Electric Car Insurance Florida Tips to Save Big on Premiums

Featured image for electric car insurance florida

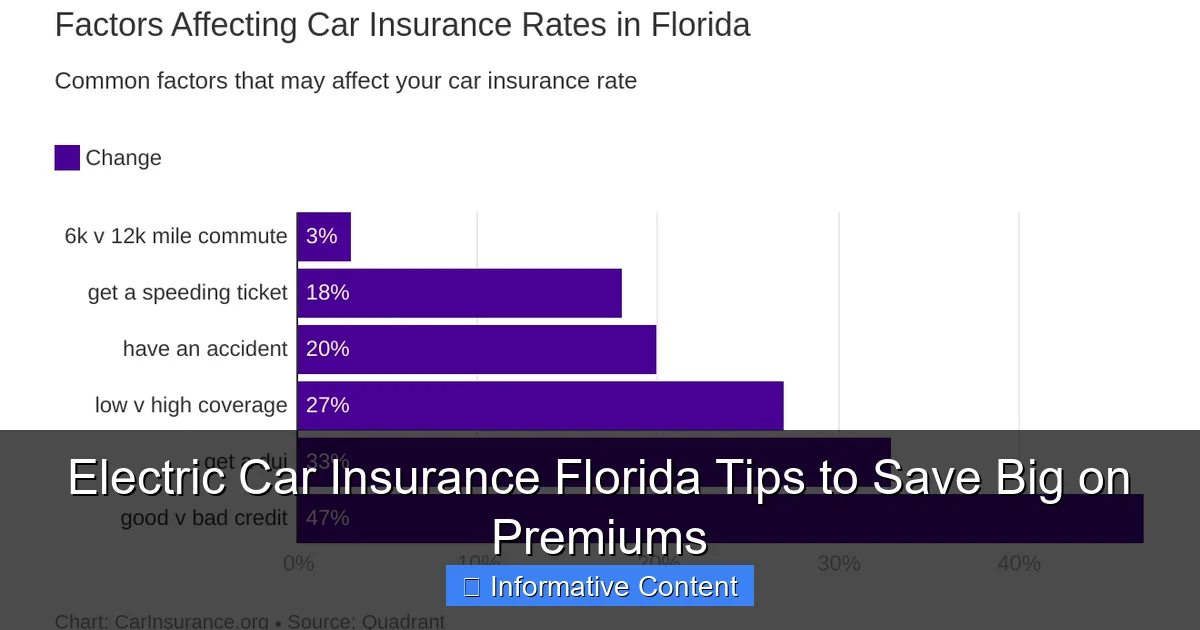

Image source: carinsurance.org

Save big on electric car insurance in Florida by comparing specialized EV policies and leveraging green vehicle discounts. Insurance premiums for electric cars can be lower due to fewer moving parts and advanced safety features, but only if you choose a provider experienced with EVs. Take advantage of state incentives, usage-based programs, and multi-policy bundling to maximize savings and protect your investment.

Key Takeaways

- Compare specialized insurers: Seek companies offering electric vehicle discounts in Florida.

- Leverage green incentives: Ask about state or utility-sponsored eco-friendly policy discounts.

- Adjust coverage wisely: Opt for comprehensive over collision if driving less.

- Bundle policies: Combine auto and home insurance for multi-policy savings.

- Maintain clean record: Safe driving ensures lowest premiums over time.

- Install safety tech: Add anti-theft or telematics for insurer discounts.

📑 Table of Contents

- Why Electric Car Insurance in Florida Is Different (And How to Save Big)

- Understanding Why Electric Car Insurance Costs More in Florida

- How to Find the Best Electric Car Insurance in Florida

- Florida-Specific Factors That Impact Your Premium

- Advanced Strategies to Slash Your Electric Car Insurance Costs

- Common Mistakes to Avoid When Insuring Your EV in Florida

- Data Table: Average Electric Car Insurance Costs in Florida (2024)

- Final Thoughts: Save Big on Electric Car Insurance in Florida

Why Electric Car Insurance in Florida Is Different (And How to Save Big)

So, you’ve made the leap into the world of electric vehicles (EVs). Maybe you’re driving a Tesla, a Ford Mustang Mach-E, or even a Hyundai Ioniq 5. You love the smooth ride, the instant torque, and the fact that you’re not paying $50 every time you pull into a gas station. But here’s something that might surprise you: insuring your electric car in Florida can cost more—sometimes a lot more—than insuring a gas-powered vehicle.

Why? It’s not just about the price tag (though EVs do cost more upfront). It’s about the unique risks, repair costs, and even how insurance companies view these high-tech machines. In Florida, where hurricanes, high humidity, and aggressive drivers are part of daily life, your electric car faces challenges that traditional vehicles don’t. But here’s the good news: with the right strategy, you can save big on electric car insurance in Florida—without sacrificing coverage.

Understanding Why Electric Car Insurance Costs More in Florida

EVs Are Expensive to Repair (Even After Minor Accidents)

Let’s say you’re driving your brand-new Tesla Model Y down I-95 and someone rear-ends you. The bumper gets scuffed, right? Not so fast. That “minor” bump could mean replacing the entire rear fascia, which houses sensors, radar, and cameras for Autopilot. And because EVs use lightweight materials like aluminum and carbon fiber, repairs are often more complex—and more expensive.

Visual guide about electric car insurance florida

Image source: probusinsurance.com

In Florida, where traffic is heavy and accidents are common, insurers know this. According to a 2023 report by the Insurance Institute for Highway Safety (IIHS), EV repair costs average 26% higher than gas-powered cars. That’s not just because of parts—it’s also because fewer mechanics are trained to work on EVs, and specialty shops charge more.

Example: A simple fender bender on a gas-powered Honda Civic might cost $2,000 to fix. The same accident on a Tesla? Easily $4,500 or more. Insurers bake these costs into your premium.

Battery Replacement: The Elephant in the Room

The battery is the heart of your EV—and it’s also the most expensive component. A full battery replacement can cost $15,000 to $20,000. While most manufacturers offer 8-year/100,000-mile warranties, insurers worry about long-term degradation and the cost of replacing a battery outside warranty.

Florida’s hot climate doesn’t help. High heat accelerates battery wear, and insurers know that. So they factor in the risk of battery failure—especially if you live in South Florida, where summer temps regularly hit 95°F.

Tip: If you’re buying a used EV, check the battery health report. A car with 70% capacity left might cost less to insure than one with 90%, because the insurer sees it as “closer to replacement.”

Hurricanes and Flooding: A Florida-Specific Risk

EVs and water don’t mix. While modern EVs are designed to be waterproof, a flooded battery pack is a total loss. And in Florida, where hurricanes like Ian and Nicole caused widespread flooding, insurers are extra cautious.

After Hurricane Ian in 2022, over 5,000 EVs were declared total losses in Florida—many from saltwater flooding. Insurers now charge higher premiums for EVs in flood-prone areas (looking at you, Miami-Dade and Broward counties).

Real talk: If you live near the coast, your EV insurance might include a “flood surcharge” or require additional coverage. Always ask your agent about flood risk and how it impacts your policy.

How to Find the Best Electric Car Insurance in Florida

Shop Around—But Use an “EV-Friendly” Broker

Not all insurers understand EVs. Some treat them like luxury gas cars and charge accordingly. Others—like Progressive, State Farm, and Liberty Mutual—have specific EV insurance programs with discounts and perks.

Start by getting quotes from at least 5 insurers. But don’t just compare prices. Ask each one: “Do you have experience insuring my specific EV model?” If they say “we treat all cars the same,” run. You want an insurer that knows the difference between a Tesla and a Toyota Camry.

Pro tip: Use a broker who specializes in EVs. They’ll know which insurers offer EV discounts and can negotiate better rates for you. For example, CoverWallet and Jerry both have EV-focused tools that compare policies side-by-side.

Look for EV-Specific Discounts

Many insurers offer discounts for EVs, but you have to ask. Here are the most common ones in Florida:

- Green Vehicle Discount: Up to 10% off for owning an EV (offered by State Farm, GEICO, and Allstate).

- Home Charger Discount: If you install a Level 2 charger at home, some insurers (like Nationwide) give 5% off.

- Usage-Based Insurance (UBI): Drive fewer than 10,000 miles a year? Insurers like Progressive and Root offer “pay-per-mile” plans that can save you 20-30%.

- Safe Driver Apps: Apps like Allstate Drivewise track your driving habits and reward safe behavior with discounts.

Example: Maria from Tampa drives her Chevy Bolt 7,000 miles a year and uses a home charger. By bundling her EV insurance with her home policy and enrolling in a UBI program, she saved $420/year.

Bundle Your Policies (But Do It Smartly)

Bundling home and auto insurance is a classic money-saver. But here’s the catch: not all bundles are equal for EVs. Some insurers charge more for EVs even when bundled.

Do this instead: Get a quote for your EV alone, then a bundled quote. If the bundle doesn’t save you at least 10%, skip it. Sometimes, a standalone EV policy with a different insurer is cheaper.

Real-world case: David from Orlando bundled his Tesla Model 3 with his home insurance through a local agent. The “bundled” rate was $1,800/year. When he checked Progressive, a standalone EV policy was just $1,450—saving him $350.

Florida-Specific Factors That Impact Your Premium

Location, Location, Location: ZIP Code Matters

In Florida, your ZIP code can make a huge difference. Insurers look at:

- Crime rates: High-theft areas (like parts of Miami and Jacksonville) mean higher premiums.

- Traffic density: More cars = more accidents. Expect higher rates in Miami, Tampa, and Orlando.

- Hurricane risk: Coastal ZIPs (e.g., 33139 in Miami) often have surcharges for wind and flood damage.

Data point: According to the Florida Office of Insurance Regulation, EV insurance in Miami-Dade County averages $2,400/year, while in rural areas like Okeechobee, it’s closer to $1,600.

Tip: If you live in a high-risk area, consider a higher deductible. A $1,000 deductible (vs. $500) can save you 15-20% on premiums.

Your Driving Record (Yes, Even for EVs)

Insurers don’t care if your car is electric or gas—they care about your record. A clean record saves you money. But here’s the twist: some insurers charge more for EVs even with a perfect record, because they see EVs as “high-risk” due to repair costs.

Fight back: Ask for a “driver-based discount.” If you have no accidents or tickets in 3+ years, some insurers (like USAA) offer 25% off. Also, consider a defensive driving course—Florida allows a 10% discount for completing a state-approved course.

Credit Score: The Hidden Factor

In Florida, insurers can use your credit score to set rates (unlike in California or Massachusetts). A lower score means higher premiums—for any car, including EVs.

Example: Two drivers with identical EVs and driving records might pay different rates based on credit. A driver with a 750 credit score could pay $1,700/year, while someone with a 600 score pays $2,300.

Action step: Check your credit report (free at AnnualCreditReport.com) and dispute errors. Even improving your score by 50 points can save hundreds.

Advanced Strategies to Slash Your Electric Car Insurance Costs

Raise Your Deductible (But Be Smart About It)

A higher deductible = lower premium. But don’t go too high. If you set a $2,500 deductible and get in a $3,000 accident, you’re on the hook for most of it.

Smart move: Set your deductible based on your savings. If you have $5,000 in an emergency fund, a $1,000 deductible is safe. If you’re tight on cash, stick with $500.

Bonus: Some insurers offer a “deductible buy-back” option. Pay a small extra fee (e.g., $50/year), and they’ll lower your deductible after 3 accident-free years.

Consider Usage-Based Insurance (UBI)

UBI tracks your driving via a plug-in device or smartphone app. If you drive safely and infrequently, you can save big. In Florida, UBI programs like Progressive Snapshot and Allstate Drivewise offer:

- Discounts for low annual mileage (under 10,000 miles).

- Rewards for avoiding hard braking and nighttime driving.

- Flexible billing (pay only for the miles you drive).

Real story: Carlos from Fort Lauderdale drives his Nissan Leaf 5,000 miles a year. With Progressive Snapshot, he pays $980/year—half what he paid for a traditional policy.

Ask About “EV-Specific” Coverage Add-Ons

Some insurers offer add-ons that can save you money in the long run:

- Battery Replacement Coverage: Covers battery damage outside warranty (e.g., from a flood). Cost: $50-$100/year. Worth it if you live in a flood zone.

- Charging Equipment Protection: Covers your home charger if it’s stolen or damaged. Cost: $20/year.

- Roadside Assistance for EVs: Includes mobile charging and towing to EV-friendly repair shops. Cost: $30/year.

Note: These add-ons might seem like “extra costs,” but they can prevent huge out-of-pocket expenses later.

Common Mistakes to Avoid When Insuring Your EV in Florida

Underinsuring Your EV (Yes, It’s a Thing)

Some drivers try to save money by skimping on coverage. But with EVs, that’s risky. If you get in a serious accident and don’t have enough coverage, you could be on the hook for thousands in repair costs.

Rule of thumb: Carry at least $250,000 in liability coverage (Florida’s minimum is just $10,000, which is dangerously low). Also, consider “gap insurance” if you lease or finance—it covers the difference between your car’s value and what you owe if it’s totaled.

Ignoring the “Total Loss” Clause

EVs are declared total losses at lower thresholds than gas cars. Why? Because repairs are so expensive. In Florida, if repairs exceed 75% of your car’s value, it’s totaled. For EVs, that threshold can be as low as 60%.

Example: Your EV is worth $40,000. A storm causes $25,000 in damage. For a gas car, it’s not a total loss (62.5% of value). For an EV? Likely totaled—even though it’s fixable.

Solution: Ask your insurer about “agreed value” policies. They guarantee a payout if your car is totaled, even if repairs are technically possible.

Not Updating Your Policy After Major Changes

Got a home charger? Installed solar panels? Moved to a safer neighborhood? Tell your insurer! These changes can lower your premium.

Pro tip: Review your policy every 6 months. Call your agent and say, “I want to make sure my EV insurance is up to date.” They might find new discounts you didn’t know about.

Data Table: Average Electric Car Insurance Costs in Florida (2024)

| EV Model | Average Annual Premium (Statewide) | Lowest Cost ZIP Code | Highest Cost ZIP Code | Best Insurer (Lowest Rate) |

|---|---|---|---|---|

| Tesla Model 3 | $2,100 | 32082 (St. Augustine) – $1,750 | 33139 (Miami Beach) – $2,600 | Progressive |

| Chevy Bolt | $1,800 | 34741 (Kissimmee) – $1,450 | 33178 (North Miami) – $2,300 | GEICO |

| Ford Mustang Mach-E | $2,250 | 32301 (Tallahassee) – $1,850 | 33140 (Miami Shores) – $2,700 | State Farm |

| Hyundai Ioniq 5 | $1,950 | 34236 (Sarasota) – $1,600 | 33131 (Downtown Miami) – $2,450 | Liberty Mutual |

Note: Rates are based on a 35-year-old driver with a clean record, 12,000 annual miles, and $1,000 deductible. Actual costs may vary.

Final Thoughts: Save Big on Electric Car Insurance in Florida

Insuring your electric car in Florida doesn’t have to break the bank. Yes, EVs come with unique risks—but with the right strategy, you can save hundreds every year. Start by shopping around with EV-savvy insurers, asking about green discounts, and taking advantage of usage-based programs. Don’t forget Florida-specific factors like hurricane risk and ZIP code premiums. And always, always review your policy regularly.

Remember: your EV is an investment. The right insurance protects that investment—and your wallet. So take these tips, call your agent, and start saving today. Because driving electric should feel good—not just for the planet, but for your bank account too.

Frequently Asked Questions

What factors affect electric car insurance rates in Florida?

Electric car insurance in Florida is influenced by factors like the vehicle’s value, repair costs, battery safety ratings, and your driving history. High-theft areas or frequent long-distance driving can also increase premiums.

How can I save on electric car insurance in Florida?

To save on electric car insurance in Florida, compare quotes from multiple insurers, ask about green vehicle discounts, and bundle policies. Installing safety features like anti-theft devices may also lower your premium.

Are electric cars more expensive to insure than gas-powered cars in Florida?

Yes, electric cars often cost more to insure due to higher repair and replacement costs for specialized parts like batteries. However, some insurers offer discounts for eco-friendly vehicles, which can offset the difference.

Does Florida offer any incentives for electric car insurance?

While Florida doesn’t have state-specific electric car insurance incentives, many insurers provide discounts for EVs, such as lower rates for reduced emissions or usage-based programs. Check with your provider for available deals.

Can I get roadside assistance for my electric car in Florida?

Yes, many insurers in Florida offer roadside assistance tailored for electric cars, including battery charging or towing to charging stations. This is often included in comprehensive coverage or as an add-on.

Do I need special coverage for my electric car in Florida?

Standard auto insurance covers most electric cars, but you may want additional coverage for battery damage or charging equipment. Confirm with your insurer that your policy meets the unique needs of EVs.