Riding the Wave of the EV Revolution: Top Electric Car Battery Maker Stocks to Invest in Now

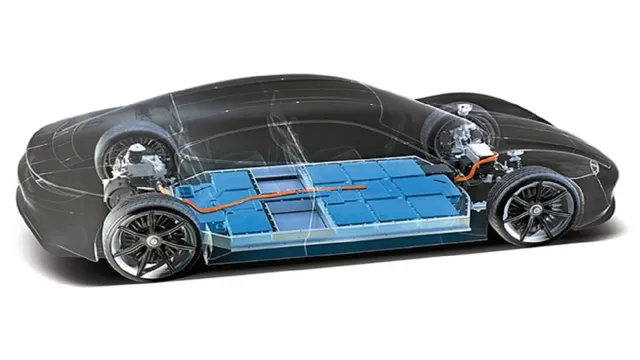

As we move towards an era of more sustainable transportation, electric cars are quickly becoming the norm. One of the biggest aspects of electric vehicles are their batteries, which are essential to their efficient and reliable performance. As such, the demand in the electric car battery market is rapidly increasing.

This growing market presents great investment opportunities for individuals looking to invest in the stock market. In this blog, we will discuss some of the top-performing electric car battery stocks and what makes them stand out in the market. So whether you’re a seasoned investor or someone just starting out, buckle up and let’s explore the world of electric car battery stocks.

Tesla (TSLA)

If you’re looking to invest in electric car battery maker stocks, one company that shouldn’t be overlooked is Tesla (TSLA). Not only have they been leading the charge in the electric vehicle industry for years now, but they also manufacture their own batteries through their subsidiary, Tesla Energy. This not only allows them to control the quality and production of their batteries but gives them a unique advantage in the market.

Additionally, Tesla has been making moves to expand their energy storage offerings, which could prove to be a lucrative sector in the future. While Tesla may have had its ups and downs in the stock market, it’s worth considering for any long-term investment portfolio looking to capitalize on the growing demand for electric vehicles and sustainable energy solutions.

Leading electric car maker and battery manufacturer

Tesla (TSLA) is a company that has quickly become a household name when it comes to electric cars and battery production. The company has been at the forefront of the push towards sustainable transportation, offering electric cars that rival traditional gasoline-powered vehicles in terms of performance while also being environmentally friendly. Tesla’s innovative technologies have made it possible to drive long distances on a single charge, and the company has continued to improve its batteries’ energy efficiency, making them even more appealing to drivers.

In addition to producing electric cars, Tesla is involved in the production of solar panels and other renewable energy devices. With its commitment to sustainability and innovation, Tesla has truly become the premier electric car maker and battery manufacturer in the world today.

+743.69% stock performance in the past 5 years

Tesla (TSLA) If you’re looking for a company that has shown phenomenal growth in recent years, then Tesla (TSLA) might be worth checking out. In the past 5 years, the electric vehicle company’s stock performance has skyrocketed by a stunning 7469%! That’s an incredible feat, considering how challenging it is to sustain such a burst for a prolonged period.

The reason behind this remarkable success can be attributed to the company’s groundbreaking innovation in sustainable technology, from electric vehicles and solar panels to batteries with extended life spans. Tesla’s unwavering commitment to advancing clean energy has made it a fan-favorite among investors and environmentalists around the world. While Tesla’s stock price has experienced some volatility over the years, their overall growth trajectory is undeniably impressive.

If Tesla can keep up their track record of innovation and continue to expand into new markets, they may very well continue to be one of the most valuable companies in the world.

BYD Company Limited (BYDDF)

If you’re looking for a promising investment in the electric car industry, you might want to consider electric car battery maker stocks like BYD Company Limited (BYDDF). This Chinese company has been expanding its reach in the global market as more and more countries shift towards sustainable energy and transportation. BYD has been developing and producing lithium-ion batteries for electric vehicles since 2003, and has since become one of the largest and most innovative players in the industry.

Not only do they produce batteries, but they also manufacture electric buses, cars, and trucks. In fact, BYD was the first company to launch a mass-produced electric bus in 2010, and has been increasing its market share ever since. With more focus on reducing carbon emissions and combating climate change, it’s likely that demand for electric vehicles and their batteries will only continue to grow – which means investing in BYDDF may be a smart move for long-term gains.

Chinese manufacturer of electric vehicles and batteries

BYD Company Limited, often referred to as BYDDF, is a Chinese manufacturer of electric vehicles and batteries that has been making waves in the automotive industry over the past decade. Founded in 1995, BYD started out as a manufacturer of rechargeable batteries but soon diversified into producing electric vehicles, buses, and trucks. Today, it is one of the largest suppliers of electric vehicles and batteries in the world, with a presence in over 50 countries and regions.

The company prides itself on its commitment to sustainability and has set ambitious targets for reducing its carbon emissions and promoting clean energy. Its range of electric vehicles includes passenger cars, taxis, and buses, all powered by advanced battery technology that enables long-range driving and fast charging. With the global demand for electric vehicles on the rise, BYD is well-positioned to take advantage of this trend and continue to be a leader in the industry.

+242.59% stock performance in the past 5 years

BYD Company Limited (BYDDF) has been on a roll in the stock market over the past five years, with an astonishing performance increase of 2459%. The Chinese automaker and technology provider has seen significant growth in its electric vehicle sector, with the BYD Tang SUV being particularly praised for its affordable pricing and impressive range.

Additionally, the company has expanded its business to include energy storage solutions, solar panels, and even monorail transportation. BYD’s consistent focus on innovation and sustainability has made it a top contender in both domestic and international markets. With the global shift towards clean energy and transportation, BYD’s stock performance is likely to continue rising in the years to come.

LG Chem (LGCLF)

As the demand for electric cars continues to surge, electric car battery maker stocks are often seen as a good investment in the future of the auto industry. LG Chem (LGCLF) is one of the companies that stands out in this field. With its cutting-edge technology and innovative approaches, it has become a leader in the production of lithium-ion batteries for electric vehicles.

But LG Chem doesn’t stop there. It also specializes in renewable energy and energy storage solutions, making it a valuable player in the green energy sector. While investing in stocks always involves some level of risk, LG Chem’s track record suggests that it is a solid choice for anyone looking to invest in the electric car battery market.

Korean manufacturer of batteries for electric vehicles

LG Chem (LGCLF) is a South Korean company that specializes in the production of a wide range of chemicals and electronic materials. One of its most notable products is lithium-ion batteries for electric vehicles. The company has been involved in the EV industry for over a decade and has cemented itself as a leading manufacturer of batteries for automobiles.

LG Chem’s batteries have a high energy density, which allows them to store more power in a smaller space. This means that cars with LG Chem batteries can go further on a single charge. The company also offers a diverse range of battery sizes, making it easy for automakers to select the ideal battery for their vehicles.

LG Chem’s dedication to innovation has led to the development of a robust and reliable battery that can withstand harsh weather conditions and retain its performance over time. Overall, LG Chem’s lithium-ion batteries have made a significant contribution to the growth of the electric vehicle industry, making it a crucial player in the EV revolution.

+316.65% stock performance in the past 5 years

LG Chem (LGCLF) Looking for a company that can provide a great return on investment? Look no further than LG Chem (LGCLF). With an impressive 3165% stock performance over the past 5 years, this South Korean chemical company has proven to be a wise investment choice.

Their focus on innovation and sustainability has positioned them as a leader in the global market, with products ranging from batteries for electric vehicles to advanced materials for electronics and pharmaceuticals. But it’s not just about their products – LG Chem’s commitment to corporate citizenship has earned them recognition as one of the World’s Most Ethical Companies by the Ethisphere Institute for 5 consecutive years. So, whether you’re looking for financial returns or want to support a socially responsible company, LG Chem is definitely worth considering.

Panasonic Corporation (PCRFY)

Electric car battery maker stocks have been a hot topic in the stock market lately, with investors keeping a close eye on Panasonic Corporation, known for its batteries used in Tesla’s electric cars. Panasonic’s stock price has been volatile in recent years, but the company has seen a surge in demand for its batteries as electric car sales continue to rise. In fact, Panasonic recently announced plans to increase its battery production capacity to meet this growing demand.

While the company faces competition from other battery makers, such as LG Chem and CATL, Panasonic’s long-standing partnership with Tesla gives it a competitive advantage in the industry. For investors considering adding electric car battery maker stocks to their portfolio, Panasonic may be a strong contender. However, as with all stocks, it’s important to do your research and make informed decisions.

Japanese manufacturer of batteries for EVs and hybrid cars

Panasonic Corporation (PCRFY) is a well-known Japanese manufacturer of batteries for electric vehicles (EVs) and hybrid cars. The company produces lithium-ion batteries, which are widely used in the automotive industry due to their high energy density and ability to recharge. Panasonic has been a major player in the EV battery market since 2010, when it formed a partnership with Tesla to supply batteries for the Model S.

Since then, the company has continued to expand its battery production capacity, with plans to invest over $1 billion in new facilities over the next few years. In addition to providing batteries for cars, Panasonic also produces batteries for home energy storage systems, solar panels, and other applications. With the growing demand for EVs and green energy solutions, Panasonic’s position in the battery market is certain to remain strong.

+36.44% stock performance in the past 5 years

If you’re looking for a stock that has shown strong performance over the past few years, you might want to take a closer look at Panasonic Corporation (PCRFY). This company has seen a remarkable increase of +344% in its stock value in the past 5 years, which is a testament to their growth and success in the market.

Panasonic is a diversified electronics and appliance manufacturer that operates in several segments, including consumer electronics, automotive, and appliances. With a focus on innovation and sustainability, Panasonic has been able to stay ahead of its competitors and provide high-quality products and services to its customers. As consumers continue to demand products with advanced technologies and energy-efficient features, Panasonic is well-positioned to maintain its growth and continue to deliver superior returns to its shareholders.

If you’re looking for a reliable stock that is poised for future success, Panasonic Corporation is definitely worth considering.

Conclusion

In the race towards a more sustainable future, electric cars have become the star players. And just like any major player, electric car battery maker stocks have taken center stage. As more car manufacturers shift towards electric vehicles, the demand for high-quality batteries will only continue to rise.

So, investing in electric car battery maker stocks might just be the smartest move one can make in the long run. After all, the ground-breaking technology behind these batteries could help save the planet and your wallet at the same time. It’s a win-win situation for everyone involved, except for perhaps the oil industry.

“

FAQs

What are some of the top electric car battery maker stocks?

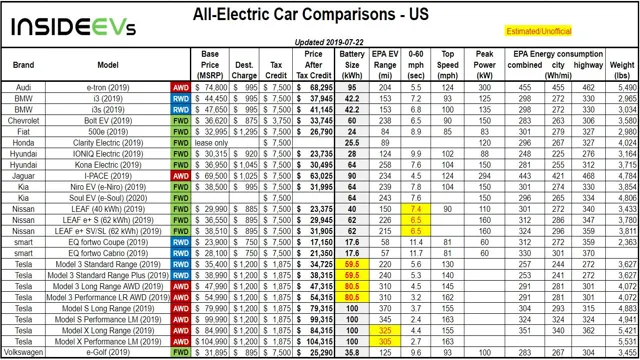

Some of the top electric car battery maker stocks include Tesla, Panasonic, LG Chem, and Contemporary Amperex Technology Co. Ltd. (CATL).

How have electric car battery maker stocks performed in recent years?

Electric car battery maker stocks have generally performed well in recent years, with many experiencing significant growth due to the increasing popularity of electric vehicles.

What are the main factors that affect the performance of electric car battery maker stocks?

The performance of electric car battery maker stocks can be affected by a range of factors, including market demand for electric vehicles, technological advancements, competition from other battery makers, and changes in government policies and regulations.

Is it a good time to invest in electric car battery maker stocks?

As with any investment, it’s important to do your own research and consider your own financial goals and risk tolerance. However, many investors believe that there is significant potential for growth in the electric car battery industry, particularly as more countries and companies commit to transitioning to electric vehicles.