Charging into the Future: Top Electric Car and Battery Stocks Worth Investing In

Electric cars and batteries have revolutionized the automobile industry. The use of electric cars has increased significantly because of their eco-friendly nature and less dependence on traditional fuel. The growth in the electric car industry has led to a surge in demand for battery stocks.

Electric car and battery stocks have become a hot topic among investors. Many investors believe that electric car and battery stocks are the future of the automobile industry. With the increasing demand for electric vehicles, the demand for battery stocks is also on the rise.

In this blog, we will explore the world of electric car and battery stocks and why they are becoming increasingly popular among investors. We will also discuss some promising electric car and battery stocks that you can consider investing in. Whether you are a seasoned investor or a newbie, this blog will provide you with some valuable insights into the electric car and battery stock market.

The Rise of Electric Cars

Electric car and battery stocks have been trending lately due to the rise in demand for electric vehicles. As people become more environmentally conscious, they are increasingly opting for sustainable and cleaner modes of transportation. This shift towards electric cars has spurred a surge in electric car and battery stocks, which have been experiencing bullish runs in the market.

The growth in these industries has been phenomenal, with industry analysts predicting that this trend is set to continue well into the future. With more and more automakers unveiling their plans for electric vehicles, the demand for batteries is expected to skyrocket. This increase in demand for batteries is great news for battery manufacturers and producers of raw materials such as lithium, cobalt, and nickel.

Investors are keenly watching these markets and are bullish on their future growth prospects. Electric car and battery stocks present a great investment opportunity for those seeking to tap into this emerging and growing market.

Growing Demand for Clean Energy

Clean Energy As climate change becomes an increasing concern, there has been a growing demand for clean energy solutions to reduce greenhouse gas emissions. One major area of focus has been the rise of electric cars. These vehicles use electricity instead of fossil fuels, providing a more sustainable and environmentally-friendly option for transportation.

With more and more automakers offering electric options, the market for electric cars is rapidly expanding. This growth is only expected to continue in the coming years, as advancements in battery technology make electric cars more affordable and practical. Plus, the benefits of electric cars go beyond just reducing emissions – they also offer a quieter and smoother driving experience, as well as lower maintenance costs.

All of these factors combined are making electric cars an increasingly popular choice for consumers looking to switch to a clean energy lifestyle.

Government Support for Electric Cars

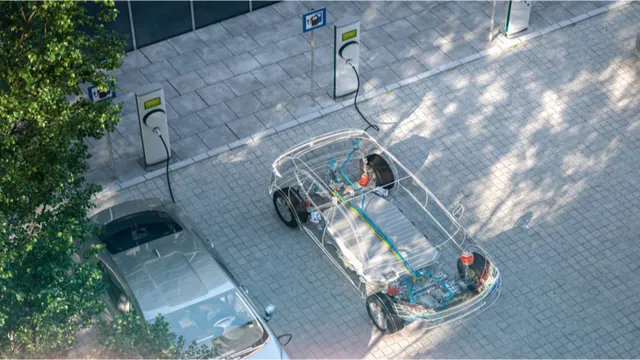

Electric Cars One of the biggest trends in the automotive industry in recent years has been the rise of electric cars. These vehicles are powered by batteries instead of gasoline, which makes them much cleaner for the environment and cheaper to operate. As more and more drivers have begun to switch to electric cars, governments around the world have started to offer various forms of support for the transition.

This often involves subsidies or tax breaks for buyers, as well as investments in infrastructure such as charging stations. While there are still some challenges to be overcome in terms of range and performance, electric cars are becoming increasingly popular and are likely to play an even bigger role in the future of transportation.

Investing in Electric Car Stocks

Investing in electric car and battery stocks can be a wise financial move for those who are looking for both long-term gains and a way to feel good about the investments they make. The rise in demand for electric vehicles (EVs) and the need for efficient and reliable battery technology has led to an increase in the value of companies that offer such products. Companies like Tesla, which produces EVs and develops advanced battery technology, has seen tremendous growth in their stock value throughout the years.

Other companies such as BYD and Nio have also experienced a significant uptick in stock value thanks to their innovative electric car designs. While investing in electric car and battery stocks can be a sound decision, it is important to research and analyze each company’s potential growth and profitability before making any investments. As with any investment, diversification is key, so it is wise to consider investing in multiple EV and battery-related companies rather than just one.

Top Electric Car Companies to Watch

Electric Car Companies Investing in electric car stocks can be an exciting and potentially profitable venture. As electric vehicles become more popular, companies that produce and support them are poised for growth. Tesla is, of course, the most well-known electric car company, but there are other players in the market to watch.

Companies like NIO, a Chinese electric vehicle manufacturer, have been gaining traction, with a focus on luxury EVs. Another contender is Rivian, an American company that produces electric pickup trucks and SUVs. General Motors has also made a commitment to electric vehicles, with a plan to invest $27 billion over the next five years.

It’s important to do your research before investing in any company, but electric car companies offer a promising opportunity for those interested in environmentally-friendly investments.

Recent Stock Performance and Trends

Investing in electric car stocks is a popular trend among investors due to the rapid growth of the electric vehicle (EV) market. Recent stock performances of companies such as Tesla, NIO, and BYD have shown significant increases, making investing in these companies a lucrative opportunity. Several factors have contributed to the growth of EVs, including government incentives, environmental concerns, and advancements in technology.

However, investing in electric car stocks requires careful consideration. Investors should assess the financial health and management of the company, as well as the overall market and competition. While investing in the electric vehicle industry can yield high returns, it also poses risks and volatility.

It’s important to stay informed and conduct thorough research before investing in any particular stock. In the end, investing in electric car stocks can potentially lead to significant profits, but it is important to diversify one’s portfolio and invest wisely.

Investment Tips for Electric Car Stocks

Investing in electric car stocks can be a smart move for those looking to diversify their portfolio and ride the wave of the electric vehicle (EV) revolution. However, with so many options to choose from, it can be overwhelming for investors to know which stocks to buy. One important tip is to research the companies producing the EV technology, as these companies will likely be in high demand in the coming years.

Another crucial factor to consider is the company’s financials and growth potential. Look for companies with a solid history of revenue growth and profitability as well as a promising outlook for future expansion. Additionally, keeping an eye on government regulations and incentives for electric vehicles can also play a significant role in the success of an EV stock.

By doing your due diligence and staying informed on industry developments, investing in electric car stocks can be a lucrative opportunity for long-term growth and sustainability.

Battery Stocks: A Key Component of Electric Cars

Electric car and battery stocks have become an integral part of the investment world as more and more people shift towards sustainable forms of transportation. In the current market, electric car and battery stocks are performing well due to the surge in electric car sales. Tesla, the leader in the electric car industry, has seen its stock skyrocket due to its innovative technology and high demand for its products.

Other companies such as NIO, General Motors, and Ford are also actively investing in electric car technology and battery production, making them attractive options for investors. In addition to electric car companies, battery manufacturers such as Panasonic, Samsung, and LG are also experiencing an increase in demand as EV adoption rates increase. The electric car and battery industry is on the rise, and investing in these companies could be a wise decision for the environmentally conscious investor looking for a promising investment opportunity.

The Importance of High-Quality Batteries

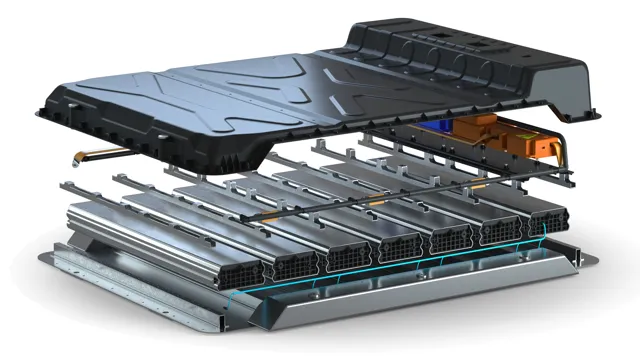

When it comes to electric cars, battery stocks are a crucial component in ensuring quality and reliability on the road. High-quality batteries not only provide the necessary power to keep the car running smoothly, but they also increase the range of the vehicle, making it more practical for everyday use. In recent years, advances in battery technology have helped to make electric cars more accessible and affordable for consumers, driving up demand for battery stocks.

Companies like Tesla and Panasonic have invested heavily in research and development to improve battery performance while keeping costs low. As the market for electric cars continues to grow, the importance of high-quality battery stocks will only increase, with more companies and investors looking to capitalize on the trend.

Top Battery Companies in the Market

When it comes to electric cars, batteries are a key component. And it’s not just any batteries we’re talking about, but the kind that can hold a charge for long periods of time while providing plenty of power to the vehicle. This is where the top battery companies in the market come into play.

Names like Tesla, Panasonic, LG Chem, and CATL dominate the industry, with each company offering its own unique advantages. Tesla, for instance, produces its own batteries in-house, giving it greater control over quality and production. Meanwhile, LG Chem is known for its high-energy density batteries, which allow for longer driving ranges.

Investing in these battery stocks means investing in the future of electric vehicles and sustainable transportation. As the world shifts towards more eco-friendly practices, these companies are positioned to be at the forefront of the movement.

Making Smart Investments in Electric Cars and Batteries

Investing in electric car and battery stocks can be a smart move for investors looking to make a long-term investment that aligns with their values. As electric vehicles continue to gain in popularity and become more affordable, companies that manufacture batteries and other components for electric vehicles are likely to see significant growth. When considering electric car and battery stocks, it’s important to look at companies with a solid track record and growth potential.

Additionally, it may be wise to diversify investments across several companies in the electric car and battery industry to minimize risk. Investors should also pay attention to factors like government policies and regulations, which can impact the industry. Investing in electric car and battery stocks can be a way to not only make a profit, but also support a cleaner, more sustainable future.

Conclusion

In conclusion, investing in electric car and battery stocks is like running a marathon – it may take some time and effort, but the finish line is worth it. As more countries push for eco-friendly alternatives and consumers demand more sustainable options, these stocks have the potential to not only provide financial returns but also contribute to a cleaner and healthier future for our planet. So, get charged up about electric car and battery stocks and let them power your portfolio to success!”

FAQs

What are some popular electric car manufacturers to invest in?

Some popular electric car manufacturers to invest in include Tesla, General Motors, and Ford.

What is the current state of the electric car market?

The electric car market is growing rapidly, with sales increasing and more manufacturers entering the market.

What are some of the top performing battery stocks?

Some of the top performing battery stocks include Tesla, Panasonic, and Samsung SDI.

What factors should be considered when investing in electric car and battery stocks?

Factors to consider when investing in electric car and battery stocks include market trends, competition, technological advancements, and overall industry growth potential.