Switch to Electric: Unveiling the Lucrative Company Tax Benefits of Electric Cars

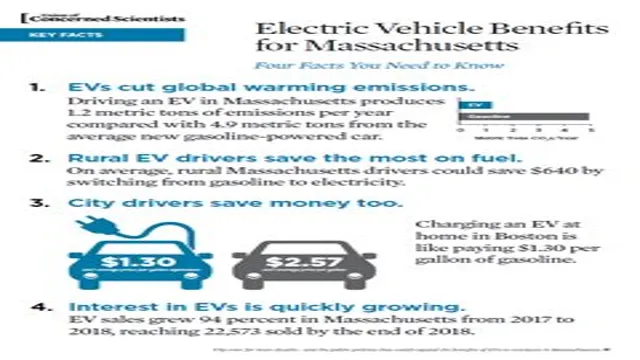

Are you a company owner looking to save money on taxes while also helping the environment? Electric cars could be the solution you’ve been searching for. Not only do they produce fewer emissions, but they also come with several tax benefits that could help you save money. However, it’s essential to understand how to navigate the complicated tax code to take full advantage of these benefits.

In this blog post, we’ll discuss some strategies for maximizing company tax benefits on electric cars. We’ll cover everything from the tax credits available for purchasing electric cars to the deductions for charging stations. By the end of this article, you’ll be able to make informed decisions about incorporating electric cars into your company’s fleet while also reaping the tax benefits.

So, let’s dive in and explore the world of electric cars and tax savings!

Understanding the Tax Benefits

If your company is considering purchasing electric cars, there are several tax benefits to take advantage of. For starters, you may qualify for a federal tax credit of up to $7,500 per vehicle. This credit can help offset the higher upfront cost of electric vehicles compared to their gasoline-powered counterparts.

Additionally, businesses can deduct the cost of electric cars as a business expense, which can lower their taxable income and reduce their overall tax bill. Plus, electric cars are often exempt from certain state and local taxes, such as sales tax and property tax. These tax benefits make it easier and more cost-effective for companies to make the switch to electric vehicles and embrace sustainable transportation options.

Electric Car Tax Credit

The electric car tax credit is a form of federal tax benefit that provides incentives to people who purchase energy-efficient vehicles. By doing so, the government is promoting the use of electric cars which are environmentally friendly and reduce the nation’s dependence on fossil fuels. Understanding this tax credit can be a bit overwhelming, but it’s an excellent opportunity for those looking to save money in the long term.

Essentially, the tax credit allows for a specific amount of money to be deducted from the income tax owed by the individual who has purchased an electric vehicle. The amount of money returned to the buyer varies and depends on factors such as the vehicle’s cost, battery capacity, and the owner’s tax liability. Those who own an electric vehicle can take advantage of this tax credit until the vehicle’s manufacturer reaches a certain number of total sales.

In short, investing in an electric vehicle can yield significant returns in the form of a tax credit incentive while also contributing to a cleaner and more sustainable environment.

Section 179 Deduction

If you’re a small business owner, you should definitely understand the Section 179 deduction for its tax benefits. In simple terms, Section 179 allows business owners to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. This deduction is particularly useful for small businesses that need to invest in equipment and technology to grow their operations.

By taking advantage of the Section 179 deduction, businesses can reduce their taxable income and increase their bottom line. In fact, it’s a great way to save money on taxes and free up capital for other business needs. It’s important to note that not all equipment and software qualify for the Section 179 deduction.

To ensure you’re taking advantage of this tax benefit, make sure to consult with a tax professional. They can help you navigate the process and identify the eligible purchases for you to take advantage of the Section 179 deduction. In conclusion, the Section 179 deduction is a valuable tax benefit for small business owners looking to invest in their businesses’ growth.

Make sure you understand the rules and regulations around it and consult with a tax professional to maximize your savings. With the right approach, the Section 179 deduction can help take your business to the next level.

Qualifying for the Tax Benefits

If you’re considering purchasing an electric car for your company, it’s important to understand the eligibility criteria for the tax benefits that come along with it. The first requirement is that the car must be bought or leased by the company and used for business purposes. The car should also meet the minimum standards for battery, i.

e., it should have a battery capacity of at least 4 kWh. To qualify for the federal tax credit, the car should be new and purchased between 2010 and 2021, with a maximum tax credit of $7,500.

Additionally, some states offer tax incentives, rebates, or exemptions on electric car purchases, so be sure to research and take advantage of any local tax benefits. As electric cars become more prevalent, it’s important to stay current on the eligibility criteria for these tax benefits to make the most of your investment.

Vehicle Eligibility Requirements

When it comes to tax benefits for vehicles, there are certain eligibility requirements that must be met. The most important factor is the type of vehicle and its fuel efficiency. Generally, vehicles that have alternative fuel sources, such as electric or hybrid cars, qualify for these tax benefits.

Additionally, the vehicle must be new or bought used from a dealer, and it must be used primarily for personal use rather than business purposes. It’s important to note that the amount of tax credit varies depending on the type of vehicle and its fuel efficiency. Hybrid cars generally qualify for a smaller tax credit, while fully electric cars often receive the maximum credit available.

Before purchasing a vehicle with the intent of receiving these tax benefits, it’s important to research the specific eligibility requirements in order to ensure that the vehicle qualifies.

Company Car Ownership Criteria

If you are considering obtaining a company car for tax benefits, there are several criteria you must meet before being eligible. First and foremost, the car must be used for business purposes at least 50% of the time, which means that personal use should be limited. Secondly, the car’s value must not exceed a certain limit, which varies depending on the year it was purchased.

Lastly, it must be registered under the name of the company in question instead of the employee’s name. Meeting these criteria will make you eligible for tax benefits. However, it is crucial to keep accurate records of how the car is used to avoid any complications during audits.

Considering the potential benefits, obtaining a company car can be a smart decision for many businesses. However, it is important to carefully evaluate your circumstances and consult with a professional tax advisor before making any decisions.

Establishing Business Use Percentage

Establishing the business use percentage is crucial to qualify for tax benefits. It’s the percentage of time, space, and expenses that you use for business purposes versus personal use. To calculate this percentage, you’ll need to determine the total square footage of your workspace and the total time you spend using it for business.

If you operate your business from home, you’ll need to consider the percentage of your home that you use for business purposes. Additionally, you’ll need to keep detailed records of all expenses related to your business, including utilities, rent, and office supplies. By establishing your business use percentage, you can claim tax deductions for these expenses, resulting in significant tax savings.

It’s important to note that the Internal Revenue Service (IRS) has strict rules about what qualifies as a business expense and what doesn’t, so it’s crucial to keep accurate records and consult with a tax professional if you’re unsure.

Calculating Tax Savings

If you are thinking of purchasing an electric car for your business, you should be aware that there are some significant tax benefits available to you. One such benefit is company tax savings. If you choose an EV that meets the criteria set by HMRC, you can claim up to 100% of the cost of the vehicle against your taxable profits.

This can result in considerable tax savings for your company. In addition, you can also claim back 100% of the VAT on the purchase price of the vehicle, which further increases your savings. The benefits don’t stop there – as long as you meet the conditions set by HMRC, you can also claim tax relief on a range of electric car-related expenses, such as the cost of installing a charging point at your business premises or the cost of charging the vehicle.

These generous tax incentives are designed to encourage businesses to adopt more sustainable transport solutions and can help you save money while also reducing your carbon footprint.

Example Savings Calculation

Calculating Tax Savings When it comes to tax season, one of the most important aspects is calculating your tax savings. This refers to the amount of money you will save on your taxes by taking advantage of deductions and credits. For example, if you have a mortgage on your home, you can deduct the interest you paid on that mortgage from your taxable income.

This can result in significant tax savings, as can other deductions such as charitable donations or medical expenses. To calculate your tax savings, you will need to gather all the relevant information and use a tax calculator or consult with a tax professional. By doing so, you can ensure that you are maximizing your savings and minimizing your tax liability.

So, be sure to take the time to calculate your tax savings this tax season and reap the benefits of your hard work and financial planning.

Takeaways and Next Steps

If you’re considering purchasing an electric car, it’s worth exploring the tax benefits available to your company. In many countries, governments offer various tax incentives designed to encourage businesses to adopt electric vehicles. These may include tax credits, deductions, or exemptions that can significantly reduce the overall cost of owning and running electric vehicles.

For example, in some jurisdictions, companies can claim back a percentage of the purchase price when they buy an electric car or receive a tax credit for the installation of charging stations. Additionally, as electric vehicles are considered to be more environmentally friendly than traditional petrol or diesel engines, some governments levy lower taxes on businesses that use them. Therefore, it’s worth doing your research to see what tax benefits are available in your jurisdiction and how your business can take advantage of them to reduce costs and contribute to a sustainable future.

Overall, investing in electric cars can be a smart financial move for your company while reducing your carbon footprint at the same time.

Conclusion

In conclusion, the tax benefits companies receive for purchasing electric cars are a win-win situation for both the environment and the financial bottom line. Not only are these vehicles better for the planet, but they also provide long-term cost savings through reduced fuel and maintenance expenses. So, if you want to give your company a jolt in the right direction, consider investing in electric cars and reap the benefits – it’s a charge worth taking!”

FAQs

Are there any tax benefits for companies that purchase electric cars?

Yes, companies can receive federal tax credits of up to $7,500 per electric vehicle purchased.

How long do companies have to claim the tax credit for purchasing electric cars?

The tax credit for purchasing electric cars can be claimed until the manufacturer has sold 200,000 eligible vehicles in the United States.

What is the maximum amount of tax credit a company can receive for purchasing multiple electric cars?

There is no limit on the number of electric cars a company can purchase and receive a tax credit for, as long as the total credit amount does not exceed the company’s tax liability.

Do state governments also offer tax benefits for companies purchasing electric cars?

Yes, many states offer additional tax incentives for companies purchasing electric cars, such as exemptions from sales tax or rebates for the purchase or installation of charging stations.