10 Chinese Electric Car Battery Stocks You Need to Know About

As the world’s automotive industry moves towards electrification, Chinese car battery stocks have become a hot topic in the investment world. However, investing in Chinese electric car battery stocks is not as simple as it seems. There are numerous factors that investors need to consider before taking the plunge into these stocks.

From government regulations to company profits, a lot of variables can impact the future of these stocks. In this blog, we will discuss the key factors that every investor should consider before investing in Chinese electric car battery stocks. So, let’s dive in and explore this exciting and complex investment opportunity.

Market Overview

Chinese electric car battery stock has been a hot topic in the market recently. With more and more countries pushing for sustainable transportation, the demand for electric vehicles has skyrocketed, resulting in a surge of interest in the companies that produce their batteries. China, being one of the largest markets for electric vehicles, has noted a significant increase in the production and sales of these cars.

As a result, Chinese electric car battery stock has seen an impressive boost as well. Investors are eyeing this market closely, identifying companies with the most promising technology and production capacity. The competition in the Chinese electric car battery market is fierce, with numerous manufacturers vying for dominance.

With the growing demand for electric cars, it is expected that this market will continue to grow, making it a popular sector for investors looking to capitalize on the rising trend towards sustainability. If you’re considering investing in this sector, make sure to research the different companies and their technologies to determine which ones have the greatest potential for growth and profitability.

Current Market Size and Growth

Market Overview: The current market for the global economy has experienced a significant growth trajectory in recent years, primarily due to technological advancements and increased connectivity between countries. The market has experienced an increase in demand from various sectors such as healthcare, transportation, retail, and manufacturing, among others. The growth rate has spurred innovation and increased competition among market players, resulting in more affordable and efficient goods and services.

The market size for 2021 is estimated to be around 76 billion and is expected to grow at a CAGR of 5% until 202

This growth projection indicates that the market is poised to experience continuous expansion, providing tremendous opportunities for investors and businesses alike. The incorporation of advanced technologies such as artificial intelligence, the Internet of Things (IoT), and blockchain will further fuel market growth and influence business processes in the global economy. In conclusion, the market opportunity is vast, and the potential for investment and growth in the global economy is enormous.

Major Players in the Industry

When it comes to industry players in the market, there are a few names that come to mind. Let’s start with Amazon, the largest and most recognizable retailer in the world. Their e-commerce platform dominates the market, generating billions in revenue each year.

Another significant contributor to the market is Walmart, with their well-established brick-and-mortar presence and growing online platform. Other major e-commerce players include Etsy for handmade and unique products, Alibaba for international trade, and Shopify for small businesses. In addition, there are various companies providing essential infrastructure and tools, like payment processors, shipping carriers, and marketing platforms.

The e-commerce market is continually evolving, and with the increasing popularity of social commerce and the rise of niche marketplaces, it will be interesting to see how these major players adapt and compete.

Battery Technology

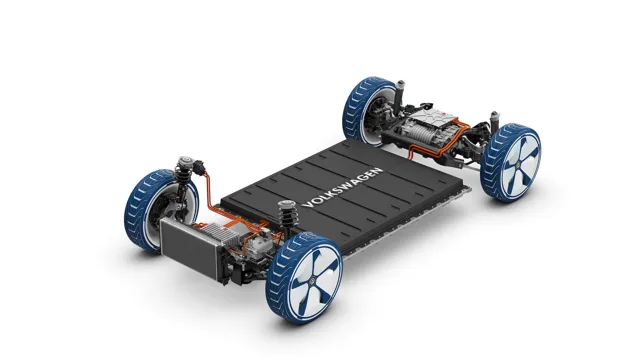

If you’re keeping an eye on the electric vehicle industry, you may be interested in Chinese electric car battery stock. China has become a major player in the EV market and their battery technology is a big part of that. Battery technology is one of the most important aspects of electric vehicles, as it determines how far the car can go on a single charge and how long it takes to charge back up.

Chinese companies such as CATL and BYD are leading the charge when it comes to battery production and are responsible for some of the most advanced batteries in the world. Investing in Chinese electric car battery stock could be a smart move for those interested in the future of the EV industry. However, it is important to conduct thorough research and stay up to date on any market developments before making any investment decisions.

Latest Developments in Chinese EV Batteries

Chinese electric vehicle (EV) battery technology has been making waves in the industry recently, with significant developments taking place. One of the most notable advancements is in the use of lithium iron phosphate (LFP) batteries. Compared to traditional lithium-ion batteries, LFP batteries are safer, longer-lasting, and cheaper to produce, making them a popular choice with leading Chinese EV manufacturers.

In addition to LFP batteries, companies are also exploring new technologies such as solid-state batteries, which promise even higher levels of safety and energy density. These developments not only improve the range and reliability of EVs but also contribute to China’s efforts to reduce its carbon footprint and increase renewable energy usage. The Chinese EV battery industry is undoubtedly one to watch, and we can expect to see more exciting advancements in the near future.

Battery Performance and Lifespan

Battery technology has come a long way in recent years, with advancements resulting in improved battery performance and longer lifespan. Lithium-ion batteries have become the standard in most electronic devices due to their high energy density, ability to recharge, and low self-discharge rate. These batteries are made up of several components, including a cathode, an anode, and an electrolyte.

The cathode and anode are made of different materials that allow for the flow of lithium ions, which store and release energy. The electrolyte acts as a medium for the ions to travel between the two electrodes. While lithium-ion batteries have shown great promise, there is still room for improvement.

Researchers are exploring new materials and designs that could lead to even better energy density and longer lifespan. As technology continues to evolve, we can expect to see more efficient and effective battery technology that enables us to stay connected and productive for longer periods of time.

Charging Infrastructure

When it comes to electric vehicles (EVs), one of the key factors in their success is their battery technology. Advanced battery technology has greatly improved the range and performance of EVs, ultimately making them more appealing to consumers. Lithium-ion batteries are currently the most common type of battery used in EVs, but there are also other promising technologies being developed.

These include solid-state batteries, which utilize a solid electrolyte instead of a liquid one, and flow batteries, which can be easily recharged by replacing the electrolyte fluid. While battery technology has come a long way, there is still room for improvement. One major challenge is decreasing the cost of manufacturing these batteries, which would make EVs more affordable for consumers.

Another challenge is finding a way to increase their energy density, allowing for longer driving ranges. As battery technology continues to advance, it will continue to play a critical role in the success of EVs.

Regulatory Environment

China, being the world’s largest producer of electric vehicles (EV), plays a significant role in the global supply chain of EV parts, especially batteries. The regulatory environment governing the Chinese electric car battery stock has been subject to ongoing changes over the years. One of the most significant developments in this regard was China’s adoption of the New Energy Vehicle Industry Development Plan in 2010, which aimed to promote the development and production of EVs in the country.

The plan offered various incentives, including tax benefits for manufacturers producing electric car batteries, encouraging companies to ramp up production. However, the government also implemented stringent regulations on battery safety and quality, which led to a consolidation of the industry and stricter quality standards for EV batteries. Overall, the regulatory environment for Chinese electric car battery stocks is evolving, with the government’s focus on sustainable urban transportation driving the market’s growth.

This growth makes investing in Chinese electric car battery stocks an attractive opportunity for long-term investors looking for exposure to the EV industry.

Government Subsidies and Incentives

When it comes to the regulatory environment surrounding government subsidies and incentives, there is a lot to consider. First and foremost, it’s important to understand that government subsidies and incentives are designed to encourage particular behaviors or industries. This could mean offering tax breaks to companies that invest in renewable energy, or providing grants to small businesses that hire employees from a certain demographic.

However, these subsidies and incentives often come with strings attached, and companies must meet certain requirements in order to qualify. This means that businesses must carefully evaluate the benefits and drawbacks of taking advantage of these programs. On the one hand, subsidies and incentives can help a company save money or expand their operations.

On the other hand, they can be complex and time-consuming to navigate, and they may not always provide the benefits that businesses hope for. In short, the regulatory environment surrounding government subsidies and incentives is an important factor to consider for any company looking to take advantage of these programs.

Emissions Standards and Regulations

When it comes to emissions, there is a lot of talk about regulations – and for good reason. Regulatory standards are crucial in ensuring that companies are held accountable for their impact on the environment. Governments around the world have implemented a range of emissions standards and regulations, from setting limits on pollutants to requiring companies to report on their environmental impact.

But while regulations are important, it can be easy to get lost in the complexity of the regulatory environment. There are multiple bodies involved in setting emissions standards and regulations, and these can vary depending on industry, geography, and other factors. It’s important for companies to stay up to date on the latest regulations and comply with them to the best of their ability.

Not only does this help protect the environment, but it can also lead to cost savings and improved reputation. As consumers become more environmentally conscious, companies that prioritize sustainability will likely have a competitive advantage.

Investment Opportunities and Risks

If you’re looking for investment opportunities in the electric vehicle industry, Chinese electric car battery stocks could be an interesting option to consider. China is the world’s largest electric vehicle market, and this trend is unlikely to change anytime soon, making it a solid market to invest in. There are certainly risks associated with investing in any stock, and the electric vehicle industry is no exception.

For one, there is uncertainty around government regulations and policy changes that could affect demand for electric cars, and therefore the demand for electric car batteries. Additionally, there is also the risk of competition from other battery manufacturers and the potential for new technologies to disrupt the market. However, with proper research and investment strategies, investing in Chinese electric car battery stocks could yield high returns over the long term.

Conclusion

In conclusion, investing in Chinese electric car battery stocks is electrifyingly promising. With the rapid growth of the electric vehicle market globally, China’s leading position in battery production, and new innovations in battery technology, it’s clear that these stocks have the potential to power up investors’ portfolios. So, if you’re looking for a shockingly good investment opportunity, look no further than Chinese electric car battery stocks.

Just be sure to keep a watchful eye on any potential jolts in the market.”

FAQs

Which Chinese companies are leading the electric car battery stock market?

Some of the leading Chinese companies in the electric car battery stock market include CATL, BYD, and LG Chem.

How has the Chinese electric car battery stock market performed in recent years?

The Chinese electric car battery stock market has seen tremendous growth in recent years due to the government’s promotion of electric vehicles and the increasing demand for clean energy technology.

Are there any risks or challenges associated with investing in Chinese electric car battery stocks?

There are always risks associated with investing, especially in emerging markets like the Chinese electric car battery stock market. Some of the potential risks include political instability, regulatory changes, and fluctuations in the global economy.

What are the future growth prospects for the Chinese electric car battery stock market?

The future for the Chinese electric car battery stock market looks promising, as the government continues to promote the adoption of electric vehicles and invest in clean energy technology. Additionally, the global demand for electric vehicles and renewable energy is expected to continue to grow, which could drive significant growth in the market.