. LG Chem’s batteries are known for their long lifespan, fast charging capabilities, and energy density, which allows electric vehicles to have an extended driving range. They work closely with automakers to develop custom battery solutions that meet their specific needs, ensuring that their vehicles meet performance, safety, and cost requirements.

As the demand for electric vehicles continues to grow, LG Chem is well-positioned to meet the needs of car manufacturers around the world, providing them with cutting-edge technology and reliable battery solutions.

Diversified product portfolio including batteries for electric vehicles and stationary energy storage

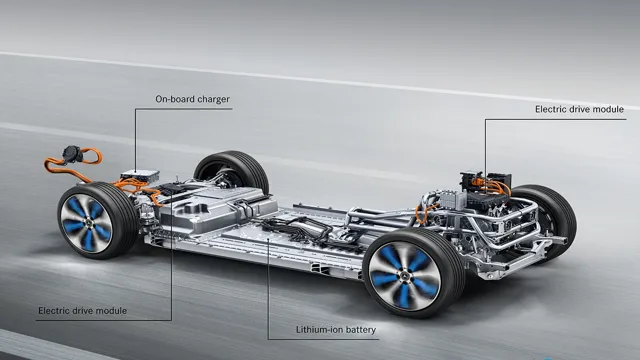

LG Chem Ltd. (LGCLF) is a world-renowned manufacturer of batteries for various applications. With a diversified product portfolio, the company is committed to providing sustainable energy solutions to customers worldwide.

One of their most prominent products is batteries for electric vehicles, where LG Chem is a leading supplier to many top automakers. These batteries are designed to provide long-lasting power and quick charging capabilities, making electric vehicles more accessible to people around the world. In addition, LG Chem also offers batteries for stationary energy storage, providing a reliable and cost-effective way to store energy for households and businesses alike.

Thanks to LG Chem’s innovative technology, these batteries can help reduce energy costs and provide backup power during outages. With such comprehensive and dependable energy solutions, LG Chem is undoubtedly leading the way towards a greener future.

Panasonic Corporation (PCRFY)

If you are looking for the best battery stocks for electric cars, look no further than Panasonic Corporation (PCRFY). The Japanese electronics company is a major player in the global battery technology industry, thanks to its partnership with Tesla. Panasonic supplies the lithium-ion batteries that power Tesla’s electric vehicles, putting it in a prime position to benefit from the growing demand for electric cars.

The company is also investing heavily in research and development to improve battery technology and increase production capacity. This commitment to innovation has led to several breakthroughs in battery design, resulting in longer-lasting and more efficient batteries. With a strong track record in the industry, and a growing global demand for electric vehicles, Panasonic is an excellent choice for investors looking to capitalize on the growth of the electric vehicle market.

Partnered with Tesla as a key supplier of batteries

Panasonic Corporation (PCRFY) has come a long way from just being a small lighting company back in 191 Today, it is known as one of the leading battery manufacturers in the world, supplying a vast range of products to various industries. One of the significant partnerships that the company has established is with Tesla, becoming its key supplier of lithium-ion batteries.

This partnership has enabled both companies to bring electric and solar solutions to homes, businesses, and consumers on a larger scale. Panasonic’s batteries have allowed Tesla to produce some of the most sought-after electric vehicles in the world, making strides in renewable energy and clean transportation. This partnership with Tesla has elevated Panasonic Corporation’s reputation as a reliable and innovative battery supplier, providing a more sustainable future for all.

Extensive experience in battery technology with a global reach

Panasonic Corporation (PCRFY) is a leading company in the battery technology industry with extensive experience and a global reach. With a commitment to innovation, Panasonic has established itself as a pioneer in lithium-ion batteries, a popular choice in energy storage for EVs and other electric devices. The company has been designing and manufacturing batteries for over 40 years, and has delivered over 300 billion battery cells worldwide.

This highlights the vast breadth of their experience and the trust they have earned from clients around the globe. Panasonic continues to lead the industry with their advanced technologies, such as their high-capacity lithium-ion cells, which have the potential to transform the energy storage landscape. Their focus on sustainable solutions has also led to the development of batteries that are recyclable and eco-friendly, ensuring that their products have minimal negative impact on the environment.

Overall, Panasonic’s commitment to excellence and focus on sustainability has helped them solidify their position as one of the foremost players in the battery technology industry.

Samsung SDI Co., Ltd. (SSDIY)

If you’re looking to invest in the best battery stocks for electric cars, Samsung SDI Co., Ltd. (SSDIY) might just be your ticket to success.

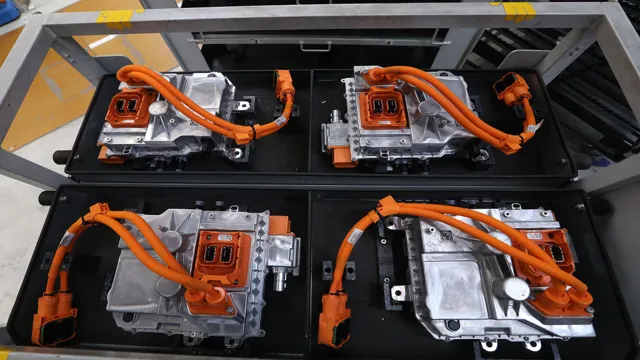

As part of the Samsung conglomerate, this South Korean-based company has quickly become a leader in the battery industry, providing high-quality, safe and reliable batteries that power a range of electric vehicles. With the growing demand for electric cars, and several countries mandating a shift to greener and cleaner energy, the electric vehicle market is only set to rise. Samsung’s expertise in battery technology and manufacturing has enabled it to become one of the major players in this industry, with partnerships with some big names in the automotive industry.

Investing in Samsung’s battery stocks could prove profitable, as the company continues to look for ways to innovate and improve its products, remaining competitive in the ever-growing market of electric vehicles.

Strong presence in the electric vehicle battery market

Samsung SDI Co., Ltd. (SSDIY) is a prominent player in the electric vehicle battery market, with a strong presence and reputable brand name.

They provide high-quality, reliable batteries for various electric vehicle models, including Tesla and BMW. SSDIY has been investing heavily in research and development to create innovative and energy-efficient battery solutions that meet the evolving needs of the automotive industry. Their products are renowned for their long life, quick charging capabilities, and safety features.

SSDIY’s commitment to sustainability has also led them to explore new avenues such as energy storage systems for renewable energy and smart homes. With their cutting-edge technology and commitment to excellence, SSDIY is well-positioned to continue leading the way in the electric vehicle battery market.

Investing heavily in research and development to improve battery performance

Samsung SDI Co., Ltd. (SSDIY) Samsung SDI Co.

, Ltd. (SSDIY) is a South Korean battery manufacturer that has invested heavily in research and development to improve battery performance. The company’s commitment to innovation is reflected in its impressive range of high-quality batteries that are used in various devices including laptops, electric cars, smartphones, and drones.

The company is a leader in the lithium-ion battery market, providing powerful and reliable batteries that are innovative and safe. Samsung SDI Co., Ltd.

(SSDIY) has been investing in the development of next-generation batteries that promise to be even more efficient and long-lasting than its current line of batteries. In recent years, the company has been exploring solid-state batteries, which are expected to be a game-changer in the battery industry. The development of solid-state batteries is expected to address the limitations of traditional lithium-ion batteries, including their limited capacity, short lifespan, and concerns about their safety.

With Samsung SDI Co., Ltd. (SSDIY) committed to investing in research and development, consumers can expect to see more powerful and efficient batteries for their devices.

Conclusion

In conclusion, the best battery stocks for electric cars are powering up the automotive industry and paving the way for a cleaner, greener future. From established players like Panasonic and LG Chem to up-and-comers like QuantumScape, these companies are pushing the boundaries of energy storage technology and setting the stage for a revolution in transportation. As investors, it’s important to keep a close eye on these battery stocks and stay charged up with the latest news and developments.

Who knows, one day we may even be able to say with a spark of pride: “I invested in the battery stocks that powered the electric car revolution!”

Investing in battery stocks for electric cars offers potential for growth in the fast-evolving electric vehicle industry.

Investing in battery stocks for electric cars is a smart way to capitalize on the fast-evolving electric vehicle industry. One stock with plenty of growth potential in this area is Samsung SDI Co., Ltd.

(SSDIY). This South Korean company manufactures lithium-ion batteries for electric vehicles and energy storage systems. With the increasing demand for electric vehicles, Samsung SDI is well-positioned for growth.

Additionally, the company has been investing heavily in research and development to improve the efficiency and performance of its batteries. Its market presence is also expanding with partnerships with major automakers like BMW and Volkswagen. As consumers continue to shift towards electric vehicles, Samsung SDI is likely to be a major player in the industry.

This is a stock worth considering for any investor who wants to capitalize on the growth potential of the electric vehicle market.

FAQs

What are the top battery stocks for electric cars in the current market?

The top battery stocks for electric cars in the current market include Tesla (TSLA), Panasonic Corporation (PCRFY), Contemporary Amperex Technology Co Ltd (CATL), LG Chem (LGCLF), and Samsung SDI (SSDIY).

How much growth can one expect from investing in battery stocks for electric cars?

Investing in battery stocks for electric cars can be quite lucrative due to the increasing demand for electric cars. The growth potential can vary depending on the specific stock, but the industry as a whole is expected to grow substantially over the next decade.

What are some potential risks associated with investing in battery stocks for electric cars?

Some potential risks associated with investing in battery stocks for electric cars include changes in government regulations or policies, fluctuation in demand for electric cars, and increased competition in the industry.

Are there any new battery technologies that could impact the current market for battery stocks for electric cars?

Yes, there are several new battery technologies being developed that could have a significant impact on the current market. These include solid-state batteries, lithium-sulfur batteries, and metal-air batteries, among others.