Charging Ahead: Profiting from the Electric Car Battery ETF Stock Boom

Electricity has transformed the way we live, from powering our homes to our mode of transportation. In recent years, the rise of electric vehicles (EVs) has been an undeniable game-changer. No longer a novelty, electric vehicles are fast becoming a practical and cost-effective alternative to traditional gasoline-powered cars.

As the popularity of EVs continues to grow, investing in electric vehicle batteries has become an intriguing prospect for many investors. The electrification of transportation has opened up new investment opportunities, and EV batteries are at the forefront of this revolution. But what exactly does it mean to invest in electric vehicle batteries? Why is it a promising investment opportunity? And what should investors be aware of before entering this market? In this blog, we’ll explore the ins and outs of investing in electric vehicle batteries and examine the opportunities and challenges the market presents.

What is an ETF Stock?

If you’re interested in investing in the electric car industry, then you may want to consider an ETF stock. An ETF, or exchange-traded fund, is a type of investment fund that holds a diverse range of assets such as stocks, bonds, or commodities. One example of an ETF stock within the electric car industry is the electric car battery ETF stock.

This type of stock would hold shares in companies that produce electric car batteries, such as Tesla, Panasonic, LG Chem, and others. Investing in an ETF stock can be less risky than investing in individual stocks because it spreads your investment across several different companies, which can help lessen the impact of one company’s poor performance. Additionally, ETFs are traded on the stock exchange just like regular stocks, making them easily accessible to individual investors.

So, if you’re looking to invest in the electric car industry, consider an electric car battery ETF stock as a potential option.

Explanation of ETFs

ETFs have become increasingly popular in recent years as investors look for ways to diversify their portfolios and reduce their overall risk exposure. Essentially, an ETF (Exchange-Traded Fund) is a type of stock that covers a basket of underlying assets, such as stocks, bonds, and commodities. Because ETFs are highly diversified, they offer a simple way for investors to gain exposure to a wide range of different assets without having to purchase each one individually.

ETFs can be bought and sold on public exchanges just like regular stocks, and they are often used by investors as a way to track a particular index or sector of the market. In addition to offering greater diversification, ETFs are generally more cost-effective than other types of investments, since they have lower fees and expenses. Overall, ETFs have become an attractive option for investors looking to balance their portfolios with a mix of different asset types.

The Rise of Electric Vehicles

Are you interested in investing in the rapidly growing electric vehicle (EV) industry? Consider an electric car battery ETF stock to potentially capitalize on this trend. As more consumers switch to EVs, the demand for efficient and long-lasting batteries is soaring. This has led to significant investments in research and development, creating opportunities for companies that produce EV batteries.

An electric car battery ETF stock provides a way to invest in a diversified portfolio of such companies and potentially benefit from the industry’s growth. With more governments pushing for cleaner transportation, it’s likely that EVs and their batteries will continue to gain popularity. As a result, an electric car battery ETF stock may be worth considering for those interested in investing in the future of transportation.

Statistics on Electric Vehicle Popularity

Electric Vehicle Popularity In recent years, there has been a significant rise in the popularity of electric vehicles (EVs). Data indicates that electric vehicle sales have increased drastically between 2014 and 2020, with over 7 million electric cars sold worldwide. Moreover, the International Energy Agency (IEA) estimates that there could be as many as 125 million electric cars on the road by 2030, if the right policies are in place.

The surge in demand for electric vehicles can be attributed to various factors like environmental concerns, lower running costs, and a growing awareness of the benefits of electric cars. EVs are known to be more energy-efficient and cause less pollution than their gasoline counterparts. With the advancements and innovations in EV technology, electric cars are becoming more affordable and offering drivers longer ranges, debunking the common myth about their limited mileage.

Electric cars are also benefiting from governmental incentives and subsidies. Governments all over the world are promoting the use of electric vehicles by offering subsidies and tax credits for buyers and equipping public spaces with EV charging stations. This has led to an increase in the number of buyers interested in purchasing EVs.

Consumers are also showing a greater interest in sustainable and eco-friendly products. As the younger generation becomes more environmentally conscious, this trend is expected to continue. With innovation and advancements in battery technology and charging infrastructure, the EV market is expected to grow even more in the coming years.

In conclusion, it’s safe to say that electric cars are here to stay, and the future belongs to zero-emissions vehicles.

Environmental Impact of Electric Vehicles

Electric vehicles have been on the rise in recent years, and for good reason. They offer a more environmentally friendly option compared to gas-powered vehicles, which are known to produce harmful emissions and contribute to air pollution. Electric vehicles are powered by rechargeable batteries, meaning they don’t produce any tailpipe emissions.

This is a significant advantage because transportation is one of the biggest sources of air pollution worldwide, and many cities have implemented measures to reduce emissions in recent years. Additionally, electric vehicles can help reduce our dependence on fossil fuels, which are a finite resource. While there are still some concerns regarding the materials used in the production of electric vehicle batteries, overall, they offer a promising solution to reducing the environmental impact of transportation.

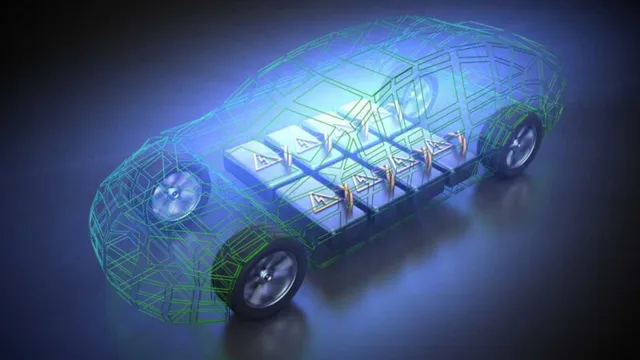

The Importance of Electric Car Batteries

When it comes to investing in electric vehicles, it’s important to consider the role of electric car batteries. These batteries serve as the lifeblood of electric cars and are crucial in determining their overall performance and efficiency. As electric vehicles become more popular, the demand for high-quality batteries is expected to skyrocket.

Investing in an electric car battery ETF stock is a great way to capitalize on this growing market. Such stocks give investors exposure to a basket of companies involved in the production of electric car batteries, from raw materials to manufacturing and distribution. By diversifying your portfolio with an electric car battery ETF stock, you can potentially reap the benefits of the growing electric vehicle industry while minimizing your risks.

Types of Electric Car Batteries

Electric car batteries are undoubtedly one of the most important components of an electric vehicle, as they determine its range and overall performance. There are several types of electric car batteries, each with its own set of advantages and disadvantages. For instance, Lithium-Ion batteries are common, as they offer high energy density and long life, making them ideal for electric vehicles.

However, they can be expensive, which may increase the overall cost of the electric car. Lead-Acid batteries, on the other hand, are cheaper but less efficient, as they have a lower energy density and shorter lifespan. Nickel-Metal Hydride batteries provide a balance between the two, but they can be difficult to dispose of and can add to the overall weight of the car.

In conclusion, choosing the right electric car battery depends on various factors, including cost, performance, and environmental impact. Electric car manufacturers need to strike a balance between these factors to create an optimal solution that benefits both the consumer and the environment. In the end, regardless of the type of battery used, the key is to find a solution that enables electric cars to become a viable alternative to traditional fossil-fuel-powered vehicles, helping to reduce carbon emissions and create a sustainable future for generations to come.

Benefits and Drawbacks of Electric Car Batteries

Electric Car Batteries Electric car batteries have changed the way we view cars and transportation in general. As more people are gravitating towards eco-friendly modes of commute, electric cars are becoming increasingly popular. While electric car batteries have their advantages, they also come with their drawbacks.

One of the main benefits of electric car batteries is their environmentally-friendly nature. They produce zero-emissions, reducing the carbon footprint and air pollution. Another advantage is their lower operating costs, as electric cars do not require oil changes or maintenance on the engine.

On the other hand, electric car batteries have a shorter range compared to traditional gas-powered vehicles. They also require longer charging times, which may not be ideal for long-distance travel. Additionally, the cost of replacing an electric car battery is quite high.

Overall, electric car batteries have made a notable impact in the auto industry and continue to be a topic of debate amongst consumers.

Top Electric Car Battery ETF Stocks

If you’re looking to invest in the electric car battery market, ETFs can be a great option. These funds allow you to invest in a basket of stocks that are specifically focused on electric car battery companies. Some of the top electric car battery ETF stocks include the Global X Lithium & Battery Tech ETF, the First Trust NASDAQ Clean Edge Green Energy Index Fund, and the WisdomTree Battery Solutions Fund.

Each of these ETFs has its own unique focus, ranging from lithium mining to battery manufacturing. By investing in a diversified portfolio of electric car battery stocks, you can capitalize on the growth potential of this exciting industry. Keep in mind that like any investment, there are risks involved, so it’s always a good idea to do your research and consult with a professional before making any decisions.

With the rise of electric vehicles and the push towards renewable energy, electric car battery ETF stocks can be a smart addition to your portfolio.

Listing of Best Electric Car Battery ETF Stocks

Electric car battery ETF stocks. If you’re interested in investing in electric car battery technology, then you might be interested in some of the top electric car battery ETF (exchange-traded fund) stocks. This type of investment can provide exposure to a portfolio of stocks within the electric car battery sector while reducing volatility and risk.

As electric vehicles become increasingly popular, these ETFs offer a unique opportunity to tap into the evolution of energy storage technology. Some of the best electric car battery ETF stocks to consider include the Amplify Lithium & Battery Technology ETF, the Global X Lithium & Battery Tech ETF, and the ALPS Clean Energy ETF. All of these ETFs have holdings in companies related to electric vehicle technology, with a focus on lithium-ion batteries, electric vehicle components, and charging infrastructure.

By investing in these ETFs, you can potentially benefit from the growth of electric vehicle sales and advancements in battery technology while diversifying your investment portfolio.

Performance and Future Growth of ETF Stocks

Electric Car Battery ETF Stocks If you’re considering investing in the electric car industry, electric car battery ETF stocks may be a great option to explore. ETFs, or exchange-traded funds, are a collection of stocks that mirror a specific market or industry. With electric cars and renewable energy being the way of the future, investing in electric car battery ETF stocks can be a great long-term investment.

Some of the top electric car battery ETF stocks to consider include iShares Global Clean Energy ETF, First Trust NASDAQ Clean Edge Green Energy Index Fund, and Invesco Solar ETF. These ETFs feature a diversified portfolio of companies involved in the electric car and renewable energy industry, such as Tesla, Enphase Energy, and Sunrun. As the demand for electric cars continues to increase, these ETF stocks have the potential for strong performance and future growth.

Conclusion

In conclusion, investing in an electric car battery ETF stock is like owning a piece of tomorrow’s technology today. With the immense growth potential of the electric vehicle market, the demand for batteries is only going to increase exponentially. So, get charged up and invest in this revolutionary industry before you’re left in the slow lane!”

FAQs

What is an electric car battery?

An electric car battery is a type of rechargeable battery that is used to power electric vehicles.

What is an ETF?

An ETF, or exchange-traded fund, is a type of investment fund that is traded on stock exchanges.

What is a stock?

A stock is a type of security that represents ownership in a corporation.

How can I invest in an electric car battery ETF stock?

To invest in an electric car battery ETF stock, you can find a broker that allows you to trade on stock exchanges and search for the specific ETF stock you want to invest in. Once you find it, you can purchase the stock through your broker.