Revving Up Your Portfolio: How to Invest in Electric Car Battery ETFs

Have you considered investing in the electric car industry, but don’t know where to start? Electric car battery ETFs might be the answer you’re looking for. With the rise of electric vehicles (EVs), the demand for electric car batteries has also increased significantly. This demand has paved the way for battery manufacturers to produce more efficient and cost-effective batteries.

As a result, investing in electric car battery ETFs has become a popular way to get exposure to this growing industry. But what are electric car battery ETFs, exactly? And how do they work? In this blog, we’ll give you all the details you need to know about electric car battery ETFs and why they could be a smart investment choice.

What are electric car battery ETFs?

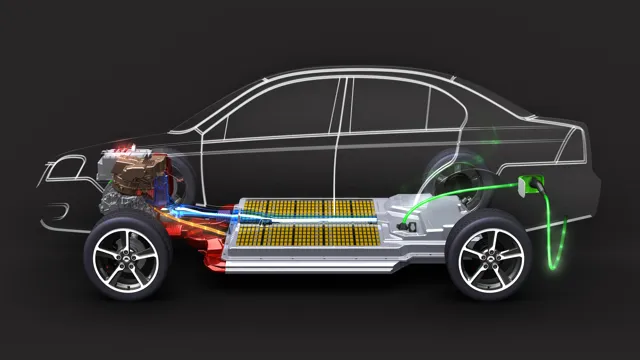

Electric car battery ETFs are investment funds that focus on companies that produce batteries for electric vehicles. These ETFs invest in companies engaged in the research, development, manufacturing, and distribution of electric vehicle batteries. The popularity of electric cars has been on the rise in recent years, and it has prompted investors to seek out opportunities to invest in the sector.

Electric car battery ETFs provide a way for investors to participate in this growing market without investing in a single stock. If you think electric vehicles are going to continue to gain in popularity in the coming years, investing in an electric car battery ETF might be a wise decision. By doing so, you can gain exposure to this growing market in a diversified way.

Definition and explanation.

Electric car battery ETFs are a type of exchange-traded fund that focuses on companies involved in the production or development of batteries for electric vehicles. Rather than investing in individual companies, an ETF allows investors to diversify their portfolio across various companies within the same industry. These ETFs usually include companies involved in the manufacture of batteries, as well as electric vehicle manufacturers.

By investing in an electric car battery ETF, investors can participate in the growth of the electric vehicle market without having to pick individual winners and losers. Some popular electric car battery ETFs include the Global X Lithium & Battery Tech ETF and the Amplify Lithium & Battery Technology ETF. With the increasing demand for electric vehicles, it’s likely that the growth potential of electric car battery ETFs will continue to soar.

Why invest in electric car battery ETFs?

If you’re looking for a way to invest in the growing electric car market, then electric car battery ETFs could be a great option. These ETFs focus on companies that are involved in the production, development, and distribution of electric car batteries, which are vital components for electric vehicles. The electric car market is growing rapidly, and many experts predict that it will only continue to do so in the future.

By investing in electric car battery ETFs, you can potentially benefit from this growth. Additionally, investing in a diversified ETF can help mitigate the risks of investing in a single company. Overall, electric car battery ETFs could be a smart investment choice for anyone looking to capitalize on the growth of the electric car market.

Growth projections and potential ROI.

Investing in electric car battery ETFs can be a wise decision for investors who are looking for growth projections and potential ROI. With the increasing demand for electric vehicles in recent years, the market for electric car batteries has also been rapidly growing. This growth trend is expected to continue in the coming years, making electric car battery ETFs a promising investment opportunity.

One of the main advantages of investing in electric car battery ETFs is the potential for high returns. This is due to the rapid growth of the industry, which is expected to continue as more countries shift toward renewable energy sources. Additionally, with the increasing need for electric cars, there will also be a higher demand for their batteries, presenting a significant opportunity for long-term growth.

Moreover, investing in electric car battery ETFs can offer investors diversification within the clean energy sector and the broader technology market. As such, these ETFs can provide a great way to gain exposure to the exciting, fast-growing electric vehicle industry without putting all your eggs in one basket. In conclusion, investing in electric car battery ETFs is an excellent opportunity for investors who are looking to generate high returns on their investments while contributing to the renewable energy sector.

With the growing demand for electric vehicles around the world, electric car battery ETFs present a perfect chance to take advantage of this trend and reap the rewards of a rapidly-growing industry.

Top electric car battery ETFs to invest in

Are you interested in investing in electric cars and their batteries? Look no further than electric car battery ETFs, which provide investors with exposure to the growing market of electric vehicles and their batteries. A few top electric car battery ETFs to consider include the Global X Lithium & Battery Tech ETF, which includes companies that specialize in lithium mining, battery production, and electric vehicle technology, and the iShares Global Clean Energy ETF, which includes a range of clean energy companies, including those that focus on electric vehicles and their batteries. These ETFs offer investors the opportunity to invest in a diversified group of companies that are at the forefront of the electric vehicle and battery industry.

So, if you are interested in investing in the future of clean energy and electric vehicles, electric car battery ETFs might be a great investment opportunity for you.

Listing and brief description of top ETFs

Are you interested in investing in electric car battery ETFs? If so, there are a few top options to consider. One of the most popular is the Global X Lithium & Battery Tech ETF (LIT), which invests in companies involved in all aspects of the lithium industry, from mining to production. Another great option is the iShares Global Clean Energy ETF (ICLN), which includes companies involved in clean energy technologies such as electric vehicles, solar and wind power, and energy storage.

Finally, the Amplify Lithium & Battery Technology ETF (BATT) focuses specifically on companies involved in the development and production of electric vehicle batteries. All of these ETFs offer investors exposure to the growing electric car and battery industry, making them potentially lucrative investments for those interested in renewable technologies.

Performance history and key metrics.

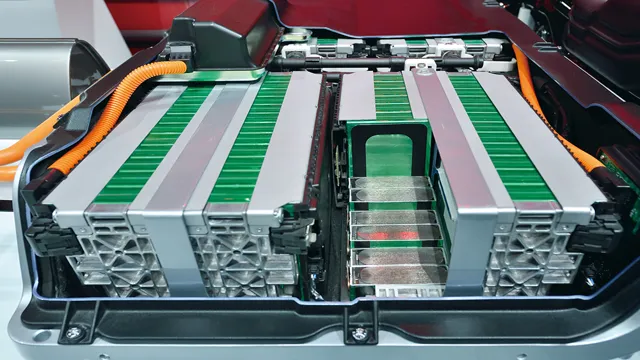

When it comes to investing in electric vehicles, the battery technology is a crucial component to consider. One way to invest in the growth of electric vehicle batteries is through electric car battery ETFs. These funds bundle together stocks from companies involved in electric vehicle battery manufacturing and use.

There are several top electric car battery ETFs to choose from, including the Global X Lithium & Battery Tech ETF and the Amplify Lithium & Battery Technology ETF. These funds have seen impressive performance over the past few years, driven by the increasing demand for electric vehicles. In terms of key metrics, investors should look at the fund’s expense ratio, holdings, and performance history.

While electric car battery ETFs offer potential for growth, it’s important to do your research and consider your investment goals before investing.

Risks and considerations

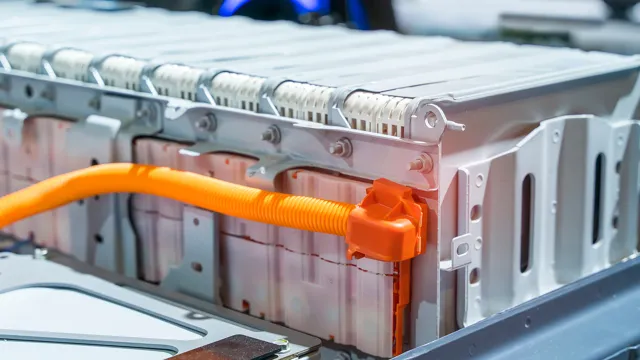

When considering investing in electric car battery ETFs, it’s important to be aware of the risks associated with this type of investment. One major risk is the potential for government regulations or policies that could negatively impact the demand for electric vehicles and their batteries. Another risk is the potential for supply chain disruptions, such as shortages of raw materials needed for battery production.

Additionally, the competition within the electric car market is growing, with new players constantly entering the space. However, despite these risks, electric car battery ETFs can provide excellent potential for long-term growth and diversification of your investment portfolio. By staying up-to-date on industry trends and understanding the risks involved, investors can effectively navigate the unique landscape of electric car battery ETFs.

Potential volatility and market risks.

As with any investment, there are risks and considerations when it comes to potential volatility and market risks. It’s important to keep in mind that the market can experience sudden shifts and downturns due to a variety of factors, such as global events, economic changes, and even social media trends. These can have a significant impact on the value of your investments, which is why it’s essential to diversify your portfolio and not put all your eggs in one basket.

It’s also crucial to keep a long-term perspective and not make impulsive decisions based on short-term market fluctuations. By staying informed and disciplined, you can navigate potential risks and reach your financial goals.

Environmental and ethical perspectives.

As we continue to assess the environmental and ethical considerations of various industries, it’s important to examine the risks associated with each. With regards to the fashion industry, there are several critical areas of concern. The production of textiles is resource-intensive, with many of the materials used having a significant environmental impact.

Additionally, many of the dyes and chemicals used in textile production are harmful to both the environment and the health of workers involved in the production process. The fast-paced nature of the fashion industry also results in a high volume of waste, with a significant portion of clothing items either going unused or ending up in landfills. From an ethical perspective, the fashion industry is also known for poor labor practices, including low wages and poor working conditions for many workers globally.

As consumers, we must work to mitigate these risks by supporting sustainable and ethical brands and reducing our own consumption by buying less and choosing higher quality, longer-lasting items. By making these choices, we can contribute to a more sustainable and equitable fashion industry.

Conclusion and final thoughts

In conclusion, electric car battery ETFs are a current and future investment that spark excitement in the world of finance. These funds recharge the potential for growth and sustainable innovation while electrifying the market. With the increasingly popular demand for electric vehicles, investing in their powering technology through ETFs offers an electrifying buzz to any investor’s portfolio.

So, whether you’re a bull or a bear, don’t be shocked to see these batteries powering up your profits in the years to come!”

FAQs

What are electric car battery ETFs?

Electric car battery ETFs are exchange-traded funds that invest in companies that produce and supply batteries for electric vehicles.

Why should I invest in electric car battery ETFs?

Investing in electric car battery ETFs can be a good way to gain exposure to the growing electric vehicle market. As more and more people transition to electric vehicles, the demand for batteries is expected to increase, which could lead to higher returns for investors.

What companies are included in electric car battery ETFs?

Companies that produce and supply batteries for electric vehicles are included in electric car battery ETFs. Some of the top holdings in popular electric car battery ETFs include Tesla, LG Chem, Panasonic, and Samsung.

Are electric car battery ETFs a good long-term investment?

Electric car battery ETFs can be a good long-term investment for investors who believe in the growth of the electric vehicle market. However, like all investments, there are risks involved, including the possibility of the industry not growing as quickly as expected or the risk of individual company performance. It’s important to do your research and consider your investment goals before investing in electric car battery ETFs.