5 Surprising Benefits of Electric Cars for Company Car Drivers – Exploring the Advantages of Electric Cars in Kind!

Electric cars are becoming increasingly popular as people look to reduce their carbon footprint and save money on fuel costs. But did you know that electric cars can also offer significant tax benefits? That’s right, switching to an electric car could have a positive impact on your bank balance at tax time. In fact, there are many benefits of electric cars for tax that are worth considering.

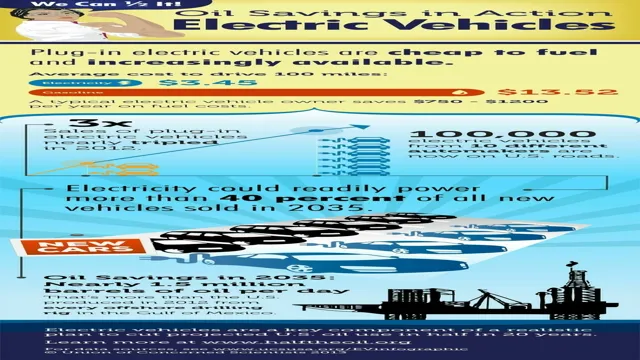

For starters, electric cars qualify for a federal tax credit of up to $7,500. This credit can be applied to the purchase of both new and used electric vehicles, making them a more financially viable option. And, depending on your state, you may also be eligible for additional tax credits or rebates.

But the benefits don’t stop there. Electric cars can also help you save money on car-related expenses, which in turn can lead to further tax savings. For example, electric cars don’t require oil changes or other costly maintenance procedures that traditional cars do.

This means you’ll save money on regular car upkeep and can put more money towards paying off your electric car. Additionally, electric cars have lower operating costs than traditional cars. They require less energy to run, which translates to lower electricity bills.

And as more and more charging stations become available, it’s becoming easier to charge your electric car while you’re out and about, meaning you’ll save money on fuel costs as well. In short, there are many benefits to owning an electric car, including tax benefits. From federal tax credits to lower operating costs, electric cars can make a big impact on your wallet.

So if you’re considering purchasing a new car, it’s worth taking a look at electric options. Not only will you be helping the environment, but you’ll also be able to reap the financial rewards that come with driving an electric car.

Reduced Tax Liability

One of the biggest benefits of driving an electric car is the reduced tax liability in the form of benefits in kind. Essentially, benefits in kind are non-cash perks that an employee receives from their employer, such as a company car. In the past, company cars were taxed based on their emissions, but now there is a lower tax rate for electric cars.

This means that employees who drive an electric car as their company car will pay less tax on it than they would on a traditional gas-powered car. In addition, electric cars are exempt from certain taxes and fees, such as road tax and the London Congestion Charge. This makes driving an electric car not only better for the environment, but also better for your wallet.

So if you’re in the market for a new company car, it might be worth considering an electric option to take advantage of these tax benefits.

Electric cars are subject to lower benefit-in-kind tax rates than traditional cars.

Electric vehicles are gaining popularity, and for good reason. Aside from being environmentally friendly, electric cars offer significant savings when it comes to taxes. More specifically, electric cars are subject to lower benefit-in-kind tax rates than traditional cars.

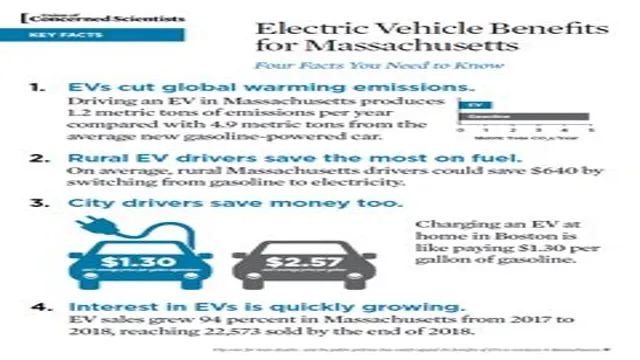

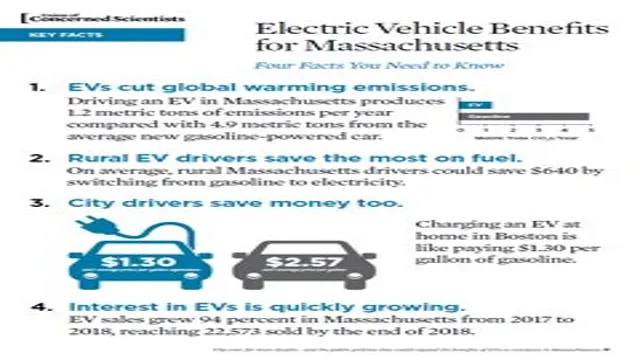

This is particularly good news for company car drivers who can benefit from reduced personal tax liabilities. In the UK, for example, the benefit-in-kind tax for electric cars is set at 1% until March 2022, which is significantly lower than the rates for cars with internal combustion engines. This means that electric car drivers will save more money in taxes than those who opt for petrol or diesel cars.

This is a significant advantage for those who are looking to save money on their transport costs while doing their part to reduce their carbon footprint. Overall, electric cars offer significant benefits beyond just being an eco-friendly option.

Tax Exemption

The rise of electric vehicles has led to a range of benefits in kind, including tax exemption. In the UK, electric cars were exempt from car tax and receiving a discount on the London congestion charge. This move encourages more drivers to switch to electric vehicles, which have a lower environmental impact than traditional gasoline-powered vehicles.

The benefits of electric cars go beyond tax advantages, as they’re cheaper to run, resulting in lower maintenance and fuel costs. Moreover, they have a better resale value, which allows individuals to recoup their investment in the long run. With these compelling benefits in kind, it’s no wonder more and more people are choosing electric cars.

Electric cars are exempt from Vehicle Excise Duty (road tax) and fuel duty.

If you’re searching for ways to save money on car taxes and fuel, an electric car might be the right choice for you. One of the benefits of owning an electric car is that it’s exempt from Vehicle Excise Duty, or road tax, and fuel duty. This means you won’t need to pay taxes on your car, which can save you a significant amount of money in the long run.

Instead of paying for fuel, you’ll only need to charge your car’s battery, which is much cheaper than buying petrol or diesel. Not only will you save money, but by driving an electric car, you’ll also be reducing your carbon footprint and helping to protect the environment. So, why not consider an electric car as your next vehicle purchase? It might just be the perfect way to reduce your tax bills and your impact on the planet.

Financial Incentives

If you’re considering purchasing an electric car, you’ll be pleased to know that there are a number of benefits in kind available to you. One of the main advantages of owning an electric vehicle is the financial incentives that come with it. These incentives can include tax credits, rebates, and reduced license fees.

In fact, in many countries, the government will even provide a monetary grant to offset the cost of purchasing an electric car. This can be particularly advantageous if you’re looking to reduce your carbon footprint and want to make a positive impact on the environment while driving. Additionally, owning an electric vehicle can help you save money on fuel costs, as electricity is typically less expensive than gasoline or diesel, making it a financially smart choice in the long run.

Overall, with the financial incentives available, purchasing an electric car can be an ideal choice for those looking to lower their carbon footprint and broaden their financial horizons.

Government grants are available for electric car owners, such as the Plug-In Car Grant and the Workplace Charging Scheme.

As a way of encouraging people to switch to electric cars, the government provides financial incentives such as the Plug-In Car Grant and the Workplace Charging Scheme. These grants are designed to make it more affordable for individuals and businesses to purchase and install charging points at their home or office. The Plug-In Car Grant provides up to £2,500 towards the cost of an eligible electric car.

The Workplace Charging Scheme offers up to £500 per socket to help businesses install charging points. These grants have made electric car ownership more affordable for many people and have contributed to the growth of the electric vehicle market. Not only does buying an electric car have environmental benefits, but it also comes with the added bonus of financial incentives from the government.

So why not consider making the switch and taking advantage of these financial incentives that are designed to make electric car ownership more accessible and affordable?

Environmental Benefits

Electric car benefits in kind are numerous, with one of the most significant being the positive impact they have on the environment. By switching to an electric vehicle, you can significantly reduce harmful emissions released into the air, ultimately improving air quality and reducing the carbon footprint. Electric cars produce zero emissions during driving because they do not rely on fossil fuels like gas or diesel.

This reduction in pollution is particularly important in densely populated urban areas where air quality concerns are high. Additionally, electric cars produce less noise pollution, offering a quieter driving experience and reducing sound pollution in the environment. Going electric also encourages the use of renewable energy sources to power vehicles, such as solar energy.

All-in-all, the environmental benefits of driving an electric car are impossible to ignore and should be an essential consideration when choosing a new vehicle.

Reduced carbon emissions and improved air quality.

Reduced carbon emissions and improved air quality are some of the most significant environmental benefits that are observed when individuals and businesses adopt environmentally conscious practices. As a result of reduced carbon emissions from vehicles and industrial processes, the amount of greenhouse gases released into the atmosphere decreases, leading to a slowing down of climate change. Additionally, limiting the quantities of pollutants emitted into the air improves air quality, leading to healthier human populations and a reduction in environmental degradation.

When businesses invest in renewable energy sources and reduce their dependence on fossil fuels, they go a long way in promoting a cleaner, healthier environment. This is why it is crucial to continue to explore and adopt clean and sustainable energy practices that have an overall positive impact not only on the ecosystem but also on human health and wellbeing.

Cost Savings

Electric cars offer a range of cost savings benefits including reduced fuel costs, maintenance costs, and tax incentives. One of the key financial benefits of driving an electric car is the reduction in costs attributed to fuel. Unlike petrol or diesel engines, electric cars are powered through electricity, which can be significantly cheaper than traditional fuels, saving you money in the long run.

Additionally, electric cars require less maintenance than conventional automobiles, as there are fewer moving parts to maintain. This translates to lower maintenance costs and greater reliability over time. Finally, electric car owners can take advantage of tax incentives offered by governments for driving eco-friendly vehicles.

This includes benefits in kind, such as reduced tax liabilities for employees who drive electric company cars. All in all, electric cars present a compelling cost-saving proposition for both private car owners and businesses alike.

Lower fuel and maintenance costs compared to traditional cars.

One of the biggest advantages of electric cars over traditional cars is their cost savings. Electric car owners enjoy lower fuel and maintenance costs compared to their gas-guzzling counterparts. First and foremost, electric cars don’t require gasoline to run, which means that owners can save hundreds (if not thousands) of dollars annually on fuel costs.

Additionally, electric cars have fewer moving parts than traditional cars, which translates to lower maintenance costs over time. There are no oil changes to worry about, and brake pads tend to last longer since electric cars use regenerative braking to slow down. Plus, electric cars are exempt from certain taxes and fees, which can further reduce the total cost of ownership.

All in all, the cost savings associated with electric cars are just one more reason to consider making the switch to a more sustainable form of transportation.

Improved Driving Experience

One of the benefits of electric cars that is often overlooked is the improved driving experience they offer. With instant torque and smooth acceleration, electric cars provide a more responsive and enjoyable ride compared to traditional gasoline-powered vehicles. Additionally, electric cars produce significantly less noise and vibration, making for a quieter and smoother ride.

This improved driving experience is not only more enjoyable for the driver and passengers, but it also helps to reduce stress and fatigue on longer journeys. Another benefit that shouldn’t be overlooked is the tax advantages that come with electric cars. With the benefits in kind, electric cars can offer significant savings for company car drivers, making them a more attractive option for business travel.

All in all, the benefits of electric cars go far beyond just being environmentally friendly – they also offer a better driving experience and significant tax advantages.

Quiet, smooth, and instant torque.

Electric vehicles are gaining popularity not just because they are energy-efficient but also because of the improved driving experience that they offer. The quiet, smooth, and instant torque that is a hallmark of electric cars can make any drive seem like a joy ride. Unlike traditional combustion engines that make a lot of noise and vibrations, electric cars offer a peaceful and serene drive.

The instant torque from the electric motor makes the acceleration process effortless, providing drivers with a feeling of exhilaration that is both thrilling and safe. One of the most significant advantages of electric vehicles is the absence of gear changes that can cause jerky movements. Instead, the electric motor provides a seamless power delivery that is both comfortable and efficient.

The improved driving experience offered by electric vehicles is something that more and more people are experiencing, leading to an increase in their adoption worldwide.

Conclusion

In the world of company cars and benefits in kind, electric vehicles have certainly taken the wheel. With lower emissions, reduced fuel costs and tax breaks, the benefits of electric cars are clear. Not only do they help the environment, but they offer a smoother, quieter ride for their drivers.

It’s time to charge ahead and switch to an electric car – your wallet, conscience and colleagues will thank you.”

FAQs

What is the current Benefit-in-Kind rate for electric cars?

The current Benefit-in-Kind rate for electric cars is 1% for the tax year 2021/22.

Are there any additional tax benefits to owning an electric car?

Yes, electric cars are exempt from paying Vehicle Excise Duty (VED) and they also qualify for a 100% discount on the London Congestion Charge.

Do I need to pay any benefit-in-kind tax on electric car charging at work?

No, the electricity used to recharge an electric car at work is tax-exempt and does not count towards the employee’s Benefit-in-Kind.

Will the benefit-in-kind tax rates for electric cars change in the future?

Yes, from 2022/23 the Benefit-in-Kind rate for electric cars will increase to 2% and will continue to rise annually until 2025/26 where it will reach a maximum of 5%.