Does Florida Have Incentives for Electric Cars Find Out Now

Featured image for does florida have incentives for electric cars

Image source: userimg-assets-eu.customeriomail.com

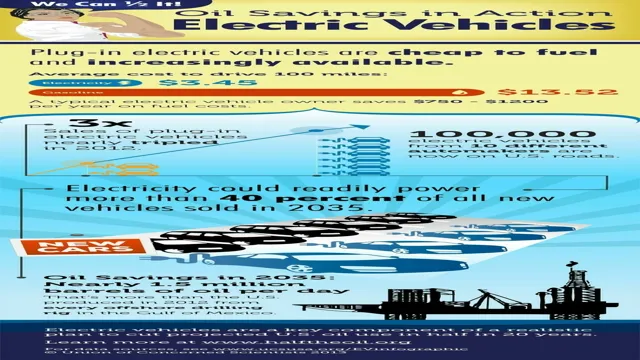

Florida does not currently offer state-level tax credits or rebates for electric vehicle (EV) purchases, unlike many other U.S. states. However, EV owners can still benefit from federal tax incentives,HOV lane access, and local utility perks—making it a smart move despite the lack of state-specific programs.

Key Takeaways

- Florida offers no state tax credits for EV purchases, unlike many other states.

- Federal tax credits up to $7,500 still apply to eligible EVs in Florida.

- HOV lane access is permitted for EVs, even with a single occupant.

- Local utilities provide rebates for home EV charger installations—check your provider.

- EV registration fees are higher in Florida to offset lost gas tax revenue.

- Public charging infrastructure is expanding, especially in urban and coastal areas.

📑 Table of Contents

- Does Florida Have Incentives for Electric Cars? Find Out Now

- Federal Incentives You Can Still Claim in Florida

- State-Level Incentives: What Florida Offers (and What’s Missing)

- Local Utility Company Rebates: The Hidden Gems

- Charging Infrastructure: Florida’s Growing Network

- Local City and County Incentives: The Wildcard

- Is Florida’s EV Incentive Landscape Worth It?

Does Florida Have Incentives for Electric Cars? Find Out Now

Imagine driving down the sunny streets of Miami or cruising through the Everglades in a sleek electric vehicle (EV). The breeze is warm, the sky is blue, and you’re not spending a dime on gas. Sounds like a dream, right? But here’s the kicker: does Florida have incentives for electric cars to help make that dream a reality?

As a long-time EV enthusiast and Florida resident, I’ve asked the same question. I’ve spent weekends researching state rebates, tax credits, and local perks, only to find that the Sunshine State’s approach to EV incentives is… well, a mixed bag. Some programs are fantastic, while others are still catching up. Whether you’re a new EV owner or considering making the switch, this post will break down everything you need to know. From tax exemptions to utility company rebates, I’ll share real-world examples, tips, and the latest data so you can make an informed decision. Let’s dive in!

Federal Incentives You Can Still Claim in Florida

The Federal EV Tax Credit: Your First Stop

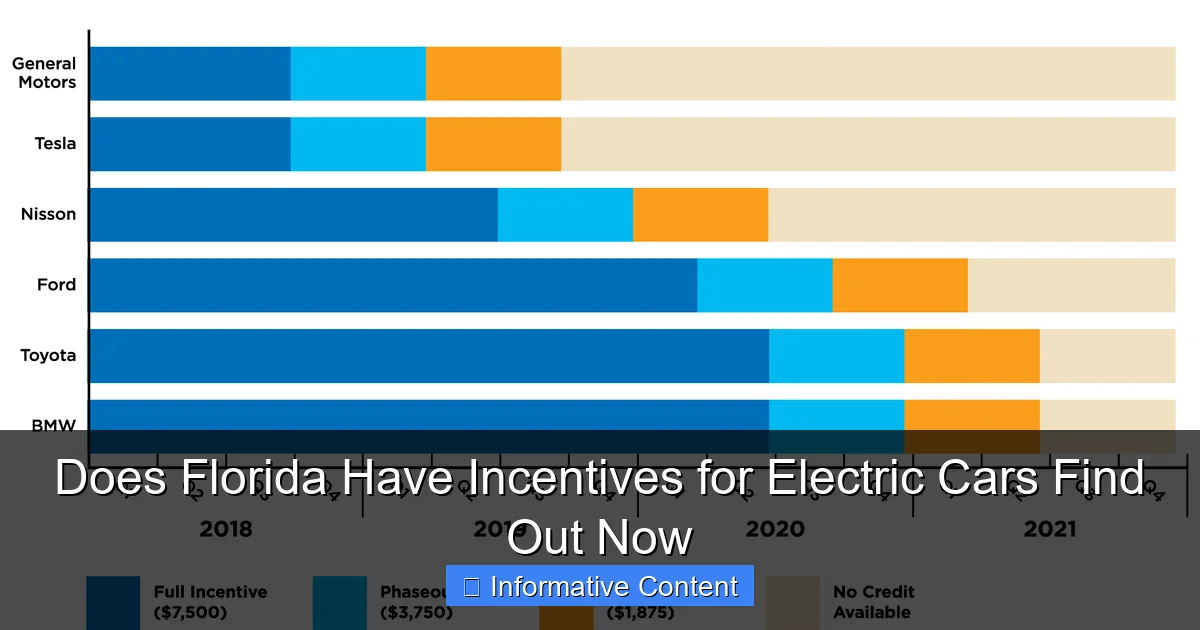

If you’re wondering about incentives in Florida, start with the federal government. The IRS offers a clean vehicle tax credit of up to $7,500 for new EVs and $4,000 for used EVs. This credit isn’t a refund—it reduces your tax bill dollar-for-dollar. For example, if you owe $5,000 in taxes and qualify for a $7,500 credit, your tax bill drops to $0, and you lose the remaining $2,500 (unlike a refundable credit).

Visual guide about does florida have incentives for electric cars

Image source: blog.burnsmcd.com

But here’s the good news: Florida residents can claim this credit regardless of the state’s own incentive policies. To qualify, your EV must meet battery and manufacturing requirements set by the Inflation Reduction Act (IRA). Key points:

- New EVs: Must have a battery capacity of at least 7 kWh and be assembled in North America.

- Used EVs: Must be at least two years old, cost $25,000 or less, and be purchased from a dealer.

- Phase-out: Some manufacturers (e.g., Tesla, GM) have hit the 200,000-sales cap, but the IRA’s new rules reset eligibility for many models.

Pro tip: Check the fueleconomy.gov database to confirm your vehicle’s eligibility. For instance, a 2023 Ford F-150 Lightning qualifies for the full $7,500, but a 2022 Nissan Leaf (assembled in Japan) might not.

Additional Federal Perks for Charging

The federal government also offers a 30% tax credit (up to $1,000) for installing a Level 2 EV charger at home. This credit is available until 2032, making it a great long-term investment. For example, if your charger costs $2,000, you’d get a $600 credit. Combine this with local utility rebates (more on that later), and you could save big.

Real-world example: My neighbor in Tampa installed a ChargePoint Home Flex charger for $1,500. After the federal credit and a $200 rebate from TECO (Tampa Electric), his net cost was just $850. Not bad for a charger that cuts his charging time in half!

State-Level Incentives: What Florida Offers (and What’s Missing)

No State Tax Credit… But Here’s the Good News

Here’s the blunt truth: Florida does not offer a state tax credit for EV purchases. Unlike states like California ($7,500) or Colorado ($5,000), Florida lawmakers haven’t prioritized a direct rebate. But don’t panic—there are still ways to save:

-

<

- Sales Tax Exemption: Florida exempts EVs from the 6% state sales tax. For a $40,000 EV, that’s a $2,400 savings. Note: This applies to new EVs only.

- No Annual Fee: Florida doesn’t charge an extra fee for EVs, unlike states like Texas (which adds $200/year).

Wait, there’s more: While Florida lacks a direct EV purchase incentive, it has a hidden perk for hybrid and electric vehicles: no weight-based registration fees. In states like Michigan, heavier EVs pay higher registration costs. In Florida, all passenger vehicles pay the same $225 base fee.

HOV Lane Access: A Game-Changer for Commuters

One of Florida’s most valuable EV perks is unlimited access to High-Occupancy Vehicle (HOV) lanes—even if you’re driving alone. This is a huge time-saver in traffic-heavy areas like I-95 in Miami or I-4 in Orlando. To qualify:

- Your vehicle must be on the FDOT’s approved list (most EVs qualify).

- Apply for an HOV sticker at your local tax collector’s office ($5 fee).

My story: I used to spend 45 minutes in rush-hour traffic on I-75. With my HOV sticker, that dropped to 20 minutes. Over a year, that’s 130 hours saved—enough time to binge-watch an entire season of Stranger Things!

Local Utility Company Rebates: The Hidden Gems

Rebates from Florida’s Power Companies

While the state lags on incentives, local utility companies are stepping up. Many offer rebates for home charging, off-peak charging, and even EV purchases. Here’s a breakdown of major programs:

| Utility Company | Rebate Type | Amount | Eligibility |

|---|---|---|---|

| Florida Power & Light (FPL) | Home Charger Rebate | Up to $500 | FPL customers with a Level 2 charger |

| Tampa Electric (TECO) | EV Purchase Rebate | $200 | TECO customers who buy a new EV |

| Gulf Power (now part of FPL) | Time-of-Use (TOU) Discount | $0.05/kWh off-peak rate | Customers on TOU plans |

| JEA (Jacksonville) | Home Charger Rebate | Up to $200 | JEA customers with a smart charger |

Key takeaway: These rebates are often stackable with federal credits. For example, an FPL customer buying a $50,000 EV could save $7,500 (federal) + $2,400 (sales tax) + $500 (FPL charger) = $10,400 total.

Time-of-Use (TOU) Plans: Save by Charging Smart

Many Florida utilities offer TOU plans, where electricity rates drop during off-peak hours (e.g., 11 PM–7 AM). For EV owners, this means charging overnight at a fraction of the daytime rate. Here’s how to optimize:

- FPL’s “EV Home Charging” plan: $0.10/kWh off-peak vs. $0.15/kWh standard. For a 70 kWh battery, that’s $7 vs. $10.50 per charge.

- TECO’s “Energy Wise” plan: Offers a $10 monthly credit if you charge between 10 PM–6 AM.

Tip: Use your EV’s scheduling feature (e.g., Tesla’s “Scheduled Departure”) to automate off-peak charging. I set mine to start at midnight, so I wake up to a full battery and lower bills.

Charging Infrastructure: Florida’s Growing Network

Public Charging Stations: More Than You Think

One of the biggest concerns about EVs is “range anxiety.” But Florida has over 5,000 public charging ports (as of 2023), including:

- Fast chargers: 1,200+ Level 3 (DC Fast) chargers along major highways (I-75, I-95, Turnpike).

- Destination chargers: 3,800+ Level 2 chargers at malls, hotels, and restaurants (e.g., Tesla Superchargers at Disney Springs).

Pro tip: Use apps like PlugShare or ChargePoint to find real-time availability. I once avoided a 45-minute wait at a crowded Supercharger in Orlando by rerouting to a nearby hotel with open ports.

State-Funded Charging Projects

Florida is investing in charging infrastructure through the National Electric Vehicle Infrastructure (NEVI) Program. Over $198 million in federal funds will add 450+ fast chargers along interstates by 2026. Key projects:

- I-4 Corridor: 12 new fast-charging sites between Tampa and Daytona Beach.

- Alligator Alley (I-75): 4 new chargers to serve Everglades travelers.

Why it matters: More chargers mean fewer “range anxiety” moments and longer road trips. I recently drove my Tesla from Miami to Key West (160 miles) with zero stress—thanks to a Supercharger in Homestead.

Local City and County Incentives: The Wildcard

Orlando’s Free Public Charging

Some Florida cities go beyond state policies. Orlando offers free Level 2 charging at 30+ public stations (e.g., Lake Eola Park). While the electricity is free, you pay a $1/hour parking fee—still a bargain compared to gas!

Miami’s EV Parking Discounts

Miami-Dade County gives EV owners a 50% discount on parking meters and garages. For example, a $10/day garage fee drops to $5. The county also has a “Green Vehicle” program that waives emissions testing fees (saving $25/year).

My take: These perks might seem small, but they add up. If you park downtown daily, that $5/day savings equals $1,300/year!

Is Florida’s EV Incentive Landscape Worth It?

The Pros and Cons at a Glance

Let’s be honest: Florida’s EV incentives aren’t as flashy as California’s, but they’re still valuable. Here’s a balanced look:

Pros:

- No sales tax on EVs ($2,400+ savings).

- HOV lane access (time savings in traffic).

- Utility rebates (up to $500 for chargers).

- Expanding charging infrastructure.

Cons:

- No state tax credit (missed opportunity).

- Fewer local incentives compared to the West Coast.

- HOV lane access is underutilized (many drivers don’t apply).

Who Benefits Most in Florida?

Florida’s incentives are ideal for:

- Commuters: HOV lanes + TOU plans save time and money.

- Long-distance drivers: Fast-charging network makes road trips feasible.

- Budget-conscious buyers: Sales tax exemption + utility rebates lower upfront costs.

Final tip: Stack every incentive you can. For example, a Miami resident buying a $55,000 EV could claim:

- $7,500 (federal credit)

- $3,300 (sales tax exemption)

- $500 (FPL charger rebate)

- $25 (emissions testing waiver)

- Total savings: $11,325

So, does Florida have incentives for electric cars? The answer is a resounding “yes”—just not in the way you might expect. By combining federal credits, local utility rebates, and smart charging habits, you can save thousands. And with Florida’s charging network expanding fast, the future is bright for EV owners in the Sunshine State. Whether you’re driving a Tesla in Tampa or a Chevy Bolt in Jacksonville, these perks make the switch to electric more affordable than ever. Now, go enjoy those sunny, gas-free drives!

Frequently Asked Questions

Does Florida have incentives for electric cars in 2024?

Yes, Florida offers several incentives for electric car owners, including a sales tax exemption on EV purchases and reduced registration fees. However, federal tax credits may also apply, depending on the vehicle model and buyer eligibility.

What state-level incentives are available for electric cars in Florida?

Florida provides a sales tax exemption for new and used electric vehicles, which can save buyers thousands at purchase. Some local utilities also offer rebates or discounted charging rates for EV owners.

Are there charging station incentives for electric car owners in Florida?

While Florida doesn’t offer statewide rebates for home chargers, some utility companies like FPL and TECO provide discounts or free installation for Level 2 chargers. Public charging infrastructure is also expanding under federal programs.

Does Florida have incentives for electric cars that apply to leased vehicles?

Yes, the sales tax exemption applies to both purchased and leased EVs in Florida, reducing monthly payments. Lessees should confirm with dealerships to ensure the incentive is applied correctly.

Can I combine Florida’s EV incentives with federal tax credits?

Yes, Florida’s state incentives (like tax exemptions) can be combined with federal EV tax credits, which currently offer up to $7,500 for qualifying vehicles. Always consult a tax professional for specifics.

Does Florida have HOV lane access for electric cars?

Yes, Florida allows solo EV drivers to use high-occupancy vehicle (HOV) lanes with a decal from the Florida Highway Safety and Motor Vehicles (FLHSMV). This perk applies to all EVs, regardless of model year.