Buying Electric Car Rebate Florida Guide to Savings and Incentives

Featured image for buying electric car rebate florida

Image source: questionpro.com

Discover how to maximize your savings with Florida’s electric car rebates and incentives, including federal tax credits up to $7,500 and potential state-level perks like HOV lane access and reduced registration fees. Act fast—eligibility rules and funding limits apply, so understanding the latest programs ensures you don’t miss out on thousands in EV savings.

Key Takeaways

- Check eligibility: Verify income and vehicle requirements for Florida’s EV rebate program.

- Maximize federal credits: Combine state rebates with up to $7,500 federal tax credit.

- Act fast: Florida’s rebates are limited and distributed on a first-come basis.

- Research local incentives: Cities offer extra perks like charging discounts or parking passes.

- Calculate total savings: Factor in fuel, maintenance, and tax breaks for long-term value.

- Buy new or used: Some pre-owned EVs qualify for partial rebates—review guidelines.

- Submit paperwork early: Delays can cost you; file promptly after purchase.

📑 Table of Contents

- Why Florida Is the Perfect Place to Go Electric

- Understanding the Federal Tax Credit and How It Works in Florida

- Florida’s State-Level Incentives: What’s Available in 2024?

- Utility Company EV Incentives in Florida (2024)

- Maximizing Savings: Smart Strategies for Florida EV Buyers

- Charging at Home and On the Go: Florida’s EV Infrastructure

- Common Mistakes to Avoid When Claiming EV Rebates in Florida

- Final Thoughts: Your Roadmap to EV Savings in Florida

Why Florida Is the Perfect Place to Go Electric

Imagine driving down I-95 with the sun on your face, the windows down, and your only worry being which beach to visit next. Now imagine doing it in a sleek electric car, knowing every mile you drive is saving you money and helping the planet. That’s the dream, and in Florida, it’s becoming a reality thanks to a growing number of electric car rebates and incentives.

As a long-time Florida driver who recently made the switch from a gas-powered SUV to a Tesla Model Y, I can tell you firsthand: the savings are real. But the process isn’t always simple. Between federal tax credits, state-level programs, utility company offers, and local perks, it’s easy to get overwhelmed. That’s why I created this buying electric car rebate Florida guide—to help you cut through the noise, avoid costly mistakes, and maximize every dollar you save. Whether you’re a first-time EV buyer or a seasoned green driver, this guide walks you through everything you need to know to make a smart, money-saving purchase.

Understanding the Federal Tax Credit and How It Works in Florida

The first stop on your electric car savings journey should be the federal tax credit. This is the biggest financial incentive available, and it’s still in play as of 2024—though with some important changes from the Inflation Reduction Act (IRA).

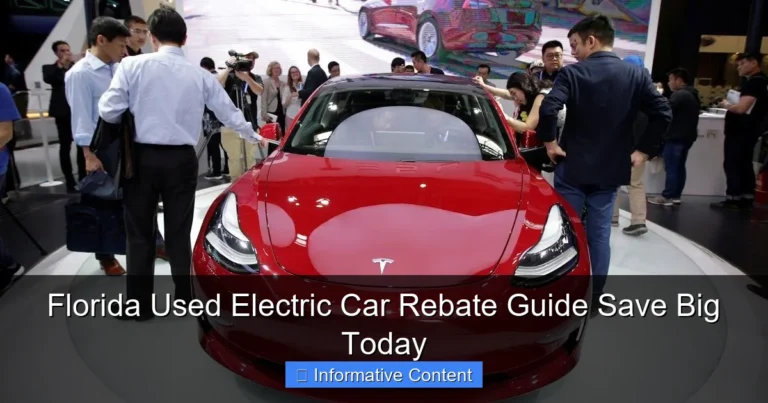

Visual guide about buying electric car rebate florida

Image source: d1aeya7jd2fyco.cloudfront.net

What Is the Federal EV Tax Credit?

The federal government offers a tax credit of up to $7,500 for qualifying new electric vehicles (EVs) and $4,000 for used EVs (2023 and newer models). Unlike a rebate you get at the point of sale, this is a credit you claim when you file your federal taxes. Think of it as money the government gives you back—but only if you owe that amount in taxes.

For example, if you owe $6,000 in federal taxes and your EV qualifies for the full $7,500 credit, you’ll get $6,000 back. The remaining $1,500? You lose it. So, it’s not a cash refund—it’s a credit against your tax liability.

Which Cars Qualify in 2024?

Not every EV qualifies. The IRA tightened rules to promote domestic manufacturing. As of 2024, only vehicles with final assembly in North America are eligible. Additionally, there are battery component and critical mineral sourcing requirements.

Popular qualifying models include:

- Tesla Model 3 (Rear-Wheel Drive and Performance versions)

- Ford F-150 Lightning (certain trims)

- Rivian R1S (if under MSRP limit)

- Chevrolet Bolt EV/EUV (though production ended, remaining inventory qualifies)

Tip: Use the EPA’s official tool to check if a specific VIN qualifies. Don’t rely on dealer claims—some salespeople aren’t up to speed.

Used EV Tax Credit: A Hidden Gem

Did you know you can get $4,000 off a used electric car? That’s right. If you buy a used EV (model year 2023 or newer) from a licensed dealer for $25,000 or less, you may qualify for the used EV tax credit. The vehicle must be at least two years old, and you must be the second owner or later.

I helped my sister buy a 2023 Nissan Leaf for $22,000 last year. She got the $4,000 credit, and because she owed $5,000 in taxes, she walked away with $1,000 in extra savings. Not bad for a “used” car!

Florida’s State-Level Incentives: What’s Available in 2024?

Here’s the good news: Florida doesn’t have a state income tax, so there’s no state EV tax credit. But don’t let that discourage you. Florida offers other valuable incentives—especially at the local and utility level.

No State Rebate, But Plenty of Perks

Unlike California or Colorado, Florida doesn’t offer a direct state rebate for EV purchases. But that doesn’t mean you’re out of luck. The Sunshine State makes up for it with:

- HOV Lane Access: All EVs with a valid Florida EV license plate can use high-occupancy vehicle (HOV) lanes, even with just one person in the car. That’s a huge time-saver during rush hour in Miami or Orlando.

- Reduced Registration Fees: Florida charges a one-time $225 EV registration fee, but it’s offset by the fact that you’re not paying annual gas tax. Over 5 years, that’s about $750 in savings.

- Exemptions from Emissions Testing: EVs don’t require annual smog checks. That’s one less appointment and $20–$40 saved each year.

Local Incentives: Cities and Counties Step Up

While the state stays neutral, many Florida cities are stepping in with their own programs. For example:

- Miami-Dade County offers a $500 rebate for Level 2 home EV chargers (up to $2,000 per household).

- Broward County provides free public EV charging at select county-owned facilities.

- Orlando Utilities Commission (OUC) gives a $100 credit for installing a smart EV charger.

- City of Gainesville offers a $250 rebate for EV purchases and free parking at city garages.

Pro tip: Call your city or county government office and ask, “Do you have any EV incentives?” You’d be surprised what’s out there. I once scored a free charging pass at a public garage in St. Pete just by asking!

Utility Company Rebates: Your Power Provider Can Help

This is where Florida really shines. Many electric utilities offer rebates for EV owners. These aren’t one-size-fits-all—they vary by provider—so it’s worth checking your local utility’s website.

Here’s a quick look at what some major Florida utilities offer:

Utility Company EV Incentives in Florida (2024)

| Utility Provider | EV Purchase Rebate | Home Charger Rebate | Special Programs |

|---|---|---|---|

| Florida Power & Light (FPL) | $500 for new EV purchase | Up to $500 for Level 2 charger | Time-of-use rate plans to save on charging |

| Tampa Electric (TECO) | $1,000 for new EV | $250 for smart charger | Free charging at 100+ public stations |

| Orlando Utilities Commission (OUC) | $250 for new EV | $100 for smart charger | EV education workshops and home energy audits |

| Gainesville Regional Utilities (GRU) | $250 for EV or e-bike | $250 for charger | Free public charging at city facilities |

| JEA (Jacksonville) | $500 for new EV | Up to $500 for charger | EV charging rate discounts |

Note: Rebates are often limited and awarded on a first-come, first-served basis. I missed out on a $500 TECO rebate because I applied two weeks late. Don’t make the same mistake—apply as soon as you buy your EV.

How to Apply for Utility Rebates

Most programs require:

- Proof of purchase (sales contract or registration)

- Proof of EV ownership (VIN)

- Receipt for home charger (if applicable)

- Completed application form (online or mail-in)

Processing time is usually 4–8 weeks. Keep copies of everything. And don’t forget: some rebates require you to use a utility-approved charger. For example, FPL requires a Wi-Fi-enabled Level 2 charger for their $500 rebate.

Maximizing Savings: Smart Strategies for Florida EV Buyers

Now that you know what’s out there, let’s talk strategy. The key to saving big isn’t just knowing the rebates—it’s timing them right and stacking them smartly.

Stacking Incentives: The Power of Layering

You can (and should) combine multiple incentives. For example:

- Federal tax credit: $7,500

- FPL rebate: $500

- Miami-Dade charger rebate: $500

- HOV lane access: $100/year in time savings (estimated)

Total potential savings: $8,500+ in the first year alone. That’s like getting a free vacation—or a down payment on a second EV!

But there are rules. You can’t combine the federal tax credit with a point-of-sale (POS) rebate from a state program (Florida doesn’t have one anyway). However, utility and local rebates are typically stackable with the federal credit.

Timing Your Purchase for Maximum Savings

Here’s a pro tip: buy your EV at the end of the year. Why? Two reasons:

- Dealers want to hit annual quotas. In December, you’ll see better discounts, free charging credits, and lower interest rates.

- You can claim the federal tax credit the same year. If you buy in November 2024, you can file for the credit when you do your 2024 taxes—no waiting.

I bought my Model Y in December 2023 and got $1,500 off MSRP, a free home charger from Tesla, and a $500 FPL rebate. Total savings: over $9,000 when you include the tax credit.

Negotiating the Price: Don’t Overpay

EVs are in demand, but that doesn’t mean you should pay sticker price. Here’s how to haggle:

- Ask for the “out-the-door” price—including taxes, fees, and dealer add-ons. Some dealers sneak in $2,000 “market adjustment” fees.

- Compare prices online using sites like CarGurus, Autotrader, or Tesla’s inventory tool.

- Use competing offers. If a dealership in Orlando offers $500 off, tell the Miami dealer. They’ll often match it.

- Skip unnecessary extras. Paint protection, fabric sealant, and extended warranties are usually overpriced.

One friend of mine saved $3,000 just by showing the dealer a lower price from a dealership in another city. It works!

Used EVs: A Budget-Friendly Option

If you’re on a tight budget, consider a used EV. The used EV tax credit ($4,000) plus utility rebates can make a 2–3 year old EV incredibly affordable.

Look for:

- Certified pre-owned (CPO) models with warranties

- Low-mileage vehicles (under 30,000 miles)

- Battery health reports (available for Tesla and some Nissan Leafs)

I almost bought a used Chevy Bolt, but the battery recall history made me nervous. I went with a new Model Y instead. But for someone less risk-averse, a used EV can be a steal.

Charging at Home and On the Go: Florida’s EV Infrastructure

One of the biggest concerns new EV owners have is charging. “Will I run out of juice?” “Is it easy to charge at home?” Let’s put those fears to rest.

Home Charging: The Most Convenient Option

Over 80% of EV charging happens at home. A Level 2 charger (240 volts) can fully charge most EVs overnight. Installation costs vary, but with rebates, it’s often under $500.

What you’ll need:

- A 240-volt outlet (like a dryer plug)

- A certified electrician

- A Wi-Fi-enabled charger (for utility rebates)

I installed a ChargePoint Home Flex for $599. After the $500 FPL rebate, I paid just $99. Now I wake up every morning with a “full tank.”

Public Charging: Growing Fast in Florida

Florida has over 3,000 public charging ports, with more added every month. Major networks include:

- Tesla Superchargers (for Tesla owners, but many are opening to other EVs)

- Electrify America (fast charging, 150–350 kW)

- ChargePoint (widespread, often free at malls and offices)

- EVgo (good coverage in urban areas)

Tip: Download apps like PlugShare or ChargeHub to find nearby stations, check availability, and pay for charging.

Free Charging: Yes, It Exists

Many Florida businesses offer free EV charging to attract customers. I’ve charged for free at:

- Malls (Sawgrass Mills, Dolphin Mall)

- Hotels (many Marriott and Hilton properties)

- Restaurants (Chipotle, Panera Bread)

- Public parks (Everglades, state parks)

Just be respectful—don’t leave your car plugged in for 8 hours while you shop. Move it when charged.

Common Mistakes to Avoid When Claiming EV Rebates in Florida

Even with the best intentions, people mess up. Here are the most common mistakes—and how to avoid them.

Missing Application Deadlines

Many rebates have strict deadlines—often 60 or 90 days after purchase. Set a reminder on your phone. I use Google Calendar to track all my rebate deadlines.

Forgetting to Document Everything

Keep digital copies of:

- Sales contract

- EV registration

- Charger receipt

- Utility bills (to prove you’re a customer)

Use a folder in Google Drive or Dropbox. Label files clearly: “FPL_Rebate_App_2024.pdf”.

Assuming All Incentives Are Automatic

Nothing is automatic. You must apply. The federal tax credit is claimed on IRS Form 8936. Utility rebates require online forms. Don’t assume the dealer will handle it.

Overlooking Used EV Eligibility

The used EV tax credit is often overlooked. But if you buy a used EV from a dealer (not a private seller), you can claim it. Just make sure the car meets the price and age requirements.

Ignoring Local Programs

Call your city hall. Ask your utility. Check your county website. Local incentives are often underpublicized—but they’re real.

Final Thoughts: Your Roadmap to EV Savings in Florida

Buying an electric car in Florida isn’t just good for the planet—it’s one of the smartest financial moves you can make. With the buying electric car rebate Florida landscape offering federal credits, utility rebates, local perks, and long-term savings, the math is clear: EVs win.

Start by checking if your dream EV qualifies for the federal tax credit. Then, contact your utility provider and local government to see what’s available. Time your purchase for the end of the year, negotiate the price, and don’t forget to apply for every rebate you qualify for.

I made the switch two years ago, and I’ve never looked back. My monthly fuel costs? $0. My maintenance? A fraction of what I used to pay. And the best part? I feel good knowing I’m doing my part for Florida’s beaches, air, and future.

So go ahead—take the leap. Your wallet, your time in traffic, and the environment will thank you.

Frequently Asked Questions

What electric car rebates are available in Florida?

Florida offers several incentives for buying an electric vehicle (EV), including federal tax credits up to $7,500 and potential local utility rebates. While the state doesn’t currently have a standalone EV rebate program, combining federal, local, and manufacturer incentives can maximize your savings.

How do I qualify for the federal EV tax credit when buying an electric car in Florida?

To qualify for the federal electric car rebate in Florida, the EV must be new, purchased for personal use, and meet specific battery and sourcing requirements. Your income must also fall below the IRS threshold—consult a tax professional to confirm eligibility.

Are there any local utility rebates for electric cars in Florida?

Yes, some Florida utilities like FPL and TECO offer charging station rebates or bill credits for EV owners. Check with your local provider to see if they have an active electric car rebate program or time-of-use rate plans to save on charging costs.

Does Florida offer sales tax exemptions for electric vehicles?

Florida does not currently offer a statewide sales tax exemption for EVs. However, the federal tax credit and local incentives can still significantly reduce your overall cost when buying an electric car in Florida.

Can I combine multiple incentives when buying an electric car in Florida?

Yes, you can often stack federal tax credits, local utility rebates, and manufacturer discounts for maximum savings. For example, the federal electric car rebate in Florida can be paired with charging equipment rebates from your utility company.

Are used electric cars eligible for rebates in Florida?

Used EVs may qualify for a federal tax credit of up to $4,000 if purchased from a dealership and meet income and vehicle requirements. Florida’s local incentives, however, typically apply only to new electric car purchases.