Juicing Up the Future: Exploring the Booming Electric Car Battery Company Shares!

Electric cars are gaining popularity rapidly as people become more aware of the negative impact of fossil fuel-powered vehicles on the environment. With increasing demand for electric vehicles, the importance of good quality, long-lasting batteries has become paramount. This has led to the emergence of several electric car battery companies that specialize in producing batteries with superior performance.

As a result, investors have taken notice, and electric car battery company shares have become a hot commodity in the stock market. In this article, we will discuss the important factors to consider before investing in these companies and explore some of the best options available today. So, buckle up and let’s dive right in!

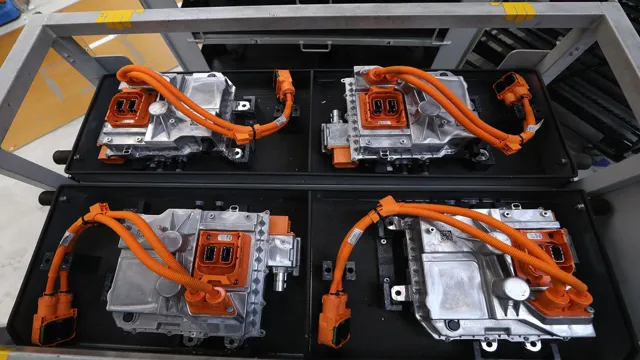

Overview of Electric Car Battery Industry

As electric cars become more popular, the demand for electric car batteries has skyrocketed. This has led to several electric car battery companies emerging on the scene and has made electric car battery company shares a hot commodity for investors. Some of the most well-known electric car battery companies include Tesla, Panasonic, and LG Chem.

These companies are not only focused on producing high-quality electric car batteries but also developing new technology to push the limits of electric cars further. The electric car battery industry is poised for significant growth, as more countries make commitments to reduce carbon emissions and transition to renewable energy sources. Investors looking to get in on the ground floor of this burgeoning industry should keep an eye on electric car battery company shares for potential investment opportunities.

Global growth projections and market trends

The Electric Car Battery Industry has been expanding rapidly across the world due to increasing demand for electric vehicles and growing environmental awareness. As per industry reports, the global electric car battery landscape is projected to grow at a CAGR of 18% from 2020 to 202

Emerging economies such as China, India, and Southeast Asian countries are expected to witness high growth rates, driven by supportive government policies and increasing adoption of electric vehicles. Furthermore, the trend of battery recycling and reuse is beginning to gain traction in the industry, with efforts being made to reduce the environmental impact of battery production and disposal. This is an important development as recycling and reuse of batteries can help combat the depletion of natural resources, reduce waste, and enable cost savings.

Overall, the electric car battery industry is expected to experience significant growth in the coming years, presenting numerous opportunities for stakeholders in the market.

Key players in the industry and their market shares

The electric car battery industry has gained tremendous momentum in recent years, attracting several key players who occupy significant market shares. Tesla, for instance, holds the lion’s share of the market with its Lithium-ion batteries that power its impressive electric vehicles. Additionally, companies like LG Chem, CATL, and Panasonic are also major players in the industry, supplying batteries to various automakers.

LG Chem, for example, supplies batteries to both General Motors and Ford. CATL, on the other hand, is a Chinese battery manufacturer that supplies batteries to various electric vehicle brands, including BMW, Volkswagen, and Tesla. As the push for electric vehicles gains even more traction, it’s expected that these key players will continue to dominate the market and drive further innovations in battery technology.

Performance of Electric Car Battery Companies

When it comes to electric car battery company shares, the performance of different companies varies greatly. Tesla, for example, has seen a significant increase in its share price over the past year due to the growing demand for electric vehicles and its dominance in the market. In contrast, companies like LG Chem, CATL, and Panasonic have experienced fluctuations in their share prices due to factors such as changing regulations, supply chain issues, and competition from other companies.

It’s important to keep in mind that the electric car market is still relatively new and unpredictable, so investing in electric car battery companies can come with some risks. However, with the push towards a more sustainable automotive industry, there is a great potential for growth and profit in the electric car battery market.

Comparison of top-performing companies in the industry

When it comes to electric car batteries, the industry is highly competitive, with companies striving to be the top-performing manufacturer. Some of the top-performing companies in the industry include Tesla, LG Chem, and Panasonic. Tesla is known for its innovative designs and has been making a name for itself in the electric car market.

LG Chem supplies batteries to several major car manufacturers and has been a leader in the lithium-ion battery market for years. Panasonic, on the other hand, has a long history in the battery industry and is known for producing high-quality products. When it comes to performance, these companies have been consistently delivering top-quality products that are efficient and reliable.

Each has its own strengths and weaknesses, but all share a common goal of creating batteries that will power the electric cars of the future. No matter which company you choose, one thing is certain: the performance of these electric car battery companies is nothing short of impressive.

Analysis of financial data and profitability

As the world moves towards adopting sustainable energy solutions, the electric car industry has been on the rise, leading to an increased demand for efficient and long-lasting batteries. With the fierce competition between electric car battery companies, it’s essential to look at their performance and financial data to determine profitability. One of the most prominent electric car battery companies is Tesla, which has seen impressive growth since its inception.

Tesla’s net income has been steadily increasing, reaching $9 billion in 2020, compared to $-862 million in 201 Other electric car battery companies, such as LG Chem and CATL, have also shown strong financial performance, with a net income of $

24 billion and $5 billion, respectively. These companies’ profitable growth can be attributed to their ability to provide high-quality and reliable batteries that meet the demands of the rapidly growing electric car market.

Overall, the performance of electric car battery companies is a promising indicator of the future of sustainable transportation and clean energy.

Impact of government policies and regulations

The electric car battery industry has seen a significant impact from government policies and regulations. In recent years, there has been an increasing focus on reducing emissions and promoting more sustainable forms of transportation. As a result, many governments have implemented regulations and incentives to encourage the adoption of electric vehicles.

This has led to a surge in demand for electric car batteries, which has had a direct impact on the performance of battery companies. The top companies in this industry have risen to the challenge, developing new technologies and investing in research to meet the growing demand. The key players in this industry have a great opportunity to capitalize on this shift towards electric mobility and continue to innovate to stay ahead of the game.

It is clear that government policies and regulations play a crucial role in driving the growth of the electric car battery industry. As more and more countries commit to reducing their carbon emissions, we can expect to see continued investment and support for electric mobility, which will fuel even greater growth in this exciting industry.

Investing in Electric Car Battery Stocks

Investing in electric car battery company stocks can be a smart move for those looking to get in on the growing trend of electric vehicles. As more people make the switch to eco-friendly transportation options, the demand for electric car batteries is only going to increase. This means that companies that produce these batteries are likely to see significant growth in the coming years.

One electric car battery company that investors may want to keep an eye on is Tesla, which is known for its cutting-edge electric vehicle technology. Other companies to watch include LG Chem, which supplies batteries for several major automakers, and Panasonic, which is a major supplier to Tesla. When considering investing in any of these companies, it’s important to do your research and evaluate their financial stability, growth potential, and competitive advantages.

While there are risks involved in any investment, investing in electric car battery company shares could potentially yield long-term gains as the demand for electric vehicles continues to rise. In addition, supporting the development and production of cleaner transportation options can also be seen as a socially responsible investment.

Factors to consider before investing

When considering investing in electric car battery stocks, it’s important to understand the current state of the market. With the rise of electric vehicles, there is a growing demand for batteries, which has created opportunities for investors. However, there are a few factors to consider before jumping in.

First and foremost, it’s important to do your research and understand the companies you are investing in. Look into their financials, management teams, and overall business strategy. Additionally, keep an eye on any regulatory changes or advancements in battery technology that could impact the market.

While investing in electric car battery stocks can be a smart move, it’s important to be cautious and strategic in order to maximize potential returns.

Top electric car battery stocks to watch

Are you considering investing in electric car battery stocks? The electric vehicle industry is rapidly growing, which means that battery stocks are a hot topic right now. One of the top electric car battery stocks to watch is Tesla (TSLA), which is one of the biggest players in the EV market. Their batteries are known for their durability, performance, and efficiency.

Another company to keep an eye on is Panasonic (PCRFY), which is one of the main suppliers of batteries for Tesla cars. They’re also expanding into the EV market in other ways, such as collaborating with Toyota on the production of a solid-state battery. Finally, there’s Albemarle (ALB), which is a leading producer of lithium, a crucial component in electric car batteries.

These companies are all seeing increased interest from investors as the demand for electric vehicles continues to rise. However, as with any investment, it’s important to do your research and make sure that you’re comfortable with the risks involved before putting your money into electric car battery stocks.

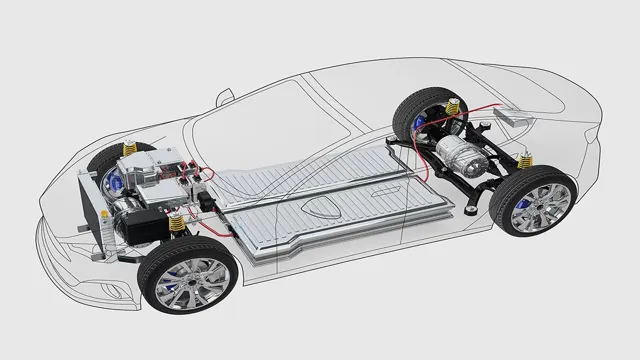

Future of Electric Car Battery Industry

Electric car battery company shares are expected to see a steady and significant rise in the future as the demand for electric vehicles continues to grow. Companies like Tesla, Panasonic, LG Chem, and CATL have been leading the way in developing advanced battery technologies that allow for longer ranges, faster charging times, and increased durability. With the increasing push for sustainable transportation, the electric car battery industry is poised for an explosion in growth and innovation.

Electric vehicle manufacturers are also investing heavily in battery technology, such as the partnerships between Toyota and Panasonic and Ford and SK Innovation. As a result, investing in these companies could prove to be a profitable decision in the long run as the industry continues to evolve and expand. Electric car battery technology has come a long way in recent years, and its advancements show no signs of slowing down.

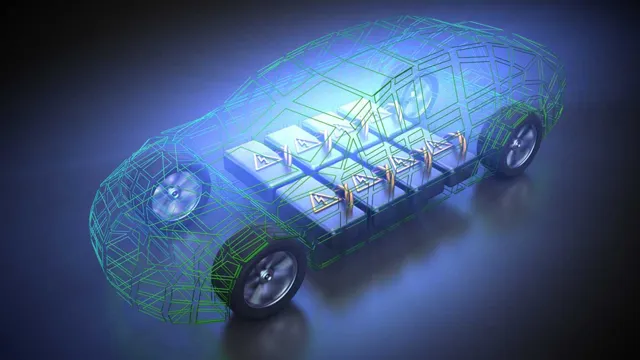

Emerging technologies and innovations in the industry

The electric car battery industry is constantly evolving to meet the demands of consumers. With the increase in popularity of electric vehicles, manufacturers are investing in new technologies and innovations to make batteries more efficient and cost-effective. One of the most promising new developments is the use of solid-state batteries, which have the potential to be safer, longer-lasting, and more environmentally friendly than traditional lithium-ion batteries.

Additionally, researchers are working on new materials to replace the expensive and rare metals currently used in battery production. As these advancements continue, the electric car battery industry is expected to see significant growth in the coming years. This is a very exciting time for innovation and we can’t wait to see what the future holds for the electric car battery industry.

Predictions for future growth and investment opportunities

The electric car battery industry is quickly becoming one of the most promising investment opportunities in the market. With the growing demand for electric vehicles, the battery industry is expected to be worth trillions of dollars in the coming years. The advancements in technology, particularly in the field of materials science, have led to the development of more efficient and cost-effective batteries that can power electric vehicles for longer distances.

This, in turn, has encouraged automakers to produce more EV models, which will drive the growth of the electric car battery industry. Additionally, the government’s push towards cleaner and greener transportation has further accelerated the growth of this industry. This is evident from the fact that many countries have announced plans to ban the sale of gasoline-powered vehicles, which will provide a significant boost to the sales of electric vehicles, which depend on batteries.

Therefore, investing in the electric car battery industry is an opportunity for those looking to capitalize on the growing demand for cleaner transportation while also supporting the transition towards a more sustainable future.

Conclusion

In electric car battery company shares, the future is bright, and the charge is high. Investing in these companies not only benefits our wallets but also the environment. With each purchase of an electric car battery company share, we help pave the way for sustainable transportation.

It’s like charging up our financial portfolio while reducing our carbon footprint. So let’s amp up our investments and drive towards a brighter, cleaner future together.”

FAQs

What are some examples of companies that produce electric car batteries?

Some companies that produce electric car batteries include Tesla, LG Chem, and Panasonic.

How does the performance of electric car batteries compare to traditional gasoline-powered cars?

Electric car batteries generally provide better performance, including quicker acceleration and a smoother, more silent ride compared to traditional cars.

Are there any environmental benefits to using electric car batteries?

Yes, using electric car batteries reduces greenhouse gas emissions and helps to combat climate change.

What is the current market outlook for electric car battery companies?

The market outlook for electric car battery companies is positive, as governments around the world are implementing policies to encourage the adoption of electric vehicles. This trend is expected to drive demand for electric car batteries in the coming years.