Rising Opportunities in Electric Car Battery Penny Stocks – Invest in the Future of Clean Energy

Electric cars are rapidly gaining popularity, and many investors are eager to capitalize on this trend by investing in electric car battery penny stocks. Penny stocks offer the potential for high returns, but they also come with a high degree of risk. It’s important to do your research and carefully evaluate the potential of each company before investing your hard-earned money.

This blog post will discuss some of the key factors to consider when investing in electric car battery penny stocks, including market trends, company financials, and industry competition. So, if you’re thinking about investing in this exciting industry, read on to discover everything you need to know about electric car battery penny stocks.

What are Electric Car Battery Penny Stocks?

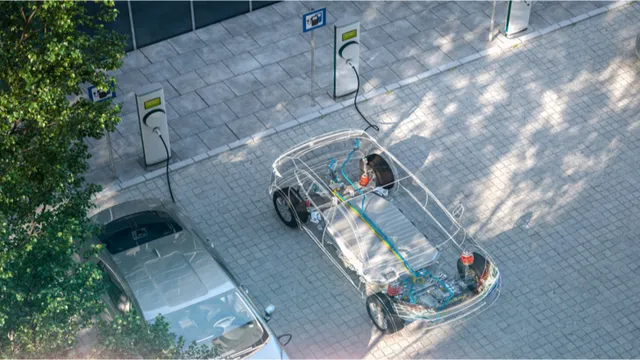

Electric car battery penny stocks are stocks of companies that manufacture and supply batteries for electric cars. They are typically low-priced stocks that are traded over-the-counter or on the pink sheets. These stocks may be an attractive investment option for some investors due to the growing demand for electric vehicles and the increasing focus on environmentally friendly transportation.

However, it is important to keep in mind that penny stocks can be highly volatile and risky, as they are often associated with smaller, less-established companies. As with any investment, it is important to do thorough research and consult with a financial advisor before making any decisions. If you’re interested in investing in electric car battery penny stocks, be sure to consider the company’s financials, their track record, and overall market trends.

Defining penny stocks and electric car batteries

When discussing penny stocks and electric car batteries, it’s important to first understand what penny stocks are. Penny stocks are stocks with a lower share price and smaller market capitalization compared to more established companies. While they may be cheap to buy, they’re also riskier investments.

When you combine penny stocks with electric car batteries, you get electric car battery penny stocks: shares in companies that produce, supply, or research batteries for electric-powered vehicles. These types of stocks can be a great investment opportunity, especially since the electric car industry is rapidly growing. However, like with any investment, it’s important to do your research before buying electric car battery penny stocks.

Look for companies with strong financials and a proven track record, and don’t base your decisions solely on the low share price. Remember, penny stocks are a more volatile investment, and you should be prepared to lose money if your investments don’t perform as planned.

Why Invest in Electric Car Battery Penny Stocks?

As the world moves towards sustainable energy, electric vehicles have become increasingly popular. This has led to a surge in demand for electric car battery penny stocks. Investing in these stocks can be a great way for investors to benefit from the shift towards electric vehicles.

These penny stocks offer the opportunity to purchase shares in companies that specialize in the production and development of electric vehicle batteries. This can include manufacturers, suppliers, and companies involved in the research and development of new battery technology. Investing in electric car battery penny stocks has the potential for significant returns, but also carries risks due to the volatility of the stock market.

However, for those who are willing to take the risk, investing in electric car battery penny stocks can be a viable option for diversifying their portfolio and taking advantage of the growth of the electric vehicle market.

Growing demand for electric cars and renewable energy sources

As the world looks towards a greener future, it’s no surprise that there’s a growing demand for electric cars and renewable energy sources. This trend has sparked a surge of interest in electric car battery penny stocks, and for good reason. Investing in penny stocks focused on electric car batteries can offer significant upside potential and high returns on investment.

One reason for this is that electric vehicles are becoming increasingly popular and more affordable. As more drivers switch to electric cars, the demand for production and innovation in car batteries will keep growing. This creates opportunities for companies in the industry, which can lead to significant gains for investors.

Additionally, renewable energy sources are becoming more ubiquitous as technologies like wind turbines and solar panels become more cost-efficient. Investing in renewable energy penny stocks can provide a hedge against traditional energy stocks while capitalizing on the growth of the sector. Overall, investing in electric car and renewable energy penny stocks can provide an exciting opportunity for investors looking to participate in the green energy revolution.

Government regulations promoting the use of renewable energy sources

Investing in electric car battery penny stocks can be a smart move, especially with the increasing government regulations promoting the use of renewable energy sources. As more and more countries push towards a greener future, the demand for electric vehicles and their components is only going to grow. This includes batteries, which are the core component of an electric car.

Companies that focus on developing and manufacturing electric car batteries are poised for success as the demand for electric vehicles increases. With the potential for strong growth, investing in penny stocks of these companies can offer a great opportunity for investors looking to enter the renewable energy market. It is important to conduct thorough research on the company before investing, as penny stocks can be volatile and require a higher degree of risk tolerance.

However, with the right investment strategy, investing in electric car battery penny stocks has the potential to generate significant returns in the long run.

Top Electric Car Battery Penny Stocks to Watch

If you’re looking for the top electric car battery penny stocks to watch, here are a few to keep your eye on. First, there’s QuantumScape Corporation (QS), which recently went public and has been making headlines for its solid-state battery technology that promises improved energy density and safety. Another option is Plug Power Inc.

(PLUG), which specializes in hydrogen fuel cells that could be a game-changer for electric vehicles. Plus, the company has partnerships with major brands like Amazon and Walmart. Lastly, there’s Tesla Inc.

(TSLA), the well-known electric car manufacturer that also produces its own batteries. Tesla’s stock has been on the rise lately, and many investors believe that its battery technology will continue to propel the company forward. Overall, these electric car battery penny stocks offer opportunities for investors looking to tap into the growing demand for renewable energy solutions.

Listing some of the popular electric car battery penny stocks on the exchange

As the world shifts towards renewable energy and electric transportation, investors are keeping a close eye on the electric vehicle battery industry. Many penny stocks on the exchange are focusing on this emerging market, and some have shown incredible potential. One such company is American Battery Metals Corporation (ABML).

Their proprietary green recycling technology for lithium-ion batteries has already attracted significant attention from major car manufacturers. Another popular option is Ideanomics Inc. (IDEX), which recently acquired a 15% stake in electric vehicle manufacturer, Energica.

IDEX’s subsidiary, Timios Holdings Corp, has also been ramping up its blockchain-based real estate transactions, adding to its diverse portfolio. Meanwhile, Flux Power Holdings Inc. (FLUX) has been making headlines with its cutting-edge battery technology for material handling equipment, providing efficient and eco-friendly solutions to a wide range of industries.

While investing in penny stocks can be risky, these companies’ commitment to innovation and sustainable solutions makes them exciting options to watch.

Highlighting their performance over the past year and future prospects

The electric vehicle market has seen significant growth in recent years, and with it, the demand for electric car batteries has also risen. As a result, there are several exciting penny stocks to watch in this fast-paced industry. One such company is QuantumScape.

They have focused on developing solid-state batteries that offer improved energy storage and faster recharge times, making them an attractive option for electric vehicles. Despite facing numerous challenges and delays, QuantumScape’s stock has continued to perform well and has become a popular choice among investors. Another promising penny stock to keep an eye on is Blink Charging.

This company specializes in providing electric vehicle charging stations across the globe, which is a critical step towards the widespread adoption of electric cars. With the increasing popularity of electric cars, Blink Charging’s stock has experienced significant growth over the past year, and the demand for their solution is only set to increase in the future. Additionally, investors may want to consider Lithium Americas, one of the world’s leading lithium producers used in battery manufacturing.

With the growing demand for batteries and lithium-ion technology, Lithium Americas is in a good position to capture a significant portion of the market share. Their stock has had steady growth over the past year and is set to continue in the future. In conclusion, the electric car battery industry is poised for significant growth, and investing in penny stocks such as QuantumScape, Blink Charging, and Lithium Americas may provide investors with a profitable opportunity.

These companies have witnessed impressive growth in their stock prices over the past year and offer promising prospects for the future. It’s always vital to conduct thorough research before investing, but with adequate knowledge and a bit of luck, investors can find great value in these penny stocks.

Risks and Rewards of Investing in Electric Car Battery Penny Stocks

Investing in electric car battery penny stocks can be both risky and rewarding. The electric car industry has been growing rapidly in recent years, and with it, the demand for electric car batteries has increased. This has led to a surge in the popularity of penny stocks for electric car battery companies.

However, these penny stocks are often highly volatile, with their prices fluctuating wildly due to the stock market’s fickle nature. Additionally, smaller companies may not have the financial stability of larger, established companies, making them more susceptible to sudden changes in the industry. Despite these risks, investing in electric car battery penny stocks can also be incredibly rewarding.

As the demand for electric cars continues to grow, there is ample opportunity for these companies to expand and increase their profits, resulting in potentially significant returns for investors. It is important to do thorough research and consider the potential risks and rewards before investing in electric car battery penny stocks.

Assessing the volatility of penny stocks

Penny stocks, electric car battery, risks and rewards. Investing in penny stocks can be tempting due to their low prices but can come with high volatility. When it comes to electric car battery penny stocks, there are both risks and rewards.

The market for electric cars is rapidly growing, and so is the demand for batteries, making these particular penny stocks alluring to investors. However, with newer technologies come greater risks, such as competition from larger corporations and government regulations. It’s important to carefully research penny stock companies, their financial standing, and their industry before investing.

Investing in electric car battery penny stocks can lead to significant rewards if done correctly, but it’s also essential to consider the potential risks and volatility associated with these investments. As with any investment, it’s crucial to have a well-informed approach and access to reliable market insights before jumping in.

Identifying risks and rewards associated with investing in electric car batteries

Investing in electric car batteries can offer both risks and rewards for penny stock investors. On the one hand, the increasing demand for electric vehicles is creating a growing market for battery manufacturers, presenting an opportunity for high returns on investments. However, this industry is also highly competitive, with many manufacturers vying for market share, which can drive down profits.

Additionally, investing in penny stocks can be volatile, with the potential for large fluctuations in stock prices. As a result, investors need to carefully evaluate all aspects of the company, including financial reports and management quality, before making any investment decisions. The key is to balance the potential rewards with the inherent risks of investing in this rapidly evolving industry.

By doing so, investors can make informed decisions that can lead to long-term success.

Conclusion

In the race towards a greener future, electric car battery penny stocks may seem like a no-brainer investment. But like any stock, caution and research are key. After all, the future may be electric, but the stock market can still be shocking!”

Summary of key takeaways and recommendations for investing in electric car battery penny stocks

Investing in electric car battery penny stocks can be a risky yet rewarding opportunity for investors. The market for electric vehicles is growing rapidly, driving up demand for the batteries that power them. However, with the emergence of new technologies and competition from established companies, there is no guarantee that penny stock companies will succeed in this market.

Investors should carefully research the company’s financial health, their partnerships, and their potential for growth before investing in them. Diversifying your portfolio and being aware of the potential volatility in the market can help mitigate some of the risks associated with investing in penny stocks. Overall, while there is a potential for high returns, investing in electric car battery penny stocks requires a cautious and informed approach.

FAQs

What are electric car battery penny stocks?

Electric car battery penny stocks are publicly traded companies that specialize in producing batteries for electric vehicles and are priced under $5 per share.

How can I invest in electric car battery penny stocks?

You can invest in electric car battery penny stocks by opening a brokerage account and purchasing shares of companies that specialize in producing batteries for electric vehicles.

How do I research electric car battery penny stocks?

Researching electric car battery penny stocks involves analyzing financial statements, understanding industry trends and news, and researching the company’s leadership and management team.

What are the risks of investing in electric car battery penny stocks?

The risks of investing in electric car battery penny stocks include volatility, lack of liquidity, and potentially poor company management leading to financial losses. It is important to thoroughly research a company before investing and understand the potential risks involved.