The Shocking Truth About Electric Car and Battery ETF – Why You Should Invest Now

Electric cars have been talked about for decades, but it is only recently that they have become a viable option for both personal and commercial transportation. With increasing concerns over climate change, more and more people are turning to electric cars as a way to reduce their carbon footprint. As a result, the electric car and battery industry is growing rapidly, with many investors taking notice.

For those looking to invest in the future, electric car and battery ETFs are an option worth considering. Electric car and battery ETFs are investment funds that focus on companies involved in the production and development of electric cars and their batteries. These ETFs have gained popularity as investors look for opportunities to profit from the growing demand for electric vehicles.

Investing in these ETFs is a way to diversify one’s portfolio while also supporting the growth of a promising industry. One of the advantages of investing in electric car and battery ETFs is that they provide exposure to a range of companies within the industry. This means that the investor doesn’t have to pick individual stocks and can benefit from the growth of the entire sector.

Additionally, the ETFs are managed by investment professionals who have the expertise to select companies that are most likely to succeed in the long run. Investing in electric car and battery ETFs is not only a smart financial decision, but it is also a way to support the transition to a more sustainable society. Electric cars and the batteries that power them are seen as key components in the fight against climate change, and by investing in the industry, individuals can play a part in this important cause.

As the world continues to move towards a greener future, electric car and battery ETFs are an exciting investment opportunity for those who want to be a part of the change.

Why Invest in Electric Car & Battery ETFs?

Electric car and battery ETFs are becoming increasingly popular investments as the world shifts towards a more sustainable lifestyle. These ETFs invest in companies that are involved in the manufacturing of electric cars and the production of batteries used in those cars. By investing in these ETFs, you’re essentially investing in the future of transportation.

The demand for electric cars is growing exponentially as people become more aware of the impact that traditional cars have on the environment. This is leading to an increase in manufacturing and innovation in the EV and battery industry. Investing in electric car and battery ETFs helps you to stay ahead of the curve and be a part of this growing trend towards eco-friendliness.

Additionally, investing in ETFs provides diversification, as you’re not putting all your eggs in one basket but instead spreading your investment across multiple companies. Overall, electric car and battery ETFs are an excellent option for those looking for an investment that aligns with their values and has great potential for growth.

The Growth Potential of the Electric Car Industry

Investing in Electric Car and Battery ETFs can provide investors with tremendous growth potential as the electric car industry is expected to experience explosive growth in the coming years. With the global push towards reducing carbon emissions and dependence on fossil fuels, the adoption of electric vehicles is set to rise rapidly, and the demand for electric car batteries is expected to soar. Buying into Electric Car and Battery ETFs allows you to invest in a diverse range of companies and sub-sectors within the industry, from car manufacturers to battery manufacturers to charging infrastructure providers.

These ETFs provide a simple and effective way to gain exposure to the electric car industry’s potential for growth and diversification, all while minimizing risk. If you’re looking to invest in a sector with high potential for returns, the Electric Car and Battery ETFs may be the way to go.

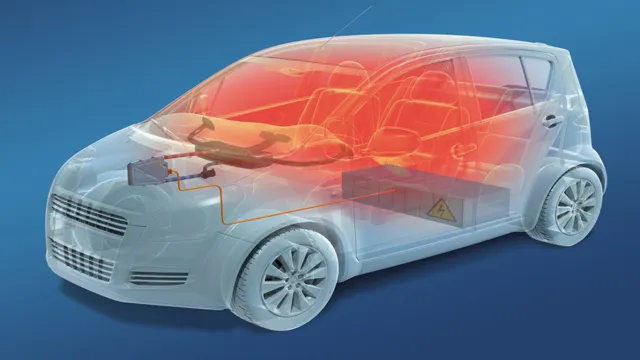

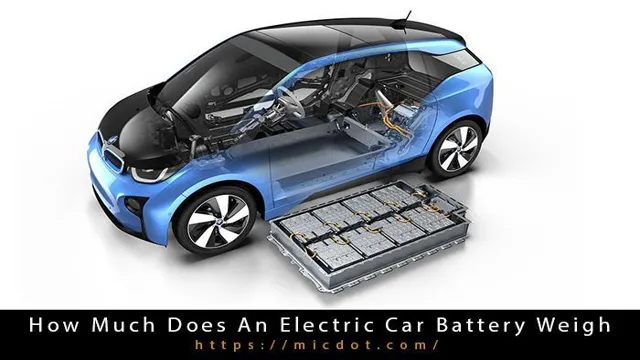

The Importance of the EV Battery Market

Investing in electric car and battery ETFs can provide a unique opportunity for investors to capitalize on the growing demand for electric vehicles and the battery market. The electric vehicle market is projected to grow exponentially in the coming years, and with it, the demand for batteries. By investing in electric car and battery ETFs, investors can gain exposure to a diversified portfolio of companies that are involved in the production and development of electric cars, batteries, and related technologies.

This can provide investors with the potential for significant gains while minimizing risk. Additionally, investing in electric car and battery ETFs is a socially responsible investment that supports the transition to clean energy and reduces carbon emissions, making it a strong choice for environmentally conscious investors. Overall, investing in electric car and battery ETFs can be a smart financial decision with the added benefit of contributing to the creation of a more sustainable future.

The Environmental and Social Benefits of Electric Cars

Investing in electric car and battery ETFs can offer investors the chance to benefit from the environmental and social benefits of electric vehicles. Electric cars are eco-friendly, emitting much less pollution than traditional vehicles, making them better for the environment. Additionally, the production of electric cars generates less noise pollution, improving the overall quality of life for those who live near heavily traveled roads.

Moreover, investing in electric car and battery ETFs supports the reduction of global carbon emissions, combating climate change. Furthermore, electric cars are less expensive to operate, with lower fuel and maintenance costs. As electric cars continue to gain popularity, investing in electric car and battery ETFs will become increasingly attractive to both investors and environmentalists alike.

By investing in these funds, investors can support companies that are leading the charge towards a cleaner future, while potentially profiting from the rapidly growing market demand for electric vehicles.

Top Electric Car & Battery ETFs

If you’re looking to invest in the electric car and battery industry, there are several ETFs available that can help you gain exposure to this burgeoning market. One of the top options is the Global X Autonomous & Electric Vehicles ETF (DRIV). This fund invests in companies that are involved in the development and production of electric vehicles, as well as those involved in autonomous vehicle technology.

Another option is the Invesco WilderHill Clean Energy ETF (PBW), which invests in companies involved in renewable energy and clean technology, including electric vehicles and battery technology. The First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) is another top choice, focusing on companies that are involved in clean energy, including electric vehicle and battery manufacturers. By investing in one of these ETFs, you can gain exposure to the growing electric car and battery industry, potentially profiting from the trend towards cleaner, more sustainable energy solutions.

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

If you’re looking to invest in electric car and battery ETFs, the First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) is a great option to consider. This ETF tracks companies involved in the production and distribution of clean energy, including electric vehicles and their components. QCLN is a passively managed fund, which means lower fees and allows for greater diversification.

As the demand for electric cars and batteries continues to rise, QCLN offers potential long-term growth opportunities for investors. However, it’s important to remember that like any investment, there are risks involved and it’s important to do your own research before making any investment decisions. With QCLN, you have the opportunity to invest in the future of green energy and electric vehicles.

Global X Lithium & Battery Tech ETF (LIT)

As the world shifts towards sustainable energy, electric cars and battery technology are becoming increasingly popular. With this rise in popularity, investors are looking for ways to invest in this emerging market. One way to do this is through the Global X Lithium & Battery Tech ETF (LIT).

This ETF invests in companies involved in mining, production, and research and development of lithium and battery technology. With a diverse portfolio of companies across the globe, it provides a unique opportunity to invest in this fast-growing industry. LIT has shown strong performance over the years, making it a top choice for investors looking to enter the electric car and battery market.

Whether you’re an experienced investor or just starting, the LIT ETF may be worth considering for your investment portfolio.

VanEck Vectors Global Alternative Energy ETF (GEX)

If you’re looking for electric car and battery ETFs to invest in, the VanEck Vectors Global Alternative Energy ETF (GEX) is definitely one to consider. This ETF tracks the performance of companies in the alternative energy sector, including those involved in electric cars, batteries, and renewable energy production. With Tesla as its top holding, GEX also includes other major players in the industry like Panasonic and Vestas Wind Systems.

Investing in GEX allows you to gain exposure to these leading companies and potentially profit as the demand for alternative energy continues to grow. It’s important to do your own research and consider your individual goals and risk tolerance before making any investment decisions, but GEX is definitely a top contender in this space.

How to Invest in Electric Car & Battery ETFs

Investing in electric car and battery ETFs is a great way to get in on the growth potential of the booming electric vehicle market. Electric car ETFs invest in companies involved in the production, distribution and sale of electric cars, while battery ETFs invest in companies involved in the production of batteries used in electric vehicles. By investing in an ETF rather than individual stocks, you can diversify your investment and minimize risk.

Some popular electric car and battery ETFs include the Global X Lithium & Battery Tech ETF, the First Trust NASDAQ Clean Edge Green Energy Index Fund, and the iShares Global Clean Energy ETF. These ETFs provide exposure to companies involved in the development of electric vehicle technology, battery production, and renewable energy, giving investors a portfolio of companies that are positioned to benefit from the shift towards electric vehicles. By investing in electric car and battery ETFs, investors can participate in the exciting future of the electric vehicle industry.

Choose a Brokerage Platform

When it comes to investing in electric car and battery ETFs, choosing the right brokerage platform is essential. You’ll want to find a platform that offers a diverse range of ETFs, low fees, and user-friendly features. Some popular options include Robinhood, Vanguard, and Fidelity.

Before investing, it’s important to do your research on the specific ETFs you’re interested in, as well as the overall electric car and battery market. Don’t be afraid to ask questions and seek advice from experienced investors or financial advisors. By taking the time to find the right platform and make informed investment decisions, you can potentially benefit from the growth of the electric car and battery industry.

Research and Select ETFs

With the push towards greener technology, electric cars and batteries have become a popular investment opportunity. One way to invest in this market is through exchange-traded funds (ETFs) that focus on electric car and battery companies. But before investing, it’s crucial to do research and choose the right ETFs for your portfolio.

Look for ETFs with a diverse range of companies in the industry, such as manufacturers, suppliers, and even charging station providers. Popular electric car and battery ETFs include the Global X Lithium & Battery Tech ETF and the KraneShares Electric Vehicles and Future Mobility ETF. It’s essential to pay attention to the expense ratios and performance history of the ETFs before investing.

These ETFs can provide investors with access to a growing market and offer diversification within the electric car and battery industry.

Conclusion: The Future of Transportation and Energy

In conclusion, investing in an electric car and battery ETF is like charging your portfolio with sustainable energy. As the world continues to shift towards green energy and governments worldwide implement stricter regulations on carbon emissions, the demand for electric cars and their batteries is only going to grow. By investing in this ETF, you not only contribute towards a better future but also secure potential returns on your investment.

So, let’s drive towards a cleaner, greener and more profitable future with electric cars and battery ETFs!”

FAQs

What is an electric car and battery ETF?

An electric car and battery ETF is an exchange-traded fund that invests in companies involved in the manufacturing, development, and production of electric vehicles and batteries.

How does an electric car and battery ETF work?

An electric car and battery ETF works by tracking the performance of an underlying index that consists of various companies involved in the electric vehicle and battery industry.

What are some companies included in an electric car and battery ETF?

Companies that may be included in an electric car and battery ETF could be Tesla, Panasonic, Samsung SDI, and LG Chem, among others.

What are some potential benefits of investing in an electric car and battery ETF?

Investing in an electric car and battery ETF provides exposure to a growing industry that may have significant potential for growth in the future. It also allows for diversification as investors gain exposure to multiple companies within the industry.