Electric Cars Get a Boost: Budget 2017’s Benefit in Kind Reignites Interest

Get ready to bid farewell to hefty taxes for electric cars – The Budget 2017 has some good news for you! With the dramatic increase in the number of people switching to electric cars, this year’s budget proposes to reduce the benefit in kind taxation on these vehicles. If you’re wondering what that means, it refers to the tax paid on the private use of a company car, which is based on the car’s list price and CO2 emissions. And this is a massive step towards encouraging more people to go green and eco-friendly with their vehicle choices.

With the upcoming changes, electric cars are set to become a more lucrative option for businesses and individuals, contributing to both environmental and financial sustainability. So, are you excited to know more about this year’s budget plan for electric cars? Read on to discover the benefits of going electric and why the Budget 2017 is a game-changer in the world of sustainable driving.

Overview of Benefit in Kind Changes

One of the key announcements in the 2017 budget was changes to the Benefit in Kind (BIK) rates for electric cars. Previously, electric cars were treated as a regular company car when it came to BIK rates, meaning that employees who received an electric car as part of their job package would have to pay tax on a percentage of the car’s value. However, as part of efforts to encourage the use of electric vehicles, the government announced that from April 2020, BIK rates for electric cars would be reduced to 0%.

This means that employees who receive an electric car as part of their job package will no longer have to pay any tax on the car’s value. This is a significant change, and it’s hoped that it will encourage more businesses and individuals to switch to electric cars, which are more environmentally friendly and cheaper to run than traditional petrol or diesel vehicles.

Explanation of Benefit in Kind for Electric Cars

Electric cars have become a popular option for individuals and companies alike due to increasing awareness of the detrimental effects of traditional gas-powered vehicles on the environment. With the shift towards electric vehicles, the UK government has made changes to the Benefit in Kind (BIK) tax system to encourage and incentivize the use of more eco-friendly cars. From April 6, 2020, electric cars will now be subject to 0% Benefit in Kind tax rate for the entire fiscal year.

This means that any employee who uses an electric vehicle for personal use will not have to pay tax on the benefit provided by their employer. This is a significant change since the previous rate was 16% for the tax year 2019/20. The new zero-rate overhaul applies to both pure electric cars and hybrid vehicles, provided that they meet new CO2 emission standards.

This change has been put in place to encourage companies to invest in greener modes of transport and reduce their overall carbon footprint.

Comparison to Benefit in Kind for Traditional Cars

When it comes to company cars, the benefits that employees enjoy have historically been taxed through Benefit in Kind (BIK) calculations. Recently, there have been changes to how BIK is calculated, particularly for electric cars. From April 6th 2020, electric company cars will be taxed at 0% of their value.

This means that employees that receive an electric company car will not have to pay any BIK tax on the car. This is a tremendous incentive for employees who may have otherwise been hesitant to make the switch to electric. The BIK tax rates for other company cars and traditional petrol or diesel cars will continue to be calculated based on the car’s carbon dioxide emissions.

As a result, it’s essential to choose carefully the type and model of the company car provided to employees, taking into account the tax burden they’ll face too. The recent BIK changes represent a push by the government towards the adoption of cleaner electric cars and a decrease in traditional petrol or diesel car usage.

Impact on Electric Car Sales

The recently announced UK budget 2017 offers some good news for those considering investing in an electric vehicle. The government has now confirmed that the benefit in kind (BIK) rates for electric cars will remain at 2% until at least 202 This is great news for businesses, as it means that company car drivers will be able to save a significant amount of money on tax.

The new budget is expected to boost the sales of electric cars across the country, as it makes them more affordable and attractive for individual buyers as well. If you are considering purchasing an electric vehicle, now is the perfect time to take advantage of these incentives and start enjoying the many benefits that electric cars have to offer. With budget 2017 electric cars benefit in kind rates remaining low, it’s now easier than ever to make the switch to a more efficient and eco-friendly vehicle.

Analysis of Electric Car Sales Trends Since Budget 2017

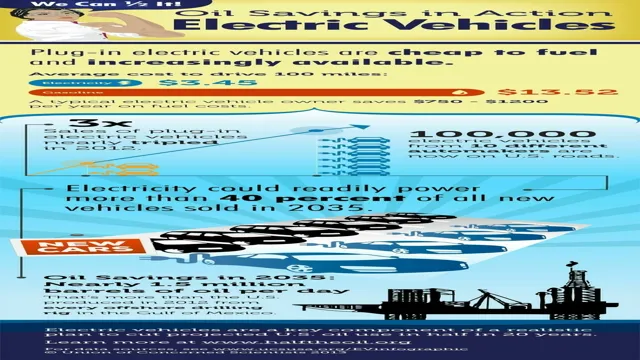

Since Budget 2017, the electric car industry has seen a surge in sales, as more people opt for environment-friendly solutions to their transportation needs. One of the main contributors to this trend is the tax incentive introduced by the government, promoting the use of electric cars over traditional petrol-powered vehicles. As a result, more and more car manufacturers have introduced electric cars, making them more accessible to the general population.

This trend has been further bolstered by the increased availability of charging stations, which has alleviated the range anxiety that consumers often have with electric cars. With all these factors working together, it is no surprise that electric car sales have experienced a significant upturn in recent years. As more people become conscious of their carbon footprint, it is likely that this trend will continue, making electric cars a more prominent feature in the automotive industry.

Case Studies of Companies That Have Switched to Electric Cars

One of the most impactful ways for companies to contribute to the transition to electric vehicles is by switching their own fleets to electric cars. Several companies have taken this step, including FedEx, Amazon, and DHL, and their stories provide good case studies on the impact of such a move. For example, after adding thousands of electric delivery vans to its fleet, FedEx claimed that it would save around $200 million in fuel costs and cut 3 million metric tons of greenhouse gas emissions over ten years.

These numbers are evidence of the tremendous impact that even a single company can have in the transition to electric cars. Furthermore, companies that switch to electric vehicles are likely to serve as an example for their peers and inspire more businesses to make the same transition. As more and more companies follow FedEx’s and Amazon’s leads, electric vehicle sales will continue to skyrocket, eventually making internal combustion engines a thing of the past.

Expert Opinions on the Impact of Benefit in Kind Changes

Numerous experts in the automotive industry have expressed concerns about the impact of the recent benefit in kind changes on electric car sales in the UK. Many believe that the changes, which were implemented to increase the taxation rates on company cars and vans, will result in a significant reduction in the number of electric vehicles purchased by businesses. This is because, under the new rules, electric cars will now be considered a high-value benefit in kind, making them much less tax-efficient for businesses.

As a result, companies may decide to switch back to traditional petrol or diesel vehicles, which would be more cost-effective in the long run. However, some experts argue that the impact of the changes on electric car sales may not be as significant as some fear, as many businesses are now placing a greater emphasis on sustainable and environmentally-friendly transportation solutions. Overall, it remains to be seen how the new benefit in kind changes will impact electric car sales in the UK.

Environmental Benefits of Electric Cars

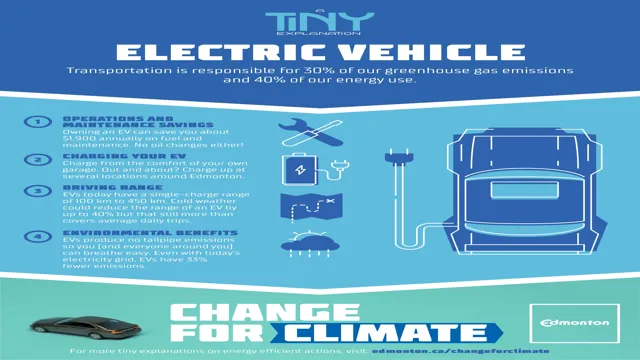

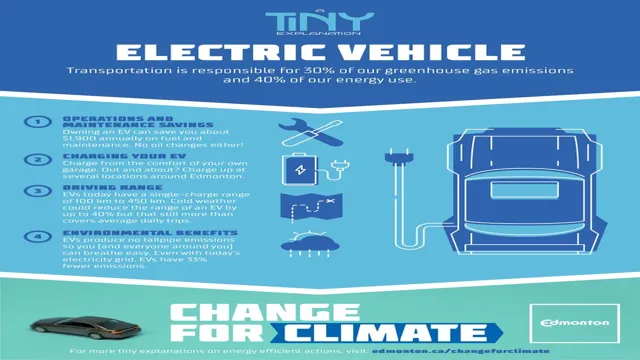

The Budget 2017 announcement regarding the benefits in kind for electric cars has brought much attention to the environmental benefits of this mode of transportation. With zero-emissions, electric cars help to reduce air pollution and fight climate change. Not only do they emit no pollutants while driving, but they can also be powered by renewable energy sources such as wind and solar, further reducing their carbon footprint.

In addition, electric cars are quieter than traditional fossil-fueled ones, reducing noise pollution. By incentivizing the adoption of electric cars, the government is taking a crucial step towards a cleaner, more sustainable future for our planet. Investing in electric cars not only benefits our environment but also promotes energy independence, protects public health, and drives innovation in the automobile industry.

The notion of a greener future is becoming increasingly popular, and electric cars offer a concrete opportunity for individuals to participate in making that future a reality.

Reduction in Carbon Emissions Compared to Traditional Cars

Electric cars offer a substantial reduction in carbon emissions compared to traditional gas-powered vehicles. This is a significant environmental benefit that cannot be ignored. When we start using electric cars, we reduce the amount of greenhouse gases released into the atmosphere.

These gases contribute to climate change, which is a serious issue that needs to be addressed. Electric cars run on electricity, which means they do not produce any harmful emissions. This has a positive impact on the environment, and it also reduces our carbon footprint.

By driving an electric car, we can make a significant difference in reducing air pollution and lowering our impact on the environment. Not only that, but it also reduces our dependence on fossil fuels, which are a finite resource. As we move towards a more sustainable future, electric cars will play a pivotal role in reducing our carbon emissions and creating a cleaner, greener planet for generations to come.

Potential for Increased Electric Car Adoption in the Future

Electric cars have the potential to make a significant impact in reducing emissions and combating climate change. In comparison to traditional cars, electric cars have zero emissions, meaning that they do not release pollutants into the air like carbon monoxide and nitrogen oxides. These pollutants contribute to smog, respiratory problems, and global warming.

Additionally, electric cars are much more energy-efficient, converting over 75% of their stored energy into usage, while traditional cars only convert around 20%. With advancements in technology, electric cars are becoming more affordable, have longer battery life, and require less maintenance. While electric cars may not be the perfect solution to reducing carbon emissions, they provide a promising alternative to traditional fossil fuel powered vehicles.

By making an effort to switch to electric cars, we can not only reduce our carbon footprint but also help to pave the way for a more sustainable future.

Conclusion: Benefit in Kind Changes and the Future of Electric Cars

In conclusion, the 2017 budget’s benefit in kind policy for electric cars is a win-win situation. Not only will it encourage individuals to choose eco-friendly vehicles, it will also result in cost savings for companies and potentially even lead to decreased air pollution. So, let’s spark up the future and drive towards a brighter and cleaner tomorrow!”

FAQs

How will the budget 2017 affect electric cars?

The budget 2017 includes a tax incentive for electric cars, which will reduce the cost of owning and operating an electric vehicle.

What is benefit in kind for electric cars?

Benefit in kind is a tax on the non-cash benefits that an employer provides to an employee, including the use of a company car. For electric cars, the benefit in kind rate is lower due to their lower emissions.

Will electric cars become more affordable after the budget 2017?

The budget 2017 includes a tax incentive for electric cars, which will reduce their cost and make them more affordable for consumers.

What are the environmental benefits of electric cars in the budget 2017?

Electric cars produce fewer emissions than petrol or diesel cars, which could help reduce the UK’s carbon footprint and improve air quality. The budget 2017 supports this by including tax incentives for electric vehicles and promoting the use of renewable energy sources.