Electric Car Income Tax Benefit: Maximize Your Savings!

Many people want to buy electric cars. They are good for the environment. They can also save you money. One way to save money is through tax benefits. This article explains electric car income tax benefits. We will cover how they work and who can get them.

What Are Electric Cars?

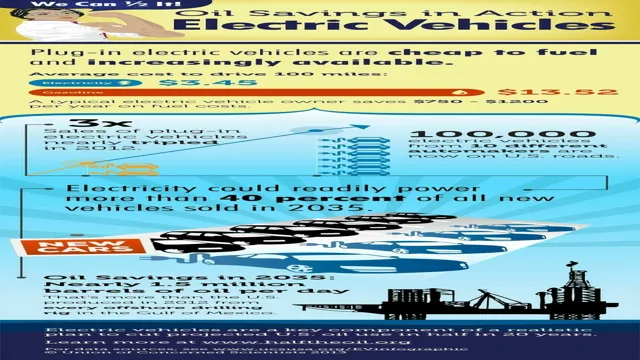

Electric cars run on electricity. They do not use gasoline. This makes them cleaner. They help reduce air pollution. More people are choosing electric cars. They are becoming more popular each year.

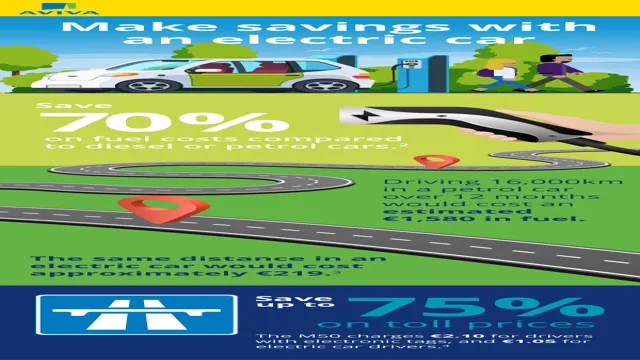

Why Choose an Electric Car?

- Lower fuel costs

- Less maintenance

- Quiet operation

- Tax benefits

Buying an electric car can be a smart choice. It helps the planet. It can also be good for your wallet. But, tax benefits can make it even better.

What Is an Income Tax Benefit?

Income tax benefits help you pay less tax. When you buy an electric car, you may qualify for these benefits. The government wants to encourage people to buy electric cars. They do this by giving tax credits.

Federal Tax Credit for Electric Cars

The federal government offers a tax credit. This is for people who buy electric cars. The credit can be up to $7,500. But not everyone gets the full amount. It depends on the car’s battery size and the manufacturer.

Here are some key points about the federal tax credit:

- Only new electric cars qualify.

- The car must have at least a 4 kWh battery.

- The credit amount decreases after a manufacturer sells 200,000 electric cars.

- Check the IRS website for up-to-date details.

State Tax Benefits

Many states offer tax benefits too. Each state has different rules. Some states give tax credits. Others give rebates. Some states even have special programs for electric car buyers.

Examples Of State Benefits

| State | Tax Credit/Rebate |

|---|---|

| California | Up to $2,500 |

| New York | Up to $2,000 |

| Texas | Up to $2,500 |

| Florida | Varies by program |

Check with your state’s tax office. They can tell you about available benefits.

Local Incentives

Some cities and local governments offer benefits too. They may have their own programs. These can include:

- Tax credits

- Rebates

- Discounts on registration fees

- Access to carpool lanes

Ask your local government for details. They can help you find local incentives for electric cars.

How to Claim Your Tax Benefits

Claiming your tax benefits is important. Here is how to do it:

- Buy an electric car.

- Keep your receipt and documents.

- Fill out IRS Form 8834.

- File your tax return.

Be sure to check for state forms as well. Each state may have its own forms for tax credits.

Tips for Maximizing Your Tax Benefits

Here are some tips to help you get the most out of your tax benefits:

- Research electric cars before buying.

- Look for state and local incentives.

- Keep all your purchase documents.

- Consult a tax professional if needed.

Common Questions About Electric Car Tax Benefits

1. Do I Qualify For The Federal Tax Credit?

To qualify, you must buy a new electric car. Check the battery size and manufacturer limits.

2. Can I Get Both Federal And State Benefits?

Yes, you can often get both. Check your state rules for more details.

3. What If I Don’t Owe Taxes?

If you don’t owe taxes, you may not get the full credit. Some states offer rebates regardless of taxes owed.

4. Can I Claim Benefits For Used Electric Cars?

Generally, tax benefits apply to new electric cars. Some states offer incentives for used cars.

5. How Do I Find Out About Local Incentives?

Contact your local government. They can provide information about local programs.

Frequently Asked Questions

What Is The Electric Car Income Tax Benefit?

The Electric Car Income Tax Benefit is a tax credit for electric vehicle buyers. It helps reduce your tax bill.

Who Qualifies For The Electric Car Tax Credit?

To qualify, you must buy a new electric vehicle. The vehicle must meet specific requirements set by the IRS.

How Much Is The Electric Car Tax Credit?

The tax credit can be up to $7,500. The amount depends on the car’s battery capacity.

Can I Get The Tax Credit For Used Electric Cars?

No, the tax credit is only for new electric vehicles. Used electric vehicles do not qualify.

Conclusion

Buying an electric car can save money. Income tax benefits make it even better. Always research before you buy. Check federal, state, and local benefits. This way, you can make informed choices. Enjoy your electric car and the savings that come with it!