Unwrap the Benefits: The Ultimate Guide to Calculating Fringe Benefits of Electric Cars

Did you know that driving an electric car not only saves you money on gas, but it can also provide fringe benefits? It’s true! Many companies are offering incentives for their employees to switch to electric cars, such as free charging stations and discounted rates on car insurance. But how do you calculate these benefits? It can get tricky, which is why we’re here to help. In this blog, we’ll break down the various fringe benefits for electric cars and how to calculate them.

So buckle up and join us!

What Are Fringe Benefits?

If you’re considering purchasing an electric car as a company vehicle, it’s important to understand the concept of fringe benefits and how they will impact your tax obligations. Fringe benefits are additional perks or benefits offered to employees, such as company cars, healthcare, or gym memberships, that are not included in their salary. Electric car fringe benefits are calculated based on the cost of the car, including GST and any modifications, and the private use percentage of the car.

This percentage is determined by how often the car is used for personal rather than business purposes. By calculating the fringe benefits of an electric car, you can determine your tax obligations and make an informed decision about whether this is the right choice for your business. So, before you make a decision, make sure to do your research and understand the specifics of electric car fringe benefits.

Definition and Types

Fringe benefits are additional perks or incentives that employers offer to their employees, outside of regular wages or salaries. These benefits can come in many different forms, ranging from health insurance and retirement savings plans, to company cars, gym memberships, and free meals. Fringe benefits are designed to not only attract top talent but also retain employees, increasing employee morale, and improving company culture.

There are several types of fringe benefits, including discretionary benefits, such as bonus pay, and mandated benefits, such as workers’ compensation and Social Security. Other common types of fringe benefits include flexible schedules, paid time off, and childcare assistance. Overall, fringe benefits are a crucial part of an employee’s overall compensation package and can have a significant impact on job satisfaction and employee retention.

How Do They Affect Taxes?

Fringe benefits are extra perks that an employer provides to their employees. These benefits can range from free meals, gym memberships, corporate discounts, and even company cars. While these fringe benefits can make an employee’s life easier, they can come with tax implications.

In the eyes of the Internal Revenue Service (IRS), fringe benefits are considered taxable income. However, the amount of tax owed on these benefits varies depending on the specific perk. For example, the value of a company car is taxed based on the car’s fair market value, while the value of a gym membership is taxed differently.

It’s essential to understand these tax implications as an employer to ensure that you are withholding the correct amount of taxes from your employees’ paychecks. Overall, while fringe benefits can be a great way to attract and retain top talent, it’s crucial to consider the potential tax consequences.

Why Offer an Electric Car Fringe Benefit?

If you’re looking for a way to incentivize your employees to switch to electric cars, offering an electric car fringe benefit might be the way to go. But how do you calculate the benefit? First, you’ll need to determine the value of the benefit by figuring out the cost of the electric car. The good news is that you can qualify for a tax credit of up to $7,500 when purchasing an electric car, which you can apply toward the benefit.

Once you’ve determined the value of the electric car, you can then calculate the amount of the fringe benefit. This can be done in a number of ways, such as offering a certain percentage of the cost of the car, or offering a set dollar amount each month to employees who drive electric cars. Regardless of how you choose to structure the benefit, it’s important to remember that offering it can be a great way to attract and retain top talent, while also doing your part to reduce your company’s carbon footprint.

Cost Savings for Employers and Employees

Electric car fringe benefits offer significant cost savings for both employers and employees. In offering this fringe benefit, employers are providing their employees with access to a more sustainable and cost-effective mode of transportation. Employees can take advantage of the lower costs associated with running an electric car, including less money spent on gas and maintenance.

Additionally, with more companies offering electric vehicle charging stations, employees can save money and time on charging their cars. For employers, offering this benefit can lead to savings on parking costs and reduced carbon emissions. It’s like giving your employees a personal chauffeur that helps cut down on their expenses and reduces their carbon footprint.

By choosing to offer electric car fringe benefits, companies are making a conscious decision to support sustainable practices while also benefiting their bottom line.

Environmental and Social Impact

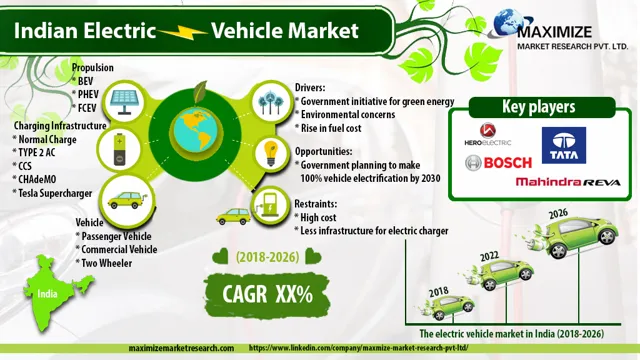

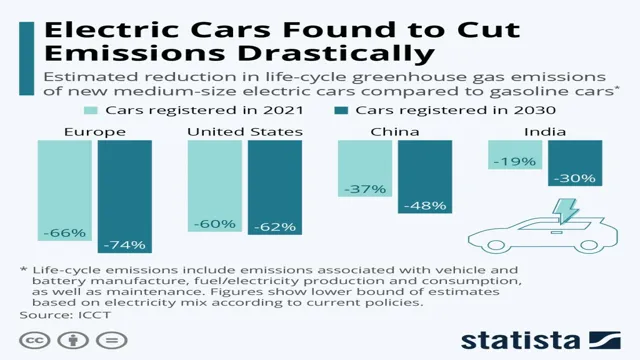

Offering electric cars as a fringe benefit can have a significant positive impact on both the environment and society. By providing employees with electric cars, companies can reduce their carbon footprint and help combat climate change. Electric cars emit less greenhouse gases than traditional gasoline cars and can also reduce air pollution in urban areas.

Additionally, providing electric cars as a fringe benefit can help promote sustainability and encourage more widespread adoption of electric cars. From a social perspective, offering electric cars as a fringe benefit can also have a positive impact on employee wellbeing and work-life balance. Commuting in an electric car can be a more enjoyable and less stressful experience, and can help employees save money on fuel costs.

This type of fringe benefit can also help companies attract and retain employees who are passionate about sustainability and want to work for companies that share their values. Ultimately, offering electric cars as a fringe benefit can be a win-win for both companies and employees, helping to create a more sustainable and socially responsible future.

Employee Attraction and Retention

Electric car fringe benefits can be a great way to attract and retain employees in today’s environmentally conscious workplace. Offering access to electric vehicles as an employee benefit can communicate your company’s commitment to sustainability while providing a valuable perk for your staff. From tax incentives to lower fuel costs, electric cars can save your employees money while improving their environmental impact.

Additionally, electric car fringe benefits can be a unique way to set your company apart from competitors in the job marketplace. By prioritizing sustainable transportation and investing in employee happiness, electric car fringe benefits can lead to increased employee satisfaction, retention, and productivity. So why not consider adding electric car fringe benefits to your company’s perks package? It could be a win-win situation for both your employees and your business.

Calculating Fringe Benefits for Electric Cars

Calculating the fringe benefits associated with electric cars can be a bit tricky, but it’s important to know the details to fully understand the financial implications of driving one. The process involves determining both the cost of the car and the amount of electricity used to power it, which can be a bit ambiguous. However, the most important consideration is the tax implications, as employees who use electric cars for business purposes may be eligible for significant tax credits.

In order to calculate the fringe benefits accurately, it’s best to consult with a tax professional or utilize financial software designed specifically for this purpose. With the growing popularity of electric cars, it’s important to stay on top of the latest tax implications and regulations related to them to ensure that you’re getting the most benefit from your investment.

Steps Involved

Calculating fringe benefits for electric cars can be a bit confusing, but it’s important to make sure you’re properly accounting for them in order to take advantage of all the tax benefits that come with owning an electric car. The first step is to determine the fair market value of the electric car, which can be done by looking at similar cars for sale in your area. Once you have the fair market value, you can calculate the fringe benefits by taking into account things like the fuel savings, the cost of any charging stations you may have installed, and any other expenses related to owning the car.

It’s important to keep accurate records of these expenses, as they can add up quickly and make a big difference when it comes to tax time. Overall, calculating fringe benefits for electric cars may seem daunting at first, but with some careful planning and attention to detail, you can make the most of your electric car ownership and reap all the financial benefits that come with it.

Example Calculation

Electric car fringe benefits calculation Calculating fringe benefits for electric cars can be a bit tricky if you’re not familiar with the process. First off, you’ll need to know the fair market value (FMV) of the electric car. This can be determined through online resources or by consulting with a car dealer.

Once you have the FMV, you’ll need to calculate the percentage of personal use versus business use for the electric car. From there, you can determine the taxable fringe benefit amount. Let’s say the FMV of the electric car is $25,000 and you use it 70% for business and 30% for personal use.

The taxable fringe benefit amount would be 30% of the FMV, which comes out to $7,500. This amount would need to be added to your employee’s W-2 form and included in their gross income for tax purposes. It’s important to note that the fringe benefit calculation for electric cars may differ based on factors such as state and federal tax laws, types of electric cars, and the length of time the electric car is being used for business purposes.

Consulting with a tax professional or HR specialist can help ensure you’re accurately calculating fringe benefits for electric cars and staying compliant with regulations. Overall, providing electric cars as fringe benefits can be a great way to show your commitment to sustainable transportation options and can even help attract and retain employees. Just be sure to follow the proper procedures for calculating and reporting fringe benefits to avoid any potential tax penalties.

Conclusion and Best Practices

In the electric car fringe benefit calculation, the outcome is clear – switching to electric is a wise and sensible choice. Not only do electric cars offer significant savings in fuel costs and emissions, but they also offer drivers a unique and exhilarating driving experience. So why settle for the ordinary when you can have the extraordinary? Don’t be shocked by the idea of going electric, embrace it and ride the current wave of change!”

FAQs

What is an electric car fringe benefit?

An electric car fringe benefit is a non-cash benefit provided by an employer to an employee who uses an electric vehicle for work purposes.

How is the value of an electric car fringe benefit calculated?

The value of an electric car fringe benefit is calculated based on the cost of the vehicle, its operating expenses, and the proportion of private use.

Can an employee salary sacrifice to reduce the amount of the electric car fringe benefit?

Yes, an employee can salary sacrifice to reduce the amount of the electric car fringe benefit, which can result in a tax saving for both the employee and employer.

Are there any tax exemptions available for electric car fringe benefits?

Yes, there are tax exemptions available for electric car fringe benefits, but they are subject to certain conditions, such as the vehicle having zero or low emissions and being used primarily for work purposes.