Charging Up Your Portfolio: Investing in Electric Car Battery Stocks in the US

As the world moves towards renewable energy sources, the demand for electric vehicles (EVs) is skyrocketing. And while carmakers are working hard to produce more EVs, the real stars behind the scenes are the electric car battery stocks. The United States, in particular, has seen a surge of interest in electric car battery stocks, with many investors keen on taking advantage of the trend.

But why are these stocks such a big deal? And which companies are worth investing in? In this blog, we’ll take a closer look at the electric car battery market in the US and highlight some of the most promising stocks. So, fasten your seatbelts and let’s get started!

Top Companies in US Electric Car Battery Market

If you’re looking to invest in electric car battery stocks in the US, there are several companies worth considering. Tesla is at the forefront of the industry, developing its own battery technology and producing batteries for other companies as well. Another major player is Panasonic, which is partnering with Tesla to manufacture batteries for their electric vehicles.

Meanwhile, LG Chem is a leading supplier of batteries for various automakers, including General Motors and Ford. Other companies to keep an eye on include Samsung SDI, SK Innovation, and CATL, all of which are expanding their presence in the US market. With the increasing demand for electric cars, these companies are well-positioned to benefit from the growing market.

But as with any investment, it’s important to do your research and assess the risks before making a decision.

Tesla (TSLA)

Tesla (TSLA) With electric cars becoming increasingly popular in the US, the demand for electric car batteries has soared. As a result, many companies have entered the market to manufacture and supply these batteries. However, a few have stood out among the rest, including Tesla (TSLA).

Tesla is a well-known brand that has been at the forefront of the electric car market since its inception and has been continually improving its batteries’ performance. Tesla’s batteries are known for their longevity, fast charging capabilities, and high energy density, making them one of the top choices for electric car manufacturers. Other companies, such as LG Chem, Panasonic, and Samsung, are also prominent in the electric car battery market.

But with Tesla’s innovative technologies and dedication to improving its batteries, it’s no wonder they are a leader in the industry.

General Motors (GM)

Electric car battery market, General Motors (GM), top companies The electric car battery market in the US has seen an unprecedented increase in popularity in recent years. With the push towards more sustainable forms of transportation, the demand for electric vehicles has grown exponentially. General Motors (GM) is one of the top companies in the electric car battery market.

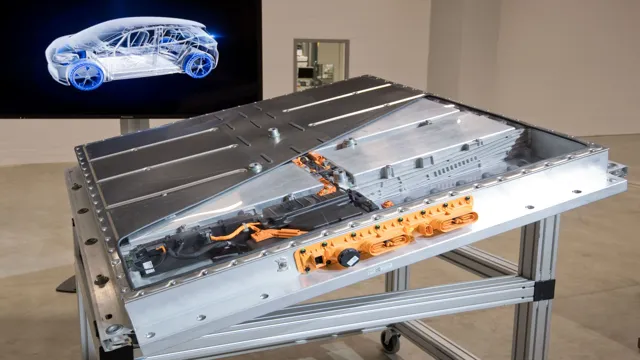

They have invested heavily in the development of battery technology and have made significant progress in creating long-lasting and affordable batteries for their vehicles. GM’s Ultium battery technology, which is set to debut in their upcoming models, promises to offer a range of up to 400 miles on a single charge. In addition to General Motors, other top companies in the electric car battery market include Tesla, Panasonic, LG Chem, and BYD.

The competition in this market is intense, and it will be interesting to see how these companies continue to innovate and push the boundaries of electric car battery technology.

Ford Motor Company (F)

One of the top companies in the US electric car battery market is the Ford Motor Company (F). They have been actively investing in electric vehicle technology and have recently announced plans to spend over $11 billion on electric vehicle production by 202 In addition to producing electric vehicles themselves, Ford has also partnered with companies like Rivian to develop new electric models.

One of Ford’s key advantages in the electric car battery market is their focus on developing advanced battery technology that can provide longer ranges for electric vehicles. They are committed to reducing their environmental impact through the use of sustainable materials and energy-efficient manufacturing processes. With their extensive experience in traditional automotive manufacturing, Ford is poised to be a major player in the electric vehicle market for years to come.

LG Chem (051910)

LG Chem, electric car battery market. When it comes to the US electric car battery market, there are a few top companies that are leading the charge. One of these companies is LG Chem, which has become a key player in the industry.

They offer a range of innovative battery solutions that are designed to improve the performance and range of electric vehicles. In fact, LG Chem is responsible for producing the battery cells used in the Chevrolet Bolt and the Chrysler Pacifica plug-in hybrid. As demand for electric vehicles continues to grow, LG Chem is well-positioned to continue to dominate the market.

Their technology is constantly evolving and improving, ensuring that they stay ahead of the curve in this rapidly developing industry. If you’re looking for a reliable and high-quality electric car battery, LG Chem is definitely a company to keep an eye on.

US Electric Car Battery Market Overview

Let’s talk about electric car battery stocks in the US. With the rise of electric vehicles and the push towards sustainable energy, the demand for electric car batteries has skyrocketed. As a result, the market for electric car battery stocks in the US is becoming increasingly competitive.

Major players in the industry include Tesla, which boasts its own proprietary battery technology, and Panasonic, which partners with Tesla to produce batteries at the Gigafactory in Nevada. Other companies such as LG Chem and Samsung SDI have also entered the US market through partnerships with automakers like General Motors and Ford. With the increasing focus on electric vehicles, the electric car battery stock market is expected to continue growing in the coming years.

It’s important to keep an eye on industry developments and potential regulatory changes that could impact these stocks.

Projected Growth in US Battery Market

The US electric car battery market is projected to grow exponentially in the next few years, with estimates showing a compound annual growth rate of over 15% between 2020 and 202 This growth is primarily driven by increasing demand for electric vehicles, which require sophisticated and reliable battery technologies to operate efficiently. The rising trend towards clean energy and sustainable transportation is also a major factor contributing to the market’s expansion.

As consumers become increasingly concerned about the environmental impact of traditional combustion engines, they are turning to electric cars as a more sustainable mode of transportation. This shift in attitude has led to a surge in investment in battery technologies, driving innovation and pushing prices down. With battery prices predicted to fall by up to 50% in the next few years, electric cars are expected to become more affordable and accessible to a wider range of consumers.

As a result, the US electric car battery market is poised for significant growth in the coming years, with unprecedented opportunities for industry players and investors alike.

EV Sales in US and Battery Market Share

The electric vehicle market is growing rapidly in the US, and so is the demand for the batteries that power them. Battery technology is constantly evolving, and there are already a few companies that dominate the market. According to recent data, Panasonic holds the greatest market share in the US electric car battery market, followed by LG and Tesla.

Lithium-ion batteries are the most commonly used batteries in electric cars, and they are becoming more efficient and cost-effective. As electric vehicles become more popular, manufacturers are focused on increasing the range of their batteries and improving their charging times. This is great news for the environment, as electric vehicles emit significantly less carbon dioxide than traditional gas-powered cars.

With the electric vehicle market growing so rapidly, it’s safe to say that the demand for batteries will continue to rise, leading to even more innovation in battery technology.

Battery Production Capacity in US

In recent years, there has been a surge in electric car production in the US, which has highlighted the need for more battery production capacity. According to market research, the US electric car battery market is set to experience significant growth in the coming years. At present, major car manufacturers are faced with a shortage of batteries, which is prolonging the time required to meet demands.

As a result, battery makers are competing to expand production, particularly for Lithium-ion batteries. The US government has also recognized the need to increase battery production capacity to support the electric car industry’s growth. To support this, the government has pledged billions of dollars in financial incentives to battery makers.

Furthermore, since the batteries’ production is energy-intensive, the government has set new electricity standards to ensure that battery makers expand production in a sustainable manner. Overall, the US electric car battery market presents enormous opportunities for investment, and it’s bound to transform the way we drive.

Investing in US Electric Car Battery Stocks

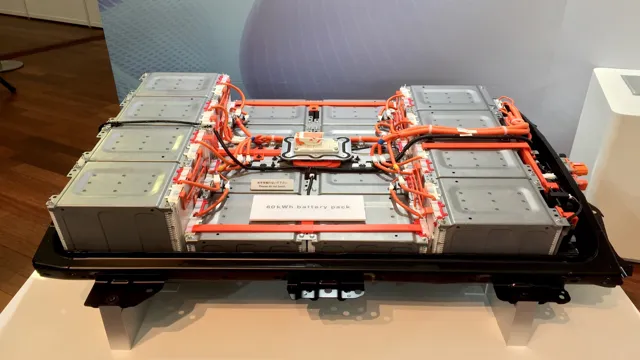

Electric car battery stocks in the US are gaining a lot of attention from investors who are looking to capitalize on the growing popularity of electric vehicles. With more and more consumers opting for eco-friendly cars, companies like Tesla, Panasonic, and Albemarle are dominating the electric car battery industry. These companies are creating high-performance battery packs that are essential for electric cars to operate efficiently and run for long distances.

Investing in electric car battery stocks in the US can prove to be a lucrative option for investors who are looking to invest in the future of sustainable transportation. These stocks offer a unique opportunity to participate in the growth of the electric car industry while also supporting environmentally-conscious technology. However, it’s important to keep in mind that these stocks are not without their risks.

It’s crucial to do your due diligence and carefully evaluate the company’s financial health and growth potential before investing. Overall, electric car battery stocks in the US are a promising investment opportunity for those who are willing to take on some risk to reap potential rewards in the future.

Risk Factors to Consider before Investing

Investing in US electric car battery stocks can be a lucrative opportunity for investors who are looking for a new market to put their money into. However, it’s important to consider the risks associated with investing in these stocks. One major risk factor is the fluctuating demand for electric vehicles.

As the electric car industry is still in its infancy, there is no telling how much demand there will be for electric vehicles in the long term. Another risk factor is the uncertainty of government policies surrounding electric cars. Changes in government regulations could significantly hinder the growth of this market and directly impact stocks.

Furthermore, there is also competition from other battery technologies and alternative energy sources that could affect the demand for electric car batteries. Before investing in US electric car battery stocks, it’s important to do your research and weigh the potential risks and rewards.

Steps to Invest in US Electric Car Battery Stocks

Investing in US electric car battery stocks can be a lucrative opportunity for investors. With the growing trend of electric vehicles, the demand for electric car batteries is on the rise. However, before investing in any stock, it is crucial to do thorough research and analysis.

The first step is to identify potential companies in the market, such as Tesla, General Motors, and Panasonic. Once you have chosen a company, review their financial statements, earnings, revenue, and outlook for the future. It is also essential to analyze the competition and potential risks.

Investing in US electric car battery stocks can provide investors with substantial returns, but it is essential to have a clear strategy and long-term mindset. It is best to consult with a financial advisor before investing to ensure that it aligns with your financial goals and risk tolerance. Overall, investing in US electric car battery stocks can be a great opportunity for investors to be a part of a growing industry while generating substantial returns.

Conclusion

In conclusion, if you’re an investor looking for a charge, electric car battery stocks in the US may be the spark you need. With the trend towards sustainability and clean energy gaining momentum, investing in these innovative companies can not only make you money but also help create a better future for the planet. So don’t wait for the competition to catch up, jump on this lucrative trend and watch your portfolio zoom ahead.

“

FAQs

What are some top electric car battery stocks in the US?

Some top electric car battery stocks in the US include Tesla, Panasonic, and Contemporary Amperex Technology Co. Limited (CATL).

How has the market for electric car battery stocks in the US performed in recent years?

The market for electric car battery stocks in the US has experienced significant growth in recent years, as electric vehicles gain popularity and governments implement policies to promote their adoption.

What companies are investing in research and development of electric car battery technology in the US?

Several companies in the US are investing in research and development of electric car battery technology, including Tesla, Panasonic, LG Chem, and General Motors.

How do fluctuations in the price of electric car battery stocks in the US affect the overall electric vehicle market?

Fluctuations in the price of electric car battery stocks in the US can have a significant impact on the overall electric vehicle market, as they can influence the cost and availability of electric vehicles and related technologies.