Charging Up the Future: Exploring Electric Battery Stocks for Cars

Have you ever considered investing in the electric car industry, specifically in electric car battery stocks? With the growing demand for electric vehicles and the push towards renewable energy sources, these stocks have the potential to become quite lucrative investments. In recent years, several major automakers have made plans to transition their fleets to electric, further enticing investors to consider electric car battery stocks. Of course, as with any investment, it’s crucial to do your research and fully understand the risks and potential rewards.

However, with advancements in battery technology leading to longer ranges and quicker charging times, the future of electric cars looks promising. As a result, companies involved in the production and distribution of electric car batteries are likely to experience significant growth in the coming years. Whether you’re a seasoned investor or just starting out, electric car battery stocks are undoubtedly worth considering as a potential addition to your portfolio.

So, what do you say – are you ready to dive into the exciting world of electric car investments?

Overview of Electric Car Battery Market

Electric car battery stocks have been on the rise in recent years as the demand for electric vehicles continues to grow. The global electric car battery market is projected to reach $78 billion by 2027, according to a report by Fortune Business Insights.

This growth can be attributed to several factors, including advancements in battery technology, government incentives for electric vehicle adoption, and increasing environmental awareness. Additionally, the rise of Tesla and other electric vehicle manufacturers has brought more attention to the battery market. Investors are taking note of this trend, as companies like Panasonic, LG Chem, and Contemporary Amperex Technology (CATL) have seen their stock prices rise in response to the growing demand for electric car batteries.

With the continued growth of the electric vehicle market, electric car battery stocks are likely to remain a promising investment opportunity.

Growth of Electric Cars

Electric Car Battery Market As more and more consumers are opting for eco-friendly and sustainable options, the market for electric cars is rapidly growing. The heart of any electric car is its battery, and the electric car battery market is experiencing a surge in demand. As technological advancements continue to be made in this field, the battery prices are also becoming more affordable, making electric cars more accessible to the average person.

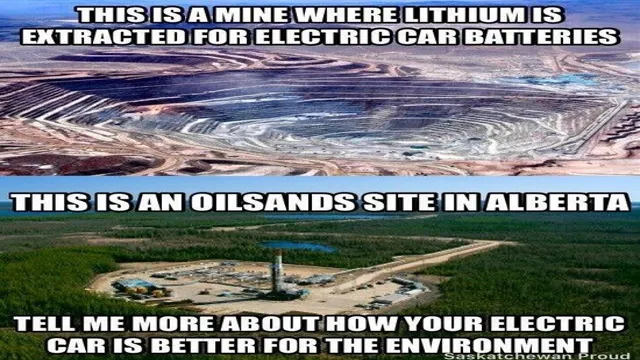

The global market for electric vehicle batteries is expected to reach over $80 billion by 2025, and numerous companies are investing in this sector, striving to create the next breakthrough battery technology. While lithium-ion batteries currently dominate the market, researchers and manufacturers are exploring alternatives like solid-state, zinc-air, and sodium-ion batteries. The rise of electric cars is not just beneficial for the environment but also presents a significant opportunity for the battery industry, paving the way for a more sustainable future.

Investment in Battery Technology

Electric car battery market Investment in battery technology has become increasingly popular as countries around the world look for renewable energy solutions. One of the most significant areas of interest within this field has been the development of electric car batteries, which are seen as a vital component in the widespread adoption of EVs. As economies of scale continue to come into effect, prices for battery technology have dropped, and research into increasing efficiency has been ramped up.

Today, several companies are fiercely competing for market share, including Tesla, LG Chem, and Samsung SDI. As the electric car battery market continues to grow, there is no doubt that we will see an increased emphasis on the development of affordable, high-performance batteries.

Top Electric Car Battery Stocks

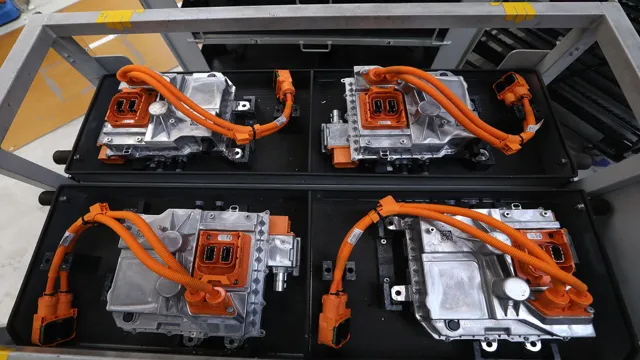

Electric vehicles are the future of transportation, and with them come the importance of the electric battery technology. Investing in electric battery for cars stocks can be an appealing opportunity, especially with the government’s push towards a greener future. Top electric car battery stocks to consider include Tesla (TSLA), Panasonic Corporation (PCRFY), and LG Chem Ltd.

(LGCLF). Tesla, the industry leader in electric vehicles, has been ramping up their battery production as demand for electric vehicles continues to grow. Panasonic Corporation, Tesla’s battery partner, is also a significant player in the electric battery technology.

LG Chem Ltd., a South Korean company, is one of the top suppliers in electric vehicle batteries worldwide. With the expected growth of electric vehicle sales in the coming years, these stocks are worth keeping an eye on for investors looking to capitalize on the industry’s growth.

Tesla

Tesla Electric vehicles are gaining popularity, and for good reason. They are environmentally friendly and cost-effective. However, one crucial aspect of electric vehicles is the battery that powers them.

As more consumers invest in electric vehicles, the demand for electric car battery stocks is growing. Battery manufacturers such as Tesla, LG Chem, and Panasonic are at the forefront of this industry. In particular, Tesla has been continuously improving its battery technology, with their latest battery, the 4680, promising to revolutionize the industry.

This new battery promises to offer a five times increase in energy capacity and six times power output at a lower cost. With Tesla’s growth and innovation, investing in the company’s battery stocks seems like a smart choice for those looking to invest in the electric vehicle industry.

Panasonic

Electric Car Battery Stocks Electric cars have been on the rise in the past few years, and investors are now faced with various opportunities to invest in this sector. One such opportunity is electric car battery stocks. Top among these stocks is Panasonic, a leading manufacturer of lithium-ion batteries.

Panasonic has been a major player in electric car batteries, supplying batteries to Tesla, among other automobile manufacturers. With its battery technology, Panasonic has been at the forefront of developing long-lasting and efficient cells that can power electric cars over long distances. In addition, the company has been implementing environmentally friendly policies, such as recycling used batteries, to reduce its carbon footprint.

Investing in electric car battery stocks like Panasonic could be a wise investment decision for those who believe in the potential growth of the electric car industry. Electric cars are the future, and investing in the stocks that power these vehicles could yield high returns in the long run.

BYD

BYD is one of the top electric car battery stocks to keep an eye on in the market. Headquartered in China, this company is the world’s largest producer of rechargeable batteries and has an increasing presence in the electric vehicle market. BYD has invested heavily in the research and development of battery technology, and their batteries have shown impressive performance and longevity.

Their partnership with Daimler AG has also helped to increase their global reach and reputation in the industry. With the growing demand for electric vehicles, BYD is in a strong position to capitalize on this trend and continue to innovate in the field of battery technology. If you’re looking to invest in the electric vehicle market, BYD is definitely a company to consider.

Factors Affecting Electric Car Battery Stocks

Electric car battery stocks are influenced by various factors. The first factor is the demand for electric cars. The more the demand for electric cars, the higher the demand for electric car batteries, which leads to increased investments in the stocks of electric car battery manufacturers.

The second factor is the price of raw materials needed to produce the batteries such as nickel, cobalt, and lithium. Any fluctuations in the prices of these materials affect the cost of producing the batteries, which translates into the prices of the stocks. The third factor is government policies and regulations.

Governments offer incentives and subsidies to encourage the production and purchase of electric cars, which drives the demand for electric car batteries. In addition, changes in regulations, such as the banning of the production of petrol and diesel cars, can further increase the demand for electric car batteries. Lastly, innovations and developments in battery technology also affect the stocks.

Improvements in battery technology can lead to better performance, longer lifespans, and lower prices of electric car batteries, leading to increased investments in the stocks of electric car battery manufacturers. Overall, the electric battery for cars stocks is influenced by multiple variables, and investors need to consider these factors before investing in such companies.

Government Regulations

One of the factors that affect electric car battery stocks is government regulations. As governments around the world strive to reduce carbon emissions, many have implemented policies and regulations that promote electric vehicles. For instance, some countries offer incentives such as tax credits and subsidies for buying electric cars, while others have stricter emission standards for vehicles.

These regulatory measures have a direct impact on the demand for electric cars, and consequently, the demand for electric car batteries. Companies that produce batteries for electric cars tend to perform better in countries with pro-electric vehicle policies. Furthermore, government regulations can affect the production of batteries themselves.

For example, lithium-ion batteries are subject to certain regulations to ensure their safety, thus, companies that meet these regulations tend to have an advantage over companies that don’t. In conclusion, keeping an eye on government regulations is essential in understanding the market for electric car batteries and making informed investment decisions.

Electric Car Sales

Electric Car Battery Stocks The demand for electric vehicles has risen significantly in recent years, leading to a surge in the production of electric car battery stocks. However, several factors can impact these stocks, including government policies, technological advancements, and consumer behavior. Government policies, like tax incentives and subsidies, can encourage consumers to purchase electric cars and boost the demand for battery stocks.

Technological advancements in battery technology may lead to more efficient and cost-effective battery production, which could also affect stocks. Additionally, consumer behavior, such as the adoption rate of electric cars, can significantly impact the demand for electric car battery stocks. As more people switch to EVs, the demand for battery stocks increases.

Understanding these factors and how they can affect electric car battery stocks is crucial for investors looking to profit from this growing market.

Conclusion and Future Outlook

As the world continues its transition towards cleaner and more sustainable modes of transportation, electric battery stocks have become an increasingly popular investment choice. With major players like Tesla leading the charge, and new innovation constantly emerging, the market for electric car batteries is poised for explosive growth. So if you’re looking to power up your portfolio with a jolt of high-voltage potential, electric battery stocks might just be the charge you need to get moving towards a brighter financial future.

“

FAQs

What is the current market trend for electric battery for cars stocks?

The current market trend for electric battery for cars stocks is showing a steady growth with the increasing demand for electric cars.

Which companies offer the best electric battery for cars stocks?

Some of the top companies that offer electric battery for cars stocks are Tesla, Panasonic, LG Chem, and CATL.

What factors affect the pricing of electric battery for cars stocks?

The pricing of electric battery for cars stocks are affected by factors such as demand and supply, competition, technological advancements, government policies, and global economic conditions.

What are the expected future developments in the electric battery for cars stocks?

The future developments in the electric battery for cars stocks include advancements in battery technology, new entrants in the market, increased competition, and more investment in research and development. Additionally, government policies aimed at promoting electric cars can also impact the demand and pricing for electric battery for cars stocks.