Unveiling the Truth: Does Your Insurance Policy Cover the Cost of Your Electric Car Battery?

As electric cars become more popular, one question on many people’s minds is whether insurance will cover their battery. After all, electric cars have different needs and requirements than traditional gasoline-powered cars. So, does insurance cover electric car batteries? The short answer is, it depends.

While some insurance policies may cover the cost of replacing an electric car’s battery, others may not. It’s important to carefully review your policy or speak with your insurance provider to understand exactly what is and isn’t covered. In this blog post, we’ll explore what factors may influence whether your insurance covers an electric car battery and what you can do to ensure you have the coverage you need.

Understanding Electric Car Batteries

Many electric vehicle owners may wonder if their insurance policy covers their car’s battery in the event of damage or failure. The answer is that it depends on the specific policy and the circumstances of the damage. Some insurance policies do offer coverage for electric car batteries, but they may have limitations or exclusions depending on the cause of the battery damage.

For example, if the battery is damaged due to regular wear and tear, it may not be covered by the insurance policy. However, if the battery is damaged in an accident or due to a covered peril such as fire or theft, it may be covered. It’s important to check with your insurance provider directly to determine the specifics and limitations of your policy’s coverage for electric car batteries.

Overall, it’s important for electric vehicle owners to consider the potential costs associated with battery damage and ensure they have appropriate coverage in place.

The Cost of Electric Car Batteries

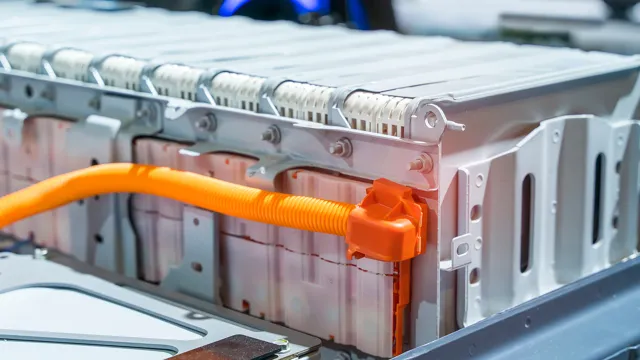

Electric car batteries can be quite costly, which is an important consideration for anyone looking to purchase an electric vehicle. However, it’s also important to understand what goes into the cost of these batteries. Electric car batteries are made up of many individual cells that are responsible for storing and releasing energy.

The cost of each cell can vary depending on the materials used and the manufacturing process. Additionally, the size of the battery pack needed for a particular vehicle can greatly affect the overall cost. Despite the cost, many electric vehicle owners find that the savings on fuel and maintenance over time make up for the initial investment in the battery.

With advancements in battery technology and increased production, it may not be long before electric car batteries become more affordable for the average consumer.

How Insurance Coverage Works

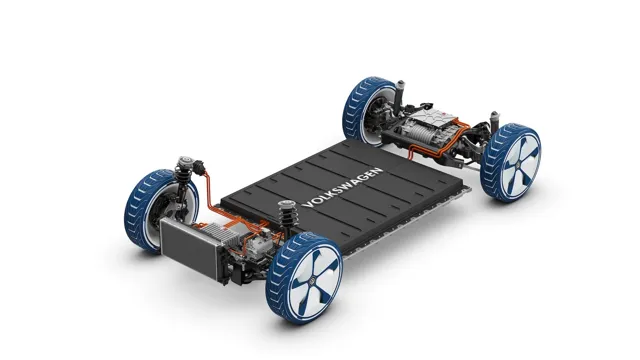

Electric car batteries are an essential part of an electric vehicle, and understanding their operation is crucial. Unlike traditional fuel-powered vehicles, electric cars rely on a battery pack to power the motor. The battery pack contains several smaller battery cells, which are connected to provide the required voltage.

These batteries are typically made of lithium-ion, which has a high energy density and is relatively lightweight. Insurance coverage of electric car batteries can vary depending on the insurance policy and the circumstances of the damage. Some policies may cover damages due to external factors such as theft, fire, or accidents, while others may cover the cost of replacing the battery pack in case of malfunction or failure.

Understanding the insurance coverage provided for electric car batteries is crucial when purchasing insurance for your electric vehicle.

Types of Coverage for Electric Car Batteries

If you’re an electric car owner, you may be wondering if your insurance covers your car’s battery. Generally, yes, most insurance policies do cover electric car batteries, but the amount of coverage varies depending on the policy. Some policies may cover the entire cost of replacing a battery if it fails, while others may only cover a certain percentage of the cost.

It’s important to read your policy and understand the specific coverage you have for your car’s battery. Additionally, some insurance companies offer extended warranties or specialized coverage for electric car batteries. It’s worth exploring these options to ensure you have the best coverage for your vehicle.

Overall, it’s always better to be prepared and have adequate coverage to protect your investment in your electric car.

Comprehensive Coverage

If you have an electric car, you must be aware that the battery is one of the most expensive and important components of your ride. That’s why it’s essential to understand the various types of coverage for electric car batteries. The most common ones are the manufacturer’s warranty, which typically covers defects in material and workmanship, and the battery-specific warranty, which covers any defects specific to the battery.

Additionally, you can opt for extended warranties that cover damage from accidents, theft, and wear and tear. Some insurers also offer specialized insurance policies for electric car batteries, which cover not only the cost of repairs but also the cost of replacing the battery. It’s crucial to know all the options and choose the most suitable coverage for your needs, considering factors such as your driving habits, location, and the age and condition of your battery.

Remember, the right coverage can save you a considerable amount of money in the long run and ensure peace of mind while you enjoy your electric ride.

Collision Coverage

Collision coverage is an important type of insurance for electric car owners to consider. This coverage ensures that if your electric car is involved in a collision, whether it’s your fault or someone else’s, the cost of repairing or replacing the battery will be covered. Without this coverage, you may be left with a hefty bill for a new battery, which can be a major expense.

In addition to collision coverage, there are other types of coverage that electric car owners should consider, such as comprehensive coverage, which covers the cost of damage to your car from things like theft, fire, or natural disasters. It’s important to review your insurance policy regularly and make sure you have the right coverage to protect your investment in your electric car.

Gap Coverage

If you’ve recently purchased an electric car, it’s important to know the types of coverage available for your battery. One type of coverage is gap coverage, which can be incredibly useful in the event of an accident or theft. Essentially, gap coverage ensures that you’re not left with a significant financial burden if your insurance payout doesn’t cover the full cost of your electric car’s battery.

This is important for electric car owners since batteries can be quite expensive to replace. Without gap coverage, you may end up paying out of pocket for the difference between your insurance payout and the cost of a new battery. So, if you’re looking for peace of mind when it comes to your electric car’s battery, be sure to consider gap coverage.

Factors Affecting Insurance Coverage for Electric Car Batteries

As electric cars gain popularity, many people are concerned about the cost of repairs and replacement parts, particularly the battery. When it comes to insurance, coverage for electric car batteries varies depending on the insurance company, the policy type, and the circumstances of the damage or loss. Some insurance policies may cover battery damage resulting from a collision or other specified events, while others may exclude batteries altogether.

Additionally, some insurers may offer specialized electric car insurance policies that include comprehensive coverage for battery replacement and repairs. It’s important to read the policy details carefully and ask questions to ensure that you have the coverage you need for your electric car battery. So, to answer the question “does insurance cover electric car battery?” – it depends on the policy you choose and the insurer you work with.

Always do your research before buying insurance for your electric car to be sure you’re getting the coverage you need.

Type of Car

When it comes to electric cars, insurance coverage for batteries is affected by several factors. One of the most important factors is the type of car you have. Some electric cars have battery packs that are more expensive to replace than others, and this can affect your coverage.

In general, the more expensive the car, the more expensive the battery pack will be, and the higher your insurance premiums will be. Additionally, some electric cars may require more specialized repair work in the event of an accident, which can also affect your coverage. It’s important to do your research and understand the specific needs of your car when considering insurance coverage for your electric car battery.

By understanding the factors that affect coverage, you can make informed decisions and ensure that you have the right level of protection for your vehicle. So, what type of electric car do you have? And have you considered the impact it may have on your insurance coverage?

Age of Car

When it comes to getting insurance coverage for an electric car battery, there are a number of factors that can affect the cost. One of the key considerations is the age of the car. As with traditional vehicles, newer cars generally come with higher premiums than older ones.

This is because the technology used in electric cars is constantly evolving, and newer vehicles tend to have more advanced and expensive batteries. Furthermore, older batteries are more likely to fail or require repairs, which can also increase the cost of insurance. If you’re considering purchasing an electric car, it’s important to factor in the cost of insurance and shop around for a policy that suits your needs and budget.

Don’t forget to consider the other factors that can impact your premiums, such as how you use your car and whether or not you have a good driving history. By doing your research and taking these factors into account, you can ensure that you’re getting the best possible coverage for your new electric vehicle.

Conclusion and Next Steps

In conclusion, do insurance policies cover the cost of replacing an electric car battery? As with most things insurance-related, the answer is: it depends. Factors such as the type of policy, coverage options, and insurer all play a role in determining if a battery replacement would be covered. However, one thing is for certain: driving an electric car is not only good for the environment, but it may also save you money on gas and maintenance costs in the long run.

And if you’re lucky enough to have an insurance policy that covers battery replacement, you’ll have even more reason to brag about your green machine!”

FAQs

What types of electric car batteries are covered by insurance?

The specific types of electric car batteries covered by insurance depend on the policy and provider. It is important to review your policy and understand what is included in your coverage.

Does insurance cover electric car battery replacement?

Again, the coverage for electric car battery replacement will depend on your policy and provider. Some policies offer coverage for battery replacement, while others do not.

Are damages to an electric car battery covered under collision coverage?

In most cases, damage to an electric car battery is not covered under collision coverage. It is usually classified as a comprehensive claim. It is best to review your policy and talk to your provider to understand your coverage.

Is it worth getting separate insurance coverage for the electric car battery?

It may be worth considering separate insurance coverage for your electric car battery, as replacing it can be very expensive. Some providers offer specific battery coverage, which can give you peace of mind and protect your investment.