Electric Car Credits 2026 What You Need to Know Now

Featured image for electric car credits 2026

Image source: i.ytimg.com

Electric car credits in 2026 will undergo major changes, with revised income limits, expanded eligibility for used EVs, and stricter battery sourcing rules. Starting in 2026, buyers must meet updated requirements to qualify for the full $7,500 tax credit, including North American assembly and critical mineral mandates. Act now to understand how these shifts impact your purchase—timing, vehicle choice, and tax planning are more crucial than ever.

Key Takeaways

- Act now: Credits may phase out—buy eligible EVs before 2026.

- Check eligibility: Not all EVs qualify—verify battery and assembly rules.

- Income limits apply: Higher earners may be disqualified—review IRS guidelines.

- Leasing loophole: Some leases qualify—ask dealers about transferable credits.

- Used EVs included: Save up to $4,000 on qualifying pre-owned models.

- Tax timing matters: Claim credits when filing—not at purchase.

📑 Table of Contents

- The Future of Electric Car Incentives: What’s Changing in 2026?

- How Electric Car Credits Work in 2026: Key Changes

- Eligibility Requirements for 2026: What’s New?

- Regional Incentives: State and Local Credits in 2026

- How to Maximize Your Savings in 2026: Practical Tips

- The Bigger Picture: How 2026 Credits Shape the EV Market

- Data Table: 2026 Federal EV Credit Breakdown

- Conclusion: Act Now to Secure Your 2026 EV Savings

The Future of Electric Car Incentives: What’s Changing in 2026?

The electric vehicle (EV) revolution is accelerating faster than ever, and as we approach 2026, a pivotal shift in electric car credits is on the horizon. For years, federal tax incentives like the Inflation Reduction Act (IRA) of 2022 have made EVs more affordable, but 2026 marks a turning point. Whether you’re a first-time EV buyer or a seasoned eco-conscious driver, understanding the upcoming changes to electric car credits 2026 is critical to maximizing savings and avoiding costly surprises. This guide breaks down everything you need to know—from eligibility criteria to regional variations—so you can plan your next vehicle purchase with confidence.

Why does 2026 matter? The IRA’s tax credit rules are set to evolve, with stricter battery component and critical mineral requirements, expanded eligibility for used EVs, and potential phaseouts for certain models. These changes reflect the U.S. government’s push to strengthen domestic supply chains and reduce reliance on foreign manufacturing. But navigating the new landscape can be daunting. Will your dream EV still qualify? How do you ensure you get the full credit? And what if you’re buying a used car? Let’s dive into the details and demystify the 2026 rules.

How Electric Car Credits Work in 2026: Key Changes

The Core Structure of the 2026 Tax Credit

The federal electric car credit remains a non-refundable tax credit of up to $7,500 for new EVs and $4,000 for used EVs (up to 30% of the sale price). However, the eligibility criteria are tightening. Starting in 2026, two critical thresholds must be met:

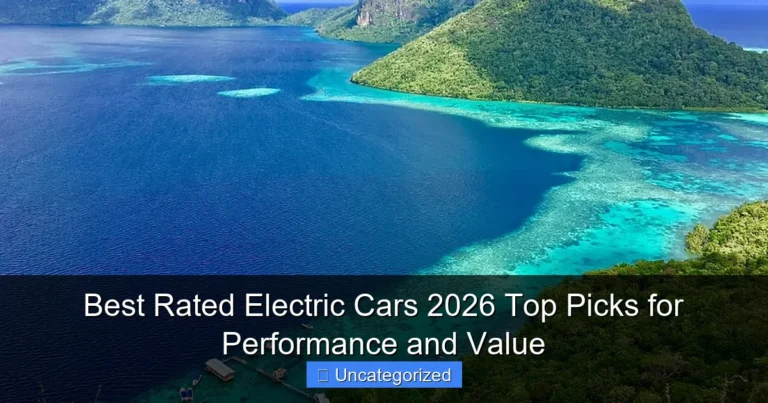

Visual guide about electric car credits 2026

Image source: i.ytimg.com

- 50% of battery components must be manufactured or assembled in North America (up from 40% in 2024).

- 60% of critical minerals (e.g., lithium, nickel, cobalt) must be sourced from the U.S. or a Free Trade Agreement (FTA) country (up from 50% in 2024).

These percentages will rise to 80% and 70%, respectively, by 2027, creating a “sliding scale” of eligibility. Vehicles that fail to meet either threshold will be disqualified entirely.

New “Buyer Income” and “MSRP Caps”

To target middle- and lower-income buyers, the 2026 rules retain strict income and price limits:

- Individual filers must have an adjusted gross income (AGI) of $150,000 or less.

- Joint filers must have an AGI of $300,000 or less.

- MSRP caps: $80,000 for SUVs, trucks, and vans; $55,000 for other vehicles.

Example: A Tesla Model Y with an MSRP of $52,000 would qualify for the full credit if it meets the battery/mineral criteria and the buyer’s income is under the cap. But a $65,000 Model Y would not.

Immediate Point-of-Sale Rebates (2024–2026)

Starting in 2024, buyers can opt to transfer their credit to the dealership, effectively reducing the purchase price upfront instead of waiting for a tax refund. This “point-of-sale” rebate will continue through 2026 but requires the dealer to register with the IRS and provide documentation. Pro tip: Always ask the dealer for a written confirmation of the credit transfer to avoid disputes later.

Eligibility Requirements for 2026: What’s New?

Vehicle-Specific Criteria

Not all EVs will qualify for the full $7,500 credit in 2026. The credit is split into two $3,750 tiers:

- Tier 1: Requires 50% North American battery components.

- Tier 2: Requires 60% North American critical minerals.

Example: The 2026 Ford F-150 Lightning (assembled in Michigan) might qualify for Tier 1 due to its domestic battery plant but could miss Tier 2 if its lithium is sourced from non-FTA countries. Buyers should check the IRS’s Qualified Vehicle List (updated quarterly) before purchasing.

Used EV Credits: A Game-Changer

The used EV credit ($4,000 or 30% of the sale price) is expanding in 2026 with two key changes:

- Eligible vehicles: Must be at least 2 years old and priced under $25,000.

- Buyer income caps: $75,000 for individuals, $150,000 for joint filers.

This opens the door for budget-conscious buyers to access affordable EVs. For instance, a 2024 Chevrolet Bolt (purchased for $22,000 in 2026) could yield a $4,000 credit—making it cheaper than many gas-powered used cars.

Exclusions and Phaseouts

Some manufacturers, like Tesla and GM, have already reached the 200,000-vehicle cap for the original EV tax credit. While the IRA reset eligibility for most automakers, vehicles from companies that fail to meet battery/mineral rules will be excluded. Additionally, luxury EVs (e.g., Porsche Taycan, Lucid Air) are unlikely to qualify due to MSRP caps.

Regional Incentives: State and Local Credits in 2026

State-Level EV Credits and Rebates

Beyond the federal credit, 26 states offer additional incentives. In 2026, these programs are becoming more aggressive:

- California: Up to $4,500 in Clean Vehicle Rebates (CVRP) for low-income buyers.

- Colorado: $2,500 state tax credit + $5,000 for trade-in of a gas vehicle.

- New York: $2,000 Drive Clean Rebate for new EVs under $60,000.

Pro tip: Stack federal and state incentives! A buyer in Colorado could save $10,000+ on a qualifying EV ($7,500 federal + $2,500 state).

Local Utility and Municipal Programs

Many utilities (e.g., PG&E, Con Edison) offer rebates for EV purchases or home charger installations. For example:

- Austin Energy (TX): $1,500 for new EVs + $500 for Level 2 chargers.

- Seattle City Light: $4,000 for low-income buyers.

Check your local utility’s website or the Database of State Incentives for Renewables & Efficiency (DSIRE) for details.

International Incentives (for U.S. Buyers)

If you’re considering importing a foreign-made EV (e.g., a European model), beware: The 2026 federal credit applies only to vehicles assembled in North America. However, some states (e.g., Vermont) offer incentives for imported EVs if they meet EPA emissions standards.

How to Maximize Your Savings in 2026: Practical Tips

Step 1: Research Eligible Vehicles

Use the IRS’s Qualified Vehicle List and tools like PlugStar or EV Life to filter EVs by credit eligibility. Pay attention to:

- Battery origin (e.g., Tesla’s Texas Gigafactory vs. a Chinese battery).

- Critical mineral sourcing (e.g., lithium from Australia vs. China).

- MSRP and trim level (e.g., a $54,000 Model 3 qualifies; a $56,000 Performance trim does not).

Step 2: Time Your Purchase

Automakers may adjust battery sourcing or manufacturing to meet 2026 requirements. For example:

- Ford is building a $5.6 billion battery plant in Michigan (2026).

- GM plans to source lithium from Nevada by 2025.

Buying an EV after these changes could unlock the full credit. Monitor automaker announcements closely.

Step 3: Document Everything

To claim the credit, you’ll need:

- A signed statement from the dealer confirming the credit transfer (for point-of-sale rebates).

- The vehicle’s VIN and manufacturer’s certification of eligibility.

- Proof of income (for tax filing).

Keep these documents for at least 3 years in case of an IRS audit.

Step 4: Consider a Used EV

The used EV credit is a hidden gem. In 2026, you could:

- Buy a 2024 Nissan Leaf for $18,000 and claim a $4,000 credit.

- Lease a used EV (if the lessor transfers the credit to you).

Used EVs also avoid depreciation hits, making them a smart financial move.

The Bigger Picture: How 2026 Credits Shape the EV Market

Impact on Automakers

The 2026 rules are reshaping the EV industry. Automakers are:

- Investing in North American battery plants (e.g., Hyundai’s Georgia plant).

- Partnering with mining companies for mineral supply (e.g., Tesla’s Nevada lithium deal).

- Redesigning models to fit MSRP caps (e.g., Hyundai’s $32,000 Ioniq 6).

By 2026, expect more affordable, domestically produced EVs—but fewer luxury models.

Environmental and Economic Benefits

The IRA’s focus on North American supply chains reduces reliance on China (which controls 80% of battery materials). This could:

- Lower carbon footprints by cutting overseas shipping.

- Create 100,000+ U.S. jobs in battery manufacturing.

However, critics argue the rules may slow EV adoption by limiting consumer choice.

Long-Term Outlook (2027–2032)

By 2032, the federal credit will phase out entirely, replaced by a point-of-sale rebate for all EVs—regardless of battery origin. This shift ensures continued incentives while supporting a mature EV market.

Data Table: 2026 Federal EV Credit Breakdown

| Credit Type | Max Amount | Eligibility Criteria | Key Deadlines |

|---|---|---|---|

| New EV Credit | $7,500 | 50% NA battery components + 60% NA critical minerals + MSRP/income caps | Must be purchased by 12/31/2026 |

| Used EV Credit | $4,000 (30% of sale price) | Vehicle ≥2 years old, price ≤$25,000, buyer income ≤$75K/$150K | First-time use only |

| Point-of-Sale Rebate | Same as above | Dealer must register with IRS and provide documentation | Available at purchase |

Conclusion: Act Now to Secure Your 2026 EV Savings

The electric car credits 2026 represent a turning point in the U.S. transition to clean transportation. With stricter battery rules, expanded used EV incentives, and regional rebates, savvy buyers have unprecedented opportunities to save. But time is of the essence: The window to maximize federal and state credits is closing fast. Whether you’re eyeing a new F-150 Lightning or a pre-owned Bolt, follow these steps:

- Research eligible vehicles using the IRS’s list.

- Time your purchase to align with automaker supply chain upgrades.

- Stack federal, state, and local incentives.

- Document everything for tax season.

The road to an affordable EV has never been clearer—or more rewarding. Start planning today, and drive into 2026 with confidence, savings, and a cleaner conscience.

Frequently Asked Questions

What are the electric car credits for 2026?

The 2026 electric car credits are federal tax incentives designed to encourage EV adoption, offering up to $7,500 for new qualifying vehicles and $4,000 for used EVs. Eligibility depends on income, vehicle price, and battery component requirements under the Inflation Reduction Act.

How do I qualify for the 2026 EV tax credit?

To qualify, your modified adjusted gross income must fall below IRS thresholds, and the EV must meet critical mineral and battery sourcing rules. The vehicle must also be assembled in North America and priced below $80,000 for SUVs/trucks/vans or $55,000 for cars.

Can I claim the electric car credit if I lease an EV in 2026?

No, the federal EV tax credit goes to the leasing company, not you. However, dealers may pass on savings through lower monthly payments, so always ask about “credit pass-through” arrangements when leasing.

Are used electric cars eligible for the 2026 EV tax credit?

Yes, used EVs purchased from a licensed dealer for $25,000 or less qualify for a $4,000 credit. The vehicle must be at least 2 years old, and your income must stay under IRS limits.

Do electric car credits 2026 apply to home chargers?

No, the 2026 EV credits only apply to vehicle purchases, not chargers. However, a separate 30% federal tax credit (up to $1,000) is available for home EVSE installation through 2032.

How will the 2026 EV tax credit rules change from 2023-2025?

By 2026, stricter battery sourcing requirements take effect, and the credit will only apply to EVs with 80%+ North American-sourced battery components. Some models eligible today may no longer qualify.