Juicing Up Your Portfolio: Exploring the Power of Electric Car Battery Company Stocks

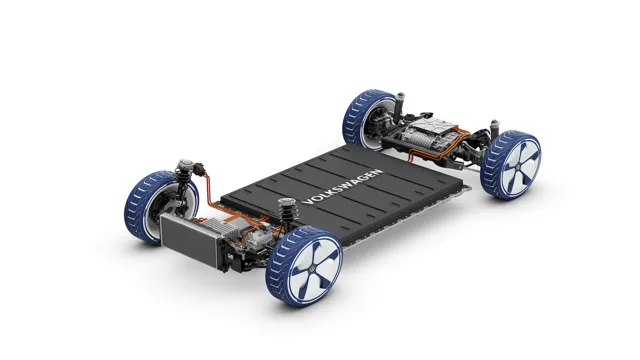

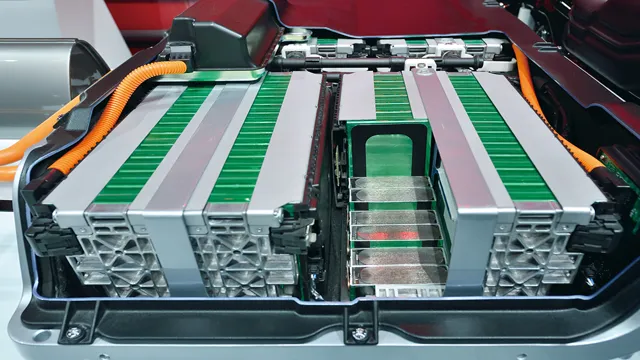

As the world moves towards a more sustainable future, electric cars are becoming a popular choice for many consumers. One key component of these vehicles is the battery. Electric car batteries are responsible for the vehicle’s power and efficiency, making them a crucial part of any electric car.

But, did you know that investing in electric car batteries could also be a profitable investment? With the increasing demand for sustainable transportation options, companies invested in electric car batteries may see significant growth in the coming years. In this blog, we’ll explore the potential profitability of investing in electric car batteries, and why this could be a wise investment decision.

Market Trends

If you’re thinking about investing in electric car battery company stock, you might be wondering about market trends. Over the past few years, there has been a growing demand for electric vehicles, and this trend is only expected to continue. As consumers become more environmentally conscious and governments push for reduced emissions, the market for electric cars is likely to grow.

With this growth comes an increased demand for batteries, which will likely benefit electric car battery companies. However, it’s important to keep in mind that the market for electric cars is still relatively new, and there may be some uncertainty around how it will develop over the long term. As with any investment, it’s important to do your research and make informed decisions based on your goals and risk tolerance.

Growing Demand for Electric Cars

Electric cars are becoming increasingly popular as more people become aware of the benefits of driving them. As gas prices continue to rise, many drivers are turning to electric cars as a more cost-effective and environmentally friendly alternative. In addition, advances in battery technology have made electric cars much more practical for everyday use, with longer driving ranges and faster charging times.

As a result, the market for electric cars is expected to grow significantly over the next few years. This trend is being fueled by a combination of government incentives, increased advertising by automakers, and growing consumer awareness of the benefits of electric cars. With more and more people looking for sustainable transportation options, electric cars are quickly becoming a key part of the automotive industry.

If you’re looking for a way to reduce your carbon footprint while saving money on gas, an electric car might be the perfect choice for you.

Decreasing Battery Production Costs

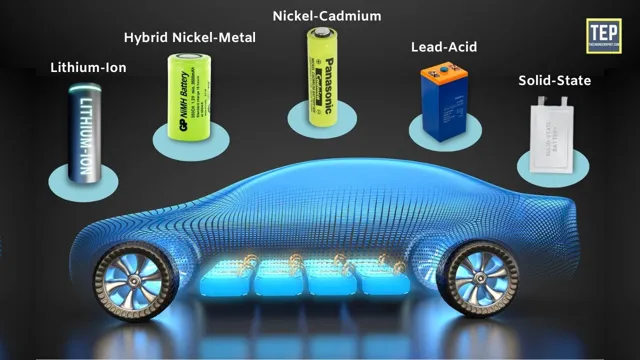

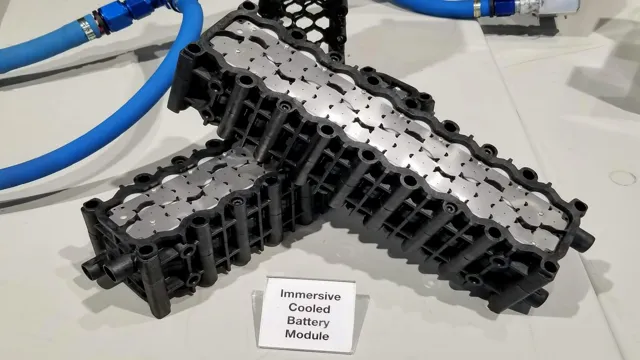

The increasing demand for electric vehicles is driving down battery production costs as manufacturers find ways to improve production efficiency and scale up their operations. This, coupled with advancements in battery technology, is making electric vehicles more affordable for consumers. The declining cost of lithium-ion batteries, which power most electric vehicles, is a key trend in the market.

Raw material costs are also being reduced by recycling battery materials and exploring alternative sources, such as seawater. Additionally, the adoption of solid-state batteries, which have higher energy densities and longer lifetimes, is likely to further reduce battery production costs in the future. As a result, electric vehicles are becoming an increasingly competitive alternative to traditional fossil fuel-powered cars, offering not only environmental benefits but also cost savings for consumers.

Top Electric Car Battery Companies

If you’re considering investing in electric car battery company stocks, there are a few key players worth keeping an eye on. One such company is Tesla, which not only manufactures electric vehicles but also produces its own batteries through its Gigafactory. Another strong contender in the market is LG Chem, a South Korean company that provides batteries to multiple automakers, including General Motors and Hyundai.

In addition to these two, Panasonic, which collaborates closely with Tesla, remains a top producer of electric vehicle batteries, as does China’s Contemporary Amperex Technology Limited (CATL), which has quickly become a major supplier to the global market. As the electric car industry continues to grow, it’s likely that these companies will remain at the forefront of the battery market. So, if you’re looking to invest in the future of environmentally-friendly transportation, keeping an eye on these companies could be a smart move.

Tesla Inc.

When it comes to electric vehicles, the importance of batteries cannot be overstated. The battery is essentially the heart of an electric car, and it’s what powers the car’s motor. Tesla Inc.

is perhaps the most well-known electric car company today, but there are other top electric car battery companies out there as well. One of these is LG Chem, a South Korean company that produces batteries for a range of electric vehicles. Another well-known company is Panasonic, which has a partnership with Tesla and produces batteries for their vehicles.

Additionally, there’s China’s Contemporary Amperex Technology, or CATL, which has become the world’s largest EV battery maker. Other notable companies in the field include Samsung SDI and BYD Auto. Each of these companies has its own unique strengths and weaknesses, and it’s important to consider all of them when making a decision about which electric car to invest in.

LG Chem Ltd.

LG Chem Ltd is one of the leading electric car battery companies in the world. The company was founded in 1947 and has since grown to become a key player in the green energy sector. LG Chem supplies electric vehicle batteries to some of the biggest automakers in the industry, including General Motors, Hyundai, and Audi.

The company’s batteries are known for their high performance and energy density, making them ideal for electric cars. LG Chem has also been investing heavily in research and development, continuously improving its battery technology and expanding its product offerings. With the transition towards electric vehicles gaining momentum, LG Chem is poised to play a major role in shaping the future of transportation.

CATL

When it comes to top electric car battery companies, CATL is a formidable player in the market. With a strong emphasis on research and development, CATL has positioned itself as a leader in battery technology. Their batteries have been used in a range of electric vehicles, from sedans to buses, and have even been used in electric scooters.

CATL is known for its high-density batteries, which provide a longer driving range and faster charging times. What sets CATL apart from its competitors is its commitment to sustainability. They have set environmental targets to reduce their carbon footprint and have developed materials that can be recycled.

All in all, CATL is a company to watch in the electric car battery industry, as they continue to innovate and contribute to a more sustainable future.

Stock Performance

Investing in electric car battery companies can be a great way to take advantage of the booming electric vehicle market. One notable electric car battery company to keep an eye on is Tesla, which has experienced tremendous growth in recent years. However, there are also other emerging electric car battery companies to consider, such as QuantumScape and Romeo Power, whose stock prices may be poised for growth as well.

It is important to do thorough research and analysis before investing in any company’s stock, including analyzing the company’s financial health, growth prospects, and competitive landscape. While electric car battery companies may be experiencing high demand currently, it is crucial to keep in mind the potential for market fluctuations and shifting industry dynamics. Nevertheless, for savvy investors who carefully consider the risks and opportunities, investing in electric car battery company stocks could offer significant potential for long-term returns.

Historical Stock Prices

Historical Stock Prices Stock performance is a crucial component of investing in the stock market. Understanding historical stock prices is a useful tool for investors to predict the company’s future performance. Historical stock prices provide a clear picture of the company’s growth or decline over the years.

Investors analyze the stock performance to forecast future returns based on historical trends and patterns. Despite market fluctuations, studying past performance of a stock can help investors make informed decisions. Many websites and platforms offer data on historical stock prices, which can help investors examine historical trends, analyze the stock performance of a particular company, and make investment decisions accordingly.

Meanwhile, periodic updates and predictions based on historical data can help investors make informed choices as they keep up with current events in the stock market.

Current Stock Analysis

In today’s stock market, it’s vital to keep a close eye on a company’s performance. Investors are constantly seeking to find the next big opportunity, and knowing how a stock is performing is a crucial part of the decision-making process. To do this, investors can look at a variety of metrics, like a company’s earnings, revenue, and cash flow.

Additionally, tracking a stock’s price, volume, and volatility can provide essential insight into its current performance. Burstiness is also a crucial factor to consider, as sudden changes in a stock’s value can present both risks and opportunities. Overall, staying up-to-date on a company’s stock performance is essential for any investor looking to make informed decisions.

Expert Opinions

If you’re considering investing in an electric car battery company stock, it’s important to do your research and seek out expert opinions before making a decision. Some industry experts believe that the future of electric vehicles is bright, with the potential to revolutionize the transportation industry and reduce our dependence on fossil fuels. However, there are also concerns around the supply chain for critical minerals and the pace of technological innovation.

As with any stock investment, it’s important to weigh the risks and potential rewards before making a decision. With the growing popularity of electric vehicles and government incentives to encourage their adoption, investing in the right electric car battery company could be a smart move in the years ahead. Just be sure to consult with investment professionals and experts in the field to get a better sense of the risks and opportunities.

Conclusion

In conclusion, investing in an electric car battery company stock is like putting your money on a fast-charging, long-lasting, emission-free ride to financial prosperity. And with the current global shift towards sustainable transportation, it’s not just a smart investment; it’s also a responsible one. So if you’re looking to power up your portfolio, don’t let this opportunity pass you by.

Charge ahead and take the electric car battery company stock for a spin!”

FAQs

What are some of the top electric car battery companies in the stock market?

Some of the top electric car battery companies in the stock market include Tesla, Panasonic, LG Chem, and Contemporary Amperex Technology.

How has the electric car battery industry impacted the stock market?

The electric car battery industry has become an increasingly important determinant of stock market trends, with the growing demand for electric cars driving up the stock prices of companies in the industry.

What factors should investors consider when investing in electric car battery company stocks?

Investors should consider factors such as the company’s financial performance, research and development capabilities, partnerships with car manufacturers, and competitive advantages in the market.

How has the regulation of the electric car battery industry affected stock prices?

Regulations such as government subsidies and mandates for electric car adoption have had a positive impact on the stock prices of electric car battery companies, as they increase demand for electric car batteries. However, stricter environmental regulations may also lead to higher costs for these companies, which could negatively affect their stock prices.