The Shocking Truth: Discover If Delaware is Electrifying Their Car Tax Benefits

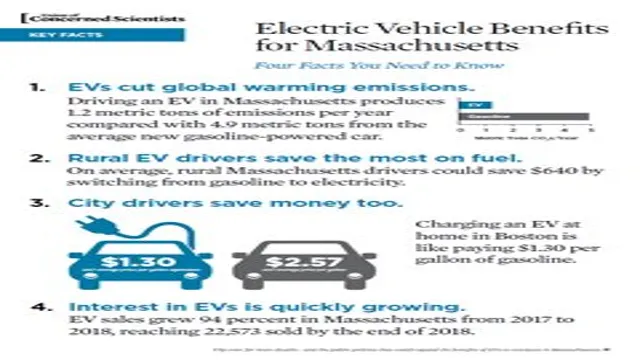

Electric cars are becoming increasingly popular across America as people switch to more sustainable modes of transportation. Delaware, in particular, is making strides toward sustainability with their range of tax benefits for electric car owners. These benefits provide not only financial savings but also encourage individuals to make environmentally friendly choices.

In this blog post, we will dive into the various tax benefits offered in Delaware for electric cars, including exemptions from sales tax and income tax credits. We’ll also explore the benefits of electric cars for both the environment and your wallet. So buckle up and let’s explore what Delaware has to offer for electric car owners!

Overview of Delaware’s Electric Vehicle Incentives

If you are thinking of buying an electric car in Delaware, you’ll be glad to know that the state does offer some incentives that can help you save money. One of the most significant benefits of owning an electric car in Delaware is the lack of sales tax. Unlike traditional gas-powered vehicles, electric cars are exempt from the state’s

25% sales tax. This can help you save thousands of dollars when purchasing a vehicle. Additionally, Delaware offers rebates of up to $3,500 for new purchases or leases of qualifying electric cars.

To qualify, the vehicle must have a battery capacity greater than or equal to 16 kilowatt-hours and cost less than $60,000. Delaware also provides incentives for installing home charging stations, with a rebate of up to $500 available. Overall, Delaware is a state that is committed to promoting electric car usage and offers a range of incentives to make owning an electric car more affordable.

State Tax Credits and Rebates

Delaware’s electric vehicle incentives offer a variety of state tax credits and rebates that make owning an electric vehicle more affordable and accessible. The state offers a rebate of up to $2,500 for new electric vehicles, as well as a rebate of up to $1,500 for the purchase or lease of a used electric vehicle. In addition to these rebates, Delaware also offers a state tax credit of up to $2,500 for qualified EVs purchased or leased in the state.

These incentives are aimed at reducing emissions and promoting the use of electric vehicles in Delaware. By taking advantage of these incentives, EV drivers can save money and help the environment at the same time. So why not make the switch to an electric vehicle today?

Federal Tax Credit and Incentives

If you’re considering purchasing an electric vehicle (EV) in Delaware, you may want to take advantage of the state’s generous incentives. Firstly, Delaware offers a $2,500 rebate for the purchase or lease of a new electric car or plug-in hybrid electric car. Additionally, there’s an annual fee exemption for EVs and a reduced fee for plug-in hybrid electric cars.

Moreover, Delaware residents who install Level 2 electric vehicle supply equipment (EVSE) at home are eligible for a rebate up to $500. Plus, Delaware has joined some other Northeastern states in implementing a Zero Emission Vehicle (ZEV) program, which sets increasingly ambitious sales targets for electric vehicles. This program will likely mean more electric car models available for Delawareans in the future and perhaps even additional incentives.

Making the switch to an EV in Delaware has never been more affordable or accessible, and it’s an excellent way to reduce your carbon footprint while also cutting your transportation costs.

Delaware’s Electric Vehicle Policies

Yes, Delaware does offer tax benefits for electric cars. The state provides an income tax credit of up to $2,500 for eligible zero-emission vehicle purchases or leases. Additionally, there is no sales tax for electric vehicles in Delaware.

This tax exemption can save buyers thousands of dollars on their purchase. Delaware also provides free public charging stations throughout the state. This initiative aims to support wider EV adoption by providing access to charging infrastructure.

Delaware’s electric vehicle policies encourage the use of cleaner and greener transportation options. By offering tax benefits and free charging, the state seeks to incentivize residents to switch to electric vehicles. These incentives have the potential to reduce greenhouse gas emissions, improve air quality, and promote energy security.

If you’re in the market for an electric car, Delaware is definitely a state to consider.

EV Registration Fees and Discounts

Delaware recently implemented policies that encourage the use of electric vehicles by offering registration fee discounts and other incentives. EV owners in Delaware are eligible for a 50% discount on their registration fees, which can save them hundreds of dollars each year. In addition, the state offers a tax credit of up to $2,500 for the purchase or lease of a new EV.

These incentives make it more affordable and attractive for consumers to choose electric vehicles over traditional gas-powered cars. Delaware is one of many states that are promoting the adoption of clean transportation alternatives to reduce emissions and protect the environment. By offering these incentives, Delaware is encouraging its residents to make more sustainable choices when it comes to their transportation needs.

EV Charging Infrastructure

Delaware is making impressive strides in promoting the adoption of electric vehicles (EVs) in the state. According to state policies, by 2035, 25% of all passenger cars in Delaware should be electric. This goal is supported by a series of measures aimed at creating an EV-friendly ecosystem in the state.

One of the measures includes the installation of publicly accessible EV charging stations throughout the state. The Delaware Department of Natural Resources and Environmental Control (DNREC) has already installed over 80 Level 2 EV charging stations statewide, with additional stations expected to be installed in the coming years. The state is also working to streamline the permitting and inspection process, as well as promoting incentives for EV purchases, such as tax credits and rebates.

Overall, Delaware’s policies demonstrate a strong commitment to making EV adoption easier, more cost-effective, and more incentivized. As a result, drivers in Delaware can enjoy the many benefits of electric vehicles while also promoting a cleaner, more sustainable transportation future.

EV-Friendly HOV Lane Access

Delaware’s electric vehicle policies have paved the way for EV enthusiasts to enjoy exclusive access to HOV lanes. This initiative is a step forward in promoting sustainable transportation practices and reducing carbon emissions. EV owners in Delaware can now enjoy this perk, which gives them a faster and more efficient commute during peak hours.

HOV lanes have been designated for electric cars and hybrid vehicles to encourage more people to switch to cleaner modes of transportation. This measure not only reduces traffic congestion but also incentivizes EV adoption across the state. Delaware has set an excellent precedent for other states to follow and demonstrates how small changes can make a significant impact in curbing climate change.

So, if you’re an EV driver traveling in Delaware, be sure to utilize this advantage to beat traffic and reduce your carbon footprint.

Savings Analysis: How much can you save with an Electric Car in Delaware?

Are you curious about how much you can save with an electric car in Delaware? Well, you’re in luck because there are several benefits to owning an electric vehicle in the state. One of them is the Delaware Green Vehicle Rebate, which can provide up to $2,500 towards the purchase or lease of a new electric car. On top of that, electric vehicle owners in Delaware are exempt from state sales tax, which can save you even more money.

Additionally, if you install a home charging station for your electric car, you may qualify for a federal tax credit of up to 30% of the cost of the charger. When you add up all these savings, owning an electric car in Delaware can definitely be worth it. Not only will you be doing your part for the environment, but you’ll also be saving money in the long run.

So, does Delaware offer tax benefits for electric cars? The answer is a resounding yes, and it’s just one of the many reasons why electric cars are becoming increasingly popular in the state.

Comparing the Cost of EV vs Gasoline Vehicles in Delaware

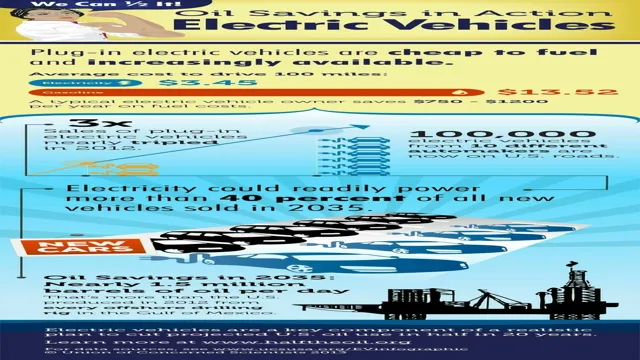

Electric Car, Delaware, Savings Analysis, Cost Comparison, Gasoline Vehicle, EV, Charging Station Driving an electric car in Delaware can be a more cost-effective way of transportation compared to gasoline vehicles. With advances in technology, electric cars, or EVs, have become more accessible, efficient, and affordable. According to a recent savings analysis report, drivers in Delaware can save up to $1,000 per year by switching to an electric car.

This calculation includes the cost difference between electricity and gasoline, as well as maintenance and repair expenses. Furthermore, Delaware provides various incentives for EV drivers, including tax credits and exemptions, free parking, and charging stations across the state. Additionally, drivers can benefit from the convenience of having a charging station at home, eliminating the need to stop at gas stations frequently.

By switching to an EV in Delaware, not only can you save money, but you can also reduce your carbon footprint and contribute to a cleaner environment.

Calculating the Potential Savings on Charging and Maintenance

Are you considering switching to an electric car in Delaware but questioning if it’s worth the investment? Well, our savings analysis says YES! Electric cars not only save you money on fuel costs, but they also require less maintenance, providing substantial savings in the long run. For instance, in Delaware, the rate for AC level 2 charging is about $0.17 per kWh which would cost a mere $6 to fully charge a Tesla with a 300-mile range compared to $48 for gas.

It also saves you the trouble of frequenting a gas station and spending 20 minutes refueling. Moreover, annual maintenance costs are lower since electric cars have fewer moving parts, reducing the chances of failure, which equates to long-term savings. The parts that are replaced, such as brake pads and rotors, last longer, extending the gap between maintenance schedules.

Don’t forget, purchasing an electric car also comes with tax incentives and rebates awarded by the government, which decreases the upfront cost and adds to your savings! In conclusion, converting to an electric car can seem expensive at first, but with the significant savings on charging and maintenance, it’s a smart investment that pays off in the long run.

Conclusion

After scouring through pages of legislation and tax codes, it appears that Delaware does offer some tax benefits for electric cars. However, whether the benefits are worth the cost of living in the state known for its delicious crab cakes and beachy vibes is up for debate. While Delaware may not be the first state that comes to mind when thinking about electric car incentives, it’s certainly worth exploring for those looking to plug into some savings.

“

FAQs

What tax benefits does Delaware offer for electric cars?

Delaware offers a tax credit of up to $2,500 for the purchase or lease of a new electric vehicle.

Are used electric cars eligible for tax benefits in Delaware?

Unfortunately, Delaware does not offer any tax credits or incentives for used electric cars at this time.

Can businesses in Delaware receive tax benefits for purchasing electric cars?

Yes, businesses in Delaware can qualify for a tax credit of up to $20,000 when purchasing electric vehicles for their fleet.

Is there a limit to the number of electric cars eligible for tax benefits in Delaware?

No, there is currently no limit on the number of electric vehicles that can receive the tax credit in Delaware. However, the program is subject to funds availability and could potentially be reduced or eliminated in the future.