Revolutionizing Company Cars: Exploring the Benefits of Electric Vehicles as Company Cars

Electric cars have revolutionized the way we think about personal transportation. Thanks to their eco-friendly nature, they’re slowly replacing traditional gasoline-powered vehicles in the market. While we’re still some way off from achieving widespread adoption, there’s no denying that electric vehicles come with a suite of benefits that are too good to ignore.

One of the most significant benefits is the “Electric Car Benefit in Kind,” a tax incentive that rewards companies and fleets that switch to electric vehicles. In this blog, we’ll explore what the Electric Car Benefit in Kind is, how it works, and why it’s so important for businesses to make the switch to electric cars. By the end of this blog, you’ll have a better understanding of why electric vehicles are quickly becoming the future of transportation.

What is Benefit in Kind?

If you’re considering getting an electric car, it’s important to understand what benefit in kind (BIK) is and how it will affect you. Benefit in kind refers to the value of any non-cash perks or benefits that you receive as an employee, such as a company car. In the case of electric cars, the BIK rate is much lower compared to traditional petrol or diesel cars.

This means that the amount of tax you pay on the value of your electric company car will be significantly lower. For example, in the UK, electric cars with zero emissions have a BIK rate of 0% for the tax year 2021-2022, meaning you won’t have to pay any tax on the car’s value as it’s considered to be a benefit for the environment. This makes electric cars an attractive option for both employers and employees alike, as it can result in significant tax savings.

Plus, not only will you be saving money on tax, but you’ll also be contributing to a greener planet by driving an environmentally-friendly car.

Explaining the Basics

Benefit in kind is a term that refers to any type of non-cash benefit provided by an employer to an employee. This can include things like health insurance, company cars, housing or accommodation, and even free meals or gym memberships. Benefits in kind are often used as a form of employee compensation and can be a great way for employers to attract and retain top talent.

However, it’s important for employees to understand that they may be liable to pay taxes on these benefits, as they are considered a form of income. So, if you receive a company car, for example, this could increase your tax liability. Therefore, it’s important to understand the tax implications of any benefits in kind you receive to avoid any unexpected tax bills.

Why Choose an Electric Car?

One of the major reasons to choose an electric car is the benefit in kind (BIK). This refers to the tax that is payable on company cars, in which the percentage of tax is based on the car’s emissions and list price. With electric cars having lower emissions than petrol or diesel vehicles, the BIK rate is significantly lower as well, making it more cost-effective for both employers and employees.

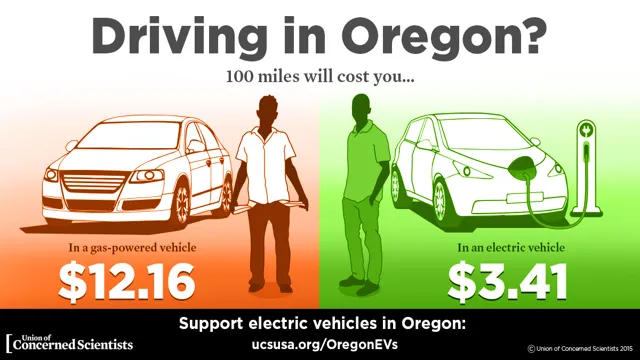

Additionally, electric cars offer a range of other benefits, such as lower running costs, a smoother driving experience, and a reduced environmental impact. With the increasing availability of charging infrastructure and more and more manufacturers producing electric vehicles, now is a great time to consider making the switch to electric. Not only is it good for your wallet, but it’s also good for the planet.

Lower Benefit in Kind Tax Rates

If you’re thinking of changing to an electric car, one of the biggest benefits is the lower Benefit in Kind (BIK) tax rates. This tax is applied to employees that receive a company car as part of their job. In recent years, the government has introduced lower tax rates for fully electric vehicles, making them an attractive option for car buyers.

This incentive encourages the transition to electric cars, which are more environmentally friendly and cheaper to run. In addition to lower BIK tax rates, electric cars often have lower maintenance costs and are exempt from road tax in some countries. So, by choosing an electric car, not only are you doing your part for the planet, but you are also saving money in the long run.

With electric car technology continuing to advance, the future is looking brighter and more sustainable for all of us.

Environmental Benefits

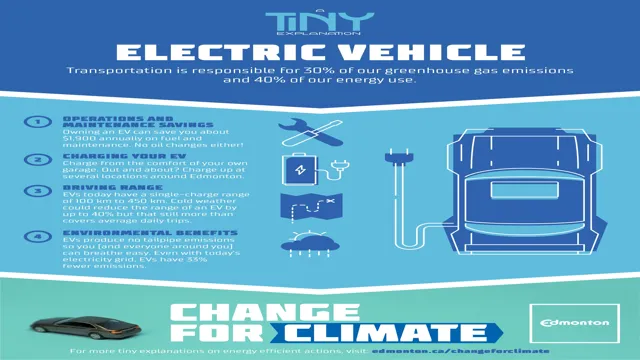

If you’re considering purchasing a new car, an electric vehicle (EV) should be at the top of your list, especially if you care about the environment. EVs produce zero emissions, meaning they don’t contribute to air pollution. This is a huge plus for those living in urban areas with poor air quality.

Additionally, EVs are much more efficient than traditional gasoline-powered cars. A typical gas-powered car only converts about 17-21% of its fuel to energy to power the car while EVs have an efficiency of around 60-70%. This equates to less energy being wasted and a reduced reliance on non-renewable resources.

Overall, EVs offer numerous environmental benefits, from reducing air pollution to conserving energy, making them a smart choice for those who want to drive a vehicle that is both eco-friendly and efficient.

How is Benefit in Kind Calculated?

If you are considering an electric car for your company car, you may be wondering how the benefit in kind is calculated. Essentially, this is the amount you will be taxed for using a company car for your personal use. The benefit in kind calculation takes into account several factors, including the car’s list price, CO2 emissions, its fuel type, and the employee’s personal tax rate.

With electric cars, the benefit in kind is usually much lower than with traditional petrol or diesel cars, as they have low CO2 emissions and are better for the environment. This tax incentive makes electric cars an attractive option for businesses looking to reduce their carbon footprint and for employees who want to save money on car tax. So, if you are thinking about investing in an electric company car, it’s worth considering how much you could save in benefit in kind taxes.

Factors That Affect Calculations

Calculating the Benefit in Kind of an employee is a complex process that takes into account various factors. Firstly, the HM Revenue & Customs (HMRC) considers the cash equivalent of the benefit provided, which is the amount that an employee would have to pay to receive the same benefit. The benefit value is then added to the employee’s other taxable income, and the total is used to calculate their tax liability.

Some of the factors that may affect the calculation of Benefit in Kind include the type of benefit provided, the employee’s salary, and the duration of the benefit. For example, if an employee receives a company car as a Benefit in Kind, the value of the benefit will depend on the car’s list price, CO2 emissions, and fuel type. Additionally, the employee’s salary and the length of time the car is available for personal use will also affect the tax liability.

It is important for employers to understand these factors when calculating Benefit in Kind to avoid any errors that could lead to fines or penalties from HMRC.

Examples and Comparison with Petrol/Diesel Cars

When it comes to calculating Benefit in Kind for electric company cars, the process can be quite different from petrol and diesel cars. Unlike traditional fuel options, electric vehicles emit zero or low CO2 emissions, making them more environmentally friendly and often resulting in lower BIK tax rates. The Benefit in Kind percentage takes into account a car’s list price, its CO2 emissions, and fuel type, among other factors.

For electric cars, the BIK percentage is based on its zero-emissions capability, resulting in a maximum BIK rate of just 1% for the 2021/22 tax year. This can be a significant advantage for both employers and employees, as electric company cars can result in a substantial decrease in taxes owed. Overall, understanding the calculations behind Benefit in Kind and how they differ for electric vehicles can provide valuable insight when deciding on the type of company car to choose.

Incentives and Support for Electric Cars

One of the incentives to promote the adoption of electric vehicles is the electric car benefit in kind (BIK) offered to employees in the UK. This is a tax on benefits received by employees who use their company cars for personal use, typically added to their income tax bills. The BIK for electric cars is currently at 0% until April 2021, reducing to 1% in April 2021 and 2% in April 202

In comparison, the BIK for petrol and diesel cars usually ranges from 16%-37%, depending on the car’s CO2 emissions. This significant reduction in tax for electric cars can save drivers hundreds or even thousands of pounds each year. Additionally, other incentives such as government grants, reduced road tax, and free public charging points are also available to encourage people to switch to electric cars.

These incentives and support can make electric vehicles a more affordable and practical choice for many, aiding the country’s transition towards a greener future.

Government Grants and Rebates

When it comes to buying an electric car, there are many incentives and support available in the form of government grants and rebates. These incentives are designed to make electric cars more affordable and accessible to the average consumer. In some states and countries, electric car buyers can qualify for tax credits and rebates that can significantly reduce the overall cost of the vehicle.

For example, in the United States, buyers of electric cars can receive a federal tax credit of up to $7,500. Additionally, some states offer additional incentives, including rebates and exemptions from certain taxes and fees. With these incentives in place, buying an electric car is not only environmentally responsible but also economically advantageous.

So, if you’re considering purchasing an electric car, be sure to explore all the available incentives and support to make the most of your investment.

Company Car Tax Exemptions

In today’s world, going green is more important than ever. With the negative effects of climate change becoming more apparent with each passing day, electric cars are one way we can help reduce our carbon footprint and keep the planet healthy for future generations. And thankfully, governments around the world are recognizing the importance of this, offering incentives and support for those who choose to go electric.

In the United Kingdom, for example, electric cars are exempt from company car tax. This not only helps reduce the cost for drivers and companies, but also incentivizes the adoption of electric vehicles. It’s just one example of the kind of support that’s available for those who want to go green and help tackle climate change.

So why not make the switch to an electric car today? Not only will you be doing your part for the planet, but you’ll also be enjoying the benefits of lower costs and tax exemptions.

Conclusion

In conclusion, the electric car benefit in kind is a shockingly good deal for environmentally conscious drivers. With lower running costs, reduced maintenance requirements, and tax incentives, it’s clear that electric cars are the spark of innovation in the world of transportation. So why wait? Join the electric vehicle revolution and charge toward a brighter, cleaner future today!”

Summary of Benefits for Choosing an Electric Car

If you’re considering buying an electric car, there are several incentives and benefits you should know about. First of all, many governments and local authorities offer financial incentives for purchasing an electric vehicle. This can take the form of rebates, tax credits, or even free charging stations.

Additionally, electric cars are more affordable to operate and maintain than gas cars, and they often have lower insurance premiums, which can save you money over time. Finally, driving an electric car is better for the environment because it produces no emissions and reduces our reliance on fossil fuels. So, not only do you get to enjoy the many benefits of driving an electric car, but you also get to feel good about making a positive impact on the planet.

FAQs

What is benefit in kind?

Benefit in kind is a non-cash perk given to employees in addition to their salaries, such as a company car.

How is benefit in kind calculated for electric cars?

Benefit in kind for electric cars is calculated based on the car’s market value, CO2 emissions, and electric range.

Are there any tax breaks for driving an electric company car?

Yes, electric company cars have a lower benefit in kind tax rate compared to petrol or diesel cars, which can result in significant tax savings.

Do electric company cars affect National Insurance contributions?

Yes, electric company cars can affect National Insurance contributions as they are considered a part of an employee’s taxable income. However, their lower benefit in kind rate may still result in lower contributions compared to petrol or diesel cars.