Electric Car Company Tax Benefits: Maximize Your Savings!

Many people want to know about electric car company tax benefits. These benefits can help car buyers save money. They also encourage companies to make more electric cars. This article will explain these benefits. We will look at federal and state programs. We will also discuss other ways to save money.

What Are Electric Cars?

Electric cars are vehicles that use electricity. They do not use gasoline or diesel. Instead, they run on batteries. These cars are better for the environment. They produce less pollution. Many people like to drive electric cars. They are quiet and smooth. They also cost less to maintain.

Why Do Tax Benefits Matter?

Tax benefits are important for many reasons. They help people buy electric cars. They also help companies that make these cars. When people save money, they are more likely to buy. This helps the environment. It also helps the economy. Here are some key points about tax benefits:

- They lower the cost of buying a car.

- They encourage people to choose electric cars.

- They support clean energy initiatives.

- They can boost the economy.

Federal Tax Credits for Electric Cars

The federal government offers tax credits for electric cars. This is a big help for buyers. The credit can be up to $7,500. This amount depends on the car’s battery size. The bigger the battery, the larger the credit.

To qualify, you must meet some rules:

- The car must be new and made by a qualified manufacturer.

- The car must have a battery that meets certain size requirements.

- The buyer must be the first owner of the vehicle.

When you buy an electric car, ask the dealer about the credit. They should help you understand how to claim it. You will need to fill out a form when you file your taxes.

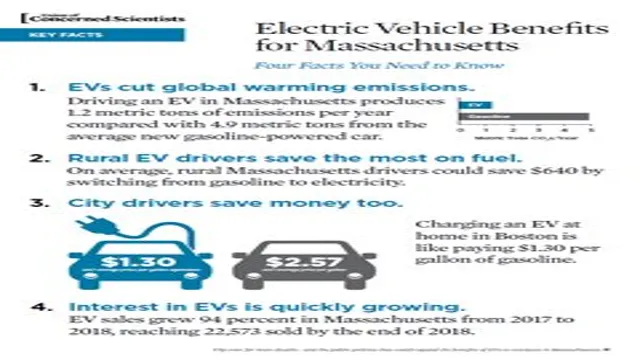

State Tax Benefits

Many states have their own tax benefits for electric cars. These can vary greatly. Some states offer extra credits. Others might have rebates or discounts. It is important to check your state’s rules.

Here are some states with notable benefits:

- California: Offers rebates up to $2,000.

- New York: Offers a credit up to $2,000.

- Texas: Has a rebate program for electric car buyers.

Always check your local laws. This way, you can find out what benefits you can get. Sometimes, local governments also offer incentives.

Other Financial Benefits

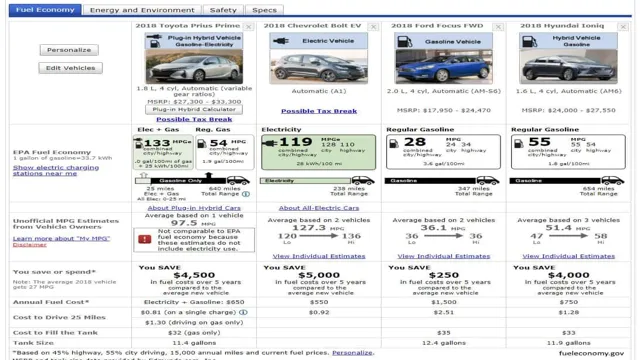

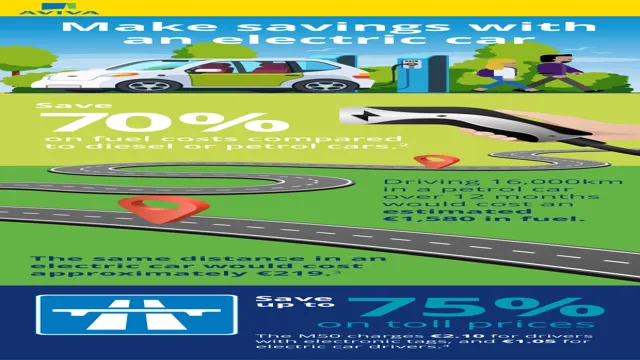

Buying an electric car has other financial benefits too. For example, electric cars cost less to fuel. Electricity is usually cheaper than gasoline. This means you save money every time you charge your car.

Here are some other savings:

- Lower Maintenance Costs: Electric cars have fewer moving parts.

- Tax Deductions: Some businesses can deduct costs.

- Reduced Registration Fees: Some states offer lower fees for electric cars.

Charging Stations and Infrastructure

Another benefit is the growing number of charging stations. Many places now have charging stations. You can find them in parking lots, malls, and highways. This makes it easier to charge your car.

Some states also offer free or low-cost charging. This can help you save even more money. Charging at home is also an option. You can install a charging station in your garage.

Environmental Benefits

Electric cars are better for the planet. They produce less carbon dioxide. This means cleaner air for everyone. Many people want to help the environment. Buying an electric car is a great way to do that.

Here are some environmental benefits:

- Reduced air pollution.

- Less noise pollution.

- Lower greenhouse gas emissions.

Challenges of Electric Cars

Even with the benefits, there are challenges. Some people worry about battery life. They may fear running out of charge. Others may think electric cars are too expensive. However, many new models are affordable. The costs are coming down every year. More choices are available than ever before.

How to Get Started

If you want to buy an electric car, here are steps to follow:

- Research different electric car models.

- Check your state and federal tax benefits.

- Visit local dealerships to see cars.

- Ask about available incentives and rebates.

- Take a test drive to feel the car.

- Make your purchase and enjoy driving.

Frequently Asked Questions

What Are Electric Car Company Tax Benefits?

Electric car company tax benefits help businesses save money on taxes when they use electric vehicles.

How Do Tax Credits For Electric Cars Work?

Tax credits lower the amount of tax owed. Companies can claim credits for buying electric vehicles.

Who Qualifies For Electric Car Tax Benefits?

Businesses and individuals who purchase electric cars may qualify for tax benefits. Eligibility depends on specific criteria.

Can Companies Deduct Electric Car Expenses?

Yes, companies can deduct costs related to electric cars, like maintenance and charging.

Conclusion

Electric car company tax benefits are important. They help buyers save money. They also encourage companies to make more electric cars. Federal and state programs provide many benefits. These include tax credits and rebates.

Electric cars are better for the environment. They cost less to fuel and maintain. More charging stations are available every year. The benefits of electric cars are clear. They are a smart choice for many people.

Take time to learn about the options. Check local and federal programs. Electric cars are a great way to save money and help the planet.