Revving Up for Growth: A Look at the Top Electric Car Battery Stocks to Watch in 2020

As the world shifts towards sustainable energy, electric cars have become more popular than ever before. They offer numerous benefits over traditional gas-powered cars, including lower emissions, fewer maintenance costs, and a quieter ride. However, one of the biggest challenges facing the electric car industry is the issue of battery technology.

Batteries are the lifeblood of electric cars, and as such, there is a growing demand for high-quality, efficient batteries that can power electric vehicles for longer periods. This is where electric car battery stocks come into the picture. In 2020, there has been a surge in the demand for electric car batteries, and as a result, battery stocks have seen a significant rise in value.

In this blog, we will take a closer look at the electric car battery stocks that are set to dominate the market in 2020 and beyond. So, fasten your seatbelt and get ready for an electrifying ride!

Current Electric Car Battery Market

Electric car battery stocks in 2020 have been on a steady rise, with investors turning their attention to this rapidly growing market. As the world becomes more environmentally conscious, the demand for electric vehicles is gradually increasing. This has caused a surge in demand for electric car batteries, which has led to an increase in stock prices for companies in this industry.

Major players, such as Tesla, have seen their stock prices rise significantly due to their impressive electric car battery technology and the growth of their electric vehicle market. Additionally, companies like LG Chem, Panasonic, and Samsung SDI are also seeing an uptick in demand for their electric car batteries as they continue to develop newer and more efficient battery technologies. The future of the electric car battery market looks bright, and investors are certainly taking notice.

If you’re considering investing in the electric car battery space, now may be a good time to do so.

Major Players in the Electric Car Battery Market

The electric car battery market is rapidly growing, and some major players are dominating the industry. Tesla is currently one of the top electric car battery manufacturers, thanks to their advanced technology that delivers long ranges and superior performance. Other big names in the field include LG Chem, Panasonic, and BYD.

LG Chem has been investing heavily in research and development, focusing on reducing prices and enhancing battery durability. Panasonic has collaborated with Tesla and also works alongside Toyota to develop batteries for hybrid cars. BYD, a Chinese company, is the world’s largest electric car battery manufacturer and has partnerships with automakers such as Daimler and Toyota.

As the market matures, more players are expected to emerge, but these firms are currently leading the pack and setting the standard for what we believe an electric vehicle battery should look like.

Recent Trends and Predictions for the Market

The current electric car battery market is seeing a significant surge due to the shift towards eco-friendliness and sustainability. The market is expected to grow exponentially, with predictions estimating that it will reach $82 billion by 202

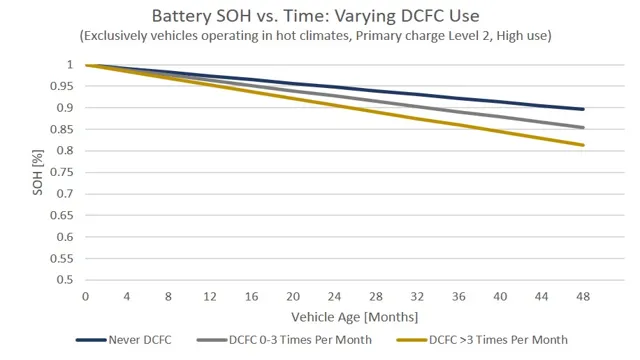

With the rise in demand for electric vehicles, the demand for batteries has also increased, causing manufacturers to invest more in research and development to create more efficient and cost-effective batteries. The key players in the market are focusing on developing advanced battery technologies with higher energy density, longer lifespan, and faster charging capabilities. The introduction of solid-state batteries is one of the recent trends, which is expected to revolutionize the market.

The solid-state battery technology has the potential to double the driving range of electric vehicles, making them more reliable and convenient for consumers. As the need for sustainable transportation increases, electric car technology will continue to evolve, and we can expect to see significant advancements in the electric car battery market in the coming years.

Investing in Electric Car Battery Stocks

If you’re interested in investing in electric car battery stocks for 2020, there are a few companies to consider. One of the top players in the industry is Tesla, which not only produces electric cars, but also manufactures its own batteries through its Gigafactory. Other companies to look at include Panasonic, which supplies batteries to Tesla as well as other carmakers, and LG Chem, which produces batteries for Tesla’s competitors such as GM and Ford.

One thing to keep in mind is that the industry is highly competitive and constantly evolving, so it’s important to do your research and stay up to date on the latest developments. Although investing in electric car battery stocks can be risky, it’s also an opportunity to be a part of a rapidly growing and significant sector of the market.

Analysis of Top Electric Car Battery Stocks

Investing in electric car battery stocks can offer a promising opportunity for investors seeking growth in the renewable energy sector. As electric vehicles gain traction worldwide, the demand for high-performance and reliable batteries is growing rapidly. Some of the leading electric car battery manufacturers include Tesla, Panasonic, BYD, LG Chem, and CATL.

Tesla’s partnership with Panasonic in producing lithium-ion batteries for its electric cars has been a significant factor in its success in the electric vehicle market. While LG Chem and CATL are both growing quickly, with a focus on innovation and expanding their market reach. As the demand for electric vehicles continues to rise, investing in electric car battery stocks can potentially provide attractive financial returns while contributing to a sustainable future.

However, investors must be mindful of the risks associated with investing in the renewable energy sector and carefully consider the long-term prospects of a company before investing.

Factors to Consider When Investing in Electric Car Battery Stocks

Investing in electric car battery stocks can be a smart move for the savvy investor looking to stay ahead of the curve. However, it’s important to consider a few key factors before diving in. One crucial aspect to keep in mind is the demand for electric cars themselves.

These vehicles are becoming increasingly popular among consumers, which means the demand for their batteries is also on the rise. It’s also important to research the specific company you’re considering investing in, and to pay attention to factors like their financial health, track record, and competitive advantages. Evaluating the overall health of the electric car industry as a whole can also provide valuable insight into the potential success of your investment.

By taking these factors into account, you can make an informed decision about whether investing in electric car battery stocks is right for you.

Potential Risks and Rewards of Investing in Electric Car Battery Stocks

Investing in electric car battery stocks can be a risky but rewarding endeavor. On one hand, there is no denying that the demand for electric vehicles and their batteries will only continue to rise as more people become environmentally conscious and governments push for cleaner transportation. However, the industry is still relatively new and volatile, with a number of competitors vying for dominance.

This means that there is a high level of uncertainty surrounding future growth and profitability. On the upside, investing in electric car battery stocks could be a lucrative long-term investment, especially for those who have a high tolerance for risk and a long investment horizon. One key advantage is that the technology behind electric car batteries is constantly evolving and improving, which means that companies that are able to innovate and stay ahead of the curve will likely be rewarded.

As with any investment, it’s important to do your research and consider your investment goals and risk tolerance before diving in.

Future Outlook for Electric Car Battery Stocks

When it comes to investing in electric car battery stocks in 2020, it seems that the future is bright. Many leading automakers are now investing heavily in electric vehicle production, and battery technology is advancing at an impressive pace. This leads to the expectation that the demand for high-quality electric car batteries will continue to grow substantially in the coming years.

With this in mind, it’s safe to predict that investing in the right battery stock could prove to be a smart choice. However, it’s essential to keep an eye on the market to identify the companies that are leading the charge in terms of battery innovation and production. The potential for a high-level return on investment may be significant, but it’s crucial to maintain a level head and not invested blindly based on headlines alone.

With a clear understanding of the market and the technology behind it, investing in electric car battery stocks in 2020 can be an opportunity to achieve significant financial growth.

Advancements in Electric Car Battery Technology

As advancements in electric car battery technology continue to occur, the future outlook for electric car battery stocks seems promising. With the demand for electric vehicles on the rise, the need for high-performing and long-lasting batteries is at an all-time high. In recent years, companies like Tesla and Panasonic have made significant strides in developing batteries with improved energy densities and longer lifespans.

These advancements have not only made electric cars more reliable and efficient but have also increased investor confidence in the electric car market. As a result, many investors are turning their attention to electric car battery stocks, anticipating continued growth and profit potential in the coming years. With so much innovation happening in the electric car battery industry, there is no doubt that we will continue to see exciting developments and opportunities for investors in the future.

So, the electric car battery market holds great potential for future investment.

Potential Disruptors in the Electric Car Battery Market

The electric car battery market has seen significant growth in recent years, with many potential disruptors on the horizon. One major player is solid-state batteries, which offer higher energy density and faster charging times than traditional lithium-ion batteries. Companies like QuantumScape and Toyota are already investing heavily in this technology, and it could rapidly become the new standard in electric car batteries.

Another potential disruptor is the use of recycled materials in battery production, as companies like BMW and Northvolt are pioneering more sustainable battery production methods. Additionally, Tesla’s new “tabless” battery design could increase energy density and reduce costs, making electric cars more accessible to the average consumer. With so many innovative developments on the horizon, the future outlook for electric car battery stocks remains promising.

Conclusion

As we venture further into the new decade, one thing is for certain: electric car battery stocks are charging up the market like never before. These powerhouses of eco-friendly energy are revolutionizing the automotive industry and investors are taking notice. With the potential for explosive growth, it’s no wonder that the electric car battery sector is driving the push towards a greener future.

So buckle up, put on your seatbelt, and get ready to watch these electrifying stocks zoom down the long and winding road of success.”

FAQs

What are the top electric car battery stocks to invest in for 2020?

Some of the top electric car battery stocks to consider investing in for 2020 include Tesla, Panasonic, LG Chem, CATL, and BYD.

How much growth is expected in the electric car battery industry in 2020?

The global electric car battery market is expected to grow at a compound annual growth rate (CAGR) of over 20% from 2020 to 2025.

What factors are driving the growth of the electric car battery industry in 2020?

The increasing demand for electric vehicles, government initiatives and investments in the development of EV infrastructure, growing concern for environmental sustainability, and advancements in battery technology are factors driving the growth of the electric car battery industry in 2020.

What are the challenges facing the electric car battery industry in 2020?

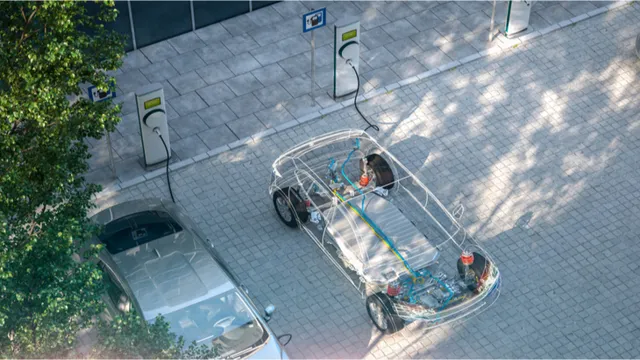

Some of the challenges facing the electric car battery industry in 2020 include the high cost of batteries, the dependency on rare earth metals for battery production, the lack of charging infrastructure, and the limited driving range of some EVs.