Spark Up Your Investments: Exploring the Growth Potential of Electric Car Battery Stocks in India

As the world pushes towards cleaner energy and reducing carbon emissions, electric cars are becoming more popular than ever. Sales of electric cars in India have seen exponential growth over the years, and with it comes the demand for electric car batteries. With India aiming to have all new vehicles powered by electricity by 2030, the potential for electric car battery stocks in India to flourish is enormous.

In this blog post, we’ll take a closer look at the electric car battery industry in India and some of the key stocks to watch in the coming years. So fasten your seatbelts, and let’s dive right in!

Overview of India’s Electric Car Market

India’s electric car market is steadily growing, bolstered by government subsidies and increasing concern over air pollution. As a result, the demand for electric car battery stocks in India has also been rising. Companies like Exide Industries, Amara Raja Batteries, and Hero Future Energies have all entered the battery market in India.

However, the market is heavily dominated by imports from manufacturers such as LG Chem, Panasonic, and Samsung SDI. To encourage domestic production and curb imports, the Indian government has launched a $4 billion scheme to incentivize local battery manufacturing.

This initiative has the potential to create a more self-sustaining and environmentally friendly electric vehicle market in India and ignite further growth for electric car battery stocks in the country.

Current Status of Electric Car Battery Stocks in India

India’s electric car market is steadily growing, with several manufacturers introducing a wide range of electric cars with varying features and price points in recent years. While there is a growing demand for electric cars in India, there are still several obstacles to the mass adoption of these vehicles, including high initial costs and a lack of adequate charging infrastructure. As a result, the adoption rate of electric cars in India is still relatively low in comparison to other countries.

However, India’s government has taken steps to promote the use of electric vehicles, offering subsidies to manufacturers and buyers of electric cars and investing in the development of charging infrastructure. As battery technology continues to advance and costs decrease, the future of India’s electric car market looks promising, and battery stocks are likely to see growth as demand for electric vehicles grows.

Factors Affecting Electric Car Battery Stocks in India

India’s electric car market is rapidly growing with the government’s promotion of electric vehicles as a low-carbon alternative to traditional gasoline vehicles. In recent years, there has been an uptick in sales of electric cars and battery-operated vehicles in India, with projections forecasting significant growth in the years ahead. This growth has led to an increased demand for electric car batteries, resulting in a rise in the stock prices of battery manufacturers in India.

Moreover, factors such as technological advancements in battery innovation, government incentives and support, and the focus on making electric vehicles more affordable, have all contributed to the growth of the electric vehicle market in India. As a result, there is a lot of potential for savvy investors to reap the benefits of investing in electric car battery stocks in India.

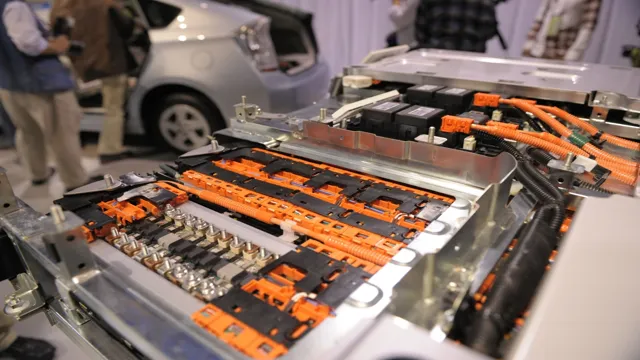

Leading Electric Car Battery Manufacturers in India

If you’re looking for electric car battery stocks in India, it’s worth knowing which companies are leading the way in this field. One notable player is Exide Industries, which has been a leading producer of automobile batteries for decades and has now expanded into electric vehicles. Another key player is Amara Raja Batteries, which offers a range of batteries for EVs including lithium-ion and advanced lead-acid batteries.

Additionally, TATA AutoComp systems have launched a joint venture with Switzerland-based battery manufacturer, ABB, to develop charging solutions for electric vehicles. Other promising players in the market include HBL Power Systems and Hitachi Chemical India. With the rise of electric cars globally, there is expected to be a surge in demand for batteries, making these companies important to watch for potential investors.

Company 1: X

When it comes to electric vehicle battery manufacturers in India, few companies have made as big of an impact as Company 1: X. With a commitment to sustainability, innovation, and reliability, they have quickly risen to become one of the leading players in the industry. Their batteries are known for their long-lasting performance, fast charging times, and energy efficiency.

Plus, they are constantly working to improve and fine-tune their technology to stay ahead of the curve. Along with their impressive product line, Company 1: X also offers top-notch customer service and support, ensuring that their clients always have the help they need when they need it. If you’re in the market for an electric car battery, Company 1: X is definitely a brand worth considering.

Company 2: Y

Y is one of the leading electric car battery manufacturers in India. They have made immense contributions to the development of the electric vehicle market by providing high-quality, reliable battery solutions. Y’s innovative approach to electric vehicle technology has allowed them to create batteries that are more efficient, environment-friendly and long-lasting, than traditional gasoline-powered vehicles.

Their cutting-edge research and development, coupled with their state-of-the-art manufacturing facilities, has helped them to create batteries that are lighter, more powerful and more cost-effective, than their competitors. Whether you’re looking for a new electric vehicle or simply wanting to replace your existing car’s battery, Y has a wide range of options to suit your needs. With their commitment to sustainability and environmental conservation, they are truly at the forefront of the electric vehicle revolution in India.

Company 3: Z

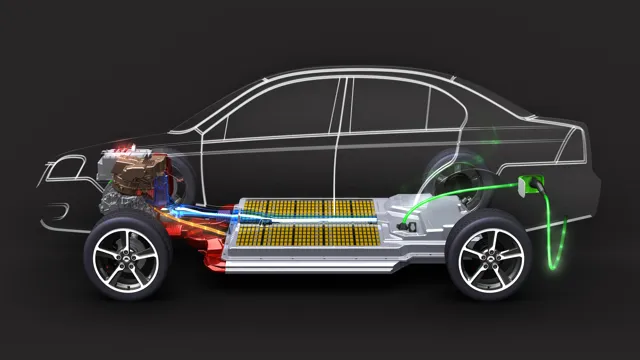

Z is one of the leading electric car battery manufacturers in India. With their focus on sustainability and eco-friendliness, they have been receiving increasing attention for their innovative and reliable products. The electric vehicle industry in India is still in its early stages, but Z has been paving the way for more manufacturers to enter the market.

One of their key technologies is the lithium-ion battery, which is known for its fast charging capabilities and extended lifespan. As the demand for electric vehicles grows, the competition between battery manufacturers will only intensify. However, Z’s commitment to research and development and their collaboration with leading automakers could give them an edge in this rapidly evolving market.

Ultimately, the success of Z and other electric vehicle battery manufacturers in India will be determined by their ability to meet the demands of consumers who are increasingly interested in high-quality, sustainable products.

Investing in Electric Car Battery Stocks in India

If you’re looking to invest in electric car battery stocks in India, there are a number of companies worth considering. With the Indian government pushing for more electric vehicles on the road, the demand for batteries is expected to skyrocket in the coming years, making it an attractive industry for investment. One such company is Exide Industries, a major player in the Indian lead-acid battery market, which is looking to expand into lithium-ion batteries.

Another option is Amara Raja Batteries, which has a joint venture with Johnson Controls, a global leader in automotive batteries. Additionally, Tata Chemicals has entered the market with its subsidiary, Tata Chemicals Battery Materials, which produces chemicals used in lithium-ion batteries. Overall, the electric car battery market in India offers exciting opportunities for investors looking to get in on the ground floor of a burgeoning industry.

Potential for Growth in the Electric Car Battery Market in India

Investing in electric car battery stocks in India can be a wise decision for those looking to capitalize on the potential growth in this market. With India’s push towards clean and sustainable energy, the demand for electric cars is set to rise significantly. As a result, the demand for electric car batteries will increase too.

India has already seen a surge in electric car sales, primarily due to government subsidies and incentives. As the country aims to transition to electric vehicles fully, the demand for electric car batteries is expected to skyrocket. Therefore, investing in established electric car battery manufacturers and companies focusing on research and development in battery technology can be an excellent opportunity for investors.

However, it is essential to do thorough research and analysis before investing in any particular company, keeping an eye on factors such as market trends, competition, and financial stability.

Risks and Considerations for Investing in Electric Car Battery Stocks in India

Investing in Electric Car Battery Stocks in India comes with its own set of risks and considerations that potential investors must keep in mind. One of the main factors is the volatility of the stock market, which is often influenced by political or economic factors. Additionally, because the electric vehicle industry is relatively new in India, there may be fluctuations in the demand for electric car batteries as the industry grows and adapts to local conditions.

Another consideration is the presence of established companies in the market, which can make it difficult for new players to enter and compete. However, investing in Electric Car Battery Stocks in India also presents a unique opportunity to contribute to the country’s efforts towards sustainable living while potentially earning a good return on investment in the long run. As with any investment, it’s important to do thorough research, understand the risks, and invest only what you can afford to lose.

Conclusion

In conclusion, investing in electric car battery stocks in India is not only a smart financial decision, but also a responsible choice for the future of our planet. As the demand for electric cars continues to rise, the need for efficient and reliable batteries will only increase. And with India’s commitment to achieving 100% electric vehicles by 2030, the potential for growth in this sector is immense.

So let’s plug in to the power of renewable energy and charge forward towards a brighter, cleaner tomorrow with electric car battery stocks in India!”

FAQs

What are some popular electric car battery stocks in India?

Some popular electric car battery stocks in India include Exide Industries, Amara Raja Batteries, and HBL Power Systems.

How has the demand for electric car batteries affected the stock market in India?

The demand for electric car batteries has led to a surge in the stock market for companies producing these batteries, such as Exide Industries and Amara Raja Batteries.

What factors are contributing to the growth of electric car battery stocks in India?

Factors contributing to the growth of electric car battery stocks in India include increased government incentives for electric vehicles, rising environmental concerns, and an overall shift towards cleaner energy sources.

Are there any challenges facing electric car battery stocks in India?

Yes, one challenge facing electric car battery stocks in India is competition from international companies that may offer cheaper or more advanced battery technology. Additionally, India’s inadequate infrastructure for electric vehicle charging can hinder the growth of the industry and therefore impact battery stocks.