Riding the Green Wave: Invest in the Future with Electric Car Battery Stock ETFs

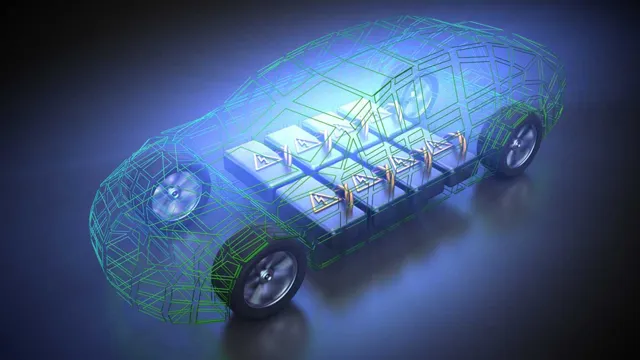

Electric cars have become increasingly popular over the years, owing to their benefits in terms of the environment and operating costs. As more and more people look to switch to electric vehicles, investors have started to see an opportunity in investing in electric car batteries. But what exactly does this mean, and how can you invest in electric car batteries? In this blog post, we’ll explore the basics of the electric car battery industry, the advantages and disadvantages of investing in this technology, and some investment tips for those looking to get started.

What are ETFs?

An electric car battery stock ETF is a type of exchange-traded fund that invests in companies involved in the development and production of batteries for electric vehicles. ETFs are collections of stocks, bonds, or other assets that are traded on an exchange much like individual stocks. These funds provide investors with a simple way to invest in a large number of companies at once.

An electric car battery stock ETF may include companies that manufacture lithium-ion batteries, electric vehicle manufacturers, and other companies involved in the growing market for electric vehicles. By investing in an ETF, investors can take advantage of the growth potential of the electric vehicle industry without having to purchase individual stocks.

Definition and Benefits

ETFs, or exchange-traded funds, are a type of investment fund that are traded like stocks on an exchange. They are made up of a diverse range of assets, such as stocks, bonds, and commodities, and are designed to give investors exposure to a particular market or sector. ETFs offer several benefits, including diversification, low fees, and ease of trading.

By investing in ETFs, investors can spread their risk across multiple assets, reducing their exposure to individual stocks or sectors. Additionally, ETFs often have lower fees than traditional mutual funds, making them a cost-effective option for investors. Finally, ETFs can be bought and sold on an exchange, making them highly liquid and easy to trade.

Overall, ETFs are a versatile and convenient investment tool that can help investors achieve their financial goals.

Types of ETFs

ETFs, or exchange-traded funds, are investment funds that are traded on stock exchanges just like individual stocks. They are composed of a portfolio of stocks, bonds, or other assets and are designed to track the performance of a particular index or sector. ETFs are an innovative investment tool that provides investors with a range of benefits, including diversification, low costs, and flexibility.

There are three main types of ETFs- Equity ETFs, Fixed Income ETFs, and Commodity ETFs. Equity ETFs invest in stocks and are the most common type of ETF. Fixed Income ETFs invest in bonds and other debt instruments.

Commodity ETFs invest in commodities like gold, silver, oil, and agriculture products. Each type of ETF has its unique investment objective and strategy. Equity ETFs are suitable for investors who want to invest in a diversified portfolio of stocks, while Fixed Income ETFs are suitable for investors who want to earn regular income from their investments.

In contrast, Commodity ETFs are suitable for investors who want to invest in commodities without taking physical ownership. Overall, ETFs are beneficial for investors who want to diversify their portfolios while keeping their costs low.

Electric Car Battery ETFs

If you are looking for an innovative way to invest in the electric car battery industry, electric car battery stock ETFs may be the perfect option for you. This type of investment allows you to buy shares of multiple companies that manufacture batteries for electric cars. As the demand for electric cars continues to rise, so does the demand for their batteries, making this a potentially profitable area of investment.

Some of the companies included in these ETFs are Tesla, Panasonic, and LG Chem. Investing in an electric car battery stock ETF may be a beneficial way to support the growth of eco-friendly transportation while also increasing your investment portfolio. So, why not consider adding an electric car battery stock ETF to your investment strategy?

Top ETFs for Electric Car Batteries

Electric car battery ETFs are a great way for investors to gain exposure to the growing electric vehicle market without having to invest in individual stocks. These ETFs provide investors with diversified exposure to companies involved in the development, manufacturing, and supply of electric car batteries. Some of the top ETFs in this space include the Global X Lithium & Battery Tech ETF, the First Trust NASDAQ Clean Edge Green Energy Index Fund, and the iShares Global Clean Energy ETF.

Each of these ETFs has its own unique focus, with some focusing on lithium mining and production, while others invest in a broad range of clean energy technologies. Investing in an electric car battery ETF can be a great way to gain exposure to the potential growth of the electric vehicle market while diversifying your investment portfolio.

Performance and Growth Trends

Electric Car Battery ETFs have emerged as a thriving investment option as environmental concerns and rising fuel costs have landed the spotlight on electric vehicles (EVs). EVs come equipped with high-capacity lithium-ion batteries, which store and supply energy to the engines. The demand for these batteries has witnessed an incredible surge, and with it, battery manufacturers and suppliers have attracted increasing interest from investors.

Electric Car Battery ETFs, which are essentially a basket of companies engaged in the manufacturing, development, and supply of EV batteries, provide an opportunity to invest in companies involved in this sector. Such ETFs offer investors exposure to various battery technologies and manufacturing capabilities without having to own individual stocks, thereby offering a diversified basket for investors who want a share of the growing market. With technological advancements and regulatory push promoting the adoption of EVs, the Electric Car Battery ETFs offer an opportunity for investors to tap into the sector’s growth potential.

Factors to Consider before Investing

When considering investments, it’s important to keep in mind the direction the world is heading towards. One market that is growing in popularity is Electric Car Battery ETFs. With the increasing demand for more environmentally friendly cars, the need for electric car batteries is rapidly increasing.

Investing in Electric Car Battery ETFs means that you gain access to a diverse portfolio of companies that are involved in the development of this technology. These ETFs could potentially offer long-term growth, as the demand for electric cars shows no sign of slowing down. It’s important to do your research and evaluate the companies within the ETF to make informed investment decisions.

Overall, Electric Car Battery ETFs could be a worthwhile investment for those who see the value in sustainable and eco-friendly technologies.

Future of Electric Car Batteries

If you’re interested in investing in the future of electric cars, it may be worth taking a look at electric car battery stock ETFs. As more and more automakers shift towards electric vehicles, the demand for high-quality, efficient batteries is only going to increase. This presents a great opportunity for investors to get in on the ground floor of this emerging trend.

Electric car battery stock ETFs typically track a basket of stocks that are involved in the production, development, and distribution of electric vehicle batteries. By investing in an electric car battery stock ETF, you can gain exposure to this growing industry while minimizing your risk. While there’s no guarantee of success when investing in the stock market, electric car battery stock ETFs are definitely worth considering for those who want to ride the wave of the electric vehicle revolution.

Current market landscape

The future of electric car batteries is looking brighter than ever before. As the world becomes more environmentally conscious, demand for electric cars is skyrocketing. This has led to an increase in research and development of battery technology, making it possible for electric cars to go further and charge faster than ever before.

One of the most exciting developments in this area is the use of solid-state batteries, which have the potential to offer greater energy density and safety than traditional lithium-ion batteries. Some companies are even exploring the use of new materials, such as silicon, in batteries, to further improve performance. With these advancements, electric cars are becoming a more viable option for consumers, and the future looks bright for the electric vehicle market.

Forecast and Growth Opportunities

The future of electric car batteries looks incredibly promising. As technology continues to evolve, we can expect to see more efficient, more powerful batteries that are capable of longer driving ranges and faster charging times. With companies like Tesla leading the way in battery innovation, we can expect to see greater penetration of electric vehicles in the coming decade.

Advances in battery technology may even make electric cars more affordable and widely available, helping to reduce our dependence on fossil fuels. So, whether you’re a fan of reducing your carbon footprint or simply want to save money on gas, the future of electric car batteries offers plenty of exciting possibilities.

Conclusion and Next Steps

In conclusion, investing in electric car battery stock ETFs can be an electrifying opportunity for investors looking to drive their portfolio to new heights. As the demand for clean energy continues to rise, the companies behind these technologies are poised to takeoff. So, plug into this electrifying trend and get ready to recharge your investments with high-voltage returns!”

FAQs

What is an electric car battery stock ETF?

An electric car battery stock ETF is a type of exchange-traded fund that invests in companies involved in the production or development of batteries for electric vehicles.

What are some popular electric car battery stock ETFs?

Some popular electric car battery stock ETFs include the Global X Lithium & Battery Tech ETF, the First Trust NASDAQ Clean Edge Green Energy Index Fund, and the Invesco WilderHill Clean Energy ETF.

Why invest in an electric car battery stock ETF?

Investing in an electric car battery stock ETF allows investors to potentially capitalize on the growth of the electric vehicle industry, as well as the increasing demand for batteries to power these vehicles. It also provides a diversified approach to investing in this industry.

What are some risks to consider when investing in an electric car battery stock ETF?

Some risks to consider when investing in electric car battery stock ETFs include the volatility of the electric vehicle industry, the potential for regulatory changes or shifts in consumer preferences, and the possibility of companies within the ETF experiencing financial difficulties. It is also important to consider the fees associated with investing in ETFs.