Maximize Your Business Tax Savings: The Growing Benefits of Owning an Electric Car

As more and more businesses recognize the benefits of going green, electric cars are quickly becoming a popular option. Not only do they help reduce a company’s carbon footprint, but they also unlock a range of tax benefits. With the growing variety of electric car models now available, there’s no reason for businesses to miss out on the advantages they offer.

In this blog post, we’ll explore just what makes electric cars such an attractive prospect for companies looking to lower their tax bills, and how they can start reaping the rewards. So buckle up and get ready to explore the world of electric cars and how they can help you take your business to the next level!

Rise of Electric Cars

If you’re a business owner, investing in electric cars is not only a step towards reducing your carbon footprint, but it’s also a smart financial move. The government offers various tax benefits for businesses that decide to switch to electric vehicles. These incentives include the federal tax credit, which can earn you up to $7,500 in tax savings per vehicle, and state rebates that can shave a few thousand dollars off the purchase price.

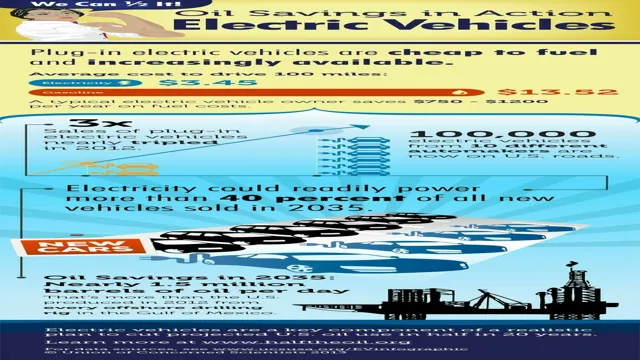

Additionally, electric cars help businesses cut costs on fuel, maintenance, and repairs, making it a practical investment. But beyond tax benefits and financial savings, adopting electric cars is a moral obligation for corporations to contribute to the global sustainability movement. With the rise of electric cars worldwide, it’s only a matter of time before this trustworthy technology replaces fossil fuels altogether and pave the way for a more sustainable future for generations to come.

Data on Electric Car Adoption in Business Settings

The rise of electric cars in business settings is on the upswing. Recent data suggests that companies are increasingly adopting electric vehicles (EVs) due to their environmental benefits, cost-savings, and government incentives that encourage their use. In fact, some businesses in the technology and delivery sectors have already embraced electric cars as part of their fleets.

This not only helps to reduce carbon emissions, but it also contributes to a positive corporate image. Moreover, the advancement of charging infrastructure is making it easier for businesses to adopt EVs, as they no longer have to worry about the range limitations of the vehicles. As more businesses begin to realize the benefits of electric cars, it’s expected that their adoption will continue to rise – making electric vehicles more mainstream for companies of all sizes.

Impact of Government Incentives on Adoption

The rise of electric cars has been greatly impacted by government incentives. With the rising concern for the environment, governments around the world have been encouraging consumers to adopt electric cars by offering various incentives. These incentives include tax credits, rebates, lower registration fees, and priority parking.

These efforts have resulted in a surge in demand for electric cars, making them more accessible and affordable for the general public. In fact, some countries, such as Norway, have reported that electric car sales account for more than half of all new car sales. This trend is expected to continue as more governments implement policies that favor sustainable transportation and as technology advancements make electric cars more appealing to consumers.

The future of transportation seems to be heading towards more sustainable and eco-friendly options, and government incentives are playing a crucial role in this transition.

Tax Benefits for Businesses Using Electric Cars

If you’re a business owner, you may be considering the switch to electric vehicles for your company’s transportation needs. Aside from the environmental benefits, there are also significant tax benefits for businesses using electric cars. Firstly, businesses can receive a federal tax credit of up to $7,500 per electric vehicle purchased.

Additionally, businesses can also take advantage of accelerated depreciation schedules for electric vehicles, allowing for larger tax deductions in the first year of ownership. Another benefit is that businesses may be eligible for state and local tax incentives for using electric vehicles, such as sales tax exemptions or reduced registration fees. By switching to electric cars, businesses can not only lower their carbon footprint but also enjoy a range of tax benefits that could lead to significant savings in the long run.

IRS Tax Credits and Deductions

Electric cars have been a hot topic lately, and with good reason. Not only are they environmentally friendly, but they also offer a variety of tax benefits for businesses who use them. One of the main tax benefits is the federal electric vehicle tax credit.

This credit can be worth up to $7,500 per vehicle and can be applied to both new and used electric cars. In addition, businesses can also take advantage of the Alternative Fuel Vehicle Refueling Property Credit, which offers a tax credit of up to 30% of the cost of installing charging stations for electric cars. These tax benefits could potentially save businesses thousands of dollars on their taxes, while also promoting sustainability in their operations.

So, if you’re a business owner considering switching to electric cars, definitely consider the potential tax benefits that come along with them.

State and Local Tax Incentives

Electric cars are becoming increasingly popular due to their eco-friendly nature and the benefits they provide compared to traditional cars that run on fossil fuels. In addition to being better for the environment, electric cars also offer businesses various tax incentives and benefits. Many state and local governments offer tax incentives to businesses that use electric cars as part of their fleet.

These include a variety of exemptions, including sales tax exemptions, income tax credits, and property tax credits. Some states also offer rebates to businesses that purchase or lease electric cars. These incentives reduce the overall cost of owning and operating an electric vehicle, making it an appealing option for businesses looking to transition to more sustainable transportation options.

By taking advantage of these tax incentives, businesses can save money while also contributing to a cleaner and more sustainable future.

Other Benefits of Electric Car Ownership

When it comes to electric cars, many people are aware of the environmental benefits of driving one. However, what people don’t often realize is the potential tax benefits that businesses can receive for using electric cars. The government offers incentives to businesses that purchase electric cars, which can include tax credits and deductions.

By using electric cars instead of traditional gas-powered vehicles, businesses can not only save money on fuel costs but also take advantage of tax breaks. These tax benefits can be a significant advantage for businesses that rely on transportation and are looking for ways to cut costs and improve their bottom line. Overall, electric car ownership offers several advantages, including environmental benefits, cost savings, and tax benefits for businesses.

Real Examples of Businesses Benefitting from Electric Cars

Businesses are increasingly recognizing the benefits of electric cars, not just for the environment, but also for their bottom line. One of the most significant advantages is the business tax benefit for electric cars. One example of a company that has benefitted from this is Element Materials Technology, a company that provides testing services to the aerospace and defense industries.

By replacing their fleet of gasoline vehicles with electric ones, they were able to take advantage of a sizable tax deduction, resulting in an annual saving of $50,000. Another example is PepsiCo, which has been able to reduce its fuel and maintenance costs by using a fleet of electric trucks for deliveries. In addition to the business tax benefit, electric vehicles also offer other advantages, such as being exempt from congestion charges and being eligible for special parking permits.

With the increasing availability of charging infrastructure, more businesses are expected to make the switch to electric vehicles, saving money and reducing their carbon footprint.

Case Study: Small Business Saves Thousands on Taxes

Electric Cars Today, we’re going to delve into a real-life scenario that shows how small businesses can benefit significantly from electric cars. Our case study is about a local catering company that chose to invest in an electric vehicle for their deliveries. Initially, it seemed like a significant investment, but the business was keen on being more eco-friendly and reducing their carbon footprint.

What they didn’t expect was the massive savings they would make on taxes. Since the electric car is seen as a “clean vehicle” by the IRS, this business was able to claim a $7,500 federal tax credit when they filed their taxes. Furthermore, they could also claim up to $2,500 in state tax credits depending on where they were located.

We’re talking about a total savings of $10,000, which is quite substantial for a small business. Overall, this shows that investing in electric cars can not only help businesses reduce their carbon footprint but also save money on taxes – a win-win situation!

Case Study: National Corporation Shows ROI of Electric Car Fleet

Electric Car Fleet Businesses are embracing the use of electric cars, and the results are impressive. For instance, a National corporation recently demonstrated the ROI of introducing electric cars into its fleet. The introduction of these vehicles led to significant savings on fuel costs, maintenance fees, and a reduction in carbon emissions.

The corporation realized the benefits of an electric car fleet by conducting a cost-benefit analysis and evaluating the data obtained by the implementation of these vehicles. This is one of several examples of businesses reaping the rewards of electric car fleets, and with the continued innovation in the technology, businesses can look forward to even more savings in the future.

Ready to Switch to Electric Cars?

Are you a business owner looking for tax benefits while also reducing your carbon footprint? Switching to electric cars may be the answer! By investing in electric vehicles for your business, you can take advantage of the business tax benefit for electric cars, which can result in significant savings on your taxes. Not only will you save money, but you’ll also be contributing to a cleaner environment, which can attract environmentally conscious customers and employees. In addition, electric cars may also have lower maintenance costs and provide long-term savings on fuel costs compared to traditional fuel-powered vehicles.

So, why not make the switch and reap the benefits for both your business and the planet?

Conclusion

In conclusion, the business tax benefits of owning an electric car are electrifyingly advantageous. Not only do they offer cost savings and eco-friendliness, but they also provide a boost to a company’s image and reputation for being socially and environmentally responsible. So whether you’re a small business owner or a large corporation, the tax benefits make driving an electric car a smart business move that benefits both your bottom line and the planet.

“

FAQs

What is the business tax benefit for buying an electric car?

As per the IRS, businesses can claim a federal tax credit of up to $7,500 for each electric car purchased for business use.

Can individuals also claim a tax benefit for buying an electric car for personal use?

Yes, individuals who purchase an electric car for personal use can claim a federal tax credit of up to $7,500. However, the credit amount may vary depending on the vehicle’s battery capacity and other factors.

Are there any state-level tax benefits for buying an electric car?

Yes, many states offer additional tax incentives or rebates for purchasing an electric car. These incentives may include exemptions from sales tax, reduced registration fees, and income tax credits.

How long will the federal tax credit for electric cars be available?

The federal tax credit for electric cars is limited to a certain number of vehicles sold by each manufacturer. Once a manufacturer reaches the limit, the credit begins to phase out for that particular make and model. For example, the tax credit for Tesla vehicles began phasing out in 2019.