Electric Cars: A Win-Win for Your Business and the Environment – Exploring the Tax Benefits and Savings for Your Company

Electric cars have been gaining popularity recently due to their significant contributions to the environment. However, their cost remains high, and buyers are looking for every possible way to minimize expenses. The good news is that companies can enjoy notable tax benefits by offering electric cars to their employees as company cars.

As electric vehicles reduce the carbon footprint, governments globally encourage their use, and therefore the provision of notable tax incentives to encourage their adoption. This blog will detail the several benefits companies stand to gain by taking the initiative of providing sustainable company cars to their staff, including savings on car allowances, tax deductions, and VAT reclaim benefits. Join us as we explore everything you need to know about the tax benefits offered to companies for investing in electric cars.

Overview of electric car tax incentives

If you’re considering purchasing an electric car for your company, it’s worth knowing about the available tax incentives. In many countries, there are various tax benefits for switching to electric cars, including company tax breaks. These tax incentives could save your business thousands of dollars, so it’s wise to take advantage of them.

There are different types of company tax benefits for electric cars, such as deductions for cars purchased, tax credits for charging stations, and exemptions from vehicle taxes and fees. Additionally, some companies may qualify for grants or subsidies for installing EV charging infrastructure. By switching to electric vehicles, you can benefit not only your company but also the environment, reducing harmful emissions while taking advantage of these cost-saving measures.

Federal tax credits for businesses

If you own a business and are considering switching to electric vehicles, you may be eligible for federal tax credits. These incentives are designed to encourage businesses to go green and reduce their carbon footprint. The amount of the tax credit varies depending on the type of vehicle and its battery capacity.

For example, a fully electric vehicle with a battery capacity of 16 kWh or more can earn a credit of up to $7,500. There are also credits available for plug-in hybrid vehicles and fuel cell vehicles. The incentives are meant to defray some of the higher upfront costs associated with purchasing eco-friendly vehicles, making it more accessible for businesses to transition to a sustainable transportation system.

Switching to electric vehicles not only benefits the environment but also helps businesses save money on fuel costs and maintenance in the long term. So, if you’re looking to adopt a more eco-friendly and cost-effective approach, electric vehicles are certainly worth considering.

State incentives and grants

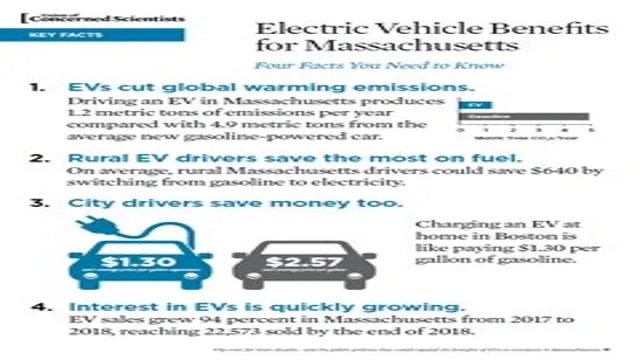

electric car tax incentives Are you in the market for an electric car but concerned about the initial cost? You may be happy to learn that there are several incentives and grants available to help reduce the cost of purchasing an electric car. From federal tax credits to state-level incentives, you can potentially save thousands of dollars on your purchase. For example, the federal government offers a tax credit of up to $7,500 for new electric car purchases.

However, it’s important to note that this credit begins to phase out once a manufacturer sells 200,000 qualifying vehicles. Some states also offer their incentives, such as rebates, tax credits, and exemptions from certain fees and taxes. It’s essential to research what incentives and grants are available in your state to determine how much financial assistance you could receive.

So, take advantage of these electric car tax incentives and grants, and start saving on your purchase today!

Impact of electric cars on company taxes

When it comes to electric cars, there are significant company tax benefits to be had. First and foremost, companies can claim a deduction of up to $18,000 for the purchase of a new electric car. This represents a substantial saving compared to traditional cars, which are subject to a much lower tax deduction limit.

Additionally, companies that invest in electric cars can also benefit from reduced fringe benefits tax (FBT) rates, further reducing their tax bill. But it’s not just about tax savings. Companies that invest in electric cars also enjoy a range of non-tax benefits, including improved corporate social responsibility, reduced fuel costs, and a more positive public image.

With the ongoing drive towards cleaner, greener transport options, it makes sense for companies to invest in electric cars and enjoy the many benefits that come with them.

Lower fuel expenses and maintenance costs

With the rising popularity of electric cars, many businesses are considering making the switch to electric vehicles. One major benefit of using electric cars is the lower fuel expenses and maintenance costs. Not only do electric cars have lower fuel costs due to their high energy efficiency, but they also have fewer moving parts which can result in lower maintenance costs.

This can have a significant impact on company taxes as the lower expenses can reduce tax liability. In addition, many countries offer tax incentives and credits to businesses that switch to electric cars as they are seen as a more eco-friendly option. By reducing fuel and maintenance costs, electric cars can not only benefit the environment but also help businesses save money in the long run.

Potential tax deductions and depreciation benefits

Electric vehicles have become increasingly popular among businesses, primarily due to their potential tax benefits. For instance, companies that own electric vehicles can claim a federal tax credit of up to $7,500 per vehicle, depending on the vehicle’s battery capacity. Moreover, electric cars utilize renewable energy sources, resulting in lower fuel costs, which helps businesses reduce their tax liabilities.

Additionally, electric vehicles also qualify for depreciation benefits, meaning companies can recover some of the costs it took to acquire them. With the right strategy in place, businesses can reduce their tax burdens significantly by embracing electric vehicles. Therefore, with the heightened importance of minimizing carbon footprints and more regulations favoring sustainable business practices, tax incentives such as this can help companies transition to electric vehicles faster.

Reduced carbon emissions and environmental benefits

Electric vehicles have a significant impact on company taxes due to their reduced carbon emissions and environmental benefits. Governments worldwide are offering incentives to companies that invest in green technologies such as electric cars. One such incentive is reduced corporate tax rates for businesses that shift to electric vehicles.

In addition, companies can claim a tax credit for each electric car purchased, and these credits can offset tax liabilities. These incentives are designed to promote sustainable practices and reduce carbon dioxide emissions, which can help to mitigate the impact of climate change. By investing in electric cars, companies can enjoy significant tax savings while also reducing their carbon footprint.

Overall, the use of electric cars is a financially smart move for companies looking to save money on taxes while also benefiting the environment.

How to take advantage of electric car tax benefits

When it comes to electric cars, company tax benefits are an excellent way to get the most out of your investment. One significant advantage of buying an electric car for business purposes is the enhanced capital allowances or 100% First-Year Allowances (FYA) offered by the government. This means that when you buy an eligible electric vehicle, you can claim the entire cost of the car as an expense in your tax return, reducing the overall tax liability for your business.

Additionally, electric cars produce zero-emissions, making them environmentally friendly and helping businesses to meet carbon reduction targets. Moreover, there are also exemptions for fuel duty and lower vehicle tax rates, further saving you money. Therefore, if you’re thinking of upgrading your business’s vehicles, it makes sense to consider the benefits of electric cars and take advantage of the tax benefits offered by the government.

Consult with a tax professional

If you’re considering purchasing an electric car, it’s essential to understand the tax benefits that come with it. The federal government provides a tax credit of up to $7,500 for the purchase of an electric car, depending on the battery capacity and manufacturer. Several states also have their own incentives, such as tax credits, rebates, and exemptions from sales tax and personal property tax.

However, navigating the tax code can be challenging, and claiming the credits can be time-consuming. That’s why consulting with a tax professional is crucial. They can help you determine which tax credits and incentives you qualify for and guide you through the process of claiming them.

They can also help you understand how your electric car purchase affects your overall tax liability. Ultimately, working with a tax professional can help you maximize your savings and ensure that you take full advantage of the tax benefits of owning an electric car.

Research tax credits and incentives for your state

Electric car tax benefits When purchasing an electric car, it’s important to research the tax credits and incentives available in your state. Many states offer tax incentives, rebates, or credits for purchasing an electric vehicle. For example, California residents can receive up to $7,000 in rebates through the Clean Vehicle Rebate Project.

Additionally, the federal government offers a tax credit of up to $7,500 for purchasing an electric car. However, be sure to check the eligibility requirements as some incentives are based on income or vehicle type. Taking advantage of these tax benefits can help you save money and make your purchase more affordable.

So, before you make your electric car purchase, make sure to do your research and see what tax advantages you may be eligible for in your state.

Conclusion and next steps

In conclusion, the company tax benefits for electric cars are a win-win situation. Not only do they promote sustainability and encourage businesses to make eco-friendly choices, but they also save on operational costs and increase employee satisfaction. Investing in electric cars is not only good for the environment, but it’s also smart business.

So, let’s charge ahead and electricify our company fleets!”

FAQs

What are the company tax benefits for electric cars?

Companies that purchase electric cars are eligible for tax incentives and credits, such as the federal tax credit and state incentives.

Can a company write off the entire cost of an electric car for tax purposes?

No, a company cannot write off the entire cost of an electric car for tax purposes. However, they may be able to deduct a portion of the cost through depreciation over several years.

Are there any restrictions on the types of electric cars that qualify for tax benefits?

Yes, only electric cars that meet certain criteria, such as battery capacity and range, are eligible for tax benefits. It is important for companies to carefully research the specific requirements for each incentive program.

Can a company receive tax benefits for charging stations for electric cars on their property?

Yes, companies may be eligible for tax credits for installing charging stations for electric cars on their property. These credits can offset the cost of installation and encourage the adoption of electric vehicles.