Maximizing Savings with Electric Car Company Tax Benefits: A Comprehensive Guide

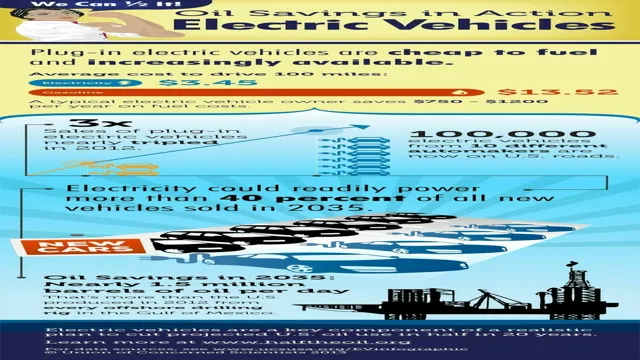

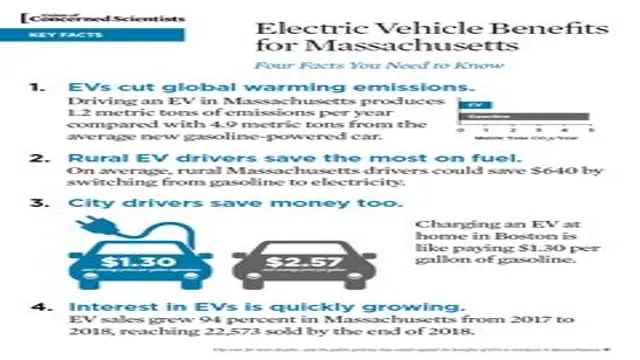

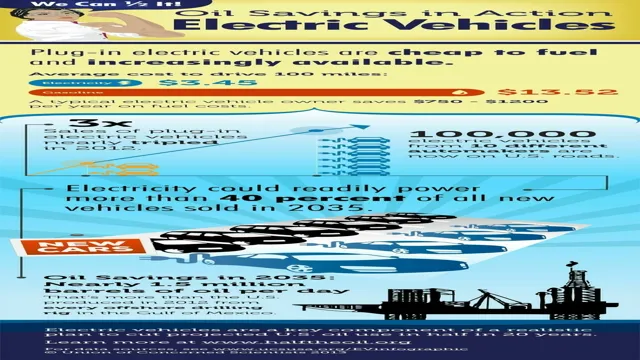

Looking to buy an electric car? You’re not alone! As more people become environmentally conscious and seek to minimize their carbon footprint, electric cars have become the vehicle of choice. The good news is that the federal government offers significant tax benefits to those who buy electric cars. If you’re considering an electric car for your next purchase, it’s vital to understand these tax benefits and how they can help you save money in the long run.

In this blog, we’ll explore the various tax benefits available to electric car owners and how they can help you make the most of your investment. So without further ado, let’s get started!

Overview of Tax Benefits

Electric car company tax benefits can be significant and provide a great incentive for those interested in purchasing an electric vehicle. One of the biggest benefits is the federal income tax credit, which can range from $2,500 to $7,500 depending on the make and model of the vehicle. Additionally, some states offer their own tax credits or exemptions for electric vehicles.

This can include sales tax exemptions, registration fee exemptions, or even free parking in certain areas. Some states may even offer rebates for purchasing or leasing an electric vehicle, which can range from a few hundred dollars up to several thousand dollars. These tax benefits can save drivers a significant amount of money in the long run and contribute to a more sustainable future for our planet.

Federal Tax Credits for EV Purchases

If you’re considering purchasing an electric vehicle (EV), you may be eligible to receive a federal tax credit. The federal government has established a program to encourage the adoption of electric vehicles, which includes tax credits that can help offset the purchase price. The amount of the tax credit depends on the battery size of the EV, with larger batteries receiving more credits.

For example, the credit for a Tesla Model S with a 100 kWh battery is $7,500, while the credit for a Nissan Leaf with a 40 kWh battery is $7,500. It’s important to note that not all EVs qualify for the tax credit, and the credit begins to phase out once the manufacturer sells a certain number of eligible vehicles. Additionally, the tax credit is non-refundable, which means that if you owe less in taxes than the amount of the credit, you won’t receive the full credit amount.

Overall, the federal tax credit for EV purchases can be a significant financial incentive for those considering going electric.

State and Local Tax Credits for EV Purchases

Electric vehicle (EV) owners can take advantage of various state and local tax credits to help offset the cost of purchasing an EV. These credits vary depending on the state, and some states may not offer any credits at all. For example, California offers a rebate of up to $2,500 for purchasing a new EV, while Colorado offers a tax credit of up to $2,500.

Other states may offer credits for installing an at-home charging station or for registering an EV. It’s important to research the specific tax benefits available in your state before making an EV purchase. These credits can make a significant impact on the overall cost of an EV, making it a more affordable option for environmentally conscious consumers.

Plus, with the growing popularity of EVs, more states are likely to create tax incentives to encourage their purchase.

Tax Deductions for EV Charging and Infrastructure

As electric cars continue to grow in popularity, the tax benefits for electric car companies are becoming more apparent. One such benefit is the tax deductions available for EV charging infrastructure. These tax breaks encourage companies to invest in electric vehicle charging stations, which provide a valuable service to EV drivers and help to reduce greenhouse gas emissions.

In addition to the cost savings from these tax deductions, electric car companies can also benefit from the positive public relations associated with supporting sustainable transportation options. By investing in EV charging infrastructure, companies can demonstrate their commitment to reducing their carbon footprint and contributing to a more sustainable future. Overall, electric car companies can reap significant tax benefits by investing in the infrastructure necessary to support the growing population of EV drivers.

Federal Tax Credits for EV Charging Equipment

As the demand for electric vehicles continues to grow, so too does the need for charging infrastructure to keep them charged and on the road. Fortunately for businesses and individuals alike, the federal government offers tax credits for purchasing and installing EV charging equipment, as well as infrastructure to support it. These tax credits can cover up to 30% of the cost of the equipment and installation, with a maximum credit of $1,000 for residential installations and $30,000 for commercial installations.

This means that companies can save thousands of dollars while also doing their part to support sustainable transportation. Additionally, these tax credits can help spur the growth of EV charging infrastructure across the country, making it easier and more convenient for drivers to switch to electric vehicles. By taking advantage of available tax deductions, businesses and individuals can help create a cleaner, more sustainable transportation future for all.

State and Local Tax Credits for EV Charging Equipment

Are you considering installing EV charging equipment at your home or business? If so, you may be eligible for state and local tax credits. These incentives can offset the cost of the equipment and installation, making it more affordable for you to invest in sustainable transportation options. Additionally, if you own a business, offering EV charging can be a valuable perk for employees and customers, attracting a more environmentally-conscious clientele.

It’s important to research the specific tax credits available in your state or locality and ensure you meet all the requirements before making a purchase. By taking advantage of tax deductions for EV charging and infrastructure, you can make a positive impact on the environment and your bottom line.

Depreciation and Expensing of EV Charging Infrastructure

Electric vehicle (EV) charging infrastructure is becoming more common as the number of EVs on the road increases. However, the cost of implementing EV charging infrastructure can be prohibitive for some businesses. Fortunately, there are tax deductions available for businesses that install EV charging stations.

Under the current tax law, businesses can expense 100% of the cost of EV charging infrastructure in the first year of service, up to $1,000,000. This is a significant change from the previous law, which required businesses to depreciate the cost of EV charging infrastructure over a period of 39 years. By taking advantage of this tax deduction, businesses can reduce their tax liability and make the implementation of EV charging infrastructure more financially feasible.

Additionally, businesses that install EV charging infrastructure may be eligible for state tax credits and other incentives, further reducing the overall cost of implementation. Overall, tax deductions and credits can help incentivize the installation of EV charging infrastructure, making EVs more accessible for everyone.

Business Tax Incentives for EV Adoption

If you’re running an electric car company, or considering starting one, you’ll be pleased to know that there are several tax incentives available to you. First, EV manufacturers can receive a tax credit of up to $7,500 for each electric vehicle they sell. This helps to offset the higher costs associated with building EVs.

Additionally, businesses can receive a tax credit of up to 30% of the cost of installing EV charging stations on their property. This incentive helps to encourage the growth of the EV industry, while also providing a valuable resource for people who own electric cars. Of course, it’s important to speak with a tax professional to ensure that you qualify for all available tax benefits.

But, overall, these incentives make it more affordable for businesses to produce and promote electric vehicles, which is great news for consumers and the environment alike.

Electric Vehicle Charging Station Installation Tax Credit

If you own a business and are thinking about making the switch to electric vehicles, here’s some good news: there are tax incentives available to help offset the cost of installing electric vehicle charging stations on your property. The Electric Vehicle Charging Station Installation Tax Credit offers a 30% credit for the cost of purchasing and installing an eligible charging station, up to a maximum credit of $30,000. This credit is available for both residential and commercial properties, but for businesses, it can be especially beneficial.

By providing electric vehicle charging stations, you not only show your commitment to sustainability, but also attract environmentally conscious customers and employees. Plus, with the tax credit, the cost of installing these stations becomes more manageable. So, if you’re a business owner interested in promoting electric vehicle adoption, take advantage of this tax incentive and consider installing electric vehicle charging stations on your property.

Alternative Fuel Vehicle Refueling Property Credit

Businesses looking to adopt electric vehicles can take advantage of a variety of tax incentives. One such incentive is the Alternative Fuel Vehicle Refueling Property Credit, which offers a tax credit of up to 30% for businesses that install EV charging stations and other alternative fuel refueling equipment. This credit can be especially valuable for businesses with large vehicle fleets or those that receive a lot of customer traffic, as it can help offset the cost of installing and maintaining charging infrastructure.

It’s important to note that this credit applies only to businesses, not individuals, and there are certain eligibility requirements that must be met in order to qualify. However, for businesses looking to reduce their carbon footprint and save money on fuel costs, the Alternative Fuel Vehicle Refueling Property Credit can be a powerful incentive to adopt electric vehicles.

Conclusion

When it comes to electric car companies, tax benefits can be the spark that ignites innovation and pushes the industry forward. Not only do these incentives encourage consumers to make the switch to cleaner transportation, but they also help companies invest in research and development for even more efficient and affordable electric vehicles. With these tax benefits in place, the road to a more sustainable future is looking brighter, and it’s all powered by tax breaks.

“

FAQs

What are the tax benefits for electric car companies?

Electric car companies can enjoy tax incentives and credits for producing and selling electric vehicles, such as the federal EV tax credit and the Section 30D credit.

How do electric car companies qualify for tax incentives?

To qualify for tax incentives, electric car companies must meet certain criteria such as producing electric vehicles with a battery capacity of at least 4 kilowatt-hours and meeting production volume requirements.

What is the federal EV tax credit for electric car companies?

The federal EV tax credit is a tax incentive provided to electric car companies that sell qualified electric vehicles to consumers. The credit amount varies based on the battery capacity and can range from $2,500 to $7,500 per vehicle sold.

Are there any other tax benefits for electric car companies besides the federal EV tax credit?

Yes, there are other tax benefits for electric car companies such as accelerated depreciation, research and development tax credits, and investment tax credits for advanced energy projects. These incentives can help electric car companies reduce their tax liability and increase their profitability.