Unlock the Savings: Understanding Car Benefit Rates for Electric Cars

If you’re in the market for a new vehicle and are considering making the switch to electric, it’s important to know about the electric car benefit rates that are available to you. These rates refer to the incentives and perks that come with owning an electric car, such as tax credits and reduced charging rates. Not only are electric cars environmentally friendly, they can also save you money in the long run.

With electric car benefit rates varying depending on your location and the type of electric car you purchase, it’s crucial to do your research and take advantage of these benefits. In this blog, we’ll take a closer look at electric car benefit rates and why they’re worth considering when making the switch to electric.

Overview of Car Benefit Rates

When it comes to car benefit rates for electric cars, there are a few things to keep in mind. First and foremost, it’s important to note that electric cars are considered to have zero emissions, making them a more environmentally-friendly option compared to traditional fuel-based vehicles. This means that electric cars typically qualify for lower car benefit rates, which can be a great advantage for employees who are provided with a company car.

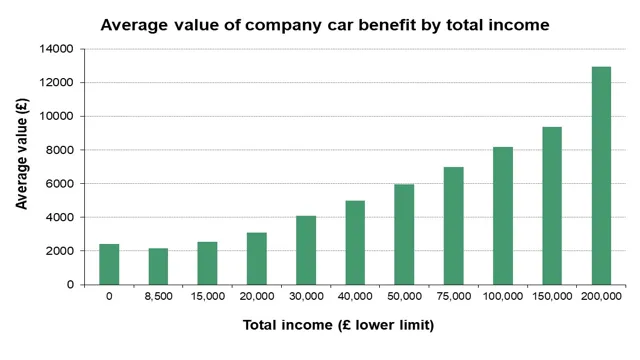

Depending on the type of electric car and its carbon dioxide emissions, the car benefit rates can vary. However, in general, electric cars are subject to lower rates compared to petrol and diesel cars. Employers should consider these lower rates when deciding on providing a company car for their employees, as it could save both the individual and their company money in the long run.

So if you are an employer or an employee exploring your options for company cars, it’s certainly worth considering the benefits of an electric vehicle.

Explanation of Car Benefit Rates for Electric Cars

Electric Car Benefit Rates Car benefit rates are something that most employees and employers find a bit confusing, especially when it comes to electric cars. To put it simply, car benefit rates are the taxable value of a vehicle that an employee receives from their employer if they use a company car for personal reasons. Generally, employees who have company cars have to pay a tax on the benefit in kind that they receive from the employer.

However, since electric cars produce zero emissions and have a lower environmental impact, the UK government has decided to incentivize drivers to use them by offering lower car benefit rates. This incentivization includes a decrease in the percentage of the car’s value that gets taxed, meaning that an electric car driver will pay a smaller tax amount than a driver of a petrol or diesel car. The main goal of this scheme is to encourage and push drivers to use greener and more environmentally friendly modes of transport, making it a win-win situation for both the environment and the driver’s finances.

Comparison of Car Benefit Rates for Electric and Non-Electric Cars

Car Benefit Rates When it comes to calculating car benefit rates for employees, the type of car they drive plays a significant role in determining the amount of tax they pay. Electric cars produce significantly less CO2 emissions than non-electric cars, and as such, attract lower benefit rates than their non-electric counterparts. The rates are set by the government and are determined by a car’s CO2 emissions, meaning that the lower the emissions, the lower the tax payable.

For example, in 2020/21, an electric car with zero emissions attracts a benefit rate of 0%, whereas a non-electric car with emissions of 116-130 g/km attracts a benefit rate of 30%. As more people make the switch to electric cars, we can expect to see the gap between the two rates widen, making electric cars even more attractive from a tax perspective.

Tax Incentives for Electric Cars

If you’re considering purchasing an electric car, it’s important to be aware of the tax incentives that may be available to you. One such incentive is car benefit rates for electric cars, which are significantly lower than for petrol or diesel vehicles. This means that if you use your electric vehicle for business purposes, you will pay less in taxes than you would with a traditional car.

Additionally, in some regions, there are also grants and tax credits available for those who purchase electric cars. These incentives can help to offset the initial cost of purchasing an electric vehicle, making them a more attractive and financially feasible option. In addition to the financial benefits, electric cars also have a lower carbon footprint than traditional vehicles, making them a more environmentally responsible choice.

Federal Tax Credits

If you’re thinking of purchasing an electric car, it is essential to know that you could be eligible for federal tax credits. This tax incentive is intended to encourage buyers to purchase eco-friendly cars that produce fewer emissions and contribute to a cleaner environment. The amount of the credit varies depending on the specific make and model of the car, but it can range from a few thousand dollars to as much as $7,500.

The federal government sets limits on the number of vehicles eligible for these credits, so it’s essential to know whether or not the credit is still available before making your purchase. Keep in mind that tax credits aren’t the same as tax deductions, which reduce the amount of taxable income. Tax credits are more valuable since they reduce the amount of tax you owe dollar-for-dollar.

So if you’re considering an electric car, don’t forget to check out available incentives, as they could save you a significant amount of money in the long run!

State and Local Incentives

When it comes to tax incentives for electric cars, there are a variety of state and local incentives that can help offset the initial cost of going green. These incentives can include tax credits, rebates, and even special carpool lane access. Many states also offer additional incentives such as free parking for electric vehicles, waived toll fees, and discounted registration fees.

These incentives can help make electric cars more affordable and accessible for everyday drivers who are looking to reduce their carbon footprint. So if you’re thinking about making the switch to an electric car, be sure to research the incentives available in your area to help you make the most informed decision.

Company Car Tax Benefits

Electric vehicles are becoming a popular choice among car buyers due to their eco-friendly features and tax benefits. The UK government is promoting the use of low-emission cars by providing tax incentives, making electric cars a financially viable option for businesses. One of the most significant tax benefits of owning an electric vehicle is the exemption from traditional company car tax.

This means electric car owners do not have to pay tax on the full amount of the vehicle’s price, resulting in significant savings. Additionally, businesses can claim a 100% first-year allowance on the purchase of electric cars, providing a substantial upfront tax saving. By switching to electric cars, businesses can not only reduce their carbon footprint but also enjoy lucrative tax benefits, making it an attractive option for the environmentally conscious employers and employees alike.

Cost Savings of Electric Cars

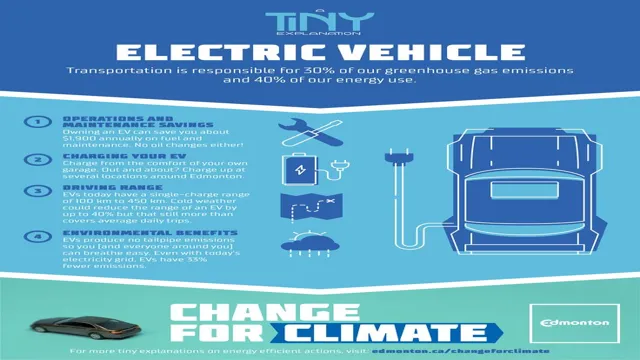

Car benefit rates for electric cars can lead to significant cost savings. This is because electric cars are exempt from certain taxes and fees, such as the Congestion Charge in London and the Vehicle Excise Duty. Additionally, electric cars have lower fuel and maintenance costs compared to traditional gas-powered cars.

The cost of charging an electric car is usually cheaper than filling up a tank with gasoline, and electric cars require less maintenance because they have fewer moving parts. Over time, these cost savings can add up and make electric cars a more financially attractive option for drivers. So not only are electric cars better for the environment, but they can also save you money in the long run.

Lower Fuel and Maintenance Costs

Electric cars offer significant cost savings compared to traditional gasoline-powered vehicles. One major benefit is lower fuel costs. Electric cars run on electricity instead of gasoline, meaning that drivers can save hundreds of dollars a year on fuel expenses.

The cost of electricity to charge an electric car is significantly less than the cost of gasoline per mile, making it a much more cost-effective option in the long run. In addition, electric cars have fewer moving parts than combustion engine vehicles, which means they require less maintenance. The cost of maintaining an electric car is typically lower, and the frequency of maintenance is also reduced.

This translates to big savings for electric car owners. Overall, the cost savings of electric cars make them a smart investment for environmentally conscious drivers who want to save money in the long run.

Potential Savings on Car Insurance

If you’re thinking about purchasing an electric car, you may be excited about the potential cost savings you can get on car insurance. This is because electric cars often come with lower insurance rates than their gas-powered counterparts. One reason for this is that electric cars generally have a smaller risk of damage and theft compared to traditional cars.

In addition, electric cars tend to have advanced safety features, such as lane departure warnings and automatic emergency braking, which can reduce the likelihood of accidents and lower insurance costs. Furthermore, some insurance companies offer discounts or reduced rates for electric car owners. So if you’re looking to save money on car insurance and make a positive environmental impact, an electric car may be a great investment for you.

Conclusion

As we navigate towards a greener and more sustainable future, the benefits of electric cars are becoming increasingly evident. With lower emission levels, reduced running costs and improved technology, electric cars are a viable option for the modern driver. It’s no wonder that the car benefit rates for electric cars are starting to reflect this shift, encouraging more people to make the switch.

So, if you’re looking for a clever and witty explanation for why car benefit rates for electric cars are on the rise, it’s simple. Electric cars are not only better for the environment, but they’re also better for your wallet. It’s a win-win situation for both you and the planet, and that’s something we can all get behind.

Happy driving!”

FAQs

What are car benefit rates for electric cars in the UK?

The car benefit rates for electric cars in the UK are currently set at 1% for the 2021/22 tax year and 2% for the 2022/23 tax year.

Are there any tax incentives for buying an electric car?

Yes, there are tax incentives for buying an electric car in the UK, including exemption from the first year vehicle tax and a grant up to £2,500 towards the cost of a new electric vehicle.

How are car benefit rates for electric cars calculated?

The car benefit rates for electric cars are calculated based on the vehicle’s manufacturer’s suggested retail price (MSRP), CO2 emissions, and the fuel type of the vehicle.

Can I claim tax relief for installing a charging point for my electric car at home?

Yes, you may be eligible to claim tax relief for the cost of installing a charging point for your electric car at home, subject to certain conditions being met. The relief is currently up to a maximum of £350.