California Electric Car Rebate 2026 What You Need to Know

Featured image for california electric car rebate 2026

Image source: i.ytimg.com

The California Electric Car Rebate 2026 offers up to $7,500 in incentives for new EV purchases, but income and vehicle eligibility rules apply—act fast, as funding is limited and expected to run out quickly. This updated program prioritizes low- to moderate-income buyers and requires vehicles to meet strict price and battery requirements. Don’t miss out—check your eligibility and apply early to secure your rebate before funds are depleted.

Key Takeaways

- Rebates up to $7,500: Qualify for substantial savings on new EV purchases in 2026.

- Income limits apply: Check eligibility—rebates phase out at higher income levels.

- Used EVs included: Save up to $4,000 on certified pre-owned electric cars.

- Apply post-purchase: Submit rebate forms within 180 days of vehicle delivery.

- Low-income priority: Enhanced incentives for disadvantaged communities and qualifying households.

- Charger incentives: Combine rebates with home charging station discounts for extra savings.

📑 Table of Contents

California Electric Car Rebate 2026: What You Need to Know

The shift toward sustainable transportation has reached a pivotal moment in California, a state long recognized as a leader in environmental policy and clean energy innovation. As the state continues its ambitious goal of achieving carbon neutrality by 2045, one of the most powerful tools in its arsenal is the California electric car rebate 2026 program. This initiative, evolving from earlier iterations of the Clean Vehicle Rebate Project (CVRP), is designed to accelerate the adoption of zero-emission vehicles (ZEVs) by making them more financially accessible to residents across income levels. With climate change concerns intensifying and gas prices fluctuating unpredictably, the rebate program is not just a policy—it’s a catalyst for change.

But what exactly does the California electric car rebate 2026 entail? How has it changed from previous years? Who qualifies? And how can you maximize your savings when purchasing an electric vehicle (EV) in the Golden State? This comprehensive guide dives into every aspect of the program, from eligibility and application processes to vehicle types, income tiers, and long-term implications for consumers and the environment. Whether you’re a first-time EV buyer, a budget-conscious family, or a tech-savvy commuter, understanding the nuances of this rebate can save you thousands of dollars—and help you contribute to a cleaner, greener future.

Overview of the California Electric Car Rebate Program

The California electric car rebate 2026 is a cornerstone of the state’s broader strategy to reduce greenhouse gas emissions and improve air quality. Administered by the California Air Resources Board (CARB) and managed by the Center for Sustainable Energy (CSE), the rebate program offers direct financial incentives to residents who purchase or lease new zero-emission and plug-in hybrid electric vehicles (PHEVs). The goal is to lower the upfront cost barrier that often deters consumers from transitioning to cleaner transportation options.

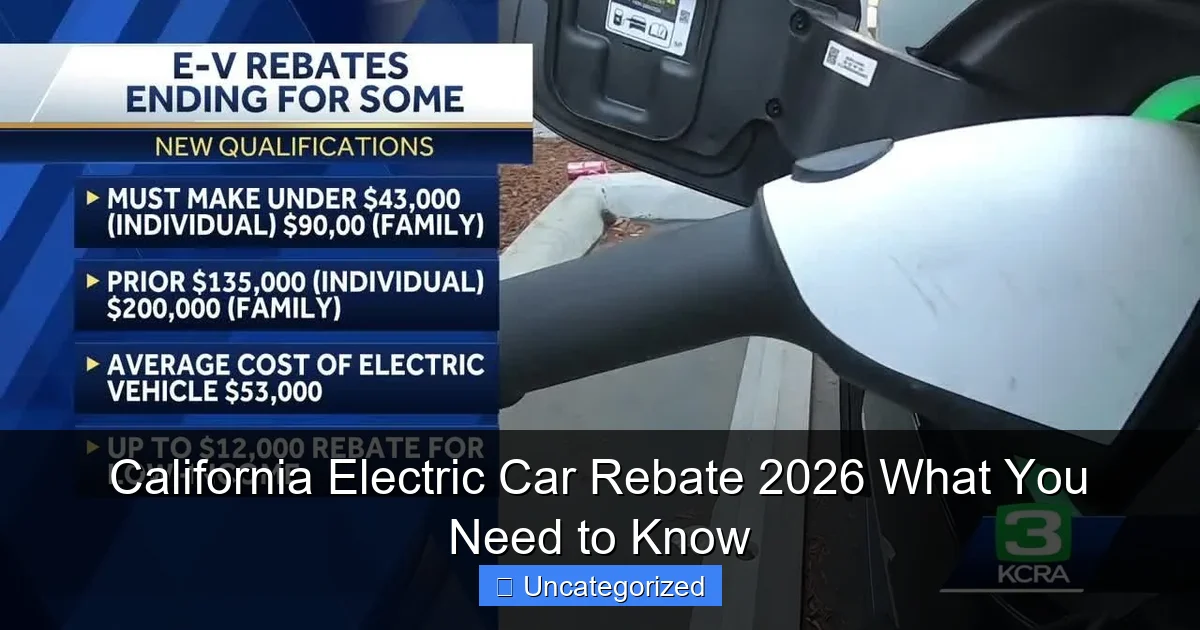

Visual guide about california electric car rebate 2026

Image source: i.ytimg.com

Historical Evolution of the Rebate

The program began in 2010 under the Clean Vehicle Rebate Project (CVRP) and has undergone several transformations to meet changing market dynamics, vehicle availability, and policy goals. In earlier years, rebates were flat—typically $2,500 for battery electric vehicles (BEVs) and $1,500 for PHEVs—regardless of buyer income. However, starting in 2016, CARB introduced income caps and tiered rebates to prioritize low- and moderate-income households. By 2022, the program had paid out over $1.2 billion in rebates, supporting more than 500,000 clean vehicle purchases.

By 2026, the program is expected to reflect even greater equity, sustainability, and scalability. The California electric car rebate 2026 continues this trend with updated income thresholds, expanded eligibility for used EVs, and enhanced incentives for disadvantaged communities. The program now aligns with California’s Advanced Clean Cars II (ACC II) regulation, which mandates that 100% of new passenger vehicle sales be zero-emission by 2035.

Key Objectives for 2026

- Equity: Prioritize rebates for low- and moderate-income households and residents in disadvantaged communities.

- Affordability: Reduce the effective purchase price of EVs to bring them in line with, or below, comparable gas-powered vehicles.

- Adoption Rate: Increase ZEV market share to over 35% of new vehicle sales by 2026.

- Environmental Impact: Reduce transportation-related emissions by incentivizing long-range BEVs and phasing out fossil-fuel vehicles.

- Consumer Awareness: Improve outreach and application accessibility to ensure all eligible Californians can participate.

For example, in 2025, a family of four earning $110,000 in Los Angeles County qualified for the highest rebate tier. In 2026, that threshold is expected to adjust slightly upward to account for inflation, ensuring continued inclusivity. Additionally, the program is exploring partnerships with community-based organizations to reach underserved populations, such as rural residents and non-English speakers.

Eligibility Requirements for the 2026 Rebate

To qualify for the California electric car rebate 2026, applicants must meet several criteria related to vehicle type, income, residency, and application timing. These requirements ensure the program targets those who need financial assistance the most while maintaining fairness and accountability.

Vehicle Eligibility

Only new or used zero-emission vehicles (ZEVs) and plug-in hybrid electric vehicles (PHEVs) purchased or leased on or after January 1, 2026, are eligible. The vehicle must be:

- Listed on the CVRP’s Eligible Vehicles list, which is updated quarterly.

- Registered in California for at least 30 months (2.5 years).

- Not previously used in a CVRP or other state rebate program.

- Have a minimum battery capacity of 5 kWh for PHEVs (to prevent low-electric-range vehicles from qualifying).

Notably, fuel cell electric vehicles (FCEVs), such as the Toyota Mirai and Hyundai NEXO, are also eligible and receive the same base rebate as BEVs.

Income-Based Tiers

The rebate amount varies based on household income, with lower-income applicants receiving higher incentives. The 2026 income tiers are expected to mirror 2025’s structure with slight adjustments for inflation. Here’s how it breaks down:

| Household Size | Low-Income Tier (Max Rebate) | Moderate-Income Tier | High-Income Tier (Ineligible) |

|---|---|---|---|

| 1 | ≤ $55,000 | $55,001 – $105,000 | > $105,000 |

| 2 | ≤ $74,000 | $74,001 – $140,000 | > $140,000 |

| 3 | ≤ $93,000 | $93,001 – $175,000 | > $175,000 |

| 4 | ≤ $112,000 | $112,001 – $210,000 | > $210,000 |

| 5+ | Add $20,000 per additional member | Adjust proportionally | Adjust proportionally |

Note: Income is based on the applicant’s most recent federal tax return. Self-employed individuals must provide additional documentation.

Residency and Application Requirements

- Applicant must be a California resident with a valid California driver’s license.

- Vehicle must be registered in California within 30 days of purchase or lease.

- Application must be submitted within 18 months of the vehicle purchase/lease date.

- Proof of purchase/lease, vehicle registration, and income verification (e.g., W-2, 1099, or tax return) must be uploaded to the CVRP portal.

Tip: If you’re leasing, ensure the lease term is at least 36 months. Short-term leases (under 24 months) are not eligible, as the program aims to promote long-term EV adoption.

Special Cases: Used EVs and Trade-Ins

Starting in 2026, the program will expand to include used electric vehicles priced under $35,000 and with less than 75,000 miles. This change is designed to increase access for low-income buyers who may not afford a new EV. Used vehicle rebates are expected to be 75% of the new vehicle amount (e.g., $2,625 instead of $3,500).

Additionally, applicants who trade in a gas-powered vehicle (especially older, high-emission models) may qualify for an additional bonus incentive of up to $1,000 through the Clean Cars 4 All program, which operates in partnership with CVRP in select counties.

Rebate Amounts and How to Calculate Your Savings

One of the most critical aspects of the California electric car rebate 2026 is understanding how much money you can actually save. The rebate is not a flat rate—it varies based on income, vehicle type, and additional incentives. Knowing how to calculate your total savings can help you make smarter purchasing decisions.

Base Rebate Amounts by Vehicle Type

- Battery Electric Vehicles (BEVs) & Fuel Cell Electric Vehicles (FCEVs): $3,500 (Low-income), $2,000 (Moderate-income)

- Plug-in Hybrid Electric Vehicles (PHEVs): $2,000 (Low-income), $1,000 (Moderate-income)

- Used EVs (2026 expansion): $2,625 (Low-income), $1,500 (Moderate-income)

High-income applicants (above the thresholds) are not eligible for any rebate.

Example Calculations

Scenario 1: Maria, a single mother in Sacramento earning $52,000 annually, purchases a new Tesla Model 3 (BEV) for $42,000.

– Base rebate: $3,500 (low-income tier)

– Federal tax credit: $7,500 (if eligible)

– Total savings: $11,000

– Effective purchase price: $31,000

Scenario 2: The Johnson family (4 members, $108,000 income) leases a new Kia EV6 (BEV) for $45,000.

– Base rebate: $2,000 (moderate-income tier)

– Lease incentive: $1,500 (manufacturer offer)

– Total savings: $3,500

– Effective lease cost: $41,500 (over 36 months)

Scenario 3: Carlos in Fresno buys a used 2023 Nissan Leaf for $28,000.

– Base rebate: $2,625 (low-income, used EV)

– Local Clean Cars 4 All bonus: $1,000 (trade-in of 2005 SUV)

– Total savings: $3,625

– Effective price: $24,375

Stacking Incentives: Maximize Your Savings

The California electric car rebate 2026 can be combined with other incentives, but not all. Here’s what you can stack:

- Federal Tax Credit (IRC 30D): Up to $7,500 for new EVs (income and MSRP limits apply).

- Manufacturer Incentives: Many automakers offer lease cash, loyalty bonuses, or referral rewards (e.g., $1,500–$2,500).

- Local Utility Rebates: PG&E, SCE, and SDG&E offer $500–$1,000 for Level 2 home charger installation.

- HOV Lane Sticker (CA DMV): Free access to carpool lanes for BEVs and FCEVs (saves time and gas).

Important: You cannot combine the CVRP rebate with the federal tax credit if the vehicle is leased (due to tax code restrictions). However, you can still claim the CVRP rebate and manufacturer incentives.

Timing Matters: Apply Early

Rebate funds are distributed on a first-come, first-served basis. In 2024, the program exhausted its funding within six months due to high demand. To avoid missing out in 2026:

- Apply immediately after purchase/lease.

- Use the CVRP online portal (cvrp.energycenter.org) for fastest processing.

- Set up email alerts for funding availability updates.

How to Apply: Step-by-Step Guide

Applying for the California electric car rebate 2026 is straightforward, but attention to detail is crucial. A single missing document can delay your rebate for weeks or even result in denial. Follow this step-by-step guide to ensure a smooth process.

Step 1: Confirm Eligibility

- Verify your income falls within the low- or moderate-tier range.

- Ensure your vehicle is on the CVRP’s 2026 eligible list.

- Confirm you’re a California resident with a valid license.

Step 2: Gather Required Documents

- Purchase/Lease Agreement: Must include vehicle VIN, price, and date.

- Vehicle Registration: CA DMV registration showing 30+ months.

- Income Verification: Most recent tax return, W-2, or 1099.

- Proof of Residency: Utility bill, lease agreement, or voter registration.

- Bank Account Info: For direct deposit (recommended).

Step 3: Submit Online Application

- Visit cvrp.energycenter.org.

- Create an account or log in.

- Select “Apply for a Rebate” and choose your vehicle type.

- Upload all required documents (PDF or JPG, under 5MB each).

- Enter bank account details for direct deposit (checks take 6–8 weeks longer).

- Review and submit.

Step 4: Track Application Status

- Check your email for confirmation and updates.

- Log in to the portal to view status: “Received,” “Under Review,” “Approved,” or “Denied.”

- If denied, you can appeal with additional documentation.

Step 5: Receive Rebate

- Direct deposit: 4–6 weeks after approval.

- Check: 8–10 weeks (not recommended due to delays).

- Rebate is typically issued as a pre-paid card or bank transfer.

Pro Tips:

- Apply within 30 days of purchase—don’t wait!

- Double-check VIN and income figures; errors are the #1 cause of delays.

- Call CVRP support at 1-866-984-2532 if you have questions (available in 10 languages).

- Save all documents in a “CVRP 2026” folder on your computer.

Future Outlook and Policy Implications

The California electric car rebate 2026 is more than a financial incentive—it’s a reflection of California’s long-term vision for a sustainable transportation future. As the state moves toward its 2035 ZEV mandate, the rebate program is expected to evolve in several key ways.

Phasing Out PHEVs and Expanding BEV Focus

Starting in 2026, CARB plans to gradually reduce rebate amounts for plug-in hybrids, shifting focus entirely to battery electric and fuel cell vehicles by 2030. This aligns with the ACC II regulation, which requires all new vehicles to have zero tailpipe emissions. By 2028, PHEV rebates may drop to $500 for low-income buyers, and high-income applicants may be excluded entirely.

Integration with Charging Infrastructure

To support increased EV adoption, the rebate program is expected to partner with state and local agencies to expand public charging networks. Applicants may receive bonus incentives for installing home chargers in multi-unit dwellings or for purchasing EVs with bidirectional charging (vehicle-to-grid) capabilities.

Equity and Accessibility Enhancements

- Mobile Application: A new CVRP app will allow applicants to scan documents and track status in real time.

- Community Outreach: Pop-up application centers in rural and underserved areas.

- Language Access: Full support in Spanish, Mandarin, Vietnamese, and Tagalog.

Impact on the Used EV Market

The 2026 expansion to used EVs is expected to create a robust secondary market, reducing e-waste and making EVs accessible to more Californians. By 2030, CARB projects that 40% of all rebate recipients will be used EV buyers.

Broader Environmental and Economic Benefits

- Reduction in CO2 emissions: Over 5 million metric tons annually by 2030.

- Job creation: 120,000+ new jobs in EV manufacturing, maintenance, and charging infrastructure.

- Consumer savings: Average $1,000/year in fuel and maintenance costs per EV owner.

Conclusion

The California electric car rebate 2026 represents a transformative opportunity for residents to embrace cleaner, more affordable transportation. With enhanced income tiers, expanded eligibility for used EVs, and stronger alignment with state climate goals, the program is more inclusive and impactful than ever before. Whether you’re motivated by cost savings, environmental responsibility, or technological innovation, now is the time to act.

By understanding the eligibility requirements, calculating your potential savings, and applying early, you can take full advantage of this valuable incentive. Remember, every EV purchased under the rebate program contributes to California’s mission of reducing air pollution, fighting climate change, and building a resilient, sustainable economy.

As the state continues to lead the nation in clean energy policy, the California electric car rebate 2026 is not just a rebate—it’s a promise. A promise of cleaner air, quieter streets, and a brighter future for all Californians. Don’t miss your chance to be part of it. Start your EV journey today.

Frequently Asked Questions

What is the California Electric Car Rebate 2026 program?

The California Electric Car Rebate 2026 is a state initiative offering financial incentives to residents who purchase or lease new electric vehicles (EVs) to reduce emissions and promote sustainable transportation. The rebate amount and eligibility criteria are expected to align with updated 2026 guidelines, which may differ from previous years.

Who qualifies for the California electric car rebate in 2026?

Eligibility typically includes California residents, income limits (varies by household size), and requirements to purchase/lease a new EV from a participating dealership. Income-based caps and vehicle MSRP thresholds are likely to remain key factors in 2026.

How much is the 2026 EV rebate in California?

Exact amounts for the California Electric Car Rebate 2026 haven’t been finalized, but rebates historically range from $2,000 to $7,500 depending on income, vehicle type, and funding availability. Check the official CVRP website for updates as the program nears launch.

Can I combine the California electric car rebate with federal tax credits?

Yes, the state rebate is stackable with the federal EV tax credit (up to $7,500 in 2026, subject to change). This combination can significantly reduce your out-of-pocket cost for qualifying vehicles.

What types of vehicles are eligible for the 2026 rebate?

New battery-electric (BEV), plug-in hybrid (PHEV), and fuel cell (FCEV) vehicles are typically eligible, provided they meet MSRP and efficiency requirements. Used EVs are generally not covered under the 2026 program.

When will the California Electric Car Rebate 2026 applications open?

The program is expected to launch in early 2026, with exact dates announced by the California Air Resources Board (CARB). Pre-registration may be available, so monitor the Clean Vehicle Rebate Project (CVRP) portal for updates.