Calculate Your Savings: The Ultimate Electric Car Benefit in Kind Calculator

Are you an employee who’s considering switching to an electric vehicle as your company car? If so, it’s important to understand the financial implications of this decision, including the Benefit in Kind (BIK) tax that you may be subject to. Luckily, there are now online calculators available to help you estimate your BIK tax and assess the potential savings of driving an electric car. An Electric Car Benefit in Kind Calculator takes into account factors such as the make and model of the vehicle, its CO2 emissions, and your personal tax bracket to determine what your BIK tax liability would be.

Many electric vehicles have lower BIK tax rates than traditional petrol or diesel cars, making them an attractive option for both employees and employers looking to reduce their tax bills. Using an Electric Car Benefit in Kind Calculator can also help you weigh the financial benefits of switching to an electric car against the upfront cost of purchasing or leasing one. Electric cars may have higher initial costs than their petrol or diesel counterparts, but the savings on BIK tax, fuel, and maintenance costs can be significant over the life of the vehicle.

In short, an Electric Car Benefit in Kind Calculator is a valuable tool for anyone considering an electric vehicle as their company car. By providing an estimate of your BIK tax liability, it can help you make an informed decision about whether an electric car is the right choice for you. So why not try one out today and take the first step towards a cleaner, greener commute?

What is Benefit in Kind?

Are you considering an electric car for your business or personal use? If so, it’s important to understand the concept of Benefit in Kind. Benefit in Kind, or BIK, refers to any non-cash benefit that an employer provides to their employees. This can include company cars, health insurance, and even gym memberships.

In the case of electric cars, the BIK rate is lower, which means that employees who opt for an electric vehicle as their company car will pay less tax than they would on a petrol or diesel car. To determine the exact amount of BIK tax you’ll have to pay, you can use an electric car benefit in kind calculator. Simply input your vehicle details, personal details, and tax band to calculate your BIK tax rate.

With this information, you can make an informed decision about whether or not an electric car is the right choice for you.

Definition and Calculation

Benefits in kind are benefits that employees receive from their employers in addition to their salary or wages. These benefits can come in various forms, such as a company car or private medical insurance. They are given to employees as a way of incentivizing them to work harder and stay with the company for longer.

The value of the benefit in kind is calculated, and based on its monetary value, it is taxed just like income tax. Benefit in kind is often a complex area, and it can be challenging to understand which benefits are subject to taxation and which ones are not. Overall, benefits in kind are a crucial part of an employee’s overall compensation package, and they can contribute significantly to employee morale and retention.

So, it’s essential for both employers and employees to understand the impact of benefit in kind on their finances.

How Electric Cars Affect Benefit in Kind

Benefit in Kind Firstly, let’s understand what is meant by Benefit in Kind. It’s a benefit that employers provide to their employees in addition to their salary. It can consist of a range of non-cash benefits such as company cars, healthcare insurance, and gym memberships.

These benefits are given to employees as an extra incentive to work for the company or as a way of retaining staff. Employees are taxed on the value of these benefits based on the market value. One of the most valuable benefits to employees is the provision of a company car, as this allows them to use a car without actually owning one.

However, for electric cars, this has a significant effect on Benefit in Kind as they attract lower tax rates compared to traditional fuel cars. This means that employers who provide electric cars to their employees can offer a more attractive Benefit in Kind package that could entice current and potential employees alike.

Electric Car Benefit in Kind Calculator

If you are considering an electric car as your company vehicle, it’s worth checking out an electric car benefit in kind calculator. This tool allows you to estimate the tax you would be liable to pay on your electric car as it is considered a perk of the job. The calculator takes into account the car’s value, your income tax rate, and the car’s CO2 emissions.

The CO2 emissions are essential as they determine the car’s benefit in kind rate, so an electric car’s rate is currently zero. This means you can save a significant amount of money compared to a traditional combustion engine car. While you still pay national insurance contributions and income tax on the car, electric cars benefit from lower running costs, so it may still be a more financially sound option.

An electric car benefit in kind calculator can help you work out the most cost-effective way of purchasing your next company car.

Input Required Information

As electric vehicles become more prevalent on our roads, it’s important to consider the tax implications of owning one, particularly for employers who provide electric company cars to their staff. Thankfully, the Electric Car Benefit in Kind Calculator can help in this regard. This handy online tool provides a straightforward way of calculating the benefit in kind tax for electric cars, using factors such as the car’s list price, CO2 emissions, and electric range.

To use the calculator, simply input all the required information and it will provide you with an accurate estimate of the tax payable. This can be particularly useful for employees who drive electric cars as company vehicles, as it can help them budget for the additional cost of the benefit in kind tax. Additionally, employers can use this tool to determine the most tax-efficient way of providing electric company cars to their staff.

By using the Electric Car Benefit in Kind Calculator, you can ensure that you’re making informed decisions about your electric car, without any unexpected surprises come tax time. It’s worth noting that the tax implications of owning an electric car can be complex, so it’s important to consult with a tax professional if you have any specific queries or concerns.

Results and Analysis

Electric Car Benefit, Kind Calculator If you’re considering switching to an electric car for your company fleet, it’s important to understand the financial implications as it affects both the employer and employee. This is where the Electric Car Benefit in Kind (BiK) Calculator comes in. It’s a free tool that helps you to calculate the taxable benefits that employees are likely to incur from the use of company vehicles, and in this case, electric cars.

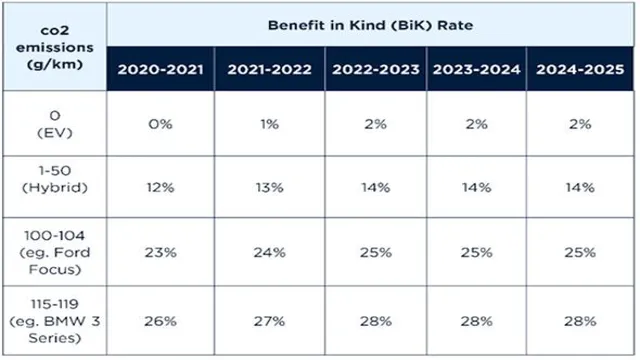

The calculator takes into account several factors including the make and model of the car, its purchase price, battery range, vehicle emissions, and the tax band. The good news is that the BiK rate for electric vehicles is significantly lower than for petrol or diesel cars. This means that employees are likely to incur lower tax liabilities and save more on their motoring costs.

Similarly, employers can benefit from lower tax liabilities and reduced fuel and maintenance costs. Overall, the Electric Car Benefit in Kind Calculator supports both employers and employees in making informed decisions about the transition to electric cars and maximizing the benefits of such a decision.

Examples of Savings and Benefits

If you’re considering purchasing an electric car, you might be wondering about the potential savings and benefits. One helpful tool to consider is the Electric Car Benefit in Kind Calculator, which helps you estimate the financial benefits of driving an electric car as a company car. By using this calculator, you can determine how much you could save on fuel costs, as well as your overall tax liability.

Additionally, electric cars are typically exempt from road tax and congestion charges, which can add up to significant savings over time. Not only that, but electric cars are generally cheaper to maintain than traditional gas-powered cars, with fewer moving parts and lower maintenance requirements. By investing in an electric car, you could not only save money, but also reduce your carbon footprint and contribute to a cleaner, greener future.

Why Use an Electric Car Benefit in Kind Calculator?

Are you considering an electric car as your next vehicle but concerned about the tax implications? Using an electric car benefit in kind calculator can help alleviate any worries you may have. This calculator estimates the amount of tax that must be paid based on the vehicle’s value, electric range, and CO2 emissions. By utilizing a benefit in kind calculator, you can make an informed decision about the financial impact of purchasing an electric car.

Moreover, it will demonstrate the potential savings available through the government’s plug-in car grant and the tax breaks that come with driving a zero-emission vehicle. With the growing interest in electric cars, it makes sense to be well informed about the benefits and tax incentives. An electric car benefit in kind calculator can help you weigh up the financial pros and cons and decide if it’s the right choice for you.

Savings on Taxes and Expenses

Using an electric car benefit-in-kind calculator can save you a lot of money on your taxes and expenses. It’s a great way to stay on top of your finances and make informed decisions about your financial future. An electric car benefit-in-kind calculator will help you determine the amount you pay in tax per year based on factors like the car’s make and model, its value, and its emissions level.

Using this tool, you can easily compare different electric car models and find the one that offers the best value for money. Plus, since electric cars have lower emissions levels than traditional cars, they qualify for lower tax rates. With an electric car benefit-in-kind calculator, you can maximize your savings and reduce your carbon footprint.

Overall, using an electric car benefit-in-kind calculator is a smart and easy way to save money and make an environmentally-friendly choice.

Reducing Carbon Footprint and Supporting Sustainability

An electric car is an excellent and sustainable mode of transport that can drastically reduce carbon footprint and help support sustainability. As such, it’s no wonder many companies are offering electric cars as company cars to their employees. However, with the introduction of Benefit In Kind (BIK) tax, many employees are worried about the cost implications of driving an electric car.

That’s where an electric car BIK calculator comes in handy. By utilizing such a calculator, employees can determine how much they will pay in BIK tax, based on factors such as the vehicle’s P11D value, CO2 emissions, and the employee’s income tax bracket. Additionally, electric car BIK calculators are beneficial in facilitating companies’ transition to low-carbon fleets by providing valuable insights into the financial implications of large scale EV adoption.

With the help of an electric car BIK calculator, employees can make informed decisions about driving sustainable electric cars without worrying about the cost implications. Therefore, the use of an electric car BIK calculator is instrumental in promoting sustainability and reducing carbon footprint.

Conclusion and Further Resources

In conclusion, calculating the benefit in kind (BIK) for electric cars may seem complex, but it’s ultimately a worthwhile endeavor. With lower taxes and reduced environmental impact, electric cars benefit both the driver and the planet. And with the help of an electric car BIK calculator, you can easily see just how much you stand to save.

So why not take the plunge and start electrifying your commute? Your wallet (and Mother Nature) will thank you!”

FAQs

What is a benefit in kind calculator for electric cars?

A benefit in kind calculator for electric cars is a tool that helps you estimate the tax you have to pay on the non-cash benefits you receive from your employer for driving an electric car.

How does using an electric car benefit in kind calculator help me save money?

Using an electric car benefit in kind calculator can help you save money by giving you an idea of how much tax you need to pay upfront. This helps you budget better and reduces any unexpected surprises when tax season comes around.

Can I use an electric car benefit in kind calculator for any type of electric car?

Yes, you can use an electric car benefit in kind calculator for any type of electric car. However, it is important to note that the benefits may vary depending on the model, make, and the year of the electric car.

How accurate are electric car benefit in kind calculators?

Electric car benefit in kind calculators are relatively accurate but may not be 100% precise. They use standard calculations based on current tax laws and rates, which can be subject to change. Therefore, it is recommended to consult with a professional tax advisor to get an accurate estimation.