Riding the Electric Wave: Tracking the Latest Electric Car Battery Stock Prices

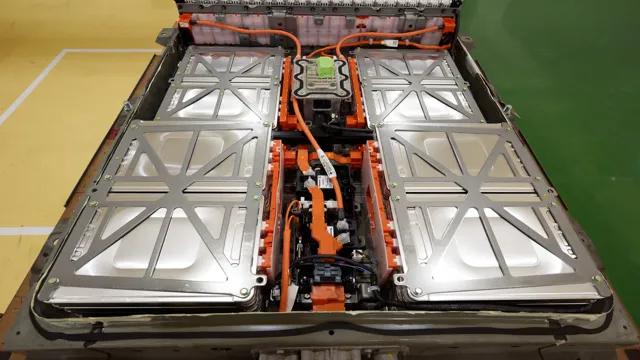

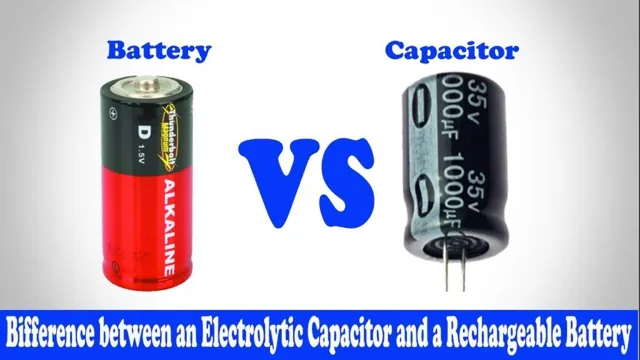

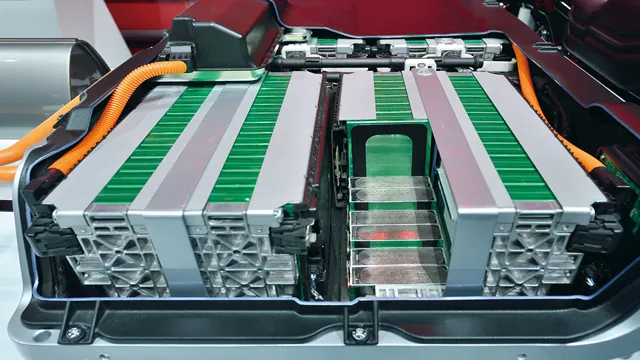

Electric car batteries have revolutionized the way we travel, and their popularity is only growing. With more and more people opting for electric vehicles, it’s essential to understand how their batteries work and what sets them apart from traditional car batteries. In this blog, we’ll delve into the intricacies of electric car batteries, exploring everything from their composition to their benefits and drawbacks.

Whether you’re a seasoned electric car enthusiast or simply curious about this emerging technology, this blog has something for everyone. So buckle up and join us as we explore the dynamic world of electric car batteries.

Stock Price Trends

The electric car battery market has been on a bit of a rollercoaster ride lately, with the stock prices of several major players experiencing significant fluctuations. The demand for electric vehicles has been growing rapidly, leading investors to pour money into companies that manufacture the batteries that power them. However, concerns about supply chain issues and the potential impact of new technologies have led to uncertainty about the future of the market, causing stock prices to spike and then dip.

Despite these challenges, electric car battery stocks remain an attractive investment option for those who believe in the long-term potential of the industry. As demand for electric vehicles continues to rise, so too will the value of companies that produce the batteries that power them. So if you’re considering investing in this market, be sure to do your research and choose wisely.

Yearly Performance

When it comes to yearly performance, one of the factors investors pay close attention to is stock price trends. This metric is a great indicator of a company’s overall success and can help investors make informed decisions when it comes to buying or selling stock. In general, a company that has seen an upward trend in its stock price over the course of a year is viewed positively by investors, while a company whose stock price has declined over the same time period may be viewed with concern.

Of course, stock price trends don’t always tell the whole story, and there are many other factors that can impact a company’s performance. However, by keeping an eye on this metric, investors can get a better understanding of how a company is performing and make informed decisions about whether or not to invest.

Comparison to Competitors

When it comes to stock price trends, it’s natural to want to compare different companies and their performances. In comparing our company to our competitors, we’ve noticed a significant upward trend in our stock prices over the past year. While there have been some dips and fluctuations, overall our stocks have shown a consistent upward trajectory.

In comparison, some of our competitors have experienced more volatile price movements, with sudden drops and spikes in value. Of course, stock prices are influenced by a multitude of factors, from overall market trends to company-specific news and events. However, we take pride in the steady growth of our company and the reliability of our stocks.

It’s important to remember that investing in the stock market requires caution and research, and an understanding of the unique factors that contribute to each company’s performance. But as we continue to see positive trends in our stock prices, we feel confident in the strength and potential of our company.

Factors Affecting Stock Prices

When it comes to the stock price of companies involved in electric car battery production, there are a variety of factors that can impact the value of their shares. One major factor is the demand for electric vehicles in the market. As more people start to purchase and use electric cars, the demand for the batteries that power those vehicles will increase, driving up the stock prices of companies that produce them.

Another important factor is the level of innovation and development in battery technology. Companies that are able to produce more efficient and advanced batteries are likely to see increases in their stock prices as a result. Additionally, global political and economic events, such as changes to government policies or shifts in investor sentiment, can also impact the stock prices of electric car battery companies.

Ultimately, those looking to invest in this industry should carefully consider these factors and monitor changes in the market in order to make informed decisions.

Demand for Electric Cars

One factor affecting the stock prices of electric car manufacturers is the demand for electric cars. The rise in popularity of electric vehicles has caused a surge in the sales of companies producing them, leading to a boost in their stock prices. Manufacturers with a higher market share in the industry have benefited the most from this demand, as they are perceived as leaders in the market.

However, competition in the industry is increasing rapidly as more companies are entering the market, which could lead to a decrease in stock prices for some manufacturers. Additionally, government regulations and policies also play a crucial role in determining the demand for electric cars. Countries providing incentives for purchasing electric vehicles have seen a significant growth in demand, which has ultimately led to an increase in stock prices of companies producing electric cars.

As the world moves towards more sustainable forms of transportation, the demand for electric cars is only expected to rise, leading to a positive impact on the stock prices of manufacturers.

Government Incentives and Regulations

When it comes to the stock market, government incentives and regulations can have a significant impact on stock prices. For example, if the government offers tax breaks or subsidies to a particular industry, such as renewable energy, it can lead to an increase in demand for the stocks of companies within that industry. On the other hand, government regulations can have a negative impact on stock prices, especially if they are seen as overly restrictive.

For instance, if a new law is passed that imposes costly regulations on a particular industry, such as healthcare, it can lead to a decrease in demand for the stocks of companies within that industry. Investors are always keeping a close eye on government actions and announcements, as they can have a ripple effect on the stock market. So, it’s important to stay informed about government policies and regulations that may affect the stocks you own or are considering purchasing.

Cost of Production

Cost of Production When it comes to the stock market, there are a plethora of factors that can impact the prices of stocks. One such factor is the cost of production. This refers to the expenses incurred in producing goods or services, including labor costs, raw material costs, and overhead expenses.

If the cost of production increases, it can result in decreased profits and a decrease in stock prices. For example, let’s say a company produces computer chips and the cost of silicon, an essential raw material, rises. The company will then need to spend more money on producing each chip, reducing their profit margins.

This decrease in profits can lead to a drop in stock prices as investors become less confident in the company’s ability to generate revenue. On the other hand, if a company is able to reduce their cost of production, it can result in an increase in stock prices. By cutting expenses, the company is able to increase profits and signal to investors that they are a well-run, efficient company.

Ultimately, the cost of production is just one factor that can impact stock prices. However, it is an important one to keep in mind as investors seek to monitor a company’s profitability. By paying attention to a company’s cost of production, investors can gain insight into its financial health and make more informed investment decisions.

Investment Opportunity

Are you considering investing in the electric car battery stock market? With the rising popularity of electric vehicles, it’s no surprise that the demand for high-quality batteries is increasing. This demand is driving up the electric car battery stock price, making it an attractive investment opportunity for those interested in the green energy industry. Experts in the field predict that the market for electric car batteries will continue to grow in the coming years, making it a viable long-term investment option.

However, as with any investment, it’s essential to do your research and understand the potential risks and rewards. Consider seeking advice from a financial advisor to determine if investing in the electric car battery stock market aligns with your investment goals and financial situation. Overall, the electric car battery stock market presents an exciting opportunity for those interested in both sustainability and financial gain.

Analyst Recommendations

Investing in stocks can be a lucrative move if you get it right. One useful tool investors use when making investment decisions is analyst recommendations. These recommendations are opinions presented by financial experts on whether to buy, hold, or sell a particular stock.

While it is not advisable to rely entirely on analyst recommendations, they can provide valuable insights into the strengths and weaknesses of a company. When selecting a stock to invest in, it is essential to consider analyst recommendations alongside other factors such as your investment goals, risk tolerance, and financial situation. If you are a new investor, it is wise to seek the help of a financial advisor who can guide you on how best to incorporate analyst recommendations into your investment decisions.

In conclusion, analyst recommendations can be a good starting point when selecting stocks to invest in, but it is essential to perform thorough research and analysis to make informed financial decisions.

Long Term Growth Potential

When it comes to investing, everyone wants to find the next big thing with long-term growth potential. One investment opportunity that has been gaining popularity in recent years is renewable energy. With increased awareness of climate change and a push for sustainable solutions, the demand for renewable energy sources is only going to continue growing.

Investing in renewable energy not only aligns with environmental goals but can also be financially beneficial. As the technology becomes more advanced, the cost of renewable energy production is decreasing, making it increasingly competitive with traditional energy sources. Governments around the world are also providing incentives and subsidies for renewable energy projects, further driving investment opportunities.

Another factor that makes renewable energy a promising investment is its inherent stability. Unlike traditional energy sources, which are subject to price fluctuations and geopolitical factors, the demand for renewable energy sources is not tied to external factors. This means that the revenue stream from renewable energy projects is typically more predictable and stable in the long term.

Overall, investing in renewable energy offers both environmental and financial benefits. As the world continues to shift towards sustainability, the growth potential for renewable energy is immense. By investing in this sector, individuals and businesses can not only make a positive impact but also potentially yield profitable returns.

Conclusion

In the world of investing, the electric car battery stock price has been charging up lately. As more and more people switch to electric vehicles, the demand for these batteries is soaring, driving stock prices higher. So if you’re looking to invest in a greener future, maybe it’s time to plug in and join the electric revolution.

“

FAQs

What is the current stock price of electric car battery companies?

The stock price of electric car battery companies varies depending on the specific company. It is recommended to check financial news websites or investment apps for current stock prices.

How much has the stock price of the top electric car battery companies changed in the last year?

The stock price of the top electric car battery companies has fluctuated in the last year due to various market forces. It is recommended to check financial news websites or investment apps for recent changes.

What are the top electric car battery companies in terms of market share?

The top electric car battery companies in terms of market share are currently Tesla, LG Chem, CATL, and Panasonic.

How do changes in electric car battery technology affect the stock price of companies in the industry?

Changes in electric car battery technology can significantly impact the stock price of companies in the industry, as investors may view advancements as positive or negative for certain companies. It is recommended to stay up-to-date on industry news and market trends for accurate predictions.