Shocking Stock Market Success: Top Electric Car Battery Companies to Invest In Now

Are you interested in investing in the futuristic electric car market? One area to consider is electric car battery stocks. As the demand for eco-friendly vehicles continues to rise, so does the importance of efficient and reliable electric car batteries. This opens up a wealth of opportunities for investors looking to get in on the ground floor of a fast-expanding market.

But what exactly should you look for when considering electric car battery stocks? One key factor is the company’s ability to innovate and develop new battery technology. With research and development continuing to drive advancements in electric cars, a company that can keep up with the latest technology will likely have an advantage in the market. Another important consideration is the company’s partnerships and relationships within the industry.

Many electric car manufacturers work closely with specific battery companies, meaning that a strong partnership can lead to consistent business and financial stability. It’s also worth considering a company’s manufacturing capabilities and whether they can efficiently produce enough batteries to meet market demand. Investing in electric car battery stocks can be both exciting and profitable.

As electric car technology continues to improve, battery companies are poised to benefit from this growing market. By doing your research and considering all the factors involved, you can make informed decisions and potentially share in the success of this emerging industry.

Top Companies on Stock Market

When it comes to electric car battery companies on the stock market, there are a few that stand out from the rest. One of the top companies in the industry is Tesla, which has become a household name for its popular electric vehicles and innovative battery technology. Another leading company in the electric car battery industry is Panasonic, which supplies batteries to Tesla as well as other major automakers.

LG Chem, based in South Korea, is also a major player in the electric car battery market, providing batteries for electric cars and other applications. Finally, there’s BYD, a Chinese company that produces not only electric car batteries but also electric buses, trucks, and other vehicles. All of these companies have made significant strides in electric car battery technology and are poised for continued growth as the electric vehicle market expands in the coming years.

If you’re looking to invest in electric car battery companies, these four companies are a great place to start.

Tesla (TSLA)

When it comes to the top companies on the stock market, Tesla (TSLA) undoubtedly stands out. The electric vehicle pioneer has experienced an impressive surge in its stock price over the past few years, fueled by growing demand for sustainable energy solutions and the company’s own innovative technology. But it’s not just about the cars themselves – Tesla’s solar panels and energy storage solutions add another layer to their success.

Despite some bumps in the road, such as production challenges and controversial CEO tweets, Tesla’s fan base remains strong and loyal. Its visionary leader, Elon Musk, has an ability to inspire and captivate, attracting investors and customers alike. But as with any high-growth company, there are also risks to consider.

Competition is heating up from established automakers and new entrants to the market, and the company is set to face financial challenges as it tries to scale up production and expand into new markets. Overall, Tesla’s impact on the automotive and energy industries cannot be denied. Its stock market success is a testament to the growing demand for sustainable and innovative solutions, and the company’s ability to stay ahead of the curve.

Whether Tesla can maintain its position as a leader and continue to drive progress in these industries remains to be seen, but one thing is certain – it will be an exciting ride for investors and consumers alike.

BYD Company (BYDDF)

BYD Company (BYDDF) When it comes to top companies in the stock market, one that stands out is BYD Company (BYDDF). This Chinese-based company is a leader in the electric vehicle industry and has been making strides towards sustainability for years. With their focus on battery technology development, BYD has become one of the largest suppliers of rechargeable batteries in the world and has even developed their own electric buses and cars.

In addition to their leadership in the transportation industry, BYD also has a strong presence in the renewable energy sector. The company is committed to reducing carbon emissions by producing solar panels and developing wind and solar power plants. Investors who are interested in environmentally conscious companies can look to BYD as a potential investment opportunity.

With their innovative solutions and commitment to sustainability, BYD Company (BYDDF) is definitely a top contender in the stock market.

LG Chem (051910.KS)

LG Chem, stock market, top companies LG Chem (0519KS) is a South Korean company that is known for its energy solutions and advanced materials. With a market cap of more than $50 billion, LG Chem has established itself as one of the top companies on the stock market.

The company’s success can be attributed to its ability to innovate and develop products that meet the ever-changing needs of consumers. LG Chem’s lithium-ion batteries are used in a wide range of applications, including electric vehicles and energy storage systems. The company is also a major producer of petrochemicals, which are used in everything from plastics to rubber.

Overall, LG Chem’s focus on sustainability and innovation has helped it to become a leader in the global market and a top choice for investors looking to add a stable and profitable company to their portfolio.

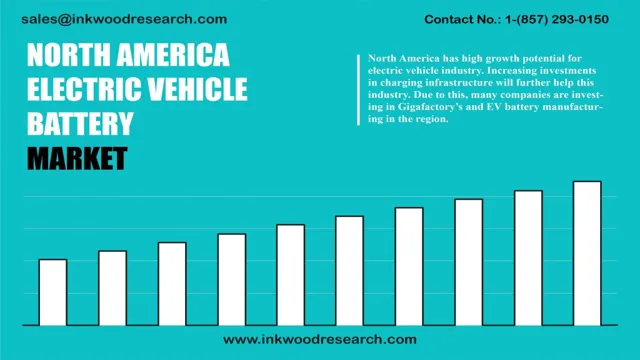

Battery Market Trends

With the rise of electric vehicles, the demand for electric car batteries has also increased. As a result, numerous electric car battery companies have emerged and some have even made their way into the stock market. For instance, there are companies like Tesla, BYD, and Panasonic that have been producing electric car batteries for years.

Tesla, for instance, has been actively shedding light on battery advancements and introduced the world to its Battery Day event in 2020, where the company presented its plans for an affordable and long-lasting battery. Meanwhile, BYD has been working on not just ramping up its production of batteries but also expanding its utilization in various industries. Panasonic, on the other hand, has been working closely with Tesla to produce batteries for their electric cars.

As electric car battery companies start to gain a stronger foothold in the stock market, the industry can potentially grow even more rapidly, driving us closer to a sustainable future.

Global Market Growth

Battery markets are experiencing substantial growth in recent years due to the rapid rise in the demand for energy storage systems worldwide. With the growing use of renewable energy sources, such as solar and wind power, the need for reliable battery solutions has become critical. Battery storage systems are not just limited to the energy sector but are also in demand for electric vehicles and portable devices.

New battery technologies, such as lithium-ion batteries, have helped bring down the costs and improve the efficiency of these systems. Experts predict that with the continuous development of these technologies, the global battery market will experience a significant boom in the coming years. As a result, many companies are investing heavily in research and development to create more advanced and cost-effective battery solutions for future applications.

The demand for sustainable, clean energy is on the rise, and the battery market’s growth is responding accordingly.

Increasing Demand for EVs

With the increasing demand for electric vehicles (EVs), the battery market is experiencing a surge in growth. Lithium-ion batteries are the most commonly used batteries in EVs, and their production is projected to increase rapidly in the future. In fact, it is expected that the global lithium-ion battery market will grow from approximately $44 billion in 2020 to over $94 billion by 202

Additionally, research is being done on the development of solid-state batteries, which could offer improved performance and increased safety. As the market for EVs continues to expand, battery manufacturers are implementing innovative solutions to meet the growing demand, such as increasing production capacity and developing more efficient battery designs. Battery technology is a crucial factor in the success of EVs, and as advancements are made, we can expect the market to continue to thrive.

Government Incentives

Government incentives have been the driving force behind the upward trend in the battery market. With a strong focus on sustainable and environmentally-friendly energy solutions, governments around the world are offering a range of incentives to encourage individuals and businesses to invest in battery technology. These incentives include tax credits, subsidies, and rebates, making it more economically viable for consumers to switch from traditional fossil fuel-based energy sources to more renewable forms.

This has resulted in a surge in demand for batteries, with key players in the market increasing production to meet consumer needs. As a result, the battery market is expected to continue to grow exponentially in the years to come, as more consumers look for green and sustainable energy solutions.

Investing in the Future

Are you looking for electric car battery companies on the stock market to invest in? With the rise of electric vehicles, the demand for their batteries is also increasing. This has created an opportunity for investors to tap into this market and potentially earn profits. One notable company is Tesla Inc.

(TSLA), which produces its own lithium-ion batteries and has been dominating the electric vehicle market. Other companies include LG Chem Ltd. (LGCLF), Samsung SDI Co.

Ltd. (SSDIY), and Panasonic Corporation (PCRFY), which supply batteries to various electric vehicle manufacturers. However, it’s important to do your research, understand the risks, and consider other factors before investing in these companies.

Factors like competition, potential regulations, and supply chain constraints can greatly impact the success of these companies. As with any investment, it’s crucial to approach it with caution and a long-term perspective.

Potential of Electric Car Batteries

Electric car batteries have immense potential in revolutionizing the automotive industry. Investing in this technology is the future, and it’s happening now. These batteries are not only environmentally friendly but also cost-efficient in the long run.

With the increasing demand for electric vehicles, investing in their batteries can lead to tremendous growth in the industry. When investing in the future, it’s essential to look at the potential for disruptive innovation, such as electric car batteries. Innovation leads to more efficient technology, more cost-effective solutions, and societal benefits.

In the same sense, investing in electric car batteries can lead to a sustainable and environmentally friendly future. The burstiness of this technology is unmatched, and with the continuous development of better batteries, the future looks brighter for electric vehicles. Investing in electric car batteries is a no-brainer because it’s a sustainable and long-lasting solution for the future of transportation.

Long-Term Investment Options

Long-Term Investment Options That Will Help You Invest in the Future Investing in the future can be a daunting task, especially with so many investment options out there. However, if you focus on long-term investments, you’ll be able to reap the benefits of compound interest and growth over time. One such investment option is stocks.

By investing in well-established companies that have a proven track record of growth, you’ll be able to take advantage of the stock market’s long-term potential. Another long-term investment option is real estate. While it may require a larger upfront investment, real estate has the potential to generate passive income through rental properties or appreciation in value.

Finally, investing in index funds or mutual funds can provide diversification and stability in your portfolio. By considering these long-term investment options, you’ll be able to invest in the future while minimizing the risks involved.

Conclusion

In the world of electric car battery companies on the stock market, it’s a charged game full of excitement and innovation. Investors are revved up as these companies strive to crack the code on longer-lasting and more efficient batteries, providing the power needed to drive toward a greener future. With cutting-edge technology and a drive for sustainability, these companies are sparking a new era of automotive innovation.

So, buckle up and prepare for a thrilling ride as we charge ahead into the electrified future.”

FAQs

What are some electric car battery companies listed on the stock market?

Some notable electric car battery companies listed on the stock market include Tesla, Panasonic, LG Chem, and BYD.

Are electric car battery companies a good investment for the future?

The electric car industry is growing rapidly and is expected to continue to do so, making electric car battery companies a strong potential investment for the future.

How do electric car battery companies impact the environment?

While electric cars are often touted as environmentally friendly, the production and disposal of their batteries can have negative environmental impacts. Electric car battery companies are constantly seeking to improve their sustainability practices.

What are some challenges facing electric car battery companies?

Electric car battery companies face challenges such as increasing competition, high costs associated with research and development, and the need to constantly improve battery technology to meet the demands of consumers.