Unveiling the Power of Electric Car Battery Mining Stocks: A Potential Revolution in the Clean Energy Industry!

Imagine taking a road trip in an electric car with limitless power supply. You wouldn’t need to stop at charging stations along the way, nor do you have to worry about running out of battery. You could go on exploring new destinations without any limitations, thanks to the electric car battery technology.

But, have you ever wondered where all of these batteries come from? Battery mining is a crucial part of the electric vehicle industry, and electric car battery mining stocks are booming. With the increasing demand for electric cars, the demand for lithium-ion batteries has also skyrocketed, leading to a surge in the demand for battery metals such as lithium, cobalt, and nickel. As a result, the electric car battery mining industry has become one of the fastest-growing sectors in the stock market.

In this blog, we’ll take a closer look at electric car battery mining stocks, the important role they play in the electric car industry, and why you should consider investing in them.

Introduction

Electric car battery mining stocks are becoming increasingly popular among investors as the demand for electric vehicles continues to rise. With more and more people making the switch from traditional fuel vehicles to electric, the need for efficient and reliable batteries is also on the rise. This has led to a surge in investment in the companies that mine the materials used in electric car batteries such as lithium, graphite, and cobalt.

As countries around the world make efforts to reduce their carbon footprint, the market for electric vehicles is expected to continue growing, which in turn will boost the demand for battery materials. As a result, investing in electric car battery mining stocks may prove to be a wise decision in the long term.

What are Electric Car Batteries?

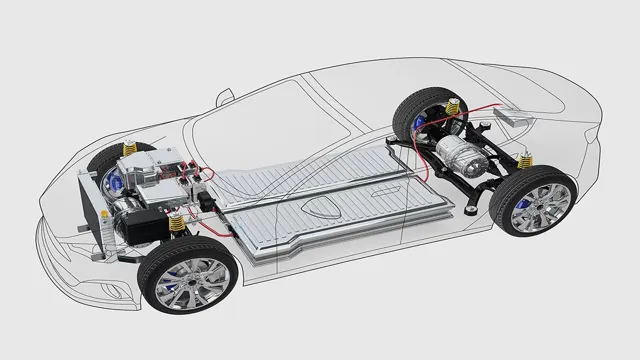

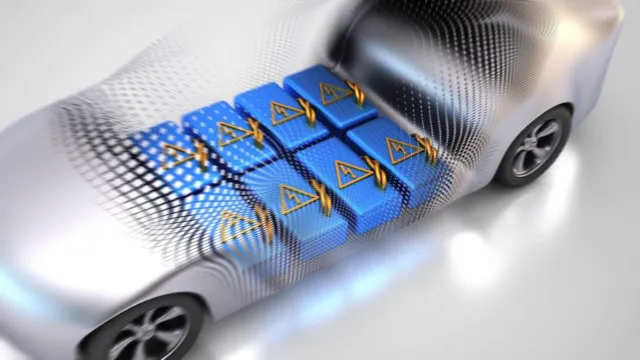

When we talk about electric cars, we cannot forget the key component that powers these vehicles: the battery. Electric car batteries are rechargeable devices that store energy for the vehicle to use while driving. These batteries differ from traditional car batteries because they are much larger and more complex.

They are composed of many small cells that work together to produce the necessary power for the car. The main advantage of electric car batteries is that they do not emit harmful gases while in use, making them a more environmentally friendly option than traditional gasoline-powered cars. Furthermore, they can be charged at home or at public charging stations, which can save drivers both time and money.

However, electric car batteries are still relatively expensive compared to traditional car batteries, making electric cars more expensive upfront. Overall, electric car batteries are a critical component of the electric car revolution and offer exciting opportunities for a greener, more sustainable future.

Why Invest in Mining Stocks for Electric Car Batteries?

Electric Car Batteries Investing in mining stocks for electric car batteries has been gaining popularity amongst investors due to the rapid growth of the electric vehicle market. As the demand for electric vehicles continues to rise, so does the demand for lithium-ion batteries which are used to power these vehicles. Lithium, cobalt, and nickel are some of the essential raw materials required in the production of these batteries.

Therefore, investing in mining stocks of these materials is becoming a lucrative option. However, investors need to consider the potential risks and rewards involved before investing in these stocks. The mining industry is known to be volatile, and fluctuations in commodity prices can significantly impact the performance of mining stocks.

On the other hand, investing in mining stocks could lead to significant returns for investors. It is essential to conduct thorough research and seek professional advice before making any investment decisions in this sector.

Top Electric Car Battery Mining Stocks to Watch

As the world shifts towards renewable energy, the demand for electric cars and their battery technology has skyrocketed. This demand has led to a surge in the electric car battery mining stocks market. Some of the top companies worth watching in this space include Albemarle Corporation, which produces lithium for electric car batteries, and Freeport-McMoRan, a copper producer which is essential in electric car battery production.

Another major player in this space is Tesla, whose focus on electric cars and sustainable energy has made it a leader in the industry. As the demand for electric cars continues to soar, investing in these electric car battery mining stocks could lead to significant returns.

Company Name and Ticker Symbol

Electric Car Battery Mining Stocks When it comes to electric cars, the batteries powering them are just as important as the cars themselves. As a result, investing in the companies that mine the materials for these batteries can be a profitable choice. One company to keep an eye on is Tesla, Inc.

(TSLA), which not only produces electric cars but also has a hand in the battery production process. Another company worth considering is Albemarle Corporation (ALB), which is one of the largest lithium producers in the world and supplies 30% of the world’s demand for the material. Other options include Sociedad Química y Minera de Chile SA (SQM), which produces a variety of chemicals and minerals used in electric batteries, and Livent Corporation (LTHM), which specializes in producing lithium.

Watching these electric car battery mining stocks may present investors with opportunities for growth and profit.

Recent Performance and Trends

If you’re looking to invest in electric car battery mining stocks, there are a few names worth keeping an eye on. One of the top performers in this space is Albemarle Corp, a lithium producer that has seen its stock surge by over 50% in the past year. Another company to consider is Livent, which specializes in the production of lithium-based products for EV batteries.

Livent’s stock has also experienced a significant uptick recently, with shares climbing by 37% over the past six months. Finally, investors might want to consider SQM, a Chilean mining company that is a major player in the lithium industry. While it may not have performed as well as other stocks in the space, SQM has a strong track record and could be a solid long-term investment option for those bullish on the growth of electric vehicles.

Overall, these three companies represent some of the top electric car battery mining stocks to watch.

Industry Outlook and Growth Potential

As the world continues to move towards renewable energy sources, the demand for electric car batteries is expected to soar. This presents investors with an opportunity to capitalize on the growth potential of electric vehicle battery mining stocks. One such stock is Albemarle Corporation (ALB), which is a leader in the production of lithium, an essential component in electric vehicle batteries.

Another promising company is Livent Corporation (LTHM), which specializes in the production of lithium hydroxide. Additionally, FMC Corporation (FMC) is another electric vehicle battery mining stock that investors should keep an eye on, as it also produces lithium and other key components for electric car batteries. The rise of electric vehicles has shifted the focus of the automotive industry towards a sustainable future, and investing in these electric car battery mining stocks could prove to be a profitable move for investors looking to capitalize on this booming industry.

Factors Affecting Electric Car Battery Mining Stocks

Electric car battery mining stocks are highly impacted by several factors that any potential investor should be aware of. One of the primary factors is the demand for electric cars themselves. As more people opt for greener transportation, the need for electric car batteries and therefore, mining operations for the materials required to build these batteries, increases.

Another key factor is the availability of these materials, such as lithium, cobalt, and nickel, which are used extensively in the production of EV batteries. Any supply chain disruption in these materials can affect the production and cost of electric car batteries, thereby impacting the mining stocks related to it. Additionally, government policies, investment in research and development, and advancements in battery technologies also play a significant role in determining the overall performance of electric car battery mining stocks.

As the need for cleaner and greener energy grows, electric car battery mining stocks are expected to remain highly sought-after by investors seeking out opportunities in the rapidly-evolving green energy sector.

Global Demand for Electric Cars

As the demand for electric cars increases globally, the mining of electric car batteries has become a hot topic. Many factors affect the mining stocks of these batteries, including government regulations, the availability of rare earth metals, and market demand. Government regulations can have a major impact on the mining industry, as many countries are looking to become more environmentally friendly and limit the amount of carbon emissions released by fossil fuel-powered cars.

Additionally, the availability of rare earth metals, such as cobalt and lithium, is crucial for the production of electric car batteries. Market demand can also play a role, as companies must keep up with consumer demand to remain competitive. As the global demand for electric cars continues to rise, it is important to consider these factors when investing in mining stocks.

Government Policies and Regulations

Electric car battery mining stocks are influenced by a number of factors. One of the most significant factors is government policies and regulations. In recent years, many governments across the world have introduced policies and regulations aimed at promoting the use of electric vehicles, with the aim of reducing harmful emissions and combatting climate change.

These policies include tax incentives for buying electric vehicles, grants for the development of EV infrastructure, and regulations requiring automakers to produce a certain percentage of electric vehicles. Such policies have a direct impact on the demand for electric vehicles and their batteries, thereby affecting the demand for mining companies that supply battery materials. Additionally, policies that promote sustainable mining and environmental protection also play a vital role in shaping the perception of investors towards electric car battery mining stocks.

Companies that demonstrate high levels of environmental responsibility are likely to attract investors who value sustainability and ethical practices in their investments. Overall, government policies and regulations are a crucial factor that investors must consider while investing in electric car battery mining stocks.

Conclusion

In conclusion, investing in electric car battery mining stocks is the perfect opportunity for those who want to have a positive impact on the environment and their bank accounts. These stocks not only provide investors with the potential for substantial profits, but they also promote the use of clean energy and sustainable transportation. So whether you’re a tree hugger or a Wall Street shark, electric car battery mining stocks are the perfect way to drive change and electrify your portfolio!”

FAQs

What are electric car battery mining stocks?

Electric car battery mining stocks are companies involved in the extraction and processing of materials used to make batteries for electric cars.

Why are electric car battery mining stocks a good investment?

Electric car battery mining stocks are a good investment because the demand for electric cars is increasing, which in turn increases the demand for battery materials such as lithium, cobalt, and nickel.

What are some examples of electric car battery mining stocks?

Some examples of electric car battery mining stocks include Albemarle Corp, Lithium Americas Corp, and Tesla Inc.

What are some risks associated with investing in electric car battery mining stocks?

Some risks associated with investing in electric car battery mining stocks include market volatility, changes in government regulations, and competition from other battery technology. It is important to do thorough research before investing.