Maximizing Your Tax Savings with Electric Car Business Benefits: A Comprehensive Guide

As the world transitions towards sustainability, electric cars are gaining popularity amongst car enthusiasts and businesses. With electric cars becoming a mainstream alternative to fossil-fueled vehicles, it’s not surprising that electric cars offer enticing tax benefits for companies. Attracted by the advantages that they offer, businesses are making significant investments in electric cars.

Apart from the environmental benefits, electric cars help companies reap substantial business tax benefits. If you’re curious about how electric cars can help your business save money on taxes, then join us in this discussion on how electric cars can offer business tax benefits!

Overview of Electric Car Tax Incentives

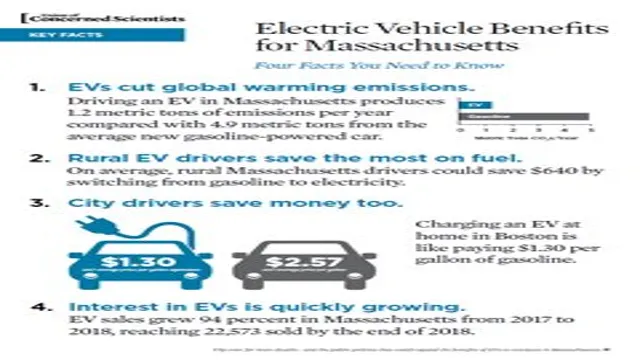

If you’re considering purchasing an electric car for your business, there may be tax benefits available to you. Electric car business tax benefits can help you save money and reduce your business’s carbon footprint. The federal government offers a tax credit of up to $7,500 for eligible electric vehicles, and some states offer additional incentives such as rebates or tax credits.

These incentives can help make the cost of purchasing an electric car more affordable for your business. Additionally, electric cars often have lower operating costs than traditional gasoline vehicles, which can save your business money on fuel and maintenance expenses. Overall, investing in an electric car for your business can be a smart financial decision that also benefits the environment.

So why not consider making the switch to an electric car and take advantage of the tax benefits available to you?

Federal Tax Credits for Electric Vehicles

If you’re considering purchasing an electric car, you may be pleased to learn about the federal tax credits available to help offset some of the cost. The federal government offers a tax credit of up to $7,500 for the purchase of a new electric vehicle. The amount of the credit depends on the vehicle’s battery size, with larger batteries qualifying for a higher credit.

It’s important to note that the tax credit is non-refundable, meaning it can only be applied to reduce your tax liability, but not to receive a refund. Additionally, the tax credit begins to phase out once a manufacturer has sold 200,000 qualifying electric vehicles, meaning that some of the most popular models may no longer be eligible for the credit. Overall, the federal tax incentives for electric cars can make purchasing an electric vehicle more affordable and help reduce your carbon footprint, so it’s worth exploring if you’re in the market for a new car.

State and Local Incentives for Electric Cars

Electric car tax incentives are a great way to encourage people to switch to more sustainable forms of transportation. Many states and local governments offer various incentives to help bring down the overall cost of purchasing an electric car. These incentives can come in the form of tax credits, rebates, and other perks.

For example, in California, residents can receive a $2,000 rebate for purchasing a new electric car, while those who live in Colorado can receive up to $5,000. Additionally, some states offer benefits such as HOV lane access, free parking, and reduced toll rates for electric car drivers. If you’re considering purchasing an electric car, it’s worth researching the incentives available in your area to see how much money you could save.

Not only will you be helping the environment, but you may save a significant amount of money in the process.

Savings on Fuel and Maintenance Costs

One major benefit of owning an electric car for your business is the savings on fuel and maintenance costs. When compared to traditional gasoline or diesel-powered vehicles, electric cars require much less maintenance, as they have fewer moving parts and do not require oil changes. Additionally, the cost of charging an electric car is significantly lower than the cost of gasoline, making it a cost-effective choice for businesses.

Furthermore, there are business tax benefits associated with owning an electric car, making it an even more attractive option. By taking advantage of tax credits and deductions, businesses can save thousands of dollars on their tax bill. With all the savings on fuel, maintenance, and tax benefits, making the switch to an electric car could be a smart decision for any business looking to reduce their expenses and positively impact the environment.

Lower Operating Costs for Electric Cars

Lower Operating Costs for Electric Cars: Savings on Fuel and Maintenance Costs Switching to an electric car can lead to significant savings on fuel and maintenance costs, making it an appealing option for budget-conscious drivers. Unlike gasoline-powered vehicles that need frequent refueling and oil changes, electric cars do not have a combustion engine that requires oil changes. Plus, electric vehicles have a simpler mechanical design, so there are fewer parts that can wear out and need replacing.

This translates to lower maintenance costs over the lifespan of the car. In terms of fuel savings, electric cars are more efficient, meaning you can travel further on the same amount of energy compared to a gasoline-powered car. Plus, the cost of electricity is typically cheaper than gasoline, so you can save money in the long run.

Overall, making the switch to an electric car can help you cut costs while reducing your carbon footprint.

Reduced Maintenance Expenses for Electric Cars

Maintaining an electric car can greatly reduce the overall expenses associated with owning a vehicle. Compared to traditional gas-powered cars, electric cars require significantly less maintenance due to their simpler design and fewer moving parts. For instance, electric cars do not need oil changes, tune-ups, and fuel filters, which can individually save a driver hundreds of dollars every year.

Additionally, electric cars have regenerative braking that helps extend the life of brake pads and rotors. In terms of fuel, electric cars are much more efficient in terms of energy usage and can be powered using renewable sources that are often cheaper than traditional gasoline. Electric cars also reduce dependence on fossil fuels, further reducing the long-term costs associated with conventional car ownership.

The savings on both fuel and maintenance expenses of electric cars make them a more financially sustainable option over time, without compromising on performance or style. Overall, switching to an electric car can be a smart financial investment that not only benefits your pocketbook but also the environment. By embracing the latest technology and lowering your carbon footprint, you’ll reap the rewards of longer-lasting maintenance, cheaper fuel costs, and an overall lighter impact on the planet.

It’s a win-win situation for everyone.

Potential Tax Deductions for Electric Car Charging Stations

Electric car owners can benefit from potential tax deductions for installing charging stations at home. These deductions can provide long-term savings on fuel and maintenance costs for electric cars. With current tax incentives, homeowners can claim up to a $1,000 tax credit for the installation of electric vehicle charging stations.

Additionally, businesses that install public charging stations can also benefit from tax deductions, including a 30% federal tax credit and depreciation deductions. These tax incentives can help offset the initial cost of installation, making it more affordable for individuals and businesses to invest in electric vehicle charging infrastructure. By taking advantage of these tax deductions, electric car owners can enjoy both financial savings and environmental benefits.

So, why not consider installing an electric car charging station today?

Implications for Small Business Owners

If you’re a small business owner who’s considering switching to electric cars, there are some significant tax benefits that you should know about. The federal government offers a tax credit of up to $7,500 for businesses that purchase or lease eligible electric vehicles. Additionally, many states and municipalities offer their own incentives, such as rebates and additional tax credits.

This can add up to significant savings for small businesses looking to reduce their carbon footprint and cut down on expenses. However, it’s important to note that the tax credit only applies to new electric vehicles, and the amount of the credit is based on the battery size of the vehicle. It’s also worth talking to a tax professional to determine how to best take advantage of these tax benefits and ensure that you’re complying with all relevant regulations.

Overall, moving to electric vehicles can offer both environmental and financial benefits for small businesses, and the tax incentives available make this transition even more attractive.

Increased Savings and Tax Benefits for Small Businesses

As a small business owner, you must constantly look for ways to save money and increase your profits. This year, the federal government has implemented several changes that benefit small businesses. The first is an increase in the amount you can contribute to retirement plans, such as 401(k)s.

This increase can help you save more for your future and reduce your taxable income. Additionally, small business owners can now deduct up to 20% of their business income from their taxes, thanks to the new qualified business income deduction. These are just a few examples of the savings and tax benefits available to small business owners this year.

As you plan your finances and taxes, be sure to take advantage of these opportunities to maximize your profits and secure your financial future.

How to Maximize Electric Car Tax Benefits for Your Business

If you’re a small business owner interested in purchasing an electric car, you’ll be thrilled to know that there are several tax benefits available to you. One of the most significant is the federal tax credit, which can reduce the cost of your electric car by up to $7,500. To qualify, the car must be new, have a battery capacity of at least 4 kWh, and be used for business purposes at least 50% of the time.

Additionally, many states offer their own tax credits and rebates, which can make electric cars even more affordable. But it’s important to note that these tax benefits may vary depending on your business structure and tax situation, so it’s always best to consult with a tax professional before making any purchases. By taking advantage of these electric car tax benefits, you’ll not only save money but also contribute to a cleaner environment and a more sustainable future.

Conclusion: Electrify Your Business for Tax Savings

In conclusion, the electric car business tax benefit is a shocking incentive for companies to make the switch to more sustainable transportation options. As the world becomes more conscious of its impact on the environment, having a greener fleet can be a real spark plug for a company’s image and bottom line. With the tax benefits available, it’s electrifying to think about how much companies can save while doing their part in reducing carbon emissions.

So, don’t resist the surge of electric car popularity in the business world – it’s a positive charge that will keep your company energized for years to come.”

FAQs

What is the electric car business tax benefit?

The electric car business tax benefit is a federal tax credit available for businesses that purchase qualifying electric vehicles for use in their operations.

Who is eligible for the electric car business tax benefit?

Any business that pays federal taxes and purchases a qualifying electric vehicle for use in their operations is eligible for the electric car business tax benefit.

How much is the electric car business tax benefit worth?

The electric car business tax benefit is worth up to $7,500 per qualifying vehicle purchased by a business.

What are the requirements for a vehicle to qualify for the electric car business tax benefit?

To qualify for the electric car business tax benefit, a vehicle must be a plug-in electric vehicle with a battery capacity of at least 4 kWh and have a gross vehicle weight rating of less than 14,000 pounds.