Chevy Electric Car Rebate How to Save Big on Your Next EV

Featured image for chevy electric car rebate

Image source: i0.wp.com

Slash thousands off your next Chevy EV with federal and state rebates—up to $7,500 in savings is possible when you combine incentives. The Chevy electric car rebate program, including the federal tax credit and additional local offers, makes models like the Equinox EV and Blazer EV more affordable than ever. Don’t miss out—check eligibility and act fast before incentives expire.

Key Takeaways

- Check eligibility: Confirm if you qualify for federal or state EV incentives before buying.

- Act fast: Some rebates are time-sensitive and may expire or reduce soon.

- Combine offers: Stack Chevy rebates with tax credits for maximum savings.

- Dealer incentives: Negotiate with dealers for additional discounts on top of rebates.

- Research models: Not all Chevy EVs qualify for the same rebate amounts—compare options.

- Document everything: Keep records of rebate forms, approvals, and payments for tax time.

📑 Table of Contents

- The Future of Driving Is Electric—And Chevy Is Leading the Charge

- Understanding the Chevy Electric Car Rebate Landscape

- Which Chevy EVs Qualify for Rebates in 2024?

- How to Apply for Chevy Electric Car Rebates: Step-by-Step Guide

- Real-World Examples: How Much Can You Save?

- Maximizing Your Savings: Advanced Tips and Tricks

- Drive Electric, Save Big—Your Chevy EV Awaits

The Future of Driving Is Electric—And Chevy Is Leading the Charge

The automotive world is undergoing a seismic shift, and at the heart of this transformation lies the electric vehicle (EV) revolution. With growing concerns about climate change, rising fuel prices, and advancements in battery technology, more drivers than ever are making the switch to electric. Among the pioneers of this movement is Chevrolet, a brand synonymous with American innovation and reliability. From the groundbreaking Chevy Bolt EV to the upcoming Chevy Silverado EV and Blazer EV, Chevrolet is offering a diverse lineup of electric vehicles designed to meet the needs of every driver—whether you’re a city commuter, a weekend adventurer, or a family on the go.

But here’s the best part: you don’t have to pay full price to go electric. Thanks to a combination of federal, state, and local incentives—including the Chevy electric car rebate—you can save thousands of dollars on your next EV purchase. These rebates aren’t just a nice perk; they’re a game-changer. Whether you’re eyeing the compact Bolt EV for its affordability or the rugged Silverado EV for its power, understanding how to leverage these rebates can make a significant difference in your final cost. In this comprehensive guide, we’ll walk you through everything you need to know about Chevy electric car rebates, from eligibility requirements to step-by-step application tips, so you can drive away in a new Chevy EV with maximum savings and minimal hassle.

Understanding the Chevy Electric Car Rebate Landscape

The term Chevy electric car rebate encompasses a wide range of financial incentives designed to make electric vehicle ownership more accessible. These rebates come from multiple sources: federal government programs, state-level initiatives, utility company partnerships, and even manufacturer-specific promotions. Understanding how these layers work together is key to unlocking the full savings potential on your next Chevy EV.

Visual guide about chevy electric car rebate

Image source: i0.wp.com

Federal Tax Credit: The Backbone of EV Incentives

At the federal level, the Inflation Reduction Act (IRA) of 2022 reshaped the landscape of EV incentives. The most prominent is the Federal Clean Vehicle Tax Credit, which offers up to $7,500 for qualifying new electric vehicles. This credit is non-refundable, meaning it reduces your tax liability dollar-for-dollar. For example, if you owe $5,000 in federal taxes and qualify for the full $7,500 credit, your tax bill drops to $0, and the remaining $2,500 is lost (it does not get refunded).

To qualify for the full $7,500, a Chevy EV must meet several criteria:

- Final assembly must occur in North America

- Vehicle price must not exceed $55,000 for sedans or $80,000 for trucks/SUVs

- Battery components must be sourced from the U.S. or countries with free trade agreements

- Critical minerals in the battery must meet specific domestic or free-trade sourcing thresholds

As of 2024, the Chevy Bolt EV and Bolt EUV qualify for the full $7,500 credit, as they are assembled in the U.S. and meet the battery component requirements. However, newer models like the Blazer EV and Silverado EV may face limitations based on battery sourcing, so it’s essential to verify eligibility with your dealer or the IRS website.

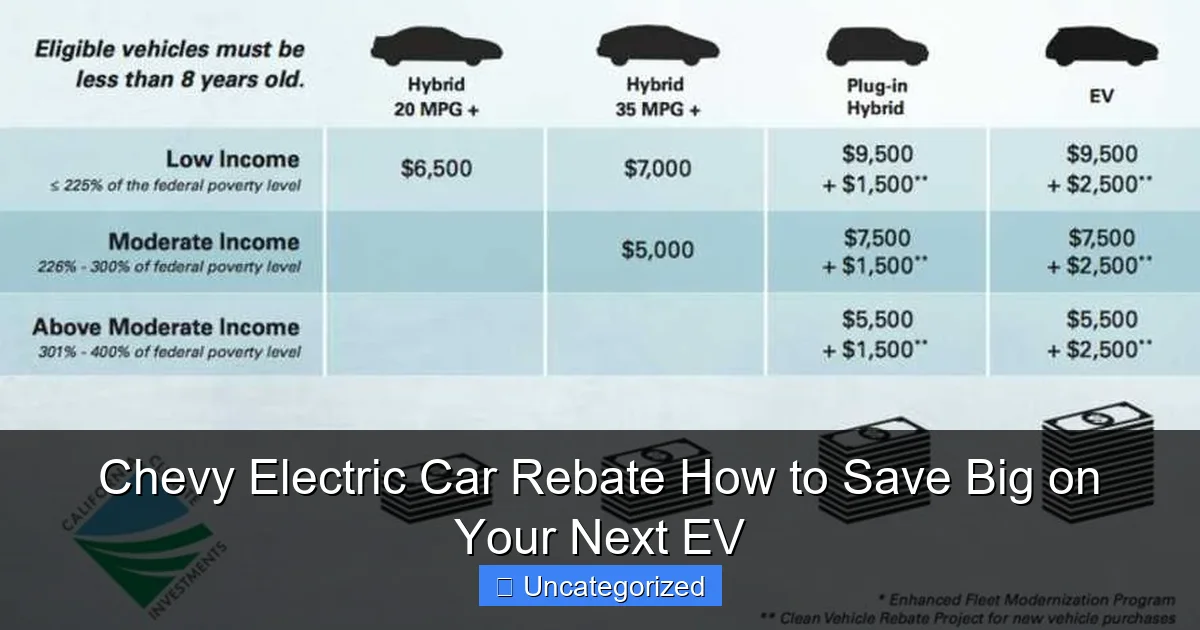

State and Local Rebates: Stack Your Savings

Beyond the federal credit, many states offer their own Chevy electric car rebates. These can range from $1,000 to $7,500, and unlike the federal credit, some are direct cash rebates or point-of-sale discounts. For example:

- California: Offers a $2,000 rebate through the Clean Vehicle Rebate Project (CVRP), with additional $2,500 for low-income buyers.

- New York: Provides a $2,000 rebate via the Drive Clean Rebate program.

- Colorado: Offers a $5,000 tax credit for new EV purchases, with a $2,500 bonus for trade-ins of gas-powered vehicles.

- Massachusetts: Offers up to $3,500 through the MOR-EV program.

Additionally, some cities and counties offer extra incentives. For instance, Los Angeles provides a $1,000 rebate for installing home EV chargers, and Austin Energy offers $1,200 for qualifying EV purchases. These local rebates are often stackable with federal and state incentives, meaning you could save $10,000 or more in high-incentive areas.

Utility Company Incentives: Hidden Gems

Many electric utilities partner with automakers and state agencies to offer Chevy electric car rebates and charger incentives. For example:

- Pacific Gas & Electric (PG&E): Offers $500–$1,000 for EV purchases and up to $500 for home charger installation.

- Con Edison (New York): Provides $500 for EV purchases and $250 for charger installation.

- Xcel Energy (Colorado): Offers $500–$1,000 for EV purchases, depending on income.

These incentives are often overlooked but can significantly reduce your upfront costs. Always check your utility provider’s website for current EV programs.

Which Chevy EVs Qualify for Rebates in 2024?

Not every Chevy electric car is eligible for the full suite of rebates. Eligibility depends on the model, price, battery sourcing, and where you live. Let’s break down the current and upcoming Chevy EV lineup and their rebate status.

Visual guide about chevy electric car rebate

Image source: i0.wp.com

Chevy Bolt EV & Bolt EUV: The Rebate Champions

The 2023 Chevy Bolt EV and Bolt EUV are the most rebate-friendly models in Chevy’s lineup. With a starting price of $26,500 (after the $7,500 federal tax credit), they are among the most affordable new EVs on the market. Both models:

- Qualify for the full $7,500 federal tax credit

- Meet all IRA requirements for battery and assembly

- Are eligible for most state and local rebates

For example, a buyer in California could save:

- $7,500 (federal)

- $2,000 (state)

- $500 (utility)

- $1,000 (charger rebate)

- Total: $11,000 in savings

Even better, Chevy often runs manufacturer rebates, such as $500–$1,000 off MSRP, which can be stacked with other incentives.

Chevy Blazer EV: The Mid-Size SUV with Growing Rebate Potential

The 2024 Chevy Blazer EV starts at $56,715, just above the $55,000 cap for the full federal tax credit. However, it may qualify for a partial credit depending on battery sourcing. As of mid-2024, the Blazer EV is eligible for a $3,750 federal credit due to partial compliance with IRA battery rules.

State rebates vary:

- California: $2,000 (if income-qualified)

- New York: $2,000

- Colorado: $5,000 (with trade-in)

Chevy is also offering a $500 loyalty rebate for current GM owners and a $500 referral bonus for sharing the purchase with friends. These can be combined with other incentives for total savings of $6,000–$8,000 in high-incentive states.

Chevy Silverado EV: The Workhorse with Big Rebate Potential

The 2024 Chevy Silverado EV starts at $74,800, placing it within the $80,000 truck/SUV cap for the federal tax credit. However, due to battery sourcing complexities, it currently qualifies for only a $3,750 credit. Still, this is a significant savings for a full-size electric truck.

State rebates for trucks are often higher:

- California: $4,500 (Workforce EV Rebate for commercial use)

- Texas: $2,500 (via Texas Emissions Reduction Plan)

- Illinois: $4,000 (Drive Electric Program)

Additionally, businesses purchasing the Silverado EV may qualify for the Commercial Clean Vehicle Credit (up to $40,000), which can be combined with other incentives for massive savings.

How to Apply for Chevy Electric Car Rebates: Step-by-Step Guide

Securing your Chevy electric car rebate requires careful planning and timely action. Here’s a step-by-step guide to ensure you don’t miss out on any savings.

Step 1: Check Eligibility Early

Before visiting a dealership, research which rebates you qualify for:

- Federal credit: Use the EPA’s Fuel Economy website to verify model eligibility.

- State rebates: Visit your state’s energy or environmental agency website (e.g., energy.ca.gov for California).

- Utility incentives: Search your provider’s website (e.g., “PG&E EV rebates”).

Pro tip: Create a spreadsheet to track deadlines, income requirements, and application links for each rebate.

Step 2: Choose the Right Purchase Method

Rebates are applied differently depending on how you buy:

- Dealer point-of-sale rebates: Some states (e.g., Colorado, Massachusetts) allow dealers to apply rebates at purchase, reducing your out-of-pocket cost. Ask your dealer if they offer this.

- Post-purchase applications: Most federal and state rebates require you to apply after purchase. The dealer will provide necessary documentation (e.g., VIN, purchase date).

- Leasing: If you lease, the leasing company may claim the federal credit. Negotiate to ensure the savings are passed to you in lower payments.

Step 3: Gather Required Documentation

Common documents needed:

- Bill of sale or lease agreement

- Vehicle identification number (VIN)

- Proof of residency (e.g., utility bill)

- Social Security Number (for tax credits)

- Income verification (for income-qualified rebates)

For the federal tax credit, you’ll file Form 8936 with your annual tax return. Keep all paperwork for at least three years.

Step 4: Submit Applications on Time

Deadlines vary:

- Federal credit: Claim when filing your taxes (due April 15).

- State rebates: Often 6–12 months post-purchase. For example, California’s CVRP requires applications within 18 months.

- Utility rebates: Typically 30–90 days post-purchase.

Set calendar reminders to avoid missing deadlines.

Step 5: Combine with Manufacturer Incentives

Chevy often offers:

- Manufacturer rebates ($500–$2,000 off MSRP)

- Loyalty bonuses (for current GM owners)

- Military, college, or first-responder discounts

Ask your dealer for a full list of current promotions. These are usually stackable with government rebates.

Real-World Examples: How Much Can You Save?

To illustrate the power of stacking Chevy electric car rebates, let’s examine three real-world scenarios.

Scenario 1: Urban Commuter in California

Vehicle: 2023 Chevy Bolt EV ($27,500 MSRP)

- Federal tax credit: $7,500

- California CVRP rebate: $2,000

- PG&E EV purchase rebate: $500

- PG&E charger rebate: $500

- Chevy loyalty rebate: $500

- Total savings: $11,000

- Final cost: $16,500

Note: The buyer qualifies for all incentives due to moderate income and home charger installation.

Scenario 2: Family in Colorado

Vehicle: 2024 Chevy Blazer EV ($56,715 MSRP)

- Federal tax credit: $3,750

- Colorado EV tax credit: $5,000 (with gas car trade-in)

- Xcel Energy rebate: $500

- Chevy referral bonus: $500

- Total savings: $9,750

- Final cost: $46,965

Note: The trade-in of a gas-powered vehicle unlocks the higher Colorado credit.

Scenario 3: Business Owner in New York

Vehicle: 2024 Chevy Silverado EV Work Truck ($74,800 MSRP)

- Federal tax credit: $3,750

- New York Drive Clean Rebate: $2,000

- Con Edison rebate: $500

- Commercial Clean Vehicle Credit: $40,000 (for business use)

- Total savings: $46,250

- Final cost: $28,550

Note: The business credit is a game-changer for commercial fleets.

Maximizing Your Savings: Advanced Tips and Tricks

To get the most out of your Chevy electric car rebate strategy, consider these expert-level tactics.

Time Your Purchase Strategically

Rebates often have funding limits. For example, California’s CVRP has a first-come, first-served model. Buy early in the year to secure rebates before funds run out. Additionally, Chevy may offer year-end clearance deals on 2023 models, which could be paired with rebates for extra savings.

Consider Used Chevy EVs

The Used Clean Vehicle Credit offers up to $4,000 for qualifying used EVs (including the Bolt EV). The vehicle must be at least two years old, cost $25,000 or less, and be the first transfer since the new credit took effect (2023). Used EVs may also qualify for state rebates.

Negotiate the Pre-Incentive Price

Dealers often mark up EVs to offset rebates. Always negotiate the MSRP before incentives. For example, a $1,000 dealer discount on a $30,000 Bolt EV, combined with a $7,500 federal credit, saves you $8,500 total.

Install a Home Charger Early

Many utility rebates require charger installation within 60–90 days of purchase. Install it early to qualify. Level 2 chargers (240V) cost $500–$1,000 but can save $1,000+ in utility rebates.

Monitor Changes to IRA Rules

The IRA’s battery sourcing rules are evolving. Chevy may update battery components to qualify for the full $7,500 credit on newer models. Subscribe to Chevy’s newsletter or check the DOE’s Alternative Fuels Data Center for updates.

| Chevy EV Model | 2024 MSRP | Federal Tax Credit | State Rebate Example | Utility Rebate Example | Total Potential Savings |

|---|---|---|---|---|---|

| Bolt EV | $27,500 | $7,500 | $2,000 (CA) | $500 (PG&E) | $11,000+ |

| Blazer EV | $56,715 | $3,750 | $5,000 (CO) | $500 (Xcel) | $9,750+ |

| Silverado EV | $74,800 | $3,750 | $4,500 (CA) | $500 (ConEd) | $46,250+ (business) |

| Used Bolt EV | $20,000 | $4,000 (used credit) | $2,000 (NY) | $500 (local) | $7,000+ |

Drive Electric, Save Big—Your Chevy EV Awaits

The era of affordable, sustainable driving is here, and Chevrolet is making it easier than ever to go electric. With the Chevy electric car rebate landscape offering unprecedented savings, there’s never been a better time to make the switch. Whether you’re drawn to the budget-friendly Bolt EV, the versatile Blazer EV, or the powerhouse Silverado EV, a combination of federal, state, and local incentives can slash thousands off your purchase price.

But remember: these rebates aren’t automatic. They require research, planning, and timely action. By understanding the rules, stacking incentives, and leveraging manufacturer promotions, you can turn a significant upfront cost into a smart, long-term investment. From urban commuters to rural adventurers and business owners, the savings are real—and they’re waiting for you.

So, what are you waiting for? Visit a Chevy dealer today, explore your Chevy electric car rebate options, and take the first step toward a cleaner, more affordable driving future. With every mile you drive in your new Chevy EV, you’re not just saving money—you’re helping build a better planet for generations to come. The road ahead is electric. Let’s drive it together.

Frequently Asked Questions

What is the Chevy electric car rebate and how does it work?

The Chevy electric car rebate is a financial incentive offered by Chevrolet or government programs to reduce the purchase price of eligible EVs like the Bolt EV or EUV. It may come as a manufacturer discount, tax credit, or state-specific rebate, depending on your location and the vehicle model.

Which Chevy electric cars qualify for a rebate?

Currently, the Chevrolet Bolt EV and Bolt EUV are the primary models eligible for rebates, including federal tax credits (up to $7,500) and select state incentives. Always verify eligibility with your local dealer or the IRS as program rules can change.

How can I claim the Chevy electric car rebate?

To claim the Chevy electric car rebate, you’ll typically submit documentation to your state’s energy or transportation agency or claim a federal tax credit when filing your taxes. Your dealership may also handle paperwork for instant savings at purchase—ask them for details.

Are there income limits for the federal EV tax credit on Chevy vehicles?

Yes, the federal EV tax credit has income caps: $150,000 for individuals, $225,000 for heads of household, and $300,000 for joint filers. Exceeding these limits may disqualify you from claiming the full credit.

Can I combine the Chevy electric car rebate with other incentives?

Yes! You can often stack the Chevy rebate with state/local incentives, utility company discounts, or loyalty programs for maximum savings. Check databases like DSIRE to find all available offers in your area.

Do Chevy EV rebates apply to leased vehicles?

For leased Chevy EVs, the rebate may be applied upfront as a manufacturer incentive to lower monthly payments. However, the tax credit typically goes to the leasing company, not the lessee—ask your dealer how savings are structured.