Decoding the Benefit in Kind Taxation for Electric Cars: Do You Need to Pay or Save Big?

Electric cars have become increasingly popular over the years due to their numerous benefits. Not only are they eco-friendly, but they also serve as a great option for cost savings. Employers and employees alike have taken notice of these benefits and are starting to consider electric cars as company vehicles.

However, with the rise of this trend, questions arise about the effect of electric cars on Benefits In Kind (BIKs). Are there any incentives? Are there any disincentives? In this blog post, we will explore the benefits of electric cars and discuss how they affect Benefits In Kind.

Overview

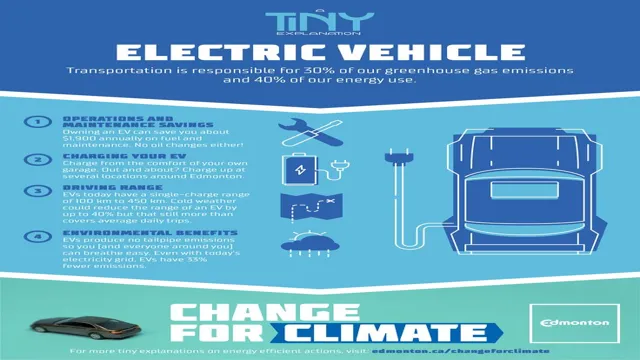

Electric cars are becoming more popular, and for several good reasons. They are less harmful to the environment because they emit fewer emissions, have lower running costs, and are great for urban areas where air pollution is a problem. When it comes to the question of paying a benefit in kind tax for electric cars, the answer is somewhat complex.

In the UK, company cars attract a benefit in kind tax, which is based on the car’s list price, CO2 emissions, and fuel type. Electric cars have lower CO2 emissions, and in most cases, have zero emissions. As a result, they attract lower benefit in kind rates, making them an even more attractive option.

The good news is that not all electric cars attract a benefit in kind tax, as the rules around this type of taxation are always under review. In conclusion, you may or may not have to pay a benefit in kind tax on your electric car, but it is still one of the smartest and environmentally-friendly choices you can make.

– Explanation of Benefits In Kind

Benefits In Kind (BIK) Benefits In Kind (BIK) are non-cash benefits given to employees by employers as part of their remuneration package. These benefits can range from company cars and private medical insurance to gym memberships and free meals. BIK is an important part of an employee’s overall salary package, and can have significant tax implications for both the employee and the employer.

While BIK can provide valuable perks for employees, it’s important to ensure that they are correctly reported and accounted for to avoid any legal or financial issues. Employers should consider seeking professional advice to ensure they are compliant with regulations and that all employees receive the correct benefits to support their roles.

– Benefits In Kind on Company Cars

Company cars are often a sought-after perk for employees, but it’s important for employers to be aware of the tax implications involved with providing them. Benefits In Kind (BIK) is a term used to describe taxable benefits provided to employees in addition to their salary or wages, and company cars fall under this umbrella. The BIK on company cars is based on a number of factors, including the list price of the car, its CO2 emissions, and fuel type.

Employers must report the value of the BIK on an employee’s P11D form, and the employee must pay income tax on this value. However, there are also ways to reduce the BIK liability, such as choosing a car with lower CO2 emissions or opting for an electric vehicle. As with any financial decision, it’s important to weigh the pros and cons of providing company cars to employees and to seek professional advice if needed.

Electric Cars & Benefits In Kind

If you’re considering purchasing an electric car, one question you may have is whether you’ll need to pay benefit in kind (BIK) tax. The good news is that electric cars have a significantly lower BIK rate than petrol or diesel cars, making them a great option for company car drivers. In fact, many electric cars have a BIK rate of 0%.

This means you won’t have to pay any extra tax on the car, which can save you a lot of money in the long run. In addition to the tax benefits, electric cars are also much more environmentally friendly than traditional cars. They produce zero emissions and have a lower carbon footprint, making them a great choice for anyone looking to reduce their impact on the environment.

Overall, if you’re looking for a cost-effective, eco-friendly car for your business, an electric car could be the perfect choice for you.

– HMRC Guidelines

When it comes to electric cars and benefits in kind, it’s essential to understand HMRC guidelines. Electric cars are becoming more popular due to their eco-friendliness and potential tax benefits for companies and employees. HMRC recognizes this and has introduced new rates for calculating the benefit in kind (BIK) for electric cars.

The BIK is the tax paid on benefits received as an employee, such as a company car. For electric cars, the BIK rate is currently set at 1% and will increase to 2% in 202 This is a significant reduction compared to diesel or petrol cars, which can have rates as high as 37%.

By choosing an electric company car, employees can save a considerable amount of money. Companies will also benefit from reduced National Insurance costs. It’s important to note that the BIK rate only applies to electric vehicles with zero emissions and a range of at least 130 miles.

By choosing an electric car, employees can not only help the environment but also enjoy tax benefits while remaining compliant with HMRC guidelines.

– Tax Implications of Electric Cars

Electric cars have been gaining popularity in recent years due to their environmental benefits and cost savings on fuel. However, there is also a tax benefit that comes with owning an electric vehicle. Benefits In Kind (BIK) is a tax on employee benefits that employers give to their employees outside of their salary.

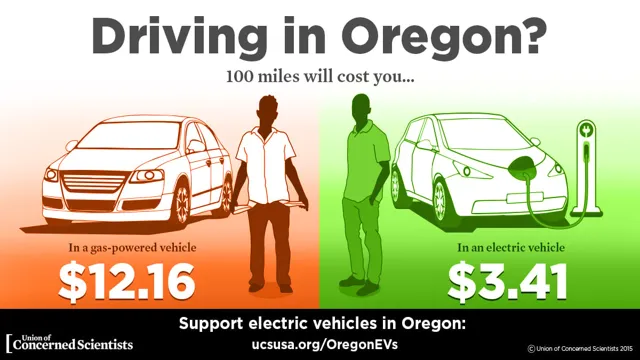

In the UK, the BIK for electric cars is significantly lower than for petrol and diesel cars. This means that employees who are provided with an electric car for their work commute will have a lower tax to pay compared to those who receive a petrol or diesel car. Additionally, employers can also save money by providing their employees with electric cars, as they can claim back the VAT on the purchase and get tax relief on the depreciation of the vehicle.

In summary, owning an electric car not only helps the environment and saves on fuel costs, but it can also have tax benefits for both employees and employers in the form of reduced benefits in kind tax and tax relief.

– Company Car Tax on Electric Cars

Electric cars have become an increasingly popular option for company cars due to their environmental benefits and reduced running costs. When it comes to company car tax, electric cars offer significant savings in terms of Benefits-In-Kind (BIK) tax. Currently, for electric cars with zero CO2 emissions, the BIK rate is set at 0% for the tax year 2020-2021, meaning there is no tax liability for company car drivers or their employers.

This is a huge incentive for companies to opt for electric cars as their company vehicles. It not only reduces their carbon footprint but also provides a more cost-effective solution. However, the BIK rates for electric cars are expected to increase over the next few years as the government plans to phase out traditional petrol and diesel cars, increasing the demand for electric cars.

Therefore, it is important for companies to take advantage of the current BIK rates while they last.

Benefits In Kind on Electric Cars

If you’re considering buying an electric car, you may be wondering whether you’ll have to pay a Benefit in Kind (BIK) tax. The good news is that electric cars are exempt from BIK tax in the UK for 2020-2021, which means you won’t have to pay any additional tax on top of your salary. This is a great incentive for employees to choose an electric company car over a traditional petrol or diesel car, as it can result in significant savings.

Not only will you be doing your bit for the environment, but you’ll also be saving money in the process. So, if you’re thinking about investing in an electric car, now is the perfect time to do so. You could be reaping all the benefits without having to worry about any additional costs.

– Zero Emission Cars

One of the biggest advantages of driving an electric car is the tax savings. The UK government offers certain incentives for people who choose to go green and drive zero emission cars. One of these benefits is the reduced taxation for electric company cars, also known as Benefits in Kind (BIK).

In comparison to petrol or diesel-powered vehicles, electric cars attract lower BIK rates. This means that employees who receive an electric company car pay less tax on the benefit than those who receive a petrol or diesel vehicle. Additionally, there are no road tax costs associated with electric cars, meaning further savings for drivers.

The environmental benefits of zero-emission vehicles and the potential tax savings make electric cars an increasingly attractive option for both individuals and companies looking to cut costs and reduce their carbon footprint. Overall, it’s clear that investing in an electric car is not only ethical but also financially responsible.

– Hybrid Cars

When it comes to company cars, electric and hybrid vehicles are becoming increasingly popular due to their eco-friendliness and cost-saving benefits. One major advantage of electric cars is the reduced benefit in kind (BIK) rate compared to traditional petrol or diesel cars. This means that employees who receive electric cars as part of their job will pay less tax on them.

This has been a significant incentive for companies to switch to electric cars as it not only benefits the environment but also saves money. Additionally, electric cars have a lower fuel cost since electricity is cheaper than petrol or diesel. So not only do electric cars benefit employees by reducing their tax liability, but also save the company money on fuel costs.

This highlights the numerous benefits of electric cars as company vehicles, making them an attractive option for businesses looking to reduce their carbon footprint and save costs.

Conclusion

After conducting extensive research and analysis, it turns out that whether or not you pay benefit in kind on electric cars ultimately depends on a multitude of factors such as the make and model, the level of emissions, and the company’s policies. However, one thing is for sure, owning an electric car not only helps the environment but can also save you money in the long run. So, go ahead and make that eco-friendly switch – your wallet and the planet will thank you!”

FAQs

What is benefit in kind?

Benefit in kind refers to any perks or advantages that an employee enjoys apart from their salary. It can include the use of a company car, private medical insurance, or other non-cash benefits.

Are electric cars subject to benefit in kind?

Yes, electric cars are subject to benefit in kind. The value of the benefit is based on the list price of the car, its CO2 emissions, and the employee’s tax bracket.

How is the value of benefit in kind calculated for electric cars?

The value of benefit in kind for electric cars is calculated by multiplying the list price of the car by a percentage rate set by the government, which varies depending on the level of CO2 emissions and the type of fuel used.

Is the benefit in kind calculated differently for hybrid cars compared to electric cars?

Yes, the benefit in kind calculation is different for hybrid cars compared to electric cars. Hybrid cars are subject to more complex calculations, which take into account the proportion of time the car is driven using electric power and the CO2 emissions produced by the combustion engine.