Revving Up the Future: A Look at the Electric Car Battery Stocks in India

Electric cars are becoming increasingly popular in India, and with them, there is a growing demand for batteries. As the government pushes for more sustainable practices, electric vehicles have become a priority, and as a result, electric car battery stocks have been skyrocketing. Investing in electric car battery stocks in India can be a smart move for those looking to capitalize on this growing trend.

But with so many options on the market, it can be challenging to know where to start. In this blog, we’ll discuss some of the top electric car battery stocks to watch in India and what factors to consider before investing. So, whether you’re a seasoned investor or looking to dip your toes into the stock market, read on to learn more about electric car battery stocks in India.

Overview of Electric Vehicle Market in India

India is a growing market for electric vehicles (EVs), with government push and favorable policies to reduce carbon emissions. With the increasing demand for EVs, there has been a rise in the demand for electric car battery stocks in India. Many companies are setting up manufacturing plants in India to tap into this potential market, including Tesla, who have just set up their first office in India.

The Indian government has set a target of 30% of all vehicles to be electric by 2030, creating a promising future for the EV industry. As more and more people move towards cleaner energy alternatives, the EV market is poised for rapid growth, creating a new wave of investment opportunities for electric car battery stocks in India. With increasing demand for batteries that are cheaper, more durable, and have higher energy densities, companies that can meet these demands are set to do well in the EV market.

Therefore, investing in these stocks is a smart decision for long-term growth and sustainability.

Current State of EV Market and Battery Usage

The electric vehicle (EV) market in India is still in its nascent stage as compared to other countries, but it is growing rapidly. India has set ambitious targets to switch to electric mobility, which includes converting 30% of all new vehicle sales to EVs by 2030. The Indian government has been promoting the adoption of EVs by offering incentives and subsidies, setting up charging infrastructure, and exempting EVs from road tax.

In addition, the cost of batteries, which is the most expensive component of an EV, is decreasing year by year, making EVs more affordable. This has led to a surge in demand for EVs, especially in urban areas, where charging infrastructure is more accessible. The major players in the Indian EV market are Tata Motors, Mahindra & Mahindra, and Ather Energy.

With the increasing popularity of EVs, it seems like the future of the automobile industry in India is electric.

Government Initiatives and Policies Supporting Electric Mobility

The Indian electric vehicle market has seen tremendous growth in recent years, with initiatives and policies supporting the adoption of electric mobility. The National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Hybrid and Electric vehicles (FAME) have provided substantial subsidies on electric vehicles to make them more affordable for customers. Additionally, the central and state governments have waived road tax and registration fees of electric vehicles.

Furthermore, the government is facilitating the installation of charging stations across the country, ensuring that electric vehicle owners have access to convenient and reliable charging infrastructure. These initiatives have had a positive impact, as India’s electric vehicle sales reached 8 lakh units in FY2020-21, a 20% increase from the previous fiscal year.

The electric vehicle market in India is expected to grow exponentially in the coming years, with the support of government initiatives and increased awareness among consumers about the benefits of electric mobility.

Leading Electric Car Battery Companies in India

If you’re interested in investing in electric car battery stocks in India, it’s important to know the leading companies in this field. One of the top electric car battery companies in India is Tata Chemicals, which produces lithium-ion batteries that are used in various electric vehicles. Another major player in this industry is Amara Raja Batteries, which produces lithium-ion batteries for electric two-wheelers and three-wheelers.

Exide Industries is also a renowned brand that produces batteries for electric vehicles and has a market share of around 30%. Furthermore, HBL Power Systems, which is known for its manufacturing of high-performance batteries for various applications, has also entered into electric car batteries production. Lastly, Mahindra Electric, owned by one of India’s largest automobile companies, is a significant player in India’s electric car battery market.

It’s worth keeping an eye on the growth and progress of these companies if you’re interested in investing in the electric car battery market in India.

Market Share and Financial Performance of Top Battery Manufacturers

The electric car market in India continues to grow at an impressive pace, and with it, the demand for electric car batteries. As more people begin to embrace the shift toward electric vehicles, the need for reliable and high-performing batteries has become more critical than ever. There are several battery manufacturers in India, but a few stand out as the leading electric car battery companies.

These include Exide Industries Limited, Amara Raja Batteries Limited, and Tata AutoComp Systems Limited. Each of these companies has built a solid reputation for producing high-quality and innovative batteries that are specifically designed for electric cars. With a focus on continuous research and development, these top battery manufacturers are working tirelessly to improve their products’ performance and efficiency while keeping their costs as low as possible.

As a result, they have succeeded in capturing a significant market share and establishing themselves as the go-to source for electric car batteries in India.

Innovations and Developments in Battery Technology

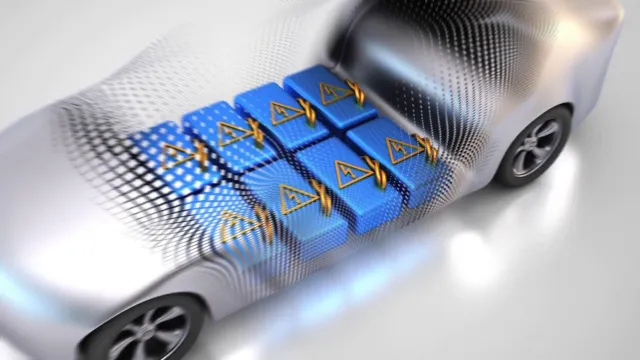

The electric vehicle market in India is rapidly growing, and this growth demands high-quality battery technology. There are several leading electric car battery companies in India, including Exide, Amara Raja, and Tata AutoComp. Exide is one of the largest storage battery manufacturers in India and produces Lithium-Ion batteries for electric vehicles.

Amara Raja, on the other hand, is known for its innovative approach and has developed a unique battery management system that optimizes battery life and performance. Tata AutoComp, a subsidiary of Tata Motors, offers Lithium-Ion battery packs for electric vehicles and has recently ventured into the manufacture of battery management systems. These companies are focused on developing cutting-edge battery technology that will reduce the cost of production and extend the range of electric vehicles.

With the ongoing research and development, the future of electric vehicles looks promising in India.

Partnerships and Collaborations between EV Manufacturers and Battery Companies

As the world becomes increasingly electrified, partnerships and collaborations between electric vehicle (EV) manufacturers and battery companies are becoming more common. In India, there are several leading electric car battery companies that are at the forefront of this trend. One such company is Exide Industries, which recently partnered with electric two-wheeler maker Ather Energy to develop and manufacture lithium-ion batteries for Ather’s vehicles.

Another key player in the Indian market is Amara Raja Batteries, which has collaborated with many major automakers to provide batteries for their EVs. Additionally, Tata Chemicals (Tata AutoComp Systems), HBL Power Systems, and Coslight India are also important players in the electric car battery arena. With more and more automakers shifting towards EVs, partnerships between EV manufacturers and battery companies will continue to play a crucial role in the development and growth of the industry.

Future Outlook for Electric Car Battery Stocks in India

Electric car battery stocks are currently seeing a boom in India’s market. This is mainly due to the government’s push towards electric vehicles and the need for sustainable modes of transportation. With an increase in demand for electric cars, the demand for their batteries will likewise increase.

This bodes well for the electric car battery stocks, as established companies like Exide Industries and Amara Raja Batteries are investing in research and development to create better batteries, while newcomers like Tata Chemicals are quickly gaining a foothold in this market. Additionally, with the decreasing cost of batteries, electric vehicles are becoming more financially feasible for the average consumer, further boosting the prospects for electric car battery stocks in India. As the demand for electric vehicles surges, electric car battery stocks are a wise investment for those looking for long-term growth.

Projections for Growth and Expansion in the EV Market

Electric car battery stocks in India are expected to see a surge in demand in the coming years as the Indian government continues to encourage the adoption of electric vehicles (EVs). With ambitious plans to electrify all new vehicles by 2030, the Indian EV market is set to witness exponential growth. In fact, it is projected to reach 63 million EVs by 2030.

This means that there will be a significant increase in demand for batteries, making it a lucrative market for battery manufacturers. However, this also presents certain challenges, such as ensuring a consistent supply of raw materials like lithium and cobalt. Despite these challenges, the Indian EV market has enormous potential, and battery stocks are poised to benefit from this growth in the years to come.

Investors looking to capitalize on this trend should keep an eye on battery manufacturers with a strong domestic presence in India, as they are likely to be at the forefront of this industry.

Factors that will Drive Demand for Electric Car Batteries

Electric Car Battery Stocks in India Electric cars have become increasingly popular, and with that, batteries for electric cars are in high demand. The future outlook for electric car battery stocks in India looks promising, as several factors will drive demand for these batteries. Firstly, the Indian government is pushing for a shift towards electric vehicles, offering incentives for manufacturers, and creating infrastructure for charging stations.

The demand for electric cars will increase with the ease of access to charging stations. Secondly, rising fuel prices and concerns over pollution will encourage more Indians to switch to electric vehicles, leading to a surge in demand for electric batteries. Lastly, the declining cost of electric batteries and technological advancements in the field will make electric cars more affordable and efficient, further driving demand.

As a result, investors can expect a bright future for electric car battery stocks in India.

Investment Opportunities in the Electric Car Battery Market

Electric car battery stocks in India are presenting some significant investment opportunities in today’s market. With the growing demand for electric cars, the demand for batteries is also increasing rapidly. This demand has resulted in a significant rise in electric car battery stocks, which has caught the attention of investors.

Investing in electric car battery stocks in India can be an excellent opportunity to capitalize on the growth potential of the electric vehicle market. Indian companies like Exide Industries Limited, Tata Chemicals, and Mahindra & Mahindra are among the leading manufacturers of electric car batteries in the country and have been showing impressive growth, attracting investors’ attention. As the trend towards renewable energy takes hold, the future of electric vehicles and their batteries is looking very promising, making this sector a very attractive investment option for those who are looking for long-term growth.

So, if you’re looking to invest in the Indian market, electric car battery stocks are definitely worth considering.

Conclusion

In conclusion, investing in electric car battery stocks in India is a smart move for environmentally-conscious investors looking to make a positive impact on the world. With the Indian government’s push for a cleaner transportation system and the increasing demand for electric vehicles, the market for electric car battery stocks is poised for significant growth. So, if you’re looking to make a profitable investment that also supports a sustainable future, consider adding electric car battery stocks in India to your portfolio.

Just remember to do your research and choose wisely – because with great power comes great responsibility.

FAQs

Which are the best electric car battery stocks in India?

Some of the best electric car battery stocks in India are Exide Industries, Amara Raja Batteries Limited, and Tata AutoComp Systems.

What is the current state of the electric car battery market in India?

The electric car battery market in India is slowly gaining traction due to the increasing adoption of electric vehicles, government incentives and initiatives, and the development of charging infrastructure.

How do electric car batteries differ from traditional car batteries?

Electric car batteries are designed to provide high power output for a longer duration, while traditional car batteries are designed to provide a burst of power to start the engine. Electric car batteries also have a higher capacity and longer lifespan.

Are there any challenges in the electric car battery industry in India?

Yes, there are still some challenges facing the electric car battery industry in India such as high costs of production and lack of infrastructure for battery recycling and disposal. However, the government is taking steps to address these challenges and promote the growth of the industry.