Power Up Your Ride: Get a Charge Out of Investing in Car Electric Battery Stocks

Have you noticed how many vehicles on the road these days are electric? It seems like every automaker is jumping on the electric vehicle (EV) bandwagon, and consumers are quickly jumping on board as well. With this shift towards sustainable transportation, investors are naturally turning their attention towards car electric battery stocks. After all, without batteries, there would be no electric cars.

But what are the best car electric battery stocks to invest in? And what do you need to know before you dive in? In this blog post, we’ll explore the EV landscape and highlight some of the top car electric battery stocks to keep an eye on.

Current Market Trends

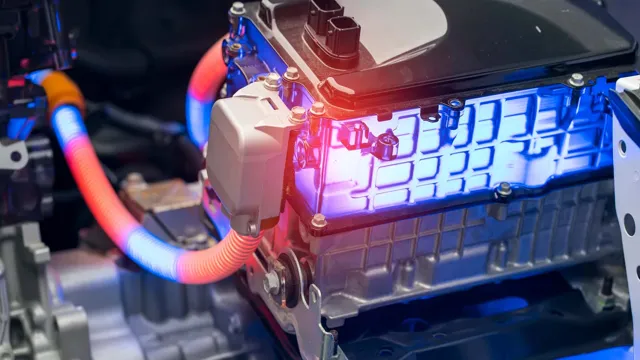

Car electric battery stocks are becoming increasingly popular as the world shifts towards renewable energy sources. The demand for electric vehicles has been on the rise, with major players in the automobile industry now offering electric cars as a significant part of their fleet. This has opened up opportunities for investors looking to invest in the car electric battery market.

With advancements in battery technology, electric cars are now more efficient and can go longer distances on a single charge. As more and more people choose to switch to electric cars, it follows that demand for electric car batteries will keep increasing. This presents a great opportunity for investors to consider investing in car electric battery stocks.

Investing in companies that are innovation leaders or that have a focus on sustainable development is a great strategy for those looking for long-term yields. As more and more countries pledge to transition to renewable energy sources, electric car batteries are poised to become a crucial component of the clean energy revolution. So, electric vehicle stocks is something you should keep an eye on if you want to invest in sustainable energy.

Increased Demand for Electric Cars

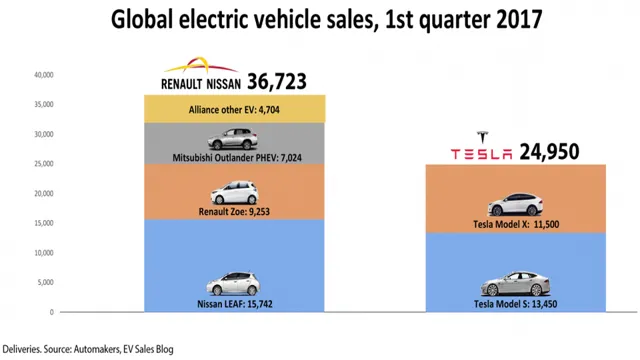

With the increasing concern for the environment, more people are looking into electric cars as a viable option for their commutes. This trend has been reflected in the current market, with an increased demand for electric vehicles. Companies like Tesla and Nissan have been leading the way, with their sleek designs and impressive battery range.

The popularity of electric cars is also in part due to the lower cost of ownership and maintenance, as well as the government incentives available in many countries. As we continue to see advancements in technology, such as improvements in battery technology and charging infrastructure, the demand for electric cars is only expected to grow. It’s an exciting time for the automotive industry, with more options than ever for eco-conscious drivers.

So, are you ready to join the electric revolution?

Government Mandates and Incentives

Government mandates and incentives are currently driving market trends in various industries. In the automotive industry, for example, many governments are mandating stricter emissions regulations, which has led to a shift towards the production of hybrid and electric vehicles. As a result, major car manufacturers have invested heavily in developing new technologies to meet these regulations and gain a competitive edge in the market.

Similarly, in the renewable energy sector, governments are offering incentives for companies that invest in clean energy production. This has led to a surge in investment in wind and solar energy projects, as well as the development of new technologies that make these sources of energy more affordable and accessible. With government mandates and incentives, industries are being driven towards greater sustainability and efficiency, paving the way for a greener, more sustainable future.

Top Players in the Industry

Car electric battery stocks are a hot topic in the industry as more and more consumers are turning to electric vehicles for their environmentally-friendly and cost-effective benefits. With this surge in demand, it’s no surprise that companies like Tesla and Panasonic are leading the way in the production and development of car electric batteries. Tesla, in particular, has made a significant impact on the industry with its groundbreaking battery technology and sleek electric car designs.

Panasonic, on the other hand, partners with Tesla to provide the batteries used in their vehicles. Beyond these giants, other players in the car electric battery stock market include LG Chem, Samsung SDI, and Contemporary Amperex Technology Co. Limited.

With the future of transportation heading towards electric mobility, investing in car electric battery stocks is definitely worth considering for those interested in sustainability and innovation.

Tesla Inc.

When it comes to the electric automotive industry, Tesla Inc. is an undeniable powerhouse. The company has completely revolutionized the industry, leading the way with their innovative designs and cutting-edge technology.

One of the key reasons for Tesla’s success is their focus on creating sustainable transportation options that don’t compromise on performance. This dedication to their mission has allowed them to attract some of the top players in the industry to their team. Tesla has been able to attract highly skilled engineers and designers from some of the biggest names in the automotive industry, including BMW, Audi, and Mercedes-Benz.

This level of talent has enabled Tesla to continue pushing the boundaries of what is possible with electric vehicles and has solidified their position as a major player in the industry. With their continued focus on innovation and sustainability, it’s clear that Tesla will continue to be a driving force in the future of the automotive industry.

Panasonic Corporation

Panasonic Corporation is a top player in the industry, with a strong reputation in producing high-quality electronics and home appliances. As one of the largest electronics companies in the world, Panasonic is known for its innovation and commitment to sustainability. The company has a diverse portfolio, ranging from televisions and cameras to air conditioners and washing machines.

One of the key strengths of Panasonic is its focus on research and development, which has enabled it to bring cutting-edge technology to the market. Additionally, the company is known for its customer-centric approach, ensuring that its products meet the needs and preferences of consumers. Overall, Panasonic is a major player in the electronics industry, and its commitment to innovation and customer satisfaction make it a popular choice among consumers worldwide.

LG Chem Ltd.

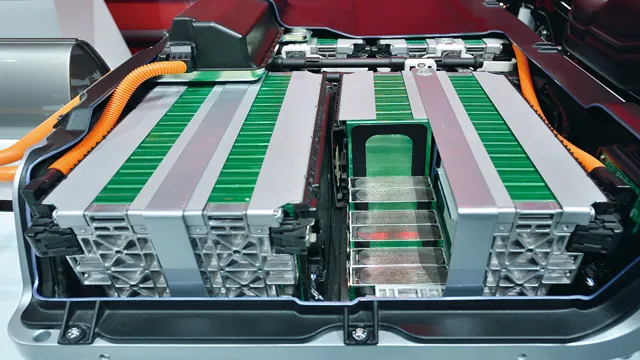

LG Chem Ltd. is one of the top players in the chemical industry, known for producing high-quality petrochemicals, energy solutions, and advanced materials. With over 24,000 employees located across the globe, LG Chem has established itself as a leading supplier for various industries ranging from electronics to automotive and more.

The company has been successful in developing innovative technologies that help to improve the overall sustainability of their products and services. LG Chem’s lithium-ion batteries, for example, are widely recognized for their reliability and long life cycle, making them an ideal choice for applications in electric vehicles and renewable energy systems. In addition to their advanced technologies, LG Chem also places a strong emphasis on environmental responsibility.

The company strives to reduce greenhouse gas emissions, waste, and other environmental impacts through sustainable production practices and eco-friendly products. Overall, LG Chem’s commitment to innovation and sustainability has earned them a prominent position in the industry.

Factors Affecting Battery Stock Prices

Investing in car electric battery stocks can be influenced by several factors. One of the most significant ones is the demand for electric cars. As more and more people become concerned about the environment, the demand for electric cars has been on the rise.

This trend has driven up the demand for car electric batteries, which has had a positive effect on the stock prices of companies that produce them. Another factor that can impact battery stock prices is the price of raw materials required to manufacture them. Companies rely on several materials, such as lithium, cobalt, and nickel, to produce car electric batteries, and any fluctuations in their prices can affect the overall cost of production.

Another factor is the level of competition within the industry. Companies that can produce batteries at a more cost-efficient rate have a competitive edge over others in the market, which can have a positive effect on their stock prices. Additionally, regulatory changes can also impact battery stock prices since new regulations can drive up or down the demand for electric cars.

Overall, investing in car electric battery stocks requires a thorough understanding of the market trends, raw material pricing, and regulatory changes.

Raw Material Availability and Prices

Raw material availability and prices can have a significant impact on battery stock prices. As batteries become more prevalent in everyday life, demand for raw materials such as lithium, cobalt, and nickel increases as well. Any disruptions to the supply chain, whether it be due to geopolitical tensions or mining accidents, can cause prices to spike and lead to increased uncertainty in the market.

In addition, battery manufacturers are constantly innovating and experimenting with new materials, which can greatly affect the prices of existing raw materials. For example, if a new technology is developed that requires less cobalt, the demand for cobalt could drop and result in lower prices. Investors in battery stocks must keep a close eye on changes in the availability and prices of raw materials to make informed decisions about their investments.

Competition Among Players

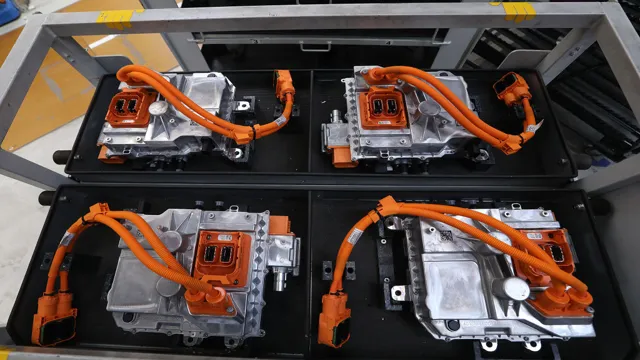

Competition Among Players Battery stock prices are subject to numerous factors, including economic trends, technological advancements, and competition among industry players. The increasing demand for electric vehicles has pushed battery makers to innovate and develop more efficient and cost-effective batteries, which has led to intense competition among companies. As the market becomes more crowded, companies are striving to differentiate themselves by offering better products at lower prices.

This drive to outdo competitors can lead to a decline in some stocks’ prices and a rise in others. Investors need to keep a close eye on market competition, as it can significantly affect battery stock prices. In a highly competitive market, it’s not always the biggest players who succeed.

Sometimes, smaller companies can make significant strides by offering niche products or innovating in certain areas. Thus, it’s essential to monitor emerging trends in the battery industry, as they may offer clues as to which companies will succeed in the long run.

Future Growth and Projections

If you’re considering investing in the stock market, car electric battery stocks could be a smart choice. With the ongoing push for sustainability and renewable energy, electric vehicles are becoming increasingly popular. This means that demand for car electric batteries is also on the rise, and as a result, companies that manufacture these batteries are poised for future growth.

Some of the biggest players in the industry include Tesla, Panasonic, and LG Chem. However, it’s important to note that the electric vehicle market is still relatively new, and it may experience some volatility in the short term. Therefore, it’s important to do your due diligence before investing and to diversify your portfolio to mitigate risk.

Overall, car electric battery stocks have great potential for future growth as the world continues to prioritize sustainability and reduce its carbon footprint.

Expected Increase in Demand for Electric Cars

With the growing concern over climate change, more and more people are turning to electric cars as their go-to vehicle for transportation. As a result, the demand for electric cars is expected to increase significantly in the coming years. Projections by market research firms indicate that the global market for electric cars will grow from

2 million in 2020 to over 40 million by 2040. This is due to several factors, including declining battery costs, government incentives, and consumer interest in sustainable transportation. Furthermore, as automakers continue to develop more efficient and affordable electric car models, electric cars are becoming more accessible to a wider audience.

It’s safe to say that the future looks bright for the electric car industry. As more people become aware of the environmental benefits, and the technology continues to improve, electric cars are a compelling option for anyone looking to reduce their carbon footprint.

Investments in Research and Development

Investments in research and development play a critical role in the future growth and projections of companies across various sectors. It is undeniable that R&D is the backbone of innovation and progress, and investing in this area can lead to long-term benefits in terms of cutting-edge technologies, new product development, and increased profitability. Companies that prioritize R&D typically have a competitive advantage over those that do not, as they are better equipped to cater to changing customer needs and preferences.

They can also tap into new markets and revenue streams that were previously untapped. Investing in R&D may seem like a costly proposition in the short term, but in the long run, it can set a company apart from its rivals and ensure its success. However, it is vital to keep a balance, and doing so by allocating resources effectively can lead to maximum returns on investment (ROI).

Market Projections for Car Electric Battery Stocks

Market projections for car electric battery stocks show an upward trend in the coming years. With the increase of electric vehicles on the road, the demand for efficient and long-lasting batteries is expected to rise. As a result, major car manufacturers are investing heavily in the development of new battery technologies, and some are even planning to manufacture their own batteries.

According to a report by Bloomberg New Energy Finance, the global electric vehicles market is predicted to surge by 58% in 202 This growth is expected to contribute to the expansion of the electric battery industry, which is projected to reach a value of $87 billion by 2026, according to MarketsandMarkets.

However, market projections also indicate that competition is likely to intensify, with a growing number of players entering the market. Therefore, it is crucial for battery manufacturers to continue to invest in research and development to remain competitive. With the rapid expansion of electric vehicle markets globally, the future of the electric battery industry certainly looks bright.

Conclusion

As the world steadily moves towards electrification, it’s no surprise that the demand for car electric battery stocks is on the rise. With major automakers such as Tesla, Volkswagen and General Motors investing heavily in electric vehicle technology, the market for car electric battery stocks is expected to reach new heights. But don’t be taken for a ride – while car electric batteries may seem like just another hot commodity, they are the driving force behind the shift towards a more sustainable future.

So keep your eyes on the road ahead, and consider investing in car electric battery stocks as a way to power your portfolio towards a brighter tomorrow.”

FAQs

What Are Electric Car Batteries Made Of?

Electric car batteries are typically made of lithium-ion, nickel-metal hybrid, or lead-acid materials.

How Do Stocks In Electric Car Battery Companies Perform?

Stocks in electric car battery companies can be volatile and dependent on factors such as technological advancements and government regulations.

How Long Does An Electric Car Battery Last?

The lifespan of an electric car battery can vary depending on the make and model of the car, but they typically last between five and ten years.

What Are The Top Electric Car Battery Companies To Invest In?

Some of the top electric car battery companies to invest in include Tesla, LG Chem, and Panasonic. However, it’s important to do your own research and carefully consider your investments before making any decisions.