Powering The Future: Exploring The Hottest Electric Car Battery Company Stocks Of 2021

If you’re looking to invest in sustainable energy, you might want to consider electric car battery company stocks. As the world shifts towards clean energy and governments implement policies to reduce carbon emissions, the demand for electric vehicles and their batteries is on the rise. This presents a promising opportunity for investors, as the electric car battery market is expected to grow substantially in the coming years.

But with several companies competing to dominate the market, it can be challenging to decide which stocks to invest in. In this blog post, we’ll provide an overview of electric car battery companies and the potential opportunities they offer to investors. So, buckle up and let’s dive in!

Top Companies in Electric Car Battery Industry

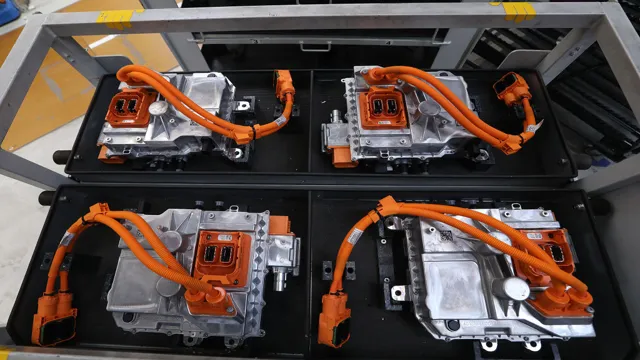

Electric car battery company stocks have been rapidly gaining popularity among investors as the demand for electric vehicles grows. Some of the top companies in this industry include Tesla, Panasonic, LG Chem, and Samsung SDI. Tesla produces high-performance electric vehicles and their battery provider is Panasonic.

LG Chem and Samsung SDI are leading suppliers of batteries for electric cars and have long-standing partnerships with major automakers. These companies not only produce electric car batteries but also provide solutions for energy storage, which is becoming increasingly important with the transition to renewable energy sources. Investing in electric car battery company stocks can be a promising long-term investment opportunity as the demand for electric vehicles and energy storage solutions continues to increase.

Tesla, Panasonic, LG Chem, CATL, BYD Auto

The electric car battery industry has surged in recent times, thanks to the increasing demand for green energy solutions. Tesla, Panasonic, LG Chem, CATL, and BYD Auto are some of the top companies in the industry, each with their unique strengths. Tesla, for example, relies on its innovative technology and high-performance to lead the pack.

Panasonic, on the other hand, boasts of its extensive expertise in battery production, having collaborated with Tesla for over ten years. LG Chem’s forte is its diverse range of batteries, which can be customized to suit different EV models. CATL is a major Chinese EV battery manufacturer that has made rapid progress in the industry because of its partnerships with major automakers, while BYD Auto is best known for producing electric buses.

The competition in the EV battery segment is increasing by the day, and it will be interesting to see how these companies evolve in the future. However, one thing is certain- these companies have the potential to revolutionize the world of electric cars, and their contributions are vital towards reducing the world’s carbon footprint.

Performance of Electric Car Battery Companies

Electric car battery company stocks have been performing well lately, with major players like Tesla and Panasonic leading the charge. With the growing demand for electric vehicles, investors are becoming increasingly interested in these stocks. Tesla’s stock has been on a steady rise since last year, with the company’s market capitalization surpassing that of General Motors and Ford combined.

Panasonic, which provides batteries for Tesla, has also seen a boost in its stock price. Another company to watch is Chinese battery maker CATL, which recently surpassed Panasonic as the world’s largest EV battery maker. As the switch to electric vehicles accelerates, the demand for high-quality batteries will only continue to grow, making it an exciting time for investors in this industry.

However, with a rapidly evolving market, it’s important to carefully research companies before investing.

Stock Prices, Revenue, Market Share

When it comes to electric car battery companies, there are a few key players that are making waves in the industry. One of the big names is Tesla, which has been a leader in developing innovative battery technology for electric vehicles. In terms of stock prices, Tesla has seen a significant increase over the past few years, with their share prices more than doubling.

This growth is partly due to their success in the electric car market, as well as their efforts to expand into other areas such as solar power and energy storage. Other leading companies in the electric car battery space include LG Chem, Panasonic, and CATL. These companies have also seen increases in market share and revenue, as demand for electric vehicles continues to rise.

As the industry becomes more competitive, we can expect to see even more innovation and breakthroughs in electric car batteries in the years to come.

Factors Affecting the Electric Car Battery Market

As more and more people turn to electric cars as a source of transportation, the demand for electric car batteries has grown considerably. This increase in demand has led to a surge in the electric car battery company stocks, making it an attractive option for investors looking to capitalize on this burgeoning market. However, various factors can affect the performance of these stocks.

For instance, the price of raw materials used in the production of these batteries, such as lithium and cobalt, can have a significant impact on the cost of manufacturing. Additionally, advancements in battery technology and the emergence of new players in the market can either drive up or drive down the value of these stocks. Ultimately, investors need to be aware of these factors and stay up-to-date with the latest trends in the industry when considering investing in electric car battery company stocks.

Government Regulations, Technological Advancements, Consumer Demand

Electric Car Battery Market The electric car battery market is affected by various factors that influence its growth and demand. Government regulations impose strict emissions standards that incentivize automakers to develop eco-friendly vehicles, such as electric cars, which require advanced battery technology. Technological advancements in battery technology, such as solid-state batteries that offer longer driving ranges and faster charging times, are also factors in the electric car battery market.

Additionally, consumer demand for electric vehicles is driving growth in the electric car battery market, as more people seek out environmentally friendly options. As a result, there has been significant investment in the development of electric car batteries, with companies seeking to enhance their performance and reduce the costs associated with their production. However, challenges remain, such as the raw material supply chain for battery production, as well as the need for increased charging infrastructure to support the growth of electric vehicles.

Overall, the electric car battery market is complex, dynamic, and subject to various internal and external factors that will continue to shape its growth and innovation in the years to come.

Investing in Electric Car Battery Stocks

Investing in electric car battery company stocks can be a wise move for investors looking to capitalize on the increasing demand for electric vehicles. As more people become aware of the benefits of electric cars, the demand for high-quality batteries is expected to skyrocket in the coming years. This presents a huge growth potential for companies specializing in electric car batteries.

Some of the key players in the electric car battery market include Tesla, Panasonic, LG Chem, and BYD. These companies have a proven track record of developing cutting-edge technologies and are well-positioned to capitalize on the growing demand for electric car batteries. Investors interested in investing in electric car battery stocks should carefully consider the financial health of these companies, as well as their track record in the industry.

With the right strategy and research, investing in electric car battery company stocks can offer significant returns over the long term.

Benefits, Risks, Tips for Successful Investment

When it comes to investing, electric car battery stocks are catching the attention of many investors looking to diversify their portfolios. The potential benefits of investing in these types of stocks include being a part of the rapidly growing electric vehicle industry, which is set to disrupt the global automotive market. However, there are also risks to consider, such as fluctuations in battery costs and the volatile nature of the stock market.

To successfully invest in electric car battery stocks, it’s important to do your research and stay informed about industry trends. It may also be helpful to consult with a financial advisor or broker as they can provide guidance on suitable investments based on your risk tolerance and financial goals. Ultimately, investing in electric car battery stocks can be a worthwhile venture, but it’s important to remain cautious and informed in order to reap the potential benefits.

Future of Electric Car Battery Companies

Investing in electric car battery company stocks can be lucrative in the long run, especially with the increasing demand for electric vehicles. Several companies such as Tesla, CATL, LG Chem, and Panasonic dominate the electric car battery market, and their stocks have already gained traction in the stock market. However, the future seems promising for other emerging players like QuantumScape, a start-up developing a solid-state battery that could revolutionize the industry.

Moreover, the industry is constantly evolving, and new partnerships and collaborations among companies could lead to more potential investment opportunities. Overall, investing in electric car battery company stocks requires research, knowledge of the industry, and keeping track of market trends to maximize profitability.

Opportunities and Challenges for the Industry

The future of electric car battery companies presents both opportunities and challenges. On one hand, the global shift towards eco-friendly transportation is driving demand for electric vehicles, and along with it, the need for powerful and long-lasting batteries. This presents an opportunity for battery companies to innovate and improve their technology, as well as expand their production capabilities to meet the growing demand.

However, on the other hand, competition in the market is intensifying, with new players entering the industry and established companies constantly improving their offerings. Battery companies will need to keep up with these developments, while also navigating factors such as fluctuating prices of raw materials and the need to balance performance with cost-effectiveness. Overall, the future of electric car battery companies looks promising, but success will require adaptability, innovation, and strategic planning.

Conclusion

In the world of electric car battery company stocks, it’s all about being charged up and ready to go. Just like a powerful battery, these stocks can provide great energy and propel your portfolio to new heights. But as with any investment, it’s important to do your research and stay informed.

So strap in and hold on tight, because with the growing popularity of electric cars, this market is sure to keep buzzing.”

FAQs

What are some of the top electric car battery companies to invest in?

Some top electric car battery companies to invest in include Tesla, Panasonic, LG Chem, and BYD.

Are electric car battery stocks a good investment option for long-term growth?

Yes, electric car battery stocks have a promising future due to the increasing demand for electric vehicles worldwide.

How has the electric car battery industry been impacted by global market fluctuations?

The electric car battery industry has seen some ups and downs due to global market fluctuations, but the overall trend is moving towards the increasing adoption of electric vehicles.

What are some potential risks associated with investing in electric car battery stocks?

Some potential risks associated with investing in electric car battery stocks include regulatory changes, competition in the industry, and fluctuations in demand for electric vehicles.

![Power Up Your Ride: Choosing the Best Battery for Your Electric Car from [Company Name]](https://electriccarwiki.com/wp-content/uploads/2023/12/battery-for-electric-car-company.webp)