Exploring the Pros and Cons of Electric Car Battery Lease vs Buy Option: What’s the Best Choice for You?

Electric cars are all the rage these days, and for good reason. They’re environmentally friendly, fuel-efficient, and a great way to save money on gas in the long run. However, when it comes to the battery that powers these electric vehicles, many people are confused about whether to lease or buy.

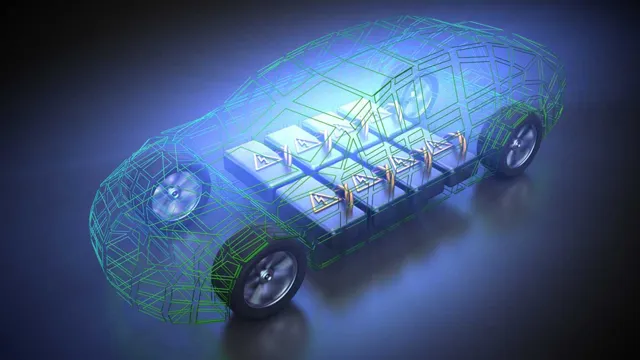

The battery is essentially the heart of an electric car and is responsible for its performance and range. Therefore, choosing between leasing or buying an electric car battery can have a significant impact on the overall ownership experience. In this blog, we’ll break down the pros and cons of both options to help you make an informed decision.

Understanding the Cost Factors

If you’re thinking about getting an electric car, one of the biggest decisions you’ll need to make is whether to lease or buy the battery. Leasing the battery can be a great option for some drivers because it reduces the upfront cost of the car and provides peace of mind knowing that any necessary battery replacements will be covered. On the other hand, buying the battery can be more cost-effective in the long run because you won’t be paying monthly lease fees and, depending on the car and battery, the battery may have a longer lifespan than the lease agreement.

It’s important to consider the cost factors such as monthly lease fees, battery replacement costs, and potential resale value when making this decision. Keep in mind that every driver’s situation is different, so it’s important to do your own research and consult with experts before making a decision.

Benefits of Leasing vs. Buying

One of the main benefits of leasing versus buying is that it may be the better option if you’re looking to reduce your immediate costs. Leasing typically involves lower monthly payments, since you’re essentially paying for the use of the vehicle for a set amount of time, rather than the entire vehicle itself. That being said, there are several cost factors to consider when deciding whether to lease or buy.

Mileage limits are one factor to be aware of, as exceeding them can result in additional fees. Additionally, there may be upfront costs associated with leasing, such as a security deposit or down payment. You’ll want to carefully consider these factors and weigh them against the potential benefits of leasing versus buying before making a decision.

Cost Comparison of Leasing vs. Buying

When it comes to deciding whether to lease or buy a vehicle, the cost can be a major factor. There are several cost factors to consider when making this decision. When leasing, you are essentially renting the vehicle for a set period of time, typically 2-4 years.

The monthly lease payment is determined by factors such as the vehicle’s residual value, the lease term, and the money factor (similar to an interest rate). There may also be additional fees such as a security deposit and a disposition fee at the end of the lease. On the other hand, when you buy a vehicle, you are responsible for the total cost of the vehicle, either through financing or paying for it in cash.

This includes the full purchase price of the vehicle, plus interest if financed. However, when you own the vehicle, you have the freedom to do whatever you want with it, whether that be customizing it or selling it whenever you want. Ultimately, the decision of leasing vs.

buying comes down to your personal priorities and budget.

Maintenance Considerations

When deciding whether to lease or buy an electric car battery, it is important to consider maintenance costs. While buying may seem like the more expensive option upfront, leasing a battery can come with unexpected maintenance fees down the line. When a leased battery reaches the end of its life, it must be returned to the manufacturer, and any damage that occurred during use may result in additional fees.

On the other hand, owning a battery means you are responsible for its maintenance, but any repairs or replacements will be within your control and budget. Ultimately, the decision between leasing or buying depends on your personal financial situation and driving needs. It’s important to weigh the pros and cons carefully before making a decision.

Leasing: Pros and Cons

When it comes to leasing a car, maintenance is one of the most important considerations to keep in mind. One of the biggest pros of leasing is that the vehicle is typically under warranty during the entire lease term, which means that most repairs will be covered by the manufacturer. This can save you a lot of money compared to owning a car and paying for expensive repairs out of pocket.

On the other hand, it’s important to keep in mind that you will be responsible for maintaining the car according to the manufacturer’s recommended schedule, including things like oil changes, tire rotations, and other routine maintenance tasks. Failure to do so could result in additional fees or even voiding of the warranty, so it’s important to stay on top of these tasks to keep the car in good shape for the duration of the lease term. Overall, if you’re willing to stay on top of maintenance requirements, leasing can be a great option for getting a new car without breaking the bank.

Buying: Pros and Cons

When it comes to buying a property, it’s important to consider maintenance requirements. Owning a home or a property means you’re responsible for upkeep, both inside and outside. This can include things like landscaping, maintaining a roof, or repairing appliances.

While renting may seem like the easier option as a tenant is generally not responsible for maintenance and repairs, it’s important to note that renting means you won’t be building equity. When you own a property, the value of that property increases over time, creating an asset that you can sell for profit in the future. When considering buying a property, it’s important to factor in the cost of maintenance and repairs, as well as the potential financial gain in the long term.

There are pros and cons to both renting and buying, so it’s important to weigh the options and make an informed decision that fits your lifestyle and financial goals.

Factors That Affect Battery Maintenance

When it comes to maintaining your battery, it’s important to keep in mind a few key factors. First and foremost, temperature plays a significant role in the lifespan of your battery. Extreme temperatures, whether hot or cold, can negatively impact your battery’s performance and lifespan.

Another crucial factor is charging habits. Overcharging, undercharging, and irregular charging can all contribute to premature battery failure. Additionally, it’s important to keep your battery clean and free of debris, as dirt and corrosion can cause electrical resistance and reduce performance.

By paying attention to these simple maintenance considerations, you can help extend the life of your battery and avoid costly replacements. So, whether you’re using your battery for your car, phone, or other device, keep in mind the impact of temperature, charging habits, and regular cleaning and maintenance for optimal performance.

Environmental Impact

When deciding between leasing or buying an electric car battery, environmental impact should be a major consideration. While buying a battery upfront may seem like the more financially sound choice, it could leave a larger carbon footprint in the long run. Batteries are a crucial component of electric cars, but they contain metals and chemicals that can harm the environment if not disposed of properly.

By leasing a battery, manufacturers are incentivized to reclaim and recycle them at the end of their lifespan, reducing waste. Additionally, as electric cars become more mainstream, battery technology is rapidly advancing. Leasing allows for the flexibility to upgrade to newer, more efficient technology as it becomes available, further reducing impact on the environment.

Ultimately, the decision to lease or buy should depend on individual circumstances, but it’s important to consider the bigger picture of environmental sustainability.

Leasing: Environmental Benefits

In recent years, environmental sustainability has become a top priority for conscientious consumers, and for good reason. The negative impacts of climate change and environmental degradation are becoming more apparent with each passing year, and individuals and businesses alike are seeking ways to reduce their ecological footprint. One effective way to do this is through leasing.

Leasing offers a number of benefits that can help to reduce environmental impact. For one, leasing often incentivizes the use of more fuel-efficient and environmentally-friendly vehicles, which can significantly reduce emissions and improve air quality. Additionally, leasing can help to reduce waste by providing a viable solution for the disposal of end-of-life vehicles, which often contain toxic chemicals that can be harmful to the environment.

With these benefits in mind, it’s clear that leasing can have a significant positive impact on the environment, making it a worthwhile consideration for individuals and businesses who are committed to sustainability.

Buying: Environmental Benefits

When it comes to buying, it’s essential to consider the environmental impact of our purchases. This means looking beyond just the price tag and considering the resources and energy used in the production, transportation, and disposal of the product. By choosing to invest in environmentally conscious products, we can reduce our carbon footprint and contribute to a more sustainable future.

Additionally, buying products made from sustainable materials like bamboo, hemp, or recycled materials can help reduce our reliance on finite resources like wood and oil. So next time you’re shopping, take a moment to consider the environmental benefits of your purchase and invest in products that align with your values and contribute to a cleaner, greener planet. By doing so, you’ll not only be helping the environment, but you’ll also be making a positive impact on the world.

Making the Right Decision

When it comes to electric cars, one of the biggest decisions you will have to make is whether to lease or buy the battery. There are pros and cons to both options, so it’s important to carefully weigh all of the factors. If you have the funds to buy the battery outright, it might make sense to do so.

You’ll own it outright and have more control over your vehicle’s maintenance and upgrades. On the other hand, if you don’t want to shell out a lot of money upfront, a battery lease can be a good option. It allows you to spread out the cost of the battery over time, typically with lower monthly payments.

However, you won’t own the battery and will have to pay for any damage or upgrades that may be necessary. Ultimately, the decision whether to lease or buy the battery will depend on your individual circumstances and priorities. Take some time to research and weigh the pros and cons before making your final decision.

Conclusion

The decision to lease or buy an electric car battery ultimately depends on a variety of factors, such as financial flexibility, driving habits, and personal preferences. Some may prefer to buy outright, while others may opt for the convenience and affordability of a lease. But no matter your decision, one thing is clear: the future of transportation is electric, and we all have a responsibility to embrace sustainable alternatives to fossil fuels.

So whether you’re leasing or buying, you’re making a smart choice for both your wallet and the planet. Charge on, my friends.”

FAQs

What is an electric car battery lease?

An electric car battery lease is an option that allows you to rent the battery of your electric car instead of purchasing it outright.

What are the benefits of leasing an electric car battery?

Leasing an electric car battery can be more cost-effective than purchasing it outright. It also provides the flexibility to upgrade your battery as new technology becomes available.

What is the cost of leasing an electric car battery?

The cost of leasing an electric car battery varies depending on the car model, battery type, and lease term. It can range from a few hundred to a few thousand dollars per year.

What are the benefits of buying an electric car battery?

Buying an electric car battery can provide long-term cost savings, as you won’t have to pay monthly lease fees. It also allows you to have full ownership and control over the battery.